by Calculated Risk on 12/17/2019 08:41:00 AM

Tuesday, December 17, 2019

Housing Starts increased to 1.365 Million Annual Rate in November

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in November were at a seasonally adjusted annual rate of 1,365,000. This is 3.2 percent above the revised October estimate of 1,323,000 and is 13.6 percent above the November 2018 rate of 1,202,000. Single‐family housing starts in November were at a rate of 938,000; this is 2.4 percent above the revised October figure of 916,000. The November rate for units in buildings with five units or more was 404,000.

Building Permits:

Privately‐owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,482,000. This is 1.4 percent above the revised October rate of 1,461,000 and is 11.1 percent above the November 2018 rate of 1,334,000. Single‐family authorizations in November were at a rate of 918,000; this is 0.8 percent (±1.3 percent)* above the revised October figure of 911,000. Authorizations of units in buildings with five units or more were at a rate of 524,000 in November.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in November compared to October. Multi-family starts were up 7.3% year-over-year in November.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last several years.

Single-family starts (blue) increased in November, and were up 16.7% year-over-year.

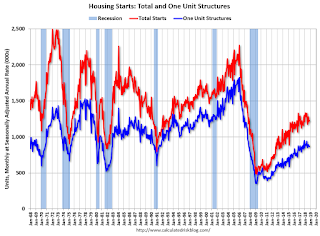

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in November were above expectations and revisions were minor.

I'll have more later …

Monday, December 16, 2019

Tuesday: Housing Starts, Industrial Production, Job Openings

by Calculated Risk on 12/16/2019 07:41:00 PM

• At 8:30 AM ET, Housing Starts for November. The consensus is for 1.344 million SAAR, up from 1.314 million SAAR.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.8% increase in Industrial Production, and for Capacity Utilization to increase to 77.2%.

• At 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS.

Sacramento Housing in November: Sales Down 4.8% YoY, Active Inventory down 33.6% YoY

by Calculated Risk on 12/16/2019 12:07:00 PM

From SacRealtor.org: Sales, inventory drop for November

November closed with a 19.4% decrease in sales volume, dropping from 1,540 in October to 1,242 units this month. Compared to one year ago (1,304), the current figure is down 4.8%.1) Overall sales decreased to 1,242 in November, down from 1,304 in November 2018. Sales were down 19.4% from October 2019 (previous month), and down 4.8% from November 2018.

...

The Active Listing Inventory decreased from 2,301 to 1,803 units. The Months of Inventory remained at 1.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [Note: Compared to November 2018, inventory is down 33.6%] .

...

The Median DOM (days on market) increased from 14 to 15 and the Average DOM increased from 28 to 29. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,242 sales this month, 68.2% (847) were on the market for 30 days or less and 86.1% (1,069) were on the market for 60 days or less.

emphasis added

2) Active inventory was at 1,803, down from 2,714 in November 2018. That is down 33.6% year-over-year. This is the seventh consecutive month with a YoY decline following 20 months of YoY increases in inventory.

NAHB: Builder Confidence Increased to 76 in December, Highest since 1999

by Calculated Risk on 12/16/2019 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 76, up from 71 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Ends Year Strong on Solid Economic Fundamentals

Builder confidence in the market for newly-built single-family homes increased five points to 76 in December off an upwardly revised November reading, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. This is the highest reading since June of 1999.

“Builders are continuing to see the housing rebound that began in the spring, supported by a low supply of existing homes, low mortgage rates and a strong labor market,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn.

“While we are seeing near-term positive market conditions with a 50-year low for the unemployment rate and increased wage growth, we are still underbuilding due to supply-side constraints like labor and land availability,” said NAHB Chief Economist Robert Dietz. “Higher development costs are hurting affordability and dampening more robust construction growth.”

…

All three HMI components registered gains in December. The HMI index gauging current sales conditions rose seven points to 84, the component measuring sales expectations in the next six months edged up one point to 79 and the measure charting traffic of prospective buyers increased four points to 58.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell two points to 61, the Midwest increased five points to 63, the South moved one point higher to 76 and the West rose three points to 84.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was well above the consensus forecast.

NY Fed: Manufacturing "Business activity was little changed in New York State"

by Calculated Risk on 12/16/2019 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity was little changed in New York State, according to firms responding to the December 2019 Empire State Manufacturing Survey. The headline general business conditions index held steady at 3.5. New orders were also little changed, while shipments grew modestly.This was slightly lower than the consensus forecast.

...

The index for number of employees was unchanged at 10.4, indicating that employment expanded for the fourth consecutive month. The average workweek index was 0.8, a sign that the average workweek was unchanged.

…

Indexes assessing the six-month outlook suggested that optimism about future conditions improved for a second consecutive month.

emphasis added

Sunday, December 15, 2019

Monday: Home Builder Survey, NY Fed Mfg

by Calculated Risk on 12/15/2019 07:45:00 PM

Weekend:

• Schedule for Week of December 15, 2019

• Mortgage Equity Withdrawal Positive in Q3

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 4.0, up from 2.9.

• At 10:00 AM, The December NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 7, and DOW futures are up 37 (fair value).

Oil prices were up over the last week with WTI futures at $59.78 per barrel and Brent at $64.90 barrel. A year ago, WTI was at $51, and Brent was at $59 - so oil prices are up 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.55 per gallon. A year ago prices were at $2.36 per gallon, so gasoline prices are up 19 cents year-over-year.

Mortgage Equity Withdrawal Positive in Q3

by Calculated Risk on 12/15/2019 12:27:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2019, the Net Equity Extraction was $31 billion, or a 0.75% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been mostly positive for the last four years. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward - but nothing like during the housing bubble.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $85 billion in Q3.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Saturday, December 14, 2019

Schedule for Week of December 15, 2019

by Calculated Risk on 12/14/2019 08:11:00 AM

The key economic reports this week are November Housing Starts, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

For manufacturing, November Industrial Production, and the December New York, Philly and Kansas City Fed surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 4.0, up from 2.9.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and total housing starts since 1968.

The consensus is for 1.344 million SAAR, up from 1.314 million SAAR.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.8% increase in Industrial Production, and for Capacity Utilization to increase to 77.2%.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings were at 7.024 million in September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224,000 initial claims, down from 252,000 last week.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 8.0, down from 10.4.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, down from 5.46 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, down from 5.46 million.The graph shows existing home sales from 1994 through the report last month.

8:30 AM: Gross Domestic Product, 3nd quarter 2018 (Third estimate). The consensus is that real GDP increased 2.1% annualized in Q3, unchanged from the second estimate of GDP.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December). The consensus is for a reading of 99.2.

10:00 AM: State Employment and Unemployment (Monthly) for November 2018

11:00 AM: the Kansas City Fed manufacturing survey for December.

Friday, December 13, 2019

Hotels: Occupancy Rate Decreased Slightly Year-over-year

by Calculated Risk on 12/13/2019 03:10:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 7 December

The U.S. hotel industry reported mostly positive year-over-year results in the three key performance metrics during the week of 1-7 December 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 2-8 December 2018, the industry recorded the following:

• Occupancy: -0.2% to 60.3%

• Average daily rate (ADR): +1.6% to US$128.66

• Revenue per available room (RevPAR): +1.4% to US$77.56

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into January.

Data Source: STR, Courtesy of HotelNewsNow.com

Q4 GDP Forecasts: 0.7% to 2.0%

by Calculated Risk on 12/13/2019 12:18:00 PM

From Merrill Lynch

The retail sales data nudged 3Q and 4Q GDP tracking a tenth lower to 2.1% and 1.5% qoq saar. [Dec 13 estimate]From Goldman Sachs:

emphasis added

Following today’s data, we lowered our Q4 GDP tracking estimate by one tenth to +1.8% (qoq ar). [Dec 13 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 0.7% for 2019:Q4 and 0.8% for 2020:Q1. [Dec 13 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 2.0 percent on December 13, unchanged from December 6. [Dec 13 estimate]CR Note: These estimates suggest real GDP growth will be between 0.7% and 2.0% annualized in Q4.