by Calculated Risk on 11/21/2019 07:10:00 PM

Thursday, November 21, 2019

"Mortgage Rates Steady Despite Bond Market Weakness"

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Steady Despite Bond Market Weakness

Mortgage rates spent a 2nd day with the average lender holding relatively steady. This follows a decent winning streak over the previous week and a half with the net effect being at least an eighth of a percent (.125%) improvement on the average conventional 30yr fixed quote.

Holding steady was a bit anticlimactic yesterday because the broader bond market (specifically, the benchmark US 10yr Treasury yield) indicated more improvement than we actually saw. That had a lot to do with the underperformance of bonds that specifically underlie mortgages (MBS or "mortgage-backed securities). But whereas MBS lagged Treasuries yesterday, they outperformed today, thus allowing lenders to keep rates unchanged even as 10yr yields moved moderately higher. [Today's Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.75%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since 2014.

This graph is interactive, and you could view mortgage rates back to the mid-1980s - click here for graph.

Video: "2020 Economic Forecast featuring the UCI Paul Merage School of Business"

by Calculated Risk on 11/21/2019 01:58:00 PM

Here is the video of UCI Finance Professor Christopher Schwarz, Dr. Richard Afable and myself at the Newport Beach Chamber of Commerce event.

Comments on October Existing Home Sales

by Calculated Risk on 11/21/2019 12:14:00 PM

Earlier: NAR: Existing-Home Sales Increased to 5.46 million in October

A few key points:

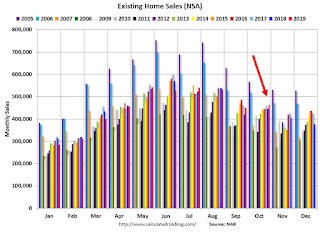

1) Existing home sales were up 4.6% year-over-year (YoY) in October. This was the fourth consecutive YoY increase - following 16 consecutive months with a YoY decrease in sales

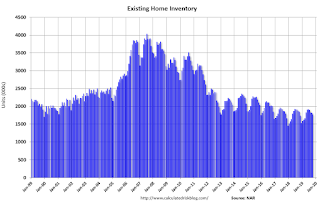

2) Inventory is still low, and was down 4.3% year-over-year (YoY) in October.

3) Year-to-date sales are down about 1.1% compared to the same period in 2018. On an annual basis, that would put sales around 5.28 million in 2019. Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown.

The comparisons will be easier towards in November and December of this year, and with lower mortgage rates, sales will probably finish the year unchanged or even up from 2018.

Sales NSA in October (463,000, red column) were above sales in October 2018 (446,000, NSA), and were the highest for October since 2006.

Overall this was a solid report.

NAR: Existing-Home Sales Increased to 5.46 million in October

by Calculated Risk on 11/21/2019 10:13:00 AM

From the NAR: Existing-Home Sales Climb 1.9% in October

Existing-home sales rose in October, a slight recovery from the declines seen in September, according to the National Association of Realtors®. The four major U.S. regions were split last month, with the Midwest and the South seeing growth, and the Northeast and the West both reporting a drop in sales.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 1.9% from September to a seasonally-adjusted annual rate of 5.46 million in October. Despite lingering regional variances, overall sales are up 4.6% from a year ago (5.22 million in October 2018).

...

Total housing inventory at the end of October sat at 1.77 million units, down approximately 2.7% from September and 4.3% from one year ago (1.85 million). Unsold inventory sits at a 3.9-month supply at the current sales pace, down from 4.1 months in September and from the 4.3-month figure recorded in October 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.46 million SAAR) were up 1.9% from last month, and were 4.6% above the October 2018 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.77 million in October from 1.82 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.77 million in October from 1.82 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 4.3% year-over-year in October compared to October 2018.

Inventory was down 4.3% year-over-year in October compared to October 2018. Months of supply decreased to 3.9 months in October.

This was close to the consensus forecast. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later …

Philly Fed Manufacturing shows "Overall Growth in November"

by Calculated Risk on 11/21/2019 08:50:00 AM

From the Philly Fed: Current Manufacturing Indexes Suggest Overall Growth in November

Manufacturing activity in the region continued to grow, according to results from the November Manufacturing Business Outlook Survey. The survey’s broad indicators remained positive, although their movements were mixed this month: The indicator for general activity increased, but the new orders, shipments, and employment indicators decreased from their readings last month. The survey’s future activity indexes remained positive, suggesting continued optimism about growth for the next six months.This was slightly above the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity rose 5 points this month to 10.4, after decreasing 6 points in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

These early reports suggest the ISM manufacturing index will probably be weak again in November - but might increase a little.

Weekly Initial Unemployment Claims at 227,000

by Calculated Risk on 11/21/2019 08:36:00 AM

The DOL reported:

In the week ending November 16, the advance figure for seasonally adjusted initial claims was 227,000, unchanged from the previous week's revised level. The previous week's level was revised up by 2,000 from 225,000 to 227,000. The 4-week moving average was 221,000, an increase of 3,500 from the previous week's revised average. The previous week's average was revised up by 500 from 217,000 to 217,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 221,000.

This was above the consensus forecast.

Wednesday, November 20, 2019

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 11/20/2019 08:23:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 219,000 initial claims, down from 225,000 last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 7.5, up from 5.6.

• At 10:00 AM, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.49 million SAAR, up from 5.38 million in September. Housing economist Tom Lawler expects the NAR to report sales of 5.36 million SAAR (take the under!).

CAR on California October Housing: Sales up 1.9% YoY, Inventory down 18%

by Calculated Risk on 11/20/2019 02:44:00 PM

The CAR reported: California housing market holds steady in October, C.A.R. reports

Shrinking inventory subdued California home sales and held home sales and prices steady in October, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 404,240 units in October, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the October pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

October’s sales figure was up 0.1 percent from the 404,030 level in September and up 1.9 percent from home sales in October 2018 of a revised 396,720.

“The California housing market continued to see gradual improvement in recent months as the current mortgage environment remains favorable to those who want to buy a home. With interest rates remaining historically low for the foreseeable future, motivated buyers finding that homes are slightly more affordable may seize the opportunity and resume their home search,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “Additionally, the condominium loan policies that went into effect mid-October could help buyers for whom single-family homes are out of reach.”

...

After 15 straight months of year-over-year increases, active listings fell for the fourth straight month, dropping 18.0 percent from year ago. The decline was the largest since May 2013.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was 3.0 months in October, down from 3.6 in both September 2019 and October 2018. It was the lowest level since June 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

FOMC Minutes: "Most participants judged that the stance of policy, after a 25 basis point reduction at this meeting, would be well calibrated"

by Calculated Risk on 11/20/2019 02:14:00 PM

From the Fed: Minutes of the Federal Open Market Committee, October 29-30, 2019. A few excerpts:

With regard to monetary policy beyond this meeting, most participants judged that the stance of policy, after a 25 basis point reduction at this meeting, would be well calibrated to support the outlook of moderate growth, a strong labor market, and inflation near the Committee's symmetric 2 percent objective and likely would remain so as long as incoming information about the economy did not result in a material reassessment of the economic outlook. However, participants noted that policy was not on a preset course and that they would be monitoring the effects of the Committee's recent policy actions, as well as other information bearing on the economic outlook, in assessing the appropriate path of the target range for the federal funds rate. A couple of participants expressed the view that the Committee should reinforce its postmeeting statement with additional communications indicating that another reduction in the federal funds rate was unlikely in the near term unless incoming information was consistent with a significant slowdown in the pace of economic activity..

emphasis added

AIA: "Architecture Billings Index Rebounds After Two Down Months"

by Calculated Risk on 11/20/2019 10:37:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Rebounds After Two Down Months

Following a two month decline in demand for design services, architecture billings got a bounce in October, according to a new report released today from the American Institute of Architects (AIA).

The Architecture Billings Index (ABI) score in October is 52.0, up from the September score of 49.7. This score reflects an increase in design services (any score above 50 indicates an increase in billings). During October, both the new project inquiries and design contracts scores moderated from September but remained positive, posting scores of 57.9 and 52.9 respectively.

“Although ongoing uncertainty over the direction of economic growth persists, a strong stock market and growing payrolls at U.S. businesses continue to generate more construction projects,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “With most regional and sector billing scores at architecture firms improving from the previous month, we’re seeing a bit of a rebound from disappointing levels of design activity in recent months.”

...

• Regional averages: South (55.5); West (51.3); Midwest (49.9); Northeast (47.2)

• Sector index breakdown: mixed practice (55.2); multi-family residential (54.0); institutional (49.9); commercial/industrial (49.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in October, up from 49.7 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some further increase in CRE investment in 2020 - but three of the previous four months were negative.