by Calculated Risk on 12/11/2019 11:15:00 AM

Wednesday, December 11, 2019

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in November, Core PCE below 2%

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in November. The 16% trimmed-mean Consumer Price Index rose 0.3% (3.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for November here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.1% annualized rate) in November. The CPI less food and energy rose 0.2% (2.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.3%. Core PCE is for October and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized and trimmed-mean CPI was at 3.1% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

BLS: CPI increased 0.3% in November, Core CPI increased 0.2%

by Calculated Risk on 12/11/2019 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.3 percent in November on a seasonally adjusted basis, after rising 0.4 percent in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.1 percent before seasonal adjustment.Core inflation was at expectations in November. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.2 percent in November, the same increase as in October.

...

The all items index increased 2.1 percent for the 12 months ending November, a larger rise than the 1.8-percent increase for the period ending October. The index for all items less food and energy rose 2.3 percent over the last 12 months. The food index rose 2.0 percent over the last l2 months, while the energy index declined 0.6 percent over the last year.

emphasis added

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 12/11/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 6, 2019. The results for the week ending November 29, 2019 included an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 9 percent from the previous week and was 146 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.4 percent from one week earlier. The unadjusted Purchase Index increased 35 percent compared with the previous week and was 5 percent higher than the same week one year ago.

...

“Low mortgage rates continue to be the trend as 2019 comes to an end, and mortgage applications responded accordingly last week, rising 3.8 percent. The 30-year fixed mortgage rate remained under 4 percent for the fourth straight week, and rates for FHA loans declined close to their lowest level of the year. The decrease in FHA rates led to a 27 percent jump in refinance applications for those loans, and their share of refinance activity – at 14 percent – was the highest since 2016,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications were down slightly, but were 5 percent higher than a year ago, which is in line with the gradual growth in the purchase market seen throughout this year.”

Added Kan, “The November jobs data showed increased payroll gains and low unemployment, which means conditions remain favorable for steady purchase growth in the coming months.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 3.98 percent from 3.97 percent, with points increasing to 0.33 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 5% year-over-year.

Tuesday, December 10, 2019

Wednesday: FOMC Announcement, CPI

by Calculated Risk on 12/10/2019 07:46:00 PM

My FOMC Preview.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Seattle Real Estate in November: Sales up 21.7% YoY, Inventory down 21.1% YoY

by Calculated Risk on 12/10/2019 03:57:00 PM

The Northwest Multiple Listing Service reported "November Surprise" brings "plenty of buyers"; uptick in home sales, prices

Brokers with Northwest Multiple Listing Service reported "plenty of buyers" competing for sparse inventory during November, which ended with a 7% year-over-year increase in pending sales. The volume of mutually accepted offers rose even more (9.2%) in the tri-county Puget Sound region consisting of King, Pierce and Snohomish counties, with Snohomish leading that list with a jump of about 12%.The press release is for the Northwest. In King County, sales were up 11.1% year-over-year, and active inventory was down 33.5% year-over-year.

...

Brokers reported 11,366 total active listings at month end, down more than 28 percent from twelve months ago when there were 15,830 active listings. November's selection was down about 21 percent from October.

emphasis added

In Seattle, sales were up 21.7% year-over-year, and inventory was down 21.1% year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (1.6 months). In many areas it appears the inventory build that started last year is over.

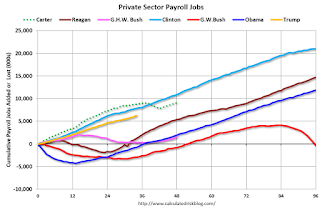

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 12/10/2019 10:56:00 AM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (34 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 34 months of Mr. Trump's term, the economy has added 6,223,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the 34 months of Mr. Trump's term, the economy has added 334,000 public sector jobs.

After 34 months of Mr. Trump's presidency, the economy has added 6,557,000 jobs, about 526,000 behind the projection.

Note: Based on the preliminary Benchmark revision, there will be 501,000 fewer jobs in March 2019 after the Benchmark revision is released in February - so job growth is probably over 1 million behind the projection.

Small Business Optimism Index Increased in November

by Calculated Risk on 12/10/2019 09:43:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): November 2019 Report: Small Business Optimism Sees Major Spike in November

Small business optimism posted the largest month-over-month gain since May 2018, rising 2.3 points to 104.7 in November.

..

Finding qualified workers though remains the top issue for 26 percent reporting this as their number one problem, 1 point below August’s record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 104.7 in November.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is a top problem.

Monday, December 09, 2019

"Mortgage Rates Snap Back to Lower Levels"

by Calculated Risk on 12/09/2019 08:05:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Snap Back to Lower Levels

Mortgage rates reacted somewhat harshly to an incredibly strong jobs report last Friday. … There will always be some obligatory response to a report as strong as that. That was indeed the case on Friday and mortgage lenders were a bit defensive in setting rates. Fortunately, the underlying bond market improved throughout the day and held onto that improvement today. As such, lenders were willing to offer much lower rates versus Friday. [Today's Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.75 - 3.875%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since 2014.

This graph is interactive, and you could view mortgage rates back to the mid-1980s - click here for interactive graph.

Remembering Paul Volcker: 2005 Speech at Stanford

by Calculated Risk on 12/09/2019 02:02:00 PM

Former Fed Chair Paul Volcker has passed away. From the NY Times: Paul A. Volcker, Fed Chairman Who Waged War on Inflation, Is Dead at 92

Here are some excerpts from a prescient speech in February 2005: Paul Volcker Feb 2005 Stanford Speech

A few selected excerpts:

"Altogether, the circumstances seem as dangerous and intractable as I can remember."

"Boomers are spending like there is no tomorrow."

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

"I come now to the heart of the problem, as a Nation we are consuming and investing, that is spending, about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day."

"What I'm really talking about boils down to the oldest lesson of financial policy in Central Banking: A strong sense of monetary and fiscal discipline."

FOMC Preview

by Calculated Risk on 12/09/2019 11:12:00 AM

The consensus is there will no change to policy when the FOMC meets this week. After three rate cuts earlier this year, the FOMC appears to be on hold.

The unemployment rate and inflation projections will probably be revised down slightly. From Goldman Sachs:

[W]e expect only a minor change to the statement’s characterization of the economy, with overall growth still characterized as “moderate” but consumption downgraded to “solid.” We also expect the economic projections to show a lower unemployment rate path (and a slightly lower NAIRU) and lower inflation this year. … Following comments from many Fed officials that policy is now "in a good place," we expect the statement to indicate that the current stance of policy is “likely to remain appropriate.” As a result, we also look for the great majority of the 2020 dots to show an unchanged policy rate.Here are the September FOMC projections.

Q1 real GDP growth was at 3.1% annualized, Q2 at 2.0% and Q3 at 2.1%. Currently most analysts are projecting around 1% to 2% in Q4. So the GDP projections will probably be little changed.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Sept 2019 | 2.1 to 2.3 | 1.8 to 2.1 | 1.8 to 2.0 |

| Jun 2019 | 2.0 to 2.2 | 1.8 to 2.2 | 1.8 to 2.0 |

The unemployment rate was at 3.5% in November. The unemployment rate projection for Q4 2019 will probably be revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Sept 2019 | 3.6 to 3.7 | 3.6 to 3.8 | 3.6 to 3.9 |

| Jun 2019 | 3.6 to 3.7 | 3.5 to 3.9 | 3.6 to 4.0 |

As of October 2019, PCE inflation was up 1.3% from October 2018 So PCE inflation projections will probably be revised down.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.6% in October year-over-year. So Core PCE inflation will probably be revised down sligthly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 to 2.1 |