by Calculated Risk on 12/13/2019 09:16:00 AM

Friday, December 13, 2019

Retail Sales increased 0.2% in November

On a monthly basis, retail sales increased 0.3 percent from October to November (seasonally adjusted), and sales were up 3.3 percent from November 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $528.0 billion, an increase of 0.2 percent from the previous month, and 3.3 percent above November 2018. Total sales for the September 2019 through November 2019 period were up 3.5 percent from the same period a year ago. The September 2019 to October 2019 percent change was revised from up 0.3 percent to up 0.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.8% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.8% on a YoY basis.The increase in November was below expectations, and sales in September were revised down, and October were revised up.

Thursday, December 12, 2019

Friday: Retail sales

by Calculated Risk on 12/12/2019 07:35:00 PM

Friday:

• At 8:30 AM ET, Retail sales for November will be released. The consensus is for a 0.4% increase in retail sales.

LA area Port Traffic Down Year-over-year in November

by Calculated Risk on 12/12/2019 04:56:00 PM

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

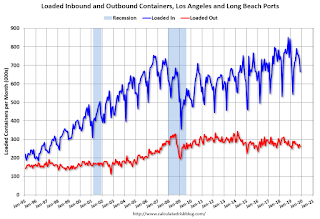

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.9% in November compared to the rolling 12 months ending in October. Outbound traffic was down 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports had been increasing (although down this year), and exports have mostly moved sideways over the last 8 years - and have also moved down recently.

Fed's Flow of Funds: Household Net Worth Increased in Q3

by Calculated Risk on 12/12/2019 02:07:00 PM

The Federal Reserve released the Q3 2019 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $113.8 trillion during the third quarter of 2019. The value of directly and indirectly held corporate equities decreased $0.3 trillion and the value of real estate increased $0.2 trillion.

Household debt increased 3.3 percent at an annual rate in the third quarter of 2019. Consumer credit grew at an annual rate of 5.1 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 2.7 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

Net Worth as a percent of GDP decreased slightly in Q3.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2019, household percent equity (of household real estate) was at 64.0% - down from Q2.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 64.0% equity - and about 2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $85 billion in Q3.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 48.8% (the lowest since 2001), down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, decreased slightly in Q3, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

CoreLogic: 2 Million Homes with Negative Equity in Q3 2019

by Calculated Risk on 12/12/2019 10:03:00 AM

From CoreLogic: CoreLogic Reports 78,000 Single-Family Properties Regained Equity in the Third Quarter of 2019

CoreLogic® ... today released the Home Equity Report for the third quarter of 2019. The report shows that U.S. homeowners with mortgages (which account for roughly 64% of all properties) have seen their equity increase by 5.1% year over year, representing a gain of nearly $457 billion since the third quarter of 2018.

...

From the second quarter of 2019 to the third quarter of 2019, the total number of mortgaged homes in negative equity decreased by 4% to 2 million homes or 3.7% of all mortgaged properties. The number of mortgaged properties in negative equity during the third quarter of 2019 fell by 10%, or 220,000 homes, compared to the third quarter of 2018, when 2.2 million homes, or 4.1% of all mortgaged properties, were in negative equity.

...

“Ten years ago, during the depths of the Great Recession, more than 11 million homeowners had negative equity or 25% of mortgaged homes,” said Dr. Frank Nothaft, chief economist for CoreLogic. “After more than eight years of rising home prices and employment growth, underwater owners have been slashed to just 2 million, or less than 4% of mortgaged homes.”

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in a home’s value, an increase in mortgage debt or both. Negative equity peaked at 26% of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis, which began in the third quarter of 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q3 to Q2 equity distribution by LTV. There are still quite a few properties with LTV over 125%.

On a year-over-year basis, the number of homeowners with negative equity has declined from 2.2 million to 2.0 million.

Weekly Initial Unemployment Claims increased sharply to 252,000

by Calculated Risk on 12/12/2019 08:37:00 AM

The DOL reported:

In the week ending December 7, the advance figure for seasonally adjusted initial claims was 252,000, an increase of 49,000 from the previous week's unrevised level of 203,000. This is the highest level for initial claims since September 30, 2017 when it was 257,000. The 4-week moving average was 224,000, an increase of 6,250 from the previous week's unrevised average of 217,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 224,000.

This was much higher than the consensus forecast.

Wednesday, December 11, 2019

Thursday: Unemployment Claims, Flow of Funds

by Calculated Risk on 12/11/2019 08:13:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 212,000 initial claims, up from 203,000 last week.

• Also at 8:30 AM, The Producer Price Index for November from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

Houston Real Estate in November: Sales up 2% YoY, Inventory Up 5%

by Calculated Risk on 12/11/2019 04:23:00 PM

From the HAR: The Houston Housing Market Chugs Confidently Along Through November

November marked the fifth consecutive positive month of home sales with continued low mortgage interest rates helping to keep the Houston real estate market on track for a record 2019. Single-family home sales across greater Houston totaled 6,395 in November, according to the latest monthly report from the Houston Association of REALTORS® (HAR). That is up 3.6 percent from one year earlier. On a year-to-date basis, home sales are running 4.1 percent ahead of 2018’s record volume.Sales are on pace for a record year in Houston.

...

Sales of all property types increased 2.1 percent in November, totaling 7,577 units. Total dollar volume rose 3.4 percent to $2.2 billion.

…

Total active listings, or the total number of available properties, rose 5.2 percent to 42,139. … Single-family homes months of inventory was flat for the first time in 2019, holding steady at a 3.8 months supply.

“The end of the year typically brings a slower pace of home sales, so we welcome another month of gains and attribute it to continued low interest rates in a market that has added more than 80,000 jobs over the past year, according to the Texas Workforce Commission,” said HAR Chair Shannon Cobb Evans with Better Homes and Gardens Real Estate Gary Greene.

emphasis added

FOMC Projections and Press Conference

by Calculated Risk on 12/11/2019 02:10:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

On the projections, growth was mostly unchanged, and unemployment and inflation were revised down slightly.

Q1 real GDP growth was at 3.1% annualized, Q2 at 2.0% and Q3 at 2.1%. Currently most analysts are projecting around 1% to 2% in Q4. So the GDP projections were little changed, although GDP for 2020 was revised up slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 2.1 to 2.2 | 2.0 to 2.2 | 1.8 to 2.0 | 1.8 to 2.0 |

| Sept 2019 | 2.1 to 2.3 | 1.8 to 2.1 | 1.8 to 2.0 | NA |

The unemployment rate was at 3.5% in November. So the unemployment rate projection for Q4 2019 was revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 3.5 to 3.6 | 3.5 to 3.7 | 3.5 to 3.9 | 3.5 to 4.0 |

| Sept 2019 | 3.6 to 3.7 | 3.6 to 3.8 | 3.6 to 3.9 | NA |

As of October 2019, PCE inflation was up 1.3% from October 2018 So PCE inflation projections were revised down slightly.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 1.4 to 1.5 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.2 |

| Sept 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 | NA |

PCE core inflation was up 1.6% in October year-over-year. So Core PCE inflation was revised down sligthly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 | 2022 |

| Dec 2019 | 1.6 to 1.7 | 1.9 to 2.0 | 2.0 to 2.1 | 2.0 to 2.2 |

| Sept 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 | NA |

FOMC Statement: No Change to Policy

by Calculated Risk on 12/11/2019 02:01:00 PM

Information received since the Federal Open Market Committee met in October indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports remain weak. On a 12‑month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee decided to maintain the target range for the federal funds rate at 1‑1/2 to 1-3/4 percent. The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective. The Committee will continue to monitor the implications of incoming information for the economic outlook, including global developments and muted inflation pressures, as it assesses the appropriate path of the target range for the federal funds rate.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; Esther L. George; Randal K. Quarles; and Eric S. Rosengren.

emphasis added