by Calculated Risk on 1/08/2020 10:50:00 AM

Wednesday, January 08, 2020

Seattle Real Estate in December: Sales up 18.7% YoY, Inventory down 24.6% YoY

The Northwest Multiple Listing Service reported Eager home buyers were plentiful in December but their choices were meager

"The buyers are out there and are showing up at open houses and making multiple offers on new listings," was how one industry leader summarized December's housing activity involving members of the Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were up 12.0% year-over-year, and active inventory was down 38.8% year-over-year.

...

Newly-released figures from Northwest MLS show inventory at the end of December was down 31% from the same month a year ago, with only 8,469 active listings compared to the year-ago total of 12,275. The figures include single family homes and condominiums across the 23 counties in the MLS service area.

…

Northwest MLS member-brokers recorded 7,093 completed transactions during December, a gain of more than 11% from the 6,374 closed sales of the same month a year ago. Prices on last month's closed sales of single family homes and condos rose 8.75% from a year ago. For the MLS market overall the price was $435,000 versus the year-ago figure of $400,000.

emphasis added

In Seattle, sales were up 18.7% year-over-year, and inventory was down 24.6% year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (1.1 months). In many areas it appears the inventory build that started last year is over.

ADP: Private Employment increased 202,000 in December

by Calculated Risk on 1/08/2020 08:22:00 AM

Private sector employment increased by 202,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 156,000 private sector jobs added in the ADP report.

...

“As 2019 came to a close, we saw expanded payrolls in December,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The service providers posted the largest gain since April, driven mainly by professional and business services. Job creation was strong across companies of all sizes, led predominantly by midsized companies.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Looking through the monthly vagaries of the data, job gains continue to moderate. Manufacturers, energy producers and small companies have been shedding jobs. Unemployment is low, but will begin to rise if job growth slows much further.”

The BLS report will be released Friday, and the consensus is for 160,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications Decreased Over Last Two Weeks in Latest Weekly Survey

by Calculated Risk on 1/08/2020 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 3, 2020. The results include adjustments to account for the holidays.

... The Refinance Index decreased 8 percent from two weeks ago and was 74 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from two weeks ago. The unadjusted Purchase Index decreased 14 percent compared with two weeks ago and was 2 percent higher than the same week one year ago.

...

“Mortgage rates dropped last week, as investors sought safety in U.S. Treasury securities as a result of the events in the Middle East, with the 30-year fixed mortgage rate declining to its lowest level (3.91 percent) since early October,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Despite lower rates, refinance volume decreased these last two weeks, and we expect that it will slowly trail off in the first half of 2020 as long as mortgage rates remain in this same narrow range. Homeowners would need to see a sharp drop in rates to reinvigorate the refinance wave seen in 2019.”

Added Fratantoni, “The end of the year is the slowest time for home sales, so it is not at all surprising that activity was light. However, after a seasonal adjustment, purchase application volume was up relative to the pre-holiday period and started off 2020 ahead of last year’s pace. We expect that the strong job market will continue to support purchase activity this year, and the uptick in housing construction towards the end of last year should provide more inventory for prospective buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.91 percent from 3.95 percent, with points increasing to 0.34 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

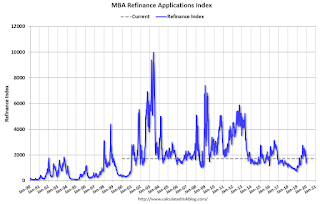

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.

Tuesday, January 07, 2020

Wednesday: ADP Employment

by Calculated Risk on 1/07/2020 08:02:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 156,000 payroll jobs added in December, up from 67,000 added in November.

Las Vegas Real Estate in December: Sales up 21% YoY, Inventory down 13% YoY

by Calculated Risk on 1/07/2020 02:27:00 PM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports year ended with higher home prices, dip in annual home sales; GLVAR housing statistics for December 2019

According to GLVAR, the total number of existing local homes, condos, townhomes and other residential properties sold in Southern Nevada during 2019 was 41,269. That’s down from 42,876 total sales in 2018 and from 45,388 in 2017.1) Overall sales were up 20.9% year-over-year to 3,214 in December 2019 from 2,658 in December 2018.

The total number of existing local homes, condos and townhomes sold during December was 3,214. Compared to one year ago, December sales were up 21.8% for homes and up 17.2% for condos and townhomes.

...

By the end of December, GLVAR reported 5,538 single-family homes listed for sale without any sort of offer. That’s down 16.3% from one year ago. For condos and townhomes, the 1,555 properties listed without offers in December represented a 1.8% increase from one year ago.

…

At the same time, the number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for 1.8% of all existing local property sales in December. That compares to 2.9% of all sales one year ago, 3.6% two years ago and 11% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,143 in December 2018 to 7,093 in December 2019. Note: Total inventory was down 12.9% year-over-year. This is the second consecutive month with a year-over-year decrease in inventory, and that follows 16 consecutive months with a YoY increase in inventory. And months of inventory is still low.

3) Low level of distressed sales.

CoreLogic: House Prices up 3.7% Year-over-year in November

by Calculated Risk on 1/07/2020 12:30:00 PM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: oreLogic Reports November Home Prices Increased by 3.7% Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.7% from November 2018. On a month-over-month basis, prices increased by 0.5% in November 2019. (October 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The YoY change in the CoreLogic index decreased over the last year, but lately the YoY change has been increasing.

...

“The latest U.S. index shows that the slowdown in home prices we saw in early 2019 ended by late summer,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Growth in the U.S. index quickened in November and posted the largest 12-month gain since February. The decline in mortgage rates, down more than one percentage point for fixed-rate loans from November 2018, has supported a rise in sales activity and home prices.”

emphasis added

Reis: Mall Vacancy Rate Increased in Q4 2019

by Calculated Risk on 1/07/2020 11:19:00 AM

Reis reported that the vacancy rate for regional malls was 9.7% in Q4 2019, up from 9.4% in Q3 2019, and up from 9.0% in Q4 2018. This is above the peak following the great recession of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.2% in Q4, up from 10.1% in Q3, and unchanged from 10.2% in Q4 2018. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

The Retail Vacancy Rate rose 0.1% in the fourth quarter as overall occupancy declined by 175,000 square feet due to the closure of 16 Kmart stores in 13 metros; Asking and Effective Rent growth was 0.1% in the quarter – the lowest since 2012.

The Mall Vacancy Rate rose 0.3% to 9.7% in the fourth quarter. Asking and Effective Rent growth was flat.

...

The fourth quarter looks like it could be the start of a declining retail market. For more than two years we had remarked how the retail statistics were defying anecdotal reports of a “retail apocalypse.” But this recent data shows that the scales may have tipped as both the retail and the Mall vacancy rate increased in the quarter. The retail rent growth was a scant 0.1% while Mall rents were flat.

...

Thus, our outlook remains cautious: if vacancies continue to rise, they should not do so at a rapid rate given how slowly the numbers have moved over the last two years. Rents should stay flat for the next few quarters. Indeed, consumers continue to buy more clothing and other goods on-line, but they are also spending more on fitness, entertainment and eating out in establishments that lease retail space. We expect these trends to continue in 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently the regional mall vacancy rates have increased significantly from an already elevated level.

Mall vacancy data courtesy of Reis

ISM Non-Manufacturing Index increased to 55.0% in December

by Calculated Risk on 1/07/2020 10:06:00 AM

The December ISM Non-manufacturing index was at 55.0%, up from 53.9% in November. The employment index decreased to 55.2%, from 55.5%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 119th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.This suggests faster expansion in December than in November.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 55 percent, which is 1.1 percentage points higher than the November reading of 53.9 percent. This represents continued growth in the non-manufacturing sector, at a slightly faster rate. The Non-Manufacturing Business Activity Index rose to 57.2 percent, a 5.6-percentage point increase compared to the November reading of 51.6 percent, reflecting growth for the 125th consecutive month. The New Orders Index registered 54.9 percent, 2.2 percentage points lower than the reading of 57.1 percent in November. The Employment Index decreased 0.3 percentage point in December to 55.2 percent from the November reading of 55.5 percent. The Prices Index reading of 58.5 percent is the same as the November figure, indicating that prices increased in December for the 31st consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth. The non-manufacturing sector had an uptick in growth in December. The respondents are positive about the potential resolution on tariffs. Capacity constraints have eased a bit; however, respondents continue to have difficulty with labor resources."

emphasis added

Trade Deficit decreased to $43.1 Billion in November

by Calculated Risk on 1/07/2020 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $43.1 billion in November, down $3.9 billion from $46.9 billion in October, revised.

November exports were $208.6 billion, $1.4 billion more than October exports. November imports were $251.7 billion, $2.5 billion less than October imports.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in November.

Exports are 26% above the pre-recession peak and unchanged compared to November 2018; imports are 8% above the pre-recession peak, and down 4% compared to November 2018.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in September, October and November.

Oil imports averaged $51.92 per barrel in November, down from $52.00 in October, and down from $57.54 in November 2018.

The trade deficit with China decreased to $26.4 billion in November, from $37.9 billion in November 2018.

Monday, January 06, 2020

Tuesday: Trade Deficit, ISM non-Mfg

by Calculated Risk on 1/06/2020 08:35:00 PM

Tuesday:

• At 8:30 AM ET, Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $43.9 billion. The U.S. trade deficit was at $47.2 billion in October.

• At 10:00 AM, the ISM non-Manufacturing Index for December. The consensus is for an increase to 54.5 from 53.9.

• Early, Reis Q4 2019 Mall Survey of rents and vacancy rates.