by Calculated Risk on 12/24/2019 10:50:00 AM

Tuesday, December 24, 2019

"Chemical Activity Barometer Is Stable In December"

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: CChemical Activity Barometer Is Stable In December

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), was stable (0.0 percent change) in December on a three-month moving average (3MMA) basis following a 0.1 percent gain in November. On a year-over-year (Y/Y) basis, the barometer rose 0.4 percent (3MMA) and follows two months of negative year-earlier comparisons.

...

“The CAB signals slow gains in U.S. commerce into the third quarter of 2020,” said Kevin Swift, chief economist at ACC.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year change in the CAB suggests that the YoY change in industrial production might be near a short term bottom, but suggests "slow gains into the third quarter of 2020".

Richmond Fed: Manufacturing Activity Slowed in December

by Calculated Risk on 12/24/2019 10:02:00 AM

From the Richmond Fed: Manufacturing Activity Slowed in December

Fifth District manufacturing activity slowed in December, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite index fell from −1 in November to −5 in December, weighed down by decreases in the already negative indexes for shipments and new orders, while the third component — employment — increased slightly. Manufacturers also reported weakness in local business conditions and capacity utilization, but they were optimistic that conditions would improve in the coming months.Another weak regional report. The Dallas Fed will report next week.

Many firms saw growth in employment and wages in December. However, respondents reported declines in the average workweek, as this index decreased to −15, its lowest reading since April 2009. Manufacturers continued to report difficulty finding workers with the necessary skills and expected that struggle to continue in the next six months.

emphasis added

Monday, December 23, 2019

Freddie Mac: Mortgage Serious Delinquency Rate increased slightly in November

by Calculated Risk on 12/23/2019 06:39:00 PM

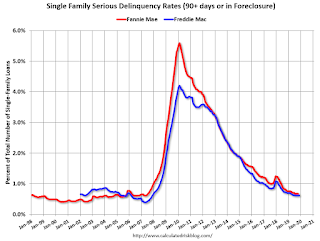

Freddie Mac reported that the Single-Family serious delinquency rate in November was 0.62%, up from 0.61% in October. Freddie's rate is down from 0.70% in November 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for November soon.

Ten Economic Questions for 2020

by Calculated Risk on 12/23/2019 02:10:00 PM

Here is a review of the Ten Economic Questions for 2019

Below are my ten questions for 2020 I'll follow up with some thoughts on each of these questions.

The purpose of these questions is to provide a framework to think about how the U.S. economy will perform in 2020 and - when there are surprises - to adjust my thinking.

1) Economic growth: Economic growth was probably just over 2% in 2019, down from 2.9% in 2018. The FOMC is expecting more of the same with growth around 1.9% next year. Some analysts are expecting growth to pick up a little in the coming year as the trade war eases and global growth increases. How much will the economy grow in 2020?

2) Employment: Through November 2019, the economy added 1,969,000 jobs, or 179,000 per month. This was down from 2018. Will job creation in 2020 be as strong as in 2019? Will job creation pick up in 2020? Or will job creation slow further in 2020?

3) Unemployment Rate: The unemployment rate was at 3.5% in November, down 0.2 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.5% to 3.7% range in Q4 2020. What will the unemployment rate be in December 2020?

4) Participation Rate: In November 2020, the overall participation rate was at 63.2%, up slightly year-over-year from 62.9% in November 2019. The BLS is projecting the overall participation rate will decline to 61.2% by 2028. Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

5) Real Wage Growth: Wage growth was disappointing in 2019 (up 3.1% year-over-year as of November). How much will wages increase in 2020?

6) Inflation: By some measures, inflation rate has increased and is now slightly above the Fed's 2% target. However core PCE was only up 1.6% YoY through November. Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

7) Monetary Policy: The Fed cut rates three times in 2019. Currently the Fed is forecasting a long pause in 2020 (no change to policy). Will the Fed cut or raise rates in 2020, and if so, by how much?

8) Residential Investment: Residential investment (RI) picked up in the second half of 2019, and new home sales were up about 10% in 2019 compared to 2018. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2020? How about housing starts and new home sales in 2020?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 3.5% in 2019, down from close to 5% YoY in November 2018. What will happen with house prices in 2020?

10) Housing Inventory: Housing inventory decreased in 2019 after increasing in 2018. Will inventory increase or decrease in 2020?

There are other important questions, such as oil prices, but these are the ones I'm focused on right now. I'll write on each of these questions over the next couple of weeks.

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

A few Comments on November New Home Sales

by Calculated Risk on 12/23/2019 11:34:00 AM

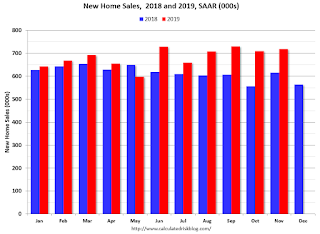

New home sales for November were reported at 719,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down, combined.

Sales were above 700 thousand SAAR for four consecutive months, and in five of the last six months - the best six month stretch since 2007.

Annual sales in 2019 will be the best year for new home sales since 2007.

Earlier: New Home Sales at 719,000 Annual Rate in November.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Sales in November were up 16.9% year-over-year compared to November 2018.

Year-to-date (through November), sales are up 9.8% compared to the same period in 2018.

The comparison for December is easy, so sales will likely be up double digits in 2019 compared to 2018 - a solid year for new home sales.

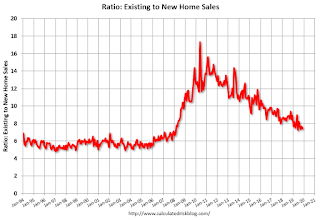

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Even though distressed sales are down significantly, following the bust, new home builders focused on more expensive homes - so the gap closed slowly.

Now the gap is mostly closed, and I expect it to close a little more. However, this assumes that the builders will offer some smaller, less expensive homes.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust - and is getting close to the historical ratio - and I expect this ratio will trend down a little more.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 719,000 Annual Rate in November

by Calculated Risk on 12/23/2019 10:15:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 719 thousand.

The previous three months were revised down, combined.

"Sales of new single‐family houses in November 2019 were at a seasonally adjusted annual rate of 719,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.3 percent above the revised October rate of 710,000 and is 16.9 percent above the November 2018 estimate of 615,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

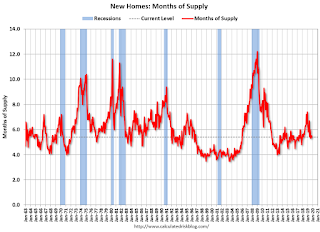

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 5.4 months from 5.5 months in October.

The months of supply decreased in November to 5.4 months from 5.5 months in October. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of November was 323,000. This represents a supply of 5.4 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2019 (red column), 52 thousand new homes were sold (NSA). Last year, 44 thousand homes were sold in November.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was below expectations of 735 thousand sales SAAR, and sales in the three previous months were revised down, combined. However this was still solid with sales up 16.9% year-over-year. I'll have more later today.

Chicago Fed "Index points to a rebound in economic growth in November"

by Calculated Risk on 12/23/2019 09:14:00 AM

From the Chicago Fed: Chicago Fed National Activity Index points to a rebound in economic growth in November

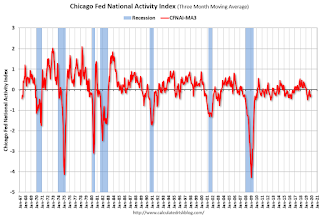

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.56 in November from –0.76 in October. All four broad categories of indicators that make up the index increased from October, and two of the four categories made positive contributions to the index in November. The index’s three-month moving average, CFNAI-MA3, moved up to –0.25 in November from –0.35 in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in November (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, December 22, 2019

Monday: New Home Sales, Durable Goods

by Calculated Risk on 12/22/2019 09:22:00 PM

Weekend:

• Schedule for Week of December 22, 2019

• Review: Ten Economic Questions for 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for November. This is a composite index of other data.

• Also at 8:30 AM, Durable Goods Orders for November. The consensus is for a 0.1% increase in durable goods.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for 735 thousand SAAR, up from 733 thousand in October.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3, and DOW futures are up 35 (fair value).

Oil prices were up over the last week with WTI futures at $60.30 per barrel and Brent at $65.99 barrel. A year ago, WTI was at $45, and Brent was at $52 - so oil prices are up over 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.32 per gallon, so gasoline prices are up 22 cents year-over-year.

Review: Ten Economic Questions for 2019

by Calculated Risk on 12/22/2019 12:36:00 PM

At the end of last year, I posted Ten Economic Questions for 2019. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2019 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

Here is review (we don't have all data yet, but enough). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2019: Will housing inventory increase or decrease in 2019?

"I expect to see inventory up again year-over-year in December 2019. My reasons for expecting more inventory are 1) inventory is still historically low (inventory in November 2018 was the second lowest since 2000), 2) higher mortgage rates, and 3) further negative impact in certain areas from new tax law."According to the November NAR report on existing home sales, inventory was down 5.7% year-over-year in November, and the months-of-supply was at 3.7 months. Early in the year, it appeared inventory would be up year-over-year, but with the decline in mortgage rates, inventory declined. This leaves inventory at a fairly low level.

9) Question #9 for 2019: What will happen with house prices in 2019?

"If inventory increases further year-over-year as I expect by December 2019, it seems likely that price appreciation will slow to the low single digits - maybe around 3%."The CoreLogic data for October showed prices up 3.5% year-over-year. The September Case-Shiller data showed prices up 3.2% YoY. So price gains did slow in 2019.

8) Question #8 for 2019: How much will Residential Investment increase?

"Most analysts are looking for starts and new home sales to increase slightly in 2019. For example, the NAHB is forecasting a slight increase in starts (to 1.269 million), and no change in home sales in 2019. And Fannie Mae is forecasting a slight increase in starts (to 1.265 million), and for new home sales to increase to 619 thousand in 2019.Through November, starts were up 0.6% year-over-year compared to the same period in 2018. New home sales were up 9.6% year-over-year through October. Both starts and new home sales will be up year-over-year in 2019.

My sense is the weakness in late 2018 will continue into 2019, and starts will be down year-over-year, but not a huge decline. My guess is starts will decrease slightly in 2019 and new home sales will be close to 600 thousand."

7) Question #7 for 2019: How much will wages increase in 2019?

"As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3.5% in 2019 according to the CES."Through November 2019, nominal hourly wages were up 3.1% year-over-year. Wages disappointed in 2019 and will likely be somewhat below my forecast of 3.5%.

6) Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

"My current guess is just one hike in the 2nd half of the year."This was incorrect. The Fed cut rates three times in 2019.

5) Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

The Fed is projecting core PCE inflation will increase to 2.0% to 2.1% by Q4 2019. There are risks for higher inflation with the labor market near full employment, however I do think there are structural reasons for low inflation (demographics, few employment agreements that lead to wage-price-spiral, etc).Several measures of inflation are slightly above the Fed's target, however core PCE was only up 1.6% YoY through November.

So, although I think core PCE inflation (year-over-year) will increase in 2019 and be around 2% by Q4 2019 (up from 1.9%), I think too much inflation will still not be a serious concern in 2019.

4) Question #4 for 2019: What will the unemployment rate be in December 2019?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the mid 3's by December 2019 from the current 3.7%. My guess is based on the participation rate being mostly unchanged in 2019, and for decent job growth in 2019, but less than in 2018 or 2017.The unemployment rate was at 3.5% in November, the participation rate was essentially unchanged from last December, and job growth was decent, but less than in 2018 or 2017.

3) Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

So my forecast is for gains of around 133,000 to 167,000 payroll jobs per month in 2019 (about 1.6 million to 2.0 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics.Through November 2019, the economy has added 1,969,000 jobs, or 179,000 per month. This is slightly above my forecast, however job growth did slow this year compared to 2018.

2) Question #2 for 2019: How much will the economy grow in 2019?

"Looking to 2019, fiscal policy will still be a positive for growth - although the boost will fade over the course of the year, and become a drag in 2020. And oil prices declined sharply in late 2018, and this will be a drag on economic growth in 2019. Auto sales are mostly moving sideways, and housing has been under pressure due to higher mortgage rates and the new tax plan.GDP growth was at a 3.1% annualized real rate in Q1, 2.0% in Q2, and 2.1% in Q3. Most forecasts are for sub-2% in Q4. In 2018 I was forecasting a pickup in growth - and that happened - and in 2019 year I expected growth to slow.

These factors suggest growth will slow in 2019, probably to the low 2s -and maybe even a 1 handle."

1) Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

My forecasts are based on a limited negative impact from Mr. Trump - and I hope that remains the case. But he is a key downside risk for the economy.Trade and immigration policies had some negative impact on the economy, and, as expected, the 2017 tax cuts completely failed to deliver on the Administration's promises (predictable). But overall the negative impact was somewhat limited.

In general I was close on GDP, employment and house prices. I was wrong on the Fed, and housing performed somewhat better than expected.

Saturday, December 21, 2019

Schedule for Week of December 22, 2019

by Calculated Risk on 12/21/2019 08:11:00 AM

Happy Holidays and Merry Christmas!

The key economic report this week is November New Home sales.

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

8:30 AM: Durable Goods Orders for November. The consensus is for a 0.1% increase in durable goods.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 735 thousand SAAR, up from 733 thousand in October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

The NYSE and the NASDAQ will close early at 1:00 PM ET.

All US markets will be closed in observance of the Christmas Holiday.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220,000 initial claims, down from 234,000 last week.

No major economic releases scheduled.