by Calculated Risk on 12/27/2019 12:57:00 PM

Friday, December 27, 2019

Philly Fed: State Coincident Indexes increased in 39 states in November

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2019. Over the past three months, the indexes increased in 42 states, decreased in five states, and remained stable in three, for a three-month diffusion index of 74. In the past month, the indexes increased in 39 states, decreased in nine states, and remained stable in two, for a one-month diffusion index of 60Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red and gray states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In November, 40 states had increasing activity including states with minor increases.

Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

by Calculated Risk on 12/27/2019 11:54:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

6) Inflation: By some measures, inflation rate has increased and is now slightly above the Fed's 2% target. However core PCE was only up 1.6% YoY through November. Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

Although there are different measure for inflation (including some private measures) they mostly show inflation slightly above the Fed's 2% inflation target. Core PCE was below the target at 1.6% YoY in November.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.3%. Core PCE is for October and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized and trimmed-mean CPI was at 3.1% annualized.

The Fed is projecting core PCE inflation will increase to 1.9% to 2.0% by Q4 2020. There are risks for higher inflation with the labor market near full employment, however I do think there are structural reasons for low inflation (demographics, few employment agreements that lead to wage-price-spiral, etc).

So, although I think core PCE inflation (year-over-year) will increase a little in 2020 (from the current 1.6%), I think too much inflation will still not be a serious concern in 2020.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

by Calculated Risk on 12/27/2019 09:30:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

7) Monetary Policy: The Fed cut rates three times in 2019. Currently the Fed is forecasting a long pause in 2020 (no change to policy). Will the Fed cut or raise rates in 2020, and if so, by how much?

The Fed raised rates once in 2015, once again in 2016, three times in 2017, and four times in 2018. And then the Fed cut rates three times in 2019. Currently the target range for the federal funds rate is 1‑1/2 to 1-3/4 percent.

There is a narrow range of views on the FOMC. As of December, looking at the "dot plot", the FOMC participants see the following number of rate cuts or hikes in 2020:

| 25bp Rate Hikes or Cuts in 2020 | FOMC Members |

|---|---|

| One Rate Cut | 0 |

| No Change | 13 |

| One Rate Hike | 4 |

Clearly the main view of the FOMC is no change in policy in 2020.

With core PCE inflation below the Fed's target, and around 2% GDP growth - the Fed will likely stay on hold in the first half of the year. Then, if there is a change in policy, it will likely happen after the election at the December meeting (as happened in 2016).

So my guess is the Fed will stay on hold in 2020 and the FOMC will keep the federal funds rate at 1‑1/2 to 1-3/4 percent. If there is a change in policy, it will likely happen in December.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Thursday, December 26, 2019

Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

by Calculated Risk on 12/26/2019 04:05:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

8) Residential Investment: Residential investment (RI) picked up in the second half of 2019, and new home sales were up about 10% in 2019 compared to 2018. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2020? How about housing starts and new home sales in 2020?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2019:

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the start of the recovery was sluggish.

Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year through 2017. However RI as a percent of GDP declined in late 2018 and early 2019.

We don't have the data yet for Q4 2019 yet, but it appears RI will make only a small contribution to GDP (probably slightly negative) in 2019.

Note that RI as a percent of GDP is still low and close to the lows of previous recessions.

Housing starts are up 0.6% through November 2019 compared to the same period in 2018, and are on pace to increase just over 1% in 2019.

Even after the significant increase over the last several years, the approximately 1.27 million housing starts in 2019 will still be the 20th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (61 total years). The seven lowest years were 2008 through 2014, and the other lower years were the bottoms of previous recessions.

New home sales in 2019, through November, were up 9.8% compared to the same period in 2018. Sales will probably finish up more than 10% year-over-year.

Here is a table showing housing starts and new home sales since 2005. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will increase further this cycle.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2,068 | --- | 1,283 | --- |

| 2006 | 1,801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1,355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1,003 | 8.5% | 437 | 1.9% |

| 2015 | 1,112 | 10.9% | 501 | 14.7% |

| 2016 | 1,174 | 5.6% | 561 | 12.0% |

| 2017 | 1,203 | 2.5% | 613 | 9.3% |

| 2018 | 1,250 | 3.9% | 617 | 0.7% |

| 20191 | 1,266 | 1.3% | 679 | 10.0% |

| 12019 estimated | ||||

Most analysts are looking for starts and new home sales to increase further in 2020. For example, Fannie Mae is forecasting an increase in starts to 1.351 million, and for new home sales to increase to 725 thousand in 2020.

Note that New Home sales have averaged 717 thousand over the last four months on seasonally adjust annual rate (SAAR) basis. So an increase to 725 thousand for 2020 isn't a large increase over the recent sales rate. And housing starts have average 1.332 million over the same period.

My sense is the pickup that happened in the second half of 2019 will continue, and my guess is starts will be up year-over-year in 2020 by mid-to-high single digits. My guess is new home sales will be over 700 thousand in 2020 (for the first time since 2007) and will also be up mid-to-high single digits.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 12/26/2019 01:53:00 PM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

CR Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 42% under Mr. Trump - compared to up 54% under Mr. Obama for the same number of market days.

If the S&P returns 29.5% from today until the end of Mr. Trump's current term (in January 2021), that would match the gains under Mr. Obama's first term.

Question #9 for 2020: What will happen with house prices in 2020?

by Calculated Risk on 12/26/2019 10:50:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 3.5% in 2019, down from close to 5% YoY in November 2018. What will happen with house prices in 2020?

The following graph shows the year-over-year change through September 2018 (Prices for October 2019 will be released next week), in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 1.6% compared to September 2018, the Composite 20 SA was up 2.1% and the National index SA was up 3.2% year-over-year. Other house price indexes have indicated similar gains (see table below).

The price increases in 2019 were lower than in 2018, however YoY price growth picked up slightly towards the end of 2019.

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Sept-19 | 2.1% |

| Case-Shiller National | Sept-19 | 3.2% |

| CoreLogic | Oct-18 | 3.5% |

| FHFA Purchase Only, Freddie and Fannie | Sept-18 | 5.1% |

Inventories will probably remain at about the same level in 2020, and will probably still be somewhat low historically.

Low inventories, and a decent economy suggests further price increases in 2020.

Last year I wrote:

"[I]t seems likely that price appreciation will slow [in 2019] to the low single digits - maybe around 3%."That happened in 2019, however now I expect some pickup in price increases from the lower mortgage rates in 2020.

If inventory remains at close to the same level, it seems likely that price appreciation will increase from the 2019 pace to the mid-single digits.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Weekly Initial Unemployment Claims decreased to 222,000

by Calculated Risk on 12/26/2019 09:02:00 AM

The DOL reported:

In the week ending December 21, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 234,000 to 235,000. The 4-week moving average was 228,000, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 225,500 to 225,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 228,000.

This was close to the consensus forecast.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 12/26/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 20, 2019.

... The Refinance Index decreased 5 percent from the previous week and was 128 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 5 percent higher than the same week one year ago.

...

“The 10-Year Treasury yield increased last week amid signs of stronger homebuilding activity and solid consumer spending, leading to a rise in conventional conforming and jumbo 30-year mortgage rates to just under 4 percent. With this increase, conventional refinance application volume fell 11 percent,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Refinance applications for government loans did increase, even though rates on FHA loans picked up. The change in the mix of business has kept the average refinance loan size smaller than we had seen earlier this year.”

Added Fratantoni, “We are in the slowest time of the year for the purchase market. Purchase application activity declined after the seasonal adjustment, but still remains about 5 percent ahead of last year’s pace. The increase in construction activity will bolster housing inventories, which should be a positive for purchase volumes going into 2020.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 3.99 percent from 3.98 percent, with points remaining unchanged at 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

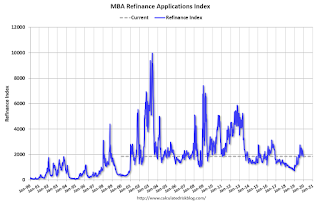

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 5% year-over-year.

Wednesday, December 25, 2019

Merry Christmas and Happy Holidays!

by Calculated Risk on 12/25/2019 06:26:00 PM

Merry Christmas and Happy Holidays!

Thursday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 220,000 initial claims, down from 234,000 last week.

Tuesday, December 24, 2019

Question #10 for 2020: Will housing inventory increase or decrease in 2020?

by Calculated Risk on 12/24/2019 12:41:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory decreased in 2019 after increasing in 2018. Will inventory increase or decrease in 2020?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see red arrow on first graph below) helped me call the top for house prices in 2006.

Earlier in 2019, when several commentators were bearish on housing, I pointed out there was no sharp increase in housing inventory (like in 2005), and that was one of the reasons I remained optimistic on housing and the economy (correctly!).

This graph shows nationwide inventory for existing homes through November 2019.

According to the NAR, inventory decreased to 1.64 million in November from 1.77 million in October. And inventory in November was down from 1.74 million in November 2018.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Note that inventory is at about the same level as in November 2017, and still 20% below the levels for November 2014 and 2015.

Inventory was down 5.7% year-over-year in November compared to November 2018. Months of supply decreased to 3.7 months in November.

Housing inventory increased YoY in 2018 due to a combination of higher mortgage rates and the new tax law. With lower mortgage rates, inventory decreased YoY at the end of 2019.

Inventory is always something to watch. If inventory increases sharply, house price growth will slow, and if inventory drops sharply, house price growth will pickup.

Since I don't expect any change in fiscal policy during an election year, and monetary policy appears to be on hold - and I don't expect either a strong pickup in the economy (and higher rates) or an economic slump - it seems likely inventory will remain at about the same level through 2020.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?