by Calculated Risk on 11/29/2019 05:00:00 PM

Friday, November 29, 2019

November 2019: Unofficial Problem Bank list Decreased to 65 Institutions

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for November 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2019. During the month, the list declined by six to 65 banks after seven removals and one addition. Aggregate assets dropped by $4.3 billion from the month to $51.0 billion. Part of the $4.3 billion decline came from a $2.1 billion decrease in reported assets with the release of third quarter financials earlier this week. A year ago, the list held 75 institutions with assets of $53.9 billion.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and then steadily declined to below 100 institutions.

Removals this month occurred through merger, action termination, or failure. Banks finding a merger partner include MidSouth Bank, National Association, Lafayette, LA ($1.7 billion Ticker: MSL); Markesan State Bank, Markesan, WI ($118 million); Fort Gibson State Bank, Fort Gibson, OK ($61 million); and The First National Bank of Paducah, Paducah, TX ($44 million). Actions were terminated against The Peoples Bank, Eatonton, GA ($130 million) and The Bank of Houston, Houston, MO ($32 million). Exiting through failure was City National Bank of New Jersey, Newark, NJ ($143 million). Added this month was Beauregard FSB, Deridder, LA ($66 million).

Q4 GDP Forecasts: 0.8% to 2.0%

by Calculated Risk on 11/29/2019 11:28:00 AM

From Goldman Sachs:

[W]e lowered our Q4 GDP tracking estimate by one tenth to +2.0% (qoq ar). (qoq ar). [Nov 27 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 0.8% for 2019:Q4. [Nov 29 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.7 percent on November 27, up from 0.4 percent on November 19. [Nov 27 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.8% and 2.0% annualized in Q4.

STR: Hotel RevPAR "Upcycle Over"

by Calculated Risk on 11/29/2019 11:21:00 AM

From Jan Freitag at HotelNewsNow: Consecutive RevPAR dips make it official: Upcycle over

Let’s look at what we know: RevPAR has now declined two months in a row—three months in the last year, and four months in the prior 13 months. Because everyone likes a record, we keep counting RevPAR growth months and are now at 112 out of the last 116 months.

That 112 months count is the record we had wanted and deserved, right? But of course it is fuzzy math since it was already back in the golden days of September 2018 that RevPAR declined for the first time—102 months since the RevPAR rocket took off in March 2010. Then RevPAR declined again in June (positive months counter: 110), September (112) and now October (112, still).

Is the upcycle over? Yes, it is. Two consecutive months of RevPAR decline are proof. But the other reality is this: annualized RevPAR will likely not decline at all in this cycle. So maybe, if you judge by year-end results, this cycle is not over at all. Our friends from Tourism Economics are clear about their conviction that GDP growth will continue to be positive, with no recession in sight, and this then fuels positive RevPAR growth. Our new 2020 RevPAR growth forecast isn’t pretty, but it’s realistic and realistically positive at +0.5%.

To get to that number, though, I would expect gyrations around the 0% point, meaning we will see plenty more months of mild RevPAR declines balanced by months with tepid RevPAR gains. That is the future we face, and the reality we already live in.

I guess the takeaway from this latest RevPAR decline is simply to heed Douglas Adams’ warning in The Hitchhiker’s Guide to the Galaxy: “Don’t Panic,” inscribed in large friendly letters on its cover.

emphasis added

Thursday, November 28, 2019

Five Economic Reasons to be Thankful

by Calculated Risk on 11/28/2019 08:11:00 AM

With a Hat Tip to Neil Irwin (he started doing this several years ago) ... here are five economic reasons to be thankful this Thanksgiving ...

1) Low unemployment rate.

The unemployment rate was at 3.6% in October. The unemployment rate is down from 3.8% in October 2018 (a year ago), and is down from the cycle peak of 10.0% in October 2009.

This is almost the lowest level for the unemployment rate since 1969 (the unemployment rate was at 3.5% in September)!

Also, this is the largest decline in the unemployment rate, from cycle peak-to-trough, since the BLS started tracking the unemployment rate in 1948. (In the early '80s, the unemployment rate declined from 10.8% to 5.0%; a decline of 5.8 percentage points. The current decline from 10.0% to 3.5% in September is 6.5 percentage points!)

2) Low unemployment claims.

Here is a graph of initial weekly unemployment claims.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims is at 219,750.

The low level of claims suggests relatively few layoffs.

3) Job Openings Near Series High.

There were 7.0 million job openings in September. This is still solid, but down from 7.6 million in September 2018.

For the nineteenth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 5 years).

Also Quits are up 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

A large number of job openings, and rising quits, are positive signs for the labor market.

4) New Home sales are at a Cycle High.

New home sales were at 733 thousand SAAR (Seasonally Adjusted Annual Rate) in October, and 738 thousand SAAR in September (highest since July 2007).

Sales were up from 557 thousand SAAR in October 2017, and up from the cycle low of 270 thousand SAAR in February 2011.

Since New Home sales are an excellent leading indicator for the economy, the new cycle high suggests no recession in the next year.

5) Household Debt burdens are near record lows.

Household debt burdens have declined sharply since the great recession.

The Household debt service ratio was at 13.2% in 2007, and has fallen to a series low of 9.69% in Q2 2019 (most recent data).

The overall Debt Service Ratio decreased in Q2 2018, and has been mostly moving sideways and is at a series low. Note: The financial obligation ratio (FOR) declined in Q2 and is also near a series low (not shown).

The DSR for mortgages (blue) is also at a series low (since at least 1980). This ratio increased rapidly during the housing bubble, and continued to increase until 2007.

This data suggests aggregate household cash flow has improved.

Happy Thanksgiving to All!

Wednesday, November 27, 2019

Fannie Mae: Mortgage Serious Delinquency Rate decreased slightly in October

by Calculated Risk on 11/27/2019 04:28:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased slightly to 0.67% in October, from 0.68% in September. The serious delinquency rate is down from 0.79% in October 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This matches the delinquency rate in July and August of this year, as the lowest serious delinquency rate for Fannie Mae since June 2007.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.51% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.25% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Zillow Case-Shiller Forecast: Similar YoY Price Gains in October compared to September

by Calculated Risk on 11/27/2019 03:21:00 PM

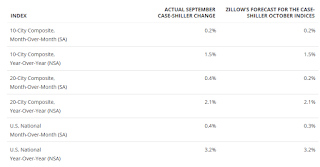

The Case-Shiller house price indexes for September were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: September Case-Shiller Results and October Forecast: Steady as She Goes

The S&P CoreLogic Case-Shiller U.S. National Home Price Index® rose 3.2% year-over-year in September (non-seasonally adjusted), up from 3.1% in August. Annual growth in the smaller 10-city index was unchanged from August, and was up slightly in the 20-city index (to 2.1%, from 2% in August).

…

In the meantime, annual growth in October as reported by Case-Shiller is expected to stay steady in all three major indices. S&P Dow Jones Indices is expected to release data for the October S&P CoreLogic Case-Shiller Indices on Tuesday, Dec. 31.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.2% in October, the same as 3.2% in September.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.2% in October, the same as 3.2% in September. The Zillow forecast is for the 20-City index to be unchanged at 2.1% YoY in October from 2.1% in September, and for the 10-City index to decline to 1.5% YoY compared to 1.5% YoY in September.

Personal Income increased Slightly in October, Spending increased 0.3%, Core PCE increase 0.1%

by Calculated Risk on 11/27/2019 10:12:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $3.3 billion (less than 0.1 percent) in October according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $12.6 billion (-0.1 percent) and personal consumption expenditures (PCE) increased $39.7 billion (0.3 percent).The October PCE price index increased 1.3 percent year-over-year and the October PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI decreased 0.3 percent in October and Real PCE increased 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through October 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was at expectations.

Note that core PCE inflation was below expectations.

NAR: "Pending Home Sales Decline 1.7% in October"

by Calculated Risk on 11/27/2019 10:04:00 AM

From the NAR: Pending Home Sales Decline 1.7% in October

Pending home sales retreated in October, taking a slight step back after two prior months of increases, according to the National Association of Realtors®. The Northeast experienced a minor uptick last month, but the other three major U.S. regions reported declines in month-over-month contract activity. However, pending home sales were up nationally and up in all regions compared to a year ago.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, fell 1.7% to 106.7 in October. Year-over-year contract signings jumped 4.4%. An index of 100 is equal to the level of contract activity in 2001.

...

With the exception of the Northeast, all regional indices saw declines in October. The PHSI in the Northeast rose 1.9% to 95.7 in October, 3.0% higher than a year ago. In the Midwest, the index slid 2.7% to 101.4 last month, 1.8% higher than in October 2018.

Pending home sales in the South decreased 1.7% to an index of 125.3 in October, a 5.1% increase from last October. The index in the West declined 3.4% in October 2019 to 91.9, which is an increase of 7.5% from a year ago.

emphasis added

Weekly Initial Unemployment Claims decrease to 213,000

by Calculated Risk on 11/27/2019 08:41:00 AM

The DOL reported:

In the week ending November 23, the advance figure for seasonally adjusted initial claims was 213,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 227,000 to 228,000. The 4-week moving average was 219,750, a decrease of 1,500 from the previous week's revised average. The previous week's average was revised up by 250 from 221,000 to 221,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 219,750.

This was lower than the consensus forecast.

Q3 GDP Revised Up to 2.1% Annual Rate

by Calculated Risk on 11/27/2019 08:36:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2019 (Second Estimate); Corporate Profits, Third Quarter 2019 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the third quarter of 2019, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.0 percent.PCE growth was unrevised at 2.9%. Residential investment was unrevised at 5.1%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 1.9 percent. With the second estimate for the third quarter, upward revisions to private inventory investment, nonresidential fixed investment, and personal consumption expenditures (PCE) were partially offset by a downward revision to state and local government spending.

emphasis added

Here is a Comparison of Second and Advance Estimates.