by Calculated Risk on 12/30/2019 06:59:00 PM

Monday, December 30, 2019

Tuesday: Case-Shiller House Prices

Tuesday:

• At 9:00 AM ET, FHFA House Price Index for October 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for October. The consensus is for a 3.2% year-over-year increase in the National index for October.

Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

by Calculated Risk on 12/30/2019 04:50:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

4) Participation Rate: In November 2020, the overall participation rate was at 63.2%, up slightly year-over-year from 62.9% in November 2019. The BLS is projecting the overall participation rate will decline to 61.2% by 2028. Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

The overall labor force participation rate is the percentage of the working age population (16 + years old) in the labor force. A large portion of the decline in the participation rate since 2000 is due to demographics and long term trends.

The Labor Force Participation Rate in November 2019 was at 63.2%, up from the cycle low of 62.4% in September 2015.

Some analysts were expecting the overall participation rate to recover to pre-recession levels (over 66%) but that analysis ignored demographics and long term trends.

Note: Due to demographics, I also follow the prime working age participation and employment population ratio.

In September, the BLS released their updated Labor Force projections through 2028. Their projections show the overall Labor Force Participation Rate (LFPR) declining to 61.2% in 2018 from the current level. Although it is uncertain when the decline in the overall LFPR will begin, demographics suggest the LFPR will decline about 2 percentage points over the next decade.

It is possible that the participation rate will increase for other groups like prime working age women, but that is unclear - and those possible trend changes will probably be overwhelmed by the larger demographic trend.

Note that the median person in the Boomer generation will be 66 in 2020, and that the youngest person will be in the 55 to 59 cohort - when the participation rate starts to decline.

Note: The participation rate for older age groups has been increasing over the last couple of decades, but that is far less significant than the number of people moving into the next age group.

All of the Baby Boom generation is now in age groups with significantly declining participation rates, and I expect this will start a downward trend for the overall participation rate over the next decade, even with a healthy job market.

So I expect the overall participation rate to decline in 2020 to just under 63% by the end of the year.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Chicago PMI "Rose to 48.9 in December"

by Calculated Risk on 12/30/2019 02:58:00 PM

Earlier from the Chicago PMI: Chicago Business Barometer™ – Rose to 48.9 in December

The Chicago Business BarometerTM, produced with MNI, rose 2.6 points in December, hitting a four-month high of 48.9.CR Note: "An indicator reading above 50 shows expansion compared with a month earlier while below 50 indicates contraction." This was another month of contraction.

Business sentiment dropped by 1.2 points to 46.2 in Q4, marking the lowest quarterly reading since Q2 2009. The index was below the 50-mark for the second successive quarter.

...

While Employment cooled to 47.4 in December, showing the largest monthly decline, it also scored the biggest quarterly gain, up by 11.1% to 48.9.

emphasis added

Question #5 for 2020: How much will wages increase in 2020?

by Calculated Risk on 12/30/2019 12:38:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

5) Real Wage Growth: Wage growth was disappointing in 2019 (up 3.1% year-over-year as of November). How much will wages increase in 2020?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

Nominal wage growth (blue line) had been running close to 2% from 2010 through 2015 with a slight upward trend.

Then the pace of wage growth started to pickup in 2016. However wage growth in 2019 was disappointing (only up 3.1% YoY in November).

However, with low inflation, workers was some real wage growth in 2019. The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up in 2015.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

![]() The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid).

The Atlanta Fed Wage tracker showed nominal wage growth close to 4% in late 2016, but dipped in 2017. At the end of 2018, wage growth was back up to close to 4% - and at 3.7% in November 2019.

Note: Economist Ernie Tedeschi has an excellent discussion on Twitter using the Atlanta Fed Wage Tracker, and breaking it down by quantile. The bottom quantile is seeing the fastest wage growth, possibly suggesting some pickup in wages in 2020.

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase to the mid 3% range in 2020 according to the CES.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Dallas Fed: "Texas Manufacturing Activity Expands Modestly"

by Calculated Risk on 12/30/2019 10:36:00 AM

From the Dallas Fed: Texas Manufacturing Activity Expands Modestly

Growth in Texas factory activity resumed in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rebounded to 3.6 after dipping into negative territory last month.This was the last of the regional Fed surveys for December.

Most other measures of manufacturing activity also rebounded in December. The new orders index rose from -3.0 to 1.6. The growth rate of orders index moved up but remained in negative territory for a third consecutive month, coming in at -5.0. The capacity utilization index shot up 13 points to 7.8, and the shipments index rose from -4.5 to 3.0.

Perceptions of broader business conditions were mixed in December. The general business activity index remained slightly negative at -3.2, while the company outlook index inched up three points to 1.3. Both indexes have oscillated between positive (expansionary) and negative (contractionary) territory this year. The index measuring uncertainty regarding companies’ outlooks receded 12 points to 5.6, its lowest reading since March.

Labor market measures suggested rising employment levels and slightly longer workweeks this month. The employment index rose from 0.9 to 6.2, indicative of a pickup in hiring.

emphasis added

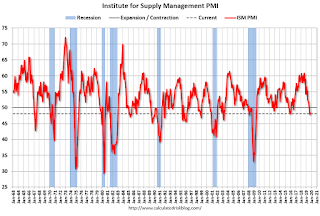

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index for December will be weak again.

NAR: "Pending Home Sales Expand 1.2% in November"

by Calculated Risk on 12/30/2019 10:03:00 AM

From the NAR: Pending Home Sales Expand 1.2% in November

Pending home sales increased in November, rebounding from the prior month’s decline, according to the National Association of Realtors®. The West region reported the highest growth last month, while the other three major U.S. regions saw only marginal variances in month-over-month contract activity. Pending home sales were up nationally and up in all regions compared to one year ago.This was close to expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, rose 1.2% to 108.5 in November. Year-over-year contract signings jumped 7.4%. An index of 100 is equal to the level of contract activity in 2001.

...

he regional indices had mixed results in November. The Northeast PHSI slid 0.1% to 96.3 in November, 2.6% higher than a year ago. In the Midwest, the index rose 1.0% to 102.5 last month, 5.0% higher than in November 2018.

Pending home sales in the South decreased 0.2% to an index of 125.0 in November, a 7.7% increase from last November. The index in the West grew 5.5% in November 2019 to 98.4, an increase of 14.0% from a year ago.

emphasis added

Sunday, December 29, 2019

Monday: Pending Home Sales, Dallas Fed Mfg

by Calculated Risk on 12/29/2019 06:29:00 PM

Weekend:

• Schedule for Week of December 29, 2019

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for December.

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 1.1% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $61.71 per barrel and Brent at $68.16 barrel. A year ago, WTI was at $46, and Brent was at $51 - so oil prices are up over 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.57 per gallon. A year ago prices were at $2.26 per gallon, so gasoline prices are up 31 cents year-over-year.

December 2019: Unofficial Problem Bank list increased to 67 Institutions, Q4 2019 Transition Matrix

by Calculated Risk on 12/29/2019 11:19:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources. DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for December 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for December2019. During the month, the list increased by two to 67 institutions after one removal and three additions. Assets increased by $104 million to $51.1 billion. A year ago, the list held 78 institutions with assets of $53.9 billion.

This month, the action against The First National Bank of Scott City, Scott City, KS ($116 million) was terminated. Added this month was First National Bank in Fairfield, Fairfield, IA ($145 million); KansasLand Bank, Quinter, KS ($53 million); and The First National Bank of Fleming, Fleming, CO ($22 million). The FDIC issued a Prompt Corrective Action order against The Farmers Bank, Carnegie, OK ($91 million).

With the conclusion of the fourth quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, 1,757 institutions have appeared on a weekly or monthly list since the start of publication. Only 3.8 percent of the banks that have appeared on a list remain today as 1,690 institutions have transitioned through the list. Departure methods include 996 action terminations, 409 failures, 266 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 5 or 1.3 percent, are still designated as being in a troubled status more than ten years later. The 409 failures represent 23.3 percent of the 1,757 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 180 | (68,469,804) | |

| Unassisted Merger | 41 | (10,072,112) | |

| Voluntary Liquidation | 5 | (10,672,586) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | 587,539 | ||

| Still on List at 12/31/2019 | 5 | 1,289,129 | |

| Additions after 8/7/2009 | 62 | 49,858,328 | |

| End (12/31/2019) | 67 | 51,147,457 | |

| Intraperiod Removals1 | |||

| Action Terminated | 816 | 326,978,159 | |

| Unassisted Merger | 225 | 84,625,963 | |

| Voluntary Liquidation | 14 | 2,558,186 | |

| Failures | 251 | 125,351,580 | |

| Total | 1,306 | 539,513,888 | |

| 1Institution not on 8/7/2009 or 12/31/2019 list but appeared on a weekly list. | |||

Saturday, December 28, 2019

Schedule for Week of December 29, 2019

by Calculated Risk on 12/28/2019 08:11:00 AM

Happy New Year! Wishing you all the best in 2020.

The key indicators include this week are Case-Shiller House Prices for October and the December ISM manufacturing index.

9:45 AM: Chicago Purchasing Managers Index for December.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 1.1% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

9:00 AM: FHFA House Price Index for October 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for October.This graph shows graph shows the Year over year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 3.2% year-over-year increase in the National index for October.

All US markets will be closed in observance of the New Year's Day Holiday.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 227,000 initial claims, up from 222,000 last week.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 49.0, up from 48.1 in November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 49.0, up from 48.1 in November.Here is a long term graph of the ISM manufacturing index.

The PMI was at 48.1% in November, the employment index was at 46.6%, and the new orders index was at 47.2%.

10:00 AM: Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.0 million SAAR in December, down from 17.1 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to be 17.0 million SAAR in December, down from 17.1 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

Friday, December 27, 2019

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 12/27/2019 05:46:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 21 Decembe

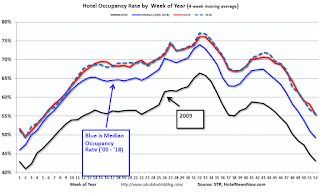

he U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 15-21 December 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 16-22 December 2018, the industry recorded the following:

• Occupancy: +5.9% to 50.1%

• Average daily rate (ADR): +1.8% to US$108.96

• Revenue per available room (RevPAR): +7.8% to US$54.55

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A solid finish to the year puts the average occupancy rate in 2019 just behind the record rate in 2018. Another strong year for hotels.

Seasonally, the 4-week average of the occupancy rate will decline into January.

Data Source: STR, Courtesy of HotelNewsNow.com