by Calculated Risk on 1/03/2020 10:06:00 AM

Friday, January 03, 2020

ISM Manufacturing index Decreased to 47.2 in December, Fifth Consecutive Month of Contraction

The ISM manufacturing index indicated contraction in December. The PMI was at 47.2% in December, down from 48.1% in November. The employment index was at 45.1%, down from 46.6% last month, and the new orders index was at 46.8%, down from 47.2%.

From the Institute for Supply Management: December 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in December, and the overall economy grew for the 128th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The December PMI® registered 47.2 percent, a decrease of 0.9 percentage point from the November reading of 48.1 percent. This is the PMI®'s lowest reading since June 2009, when it registered 46.3 percent. The New Orders Index registered 46.8 percent, a decrease of 0.4 percentage point from the November reading of 47.2 percent. The Production Index registered 43.2 percent, down 5.9 percentage points compared to the November reading of 49.1 percent. The Backlog of Orders Index registered 43.3 percent, up 0.3 percentage point compared to the November reading of 43 percent. The Employment Index registered 45.1 percent, a 1.5-percentage point decrease from the November reading of 46.6 percent. The Supplier Deliveries Index registered 54.6 percent, a 2.6-percentage point increase from the November reading of 52 percent. The Inventories Index registered 46.5 percent, an increase of 1 percentage point from the November reading of 45.5 percent. The Prices Index registered 51.7 percent, a 5-percentage point increase from the November reading of 46.7 percent. The New Export Orders Index registered 47.3 percent, a 0.6-percentage point decrease from the November reading of 47.9 percent. The Imports Index registered 48.8 percent, a 0.5-percentage point increase from the November reading of 48.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 49.0%, and suggests manufacturing contracted further in December.

Thursday, January 02, 2020

Friday: ISM Mfg, Construction Spending, Auto Sales

by Calculated Risk on 1/02/2020 06:56:00 PM

Friday:

• At 10:00 AM ET, ISM Manufacturing Index for December. The consensus is for the ISM to be at 49.0, up from 48.1 in November.

• Also at 10:00 AM, Construction Spending for November. The consensus is for a 0.3% increase in construction spending.

• All day, Light vehicle sales for December. The consensus is for light vehicle sales to be 17.0 million SAAR in December, down from 17.1 million in November (Seasonally Adjusted Annual Rate).

Question #1 for 2020: How much will the economy grow in 2020?

by Calculated Risk on 1/02/2020 03:24:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

1) Economic growth: Economic growth was probably just over 2% in 2019, down from 2.9% in 2018. The FOMC is expecting more of the same with growth around 1.9% next year. Some analysts are expecting growth to pick up a little in the coming year as the trade war eases and global growth increases. How much will the economy grow in 2020?

First, since I'm frequently asked, I don't see a recession starting in 2020.

Here is a table of the annual change in real GDP since 2005. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%., although demographics are improving somewhat (more prime age workers).

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2019, I used a 2.0% annual growth rate in Q4 2019 (this gives 2.3% Q4 over Q4 or 2.3% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.1% |

| 2006 | 2.9% | 2.6% |

| 2007 | 1.9% | 2.0% |

| 2008 | -0.1% | -2.8% |

| 2009 | -2.5% | 0.2% |

| 2010 | 2.6% | 2.6% |

| 2011 | 1.6% | 1.6% |

| 2012 | 2.2% | 1.5% |

| 2013 | 1.8% | 2.6% |

| 2014 | 2.5% | 2.9% |

| 2015 | 2.9% | 1.9% |

| 2016 | 1.6% | 2.0% |

| 2017 | 2.4% | 2.8% |

| 2018 | 2.9% | 2.5% |

| 20191 | 2.3% | 2.3% |

| 1 2019 estimate based on 2.0% Q4 annualized real growth rate | ||

The FOMC is projecting real GDP growth of 2.0% to 2.2% in 2020 (Q4 over Q4).

Goldman Sachs recently projected: "Easier financial conditions, the end of the inventory adjustment, and strength in consumer spending also suggest a solid growth outlook, and we expect growth to accelerate modestly to 2.25-2.5% in 2020."

The most recent CBO forecast is for 2.1% real GDP growth in 2020.

Note: The Trump administration projected 3.5% annual real growth over Mr. Trump's term: "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate." (now removed from Trump website). That didn't happen.

As expected, there was a slowdown in growth in 2019 due to a combination of factors. The fiscal boost faded in 2019, housing was under pressure early in the year from higher mortgage rates and the new tax policy, and the negative impact from the trade war.

Looking to 2020, fiscal policy will likely have a minor impact. Trade tensions have eased somewhat. Oil prices have increased in 2019, and this will be a slight positive on economic growth in certain states in 2020. Housing is getting a boost from lower mortgage rates. However, auto sales are mostly moving sideways.

These factors suggest real GDP growth probably in the 2% to 2.5% range in 2020.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

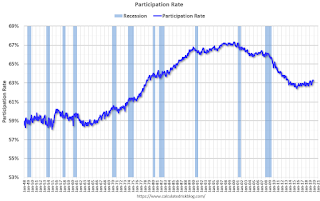

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

by Calculated Risk on 1/02/2020 10:32:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

2) Employment: Through November 2019, the economy added 1,969,000 jobs, or 179,000 per month. This was down from 2018. Will job creation in 2020 be as strong as in 2019? Will job creation pick up in 2020? Or will job creation slow further in 2020?

For review, here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total and private employment gains, 2014 was the best year since the '90s, and it appears job growth peaked for this cycle in 2014.

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,407 | 3,212 | 195 |

| 1998 | 3,048 | 2,735 | 313 |

| 1999 | 3,179 | 2,718 | 461 |

| 2000 | 1,936 | 1,672 | 264 |

| 2001 | -1,725 | -2,276 | 551 |

| 2002 | -509 | -742 | 233 |

| 2003 | 117 | 159 | -42 |

| 2004 | 2,039 | 1,892 | 147 |

| 2005 | 2,524 | 2,338 | 186 |

| 2006 | 2,100 | 1,891 | 209 |

| 2007 | 1,141 | 853 | 288 |

| 2008 | -3,552 | -3,732 | 180 |

| 2009 | -5,053 | -4,979 | -74 |

| 2010 | 1,035 | 1,251 | -216 |

| 2011 | 2,075 | 2,387 | -312 |

| 2012 | 2,174 | 2,241 | -67 |

| 2013 | 2,302 | 2,369 | -67 |

| 2014 | 3,006 | 2,879 | 127 |

| 2015 | 2,729 | 2,574 | 155 |

| 2016 | 2,318 | 2,116 | 202 |

| 2017 | 2,153 | 2,068 | 85 |

| 20181 | 2,679 | 2,583 | 96 |

| 20192 | 2,204 | 2,042 | 162 |

| 1Job growth in 2018 and early 2019 is expected to be revised down significantly. 22019 is year-over-year job gains through November | |||

The good news is job market still has solid momentum heading into 2020.

Note: Some people compare to the '80s and '90s, without thinking about changing demographics. The prime working age population (25 to 54 years old) was growing 2.2% per year in the '80s, and 1.3% per year in the '90s. The prime working age population has actually declined slightly in the '10s. Note: The prime working age population appears to be growing slowly again, and growth should pick up in the 2020s.

Note that some people will be confused by the Census hiring and firing. In May 2010, the Census hired 411,000 people. More than half were let go in June - the rest over the next several months. The Census will distort the headline employment numbers again in 2020, especially in April, May, June and July.

The second table shows the change in construction and manufacturing payrolls starting in 2006.

| Construction Jobs (000s) | Manufacturing (000s) | |

|---|---|---|

| 2006 | 152 | -178 |

| 2007 | -195 | -269 |

| 2008 | -789 | -896 |

| 2009 | -1,047 | -1,375 |

| 2010 | -187 | 120 |

| 2011 | 144 | 207 |

| 2012 | 113 | 158 |

| 2013 | 208 | 123 |

| 2014 | 361 | 209 |

| 2015 | 339 | 70 |

| 2016 | 193 | -7 |

| 2017 | 268 | 190 |

| 2018 | 307 | 264 |

| 20191 | 146 | 56 |

| 12019 is Year-over-year job gains through November | ||

Energy related construction and manufacturing hiring was solid in 2017 and 2018 as oil prices increased. However, in 2019, energy related employment was probably weak since oil price had fallen sharply at the end of 2018. Also, there was general weakness in manufacturing in 2019 due to the trade war, and the lack of growth in the auto sector. With easing trade tensions, manufacturing employment gains might increase in 2020, and with a pickup in construction activity, construction employment might increase too.

However, my sense is the overall participation rate will decline slightly in 2020 (due to demographics), and employers will have more difficultly in finding employees to replace them.

So my forecast is for gains of around 125,000 to 150,000 payroll jobs per month in 2020 (about 1.5 million to 1.8 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Weekly Initial Unemployment Claims at 222,000

by Calculated Risk on 1/02/2020 08:34:00 AM

The DOL reported:

In the week ending December 28, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 222,000 to 224,000. The 4-week moving average was 233,250, an increase of 4,750 from the previous week's revised average. This is the highest level for this average since January 27, 2018 when it was 235,750. The previous week's average was revised up by 500 from 228,000 to 228,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 233,250.

This was close to the consensus forecast.

Wednesday, January 01, 2020

Question #3 for 2020: What will the unemployment rate be in December 2020?

by Calculated Risk on 1/01/2020 02:55:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2020. I'm adding some thoughts, and maybe some predictions for each question.

3) Unemployment Rate: The unemployment rate was at 3.5% in November, down 0.2 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 3.5% to 3.7% range in Q4 2020. What will the unemployment rate be in December 2020?

This first graph shows the unemployment rate since 1948.

The unemployment rate has declined steadily after peaking at 10% following the great recession.

The current unemployment rate (3.5%) is below the low (3.8%) at the end of the '90s expansion, and at the lowest rate since 1969.

As I've mentioned before, current demographics share some similarities to the '60s, and the unemployment rate bottomed at 3.4% in the '60s - and we might see the unemployment rate that low or lower in this cycle. If we look further back in time, the unemployment rate was as low as 2.5% in the 1950s.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate.

On participation: We can be pretty certain that the participation rate will decline over the next decade or longer based on demographic trends. However, over the last several years, the participation rate has been fairly steady as the strong labor market offset the long term trend.

The participation increased significantly starting in the late 60s as the Boomer generation entered the workforce and women participated at a much higher rate.

Since 2000, the participation rate has generally declined, mostly due to demographics.

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.8% | -0.1 | 5.6% |

| 2015 | 62.7% | -0.1 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

| 2017 | 62.7% | 0.0 | 4.1% |

| 2018 | 63.1% | 0.4 | 3.9% |

| 20191 | 63.2% | 0.1 | 3.5% |

| 12019 is for November 2019. | |||

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the low 3's by December 2020 from the current 3.5%. My guess is based on the participation rate declining slightly in 2020, and for decent job growth in 2020, but less than in 2019. If I'm wrong about the participation rate (the start of the decline might be delayed for another year or so), then the unemployment rate will likely be in the mid 3% range by December 2020.

Here are the Ten Economic Questions for 2020 and a few predictions:

• Question #1 for 2020: How much will the economy grow in 2020?

• Question #2 for 2020: Will job creation in 2020 be as strong as in 2019?

• Question #3 for 2020: What will the unemployment rate be in December 2020?

• Question #4 for 2020: Will the overall participation rate start declining in 2020, or will it move more sideways (or slightly up) in 2020?

• Question #5 for 2020: How much will wages increase in 2020?

• Question #6 for 2020: Will the core inflation rate rise in 2020? Will too much inflation be a concern in 2020?

• Question #7 for 2020: Will the Fed cut or raise rates in 2020, and if so, by how much?

• Question #8 for 2020: How much will RI increase in 2020? How about housing starts and new home sales in 2020?

• Question #9 for 2020: What will happen with house prices in 2020?

• Question #10 for 2020: Will housing inventory increase or decrease in 2020?

Tuesday, December 31, 2019

Lawler: US Population Growth Slowed Again in 2019

by Calculated Risk on 12/31/2019 04:29:00 PM

CR Note: These lower population estimates are important for projections of economic growth and housing. I mentioned this slowdown in growth earlier this month in Is the Future still Bright?

From housing economist Tom Lawler: US Population Growth Slowed Again in 2019

Yesterday the Census Bureau released its “Vintage 2019” estimates of the US resident population, which showed that population growth in 2019 was the slowest (in numbers) since 1942 and the slowest in percentage growth since 1918. According to these estimates, the US resident population on July 1, 2019 was 328,239,523, just 1,552,022 (or 0.475%) higher than the downwardly-revised population estimate for July 1, 2018. 2009 was the third consecutive year that US population growth slowed significantly, reflecting lower births, higher deaths, and lower net international migration.

| Births | Deaths | Net International Migration | Total | |

|---|---|---|---|---|

| 2010-2016 (Yr. Avg.) | 3,961,544 | 2,601,247 | 909,644 | 2,269,941 |

| 2016-2017 | 3,901,982 | 2,788,163 | 930,409 | 2,044,228 |

| 2017-2018 | 3,824,521 | 2,824,382 | 701,823 | 1,701,962 |

| 2018-2019 | 3,791,712 | 2,835,038 | 595,348 | 1,552,022 |

The latest population estimate for July 1, 2018 was 479,933 lower than the “Vintage 2018” estimate for that year, with the downward revision reflecting somewhat lower births, somewhat higher deaths, and significant lower net international migration. Population estimates for previous years of this decade were also revised downward modestly, mainly reflecting lower estimates for net international migration.

While updated estimates of the population by age won’t be available for several months, these latest estimates, if accurate, suggest that both total population growth and the growth in the working-age population were significantly slower over the past two years than previously thought.

For folks who use Census population projections to forecast other key variables, it is worth noting that the latest population estimate for 2019 is a sizable 1,965,493 lower than the estimate from the “Census 2017” projections, which are the latest available.

Updated population projections, originally slated for release in late October, are now scheduled to be released sometime in January. These estimates, however, will use the “Vintage 2018” estimates as a starting point, and as such are out of date before they are even released. Below is the latest from Census on the upcoming population projections release.

"The U.S. Census Bureau will be releasing several new and updated population projection reports that cover projected life expectancy by nativity, projected population by alternative migration scenarios and updated population projections by demographic characteristics. Supplemental data files for the alternative migration scenarios and input data sets for the main projections series are also being released."

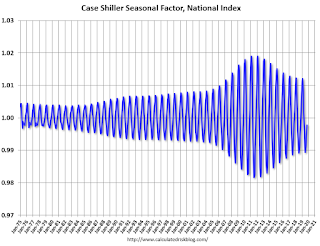

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/31/2019 01:19:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Fannie Mae: Mortgage Serious Delinquency Rate decreased slightly in November

by Calculated Risk on 12/31/2019 11:09:00 AM

Fannie Mae reported that the Single-Family Serious Delinquency decreased slightly to 0.66% in November, from 0.67% in October. The serious delinquency rate is down from 0.76% in November 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is the the lowest serious delinquency rate for Fannie Mae since June 2007.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.45% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.08% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.34% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Case-Shiller: National House Price Index increased 3.3% year-over-year in October

by Calculated Risk on 12/31/2019 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller Index Shows Annual Home Price Gains Increased In October

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.3% annual gain in October, up from 3.2% in the previous month. The 10-City Composite annual increase came in at 1.7%, up from 1.5% in the previous month. The 20-City Composite posted a 2.2% year-over-year gain, up from 2.1% in the previous month.

Phoenix, Tampa and Charlotte reported the highest year-over-year gains among the 20 cities. In October, Phoenix led the way with a 5.8% year-over-year price increase, followed by Tampa with a 4.9% increase and Charlotte with a 4.8% increase. Twelve of the 20 cities reported greater price increases in the year ending October 2019 versus the year ending September 2019.

...

The National Index, 10-City and 20-City Composites all posted a month-over-month increase of 0.1% before seasonal adjustment in October. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase in October while the 10-City and 20-City Composites both posted a 0.4% increase. In October, eight of 20 cities reported increases before seasonal adjustment while 18 of 20 cities reported increases after seasonal adjustment.

"October’s U.S. housing data continue to be reassuring,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “With October’s 3.3% increase in the national composite index, home prices are currently more than 15% above the pre-financial crisis peak reached July 2006. October’s results were broad-based, as both our 10- and 20-city composites rose. Of the 20 cities in the composite, only San Francisco saw a year-over-year price decline in October.

…

“As was the case last month, after a long period of decelerating price increases, the national, 10-city, and 20-city composites all rose at a modestly faster rate in October compared to September. This stability was broad-based, reflecting data in 12 of 20 cities. It is, of course, still too soon to say whether this marks an end to the deceleration or is merely a pause in the longer-term trend.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.7% from the bubble peak, and up 0.4% in October (SA) from September.

The Composite 20 index is 5.5% above the bubble peak, and up 0.4% (SA) in October.

The National index is 14.8% above the bubble peak (SA), and up 0.5% (SA) in October. The National index is up 55.2% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 1.7% compared to October 2018. The Composite 20 SA is up 2.2% year-over-year.

The National index SA is up 3.3% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.