by Calculated Risk on 12/18/2019 06:57:00 PM

Wednesday, December 18, 2019

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 224,000 initial claims, down from 252,000 last week.

• At 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 8.0, down from 10.4.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, down from 5.46 million.

Phoenix Real Estate in November: Sales up 7.0% YoY, Active Inventory Down 20.7% YoY

by Calculated Risk on 12/18/2019 02:15:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 6,974 in November, down from 7,848 in October, and up from 6,515 in November 2018. Sales were down 11.1% from October 2019 (last month), and up 7.0% from November 2018.

2) Active inventory was at 13,675, down from 18,162 in November 2018. That is down 24.7% year-over-year.

3) Months of supply increased to 2.49 months in November from 2.35 months in October. This remains relatively low.

This is another market with increasing sales and falling inventory.

Lawler: Early Read on Existing Home Sales in November

by Calculated Risk on 12/18/2019 11:04:00 AM

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.43 million in November, down 0.5% from October’s preliminary pace and up 4.2% from last November’s seasonally adjusted pace. Unadjusted sales should be about flat from a year ago, with the SA/NSA difference reflecting this November’s lower business day count comparted to last November.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of November should be down by about 9.1% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 5.8% from last November.

CR Note: The National Association of Realtors (NAR) is scheduled to release November existing home sales on Thursday, December 19th at 10:00 AM ET. The consensus is for 5.45 million SAAR.

AIA: "Architecture Billings Index continues to show modest growth"

by Calculated Risk on 12/18/2019 09:37:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index continues to show modest growth

Demand for design services in November increased at a modest pace for the second month in a row, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 51.9 for November reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). During November, both the new project inquiries and design contracts scores were positive, posting scores of 60.9 and 52.9 respectively.

“The uncertainty surrounding the overall health of the economy is leading developers to proceed with more caution on new projects,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “We are at a point where there is a potential for an upside but also a potential for things to get worse.”

...

• Regional averages: South (54.5); West (51.3); Midwest (51.1); Northeast (47.5)

• Sector index breakdown: commercial/industrial (52.9) mixed practice (52.2); multi-family residential (51.5); institutional (50.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in October, down from 52.0 in October. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some further increase in CRE investment in 2020 - but three of the previous six months were negative.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 12/18/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 13, 2019.

... The Refinance Index decreased 7 percent from the previous week and was 135 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

"Mortgage rates were mostly unchanged, even as a potential trade deal between the U.S. and China caused rates to inch forward at the end of last week,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “With rates showing little meaningful movement, both refinance and purchase activity took a step back. As we move into the slowest time of the year for home sales, purchase application volume is declining but continues to outperform year-ago levels, when rates were much higher. Purchase activity was 10 percent higher than a year ago.”

Added Fratantoni, “2019 was another year of inadequate housing supply in relation to demand. The good news is that the tide could be slowly turning for potential buyers. Housing starts and permits rose strongly in November, and homebuilder confidence has surged to a level not seen since 1999.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remained unchanged at 3.98 percent, with points remaining unchanged at 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

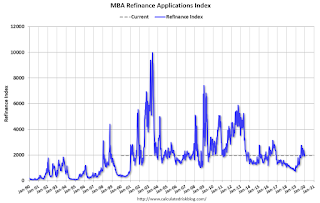

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

Tuesday, December 17, 2019

Wednesday: MBA Mortgage Index, Architecture Billings Index

by Calculated Risk on 12/17/2019 07:35:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

CAR on California November Housing: Sales up 5.6% YoY, Inventory down 22.5%

by Calculated Risk on 12/17/2019 02:52:00 PM

The CAR reported: California home sales and prices ease back in November, but low rates and tight supply continue to provide support to the market, C.A.R. reports

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 402,880 units in November, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the November pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

November’s sales figure was down 0.3 percent from the 404,240 level in October and up 5.6 percent from home sales in November 2018 of a revised 381,690.

“While statewide home sales and prices eased back slightly as the housing market continued to move into the off season, a favorable lending environment continues to draw interest from buyers who want to take advantage of low rates,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “The upper end of the market, in particular, is showing some welcomed improvement in recent months as both sales and prices posted mild growth from a year ago in November.”

...

After 15 straight months of year-over-year increases, active listings fell for the fifth straight month, dropping 22.5 percent from year ago. The decline was the third consecutive double-digit drop and the largest since April 2013.

The sharp drop in active listings and slight uptick in year-over-year sales put a dent in housing inventory. The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was 3.1 months in November, up slightly from 3.0 months in October but down sharply from 3.7 months in November 2018. It was the second lowest level in the last 17 months. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

Comments on November Housing Starts

by Calculated Risk on 12/17/2019 11:59:00 AM

Earlier: Housing Starts increased to 1.365 Million Annual Rate in November

Total housing starts in November were above expectations and revisions to prior months were minor.

The housing starts report showed starts were up 3.2% in November compared to October, and starts were up 13.6% year-over-year compared to November 2018.

Single family starts were up 16.7% year-over-year, and multi-family starts were up 4.4% YoY.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were up 13.6% in October compared to October 2018.

Year-to-date, starts are up 0.6% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the comparison will be easy in December.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. However, with the strong finish to the year, starts will be up in 2019 compared to 2018.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts- although starts are picking up a little again.

As I've been noting for several years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

BLS: Job Openings "Edged up" to 7.3 Million in October

by Calculated Risk on 12/17/2019 10:05:00 AM

Notes: In October there were 7.267 million job openings, and, according to the October Employment report, there were 5.855 million unemployed. So, for the twentieth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 5 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings edged up to 7.3 million (+235,000) on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.8 million and 5.6 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in October at 3.5 million and the rate was unchanged at 2.3 percent. Quits increased in other services (+66,000) and educational services (+12,000). Quits decreased in retail trade (-63,000) and in durable goods manufacturing (-21,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 7.267 million from 7.032 million in September.

The number of job openings (yellow) are down 4% year-over-year.

Quits are up 1% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

Industrial Production Increased in November

by Calculated Risk on 12/17/2019 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production and manufacturing production both rebounded 1.1 percent in November after declining in October. These sharp November increases were largely due to a bounceback in the output of motor vehicles and parts following the end of a strike at a major manufacturer. Excluding motor vehicles and parts, the indexes for total industrial production and for manufacturing moved up 0.5 percent and 0.3 percent, respectively. Mining production edged down 0.2 percent, while the output of utilities increased 2.9 percent.

At 109.7 percent of its 2012 average, total industrial production was 0.8 percent lower in November than it was a year earlier. Capacity utilization for the industrial sector increased 0.7 percentage point in November to 77.3 percent, a rate that is 2.5 percentage points below its long-run (1972–2018) average.

emphasis added

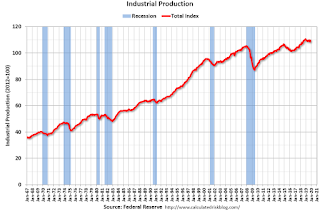

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.3% is 2.5% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 109.7. This is 26% above the recession low, and 4.1% above the pre-recession peak.

The change in industrial production and increase in capacity utilization were above consensus expectations.