by Calculated Risk on 1/10/2020 12:28:00 PM

Friday, January 10, 2020

Q4 GDP Forecasts: 1.1% to 2.3%

From Merrill Lynch

We lowered 1Q GDP growth by 0.7pp to 1.0% to reflect a likely steeper drop in inventories. As a partial offset, we boosted 2Q GDP to 2.0%. 4Q19 is tracking 2.2%. [Jan 10 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.1% for 2019:Q4 and 1.2% for 2020:Q1. [Jan 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 2.3 percent on January 10, unchanged from January 7 after rounding. [Jan 10 estimate]CR Note: These estimates suggest real GDP growth will be between 1.1% and 2.3% annualized in Q4.

Comments on December Employment Report

by Calculated Risk on 1/10/2020 09:27:00 AM

The headline jobs number at 145 thousand for December was below consensus expectations of 160 thousand, and the previous two months were revised down 14 thousand, combined. The unemployment rate was unchanged at 3.5%.

Earlier: December Employment Report: 145,000 Jobs Added, 3.5% Unemployment Rate

In December, the year-over-year employment change was 2.108 million jobs including Census hires.

Seasonal Retail Hiring

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 76 thousand workers (NSA) net in December. Note: this is NSA (Not Seasonally Adjusted).

In October, November and December combined, retailers hired more seasonal workers than in the previous two years.

Average Hourly Earnings

Wage growth was below expectations. From the BLS:

"In December, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $28.32. Over the last 12 months, average hourly earnings have increased by 2.9 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.9% YoY in December.

Wage growth had been generally trending up, but weakened in 2019.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was increased in December to 82.9%, and the 25 to 54 employment population ratio increased to 80.4%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 4.1 million, changed little in December but was down by 507,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in December to 4.148 million from 4.288 million in November. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.7% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.186 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.219 million in November.

Summary:

The headline jobs number was below expectations, and the previous two months were revised down. The headline unemployment rate was unchanged at 3.5%; wage growth was well below expectations. Overall this was a disappointing report.

In 2019, the economy added 2.108 million jobs, down from 2.679 million jobs during 2018 (although 2018 will be revised down with benchmark revision to be released in February 2020). So job growth has slowed.

December Employment Report: 145,000 Jobs Added, 3.5% Unemployment Rate

by Calculated Risk on 1/10/2020 08:44:00 AM

From the BLS:

Total nonfarm payroll employment rose by 145,000 in December, and the unemployment rate was unchanged at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in retail trade and health care, while mining lost jobs.

...

The change in total nonfarm payroll employment for October was revised down by 4,000 from +156,000 to +152,000, and the change for November was revised down by 10,000 from +266,000 to +256,000. With these revisions, employment gains in October and November combined were 14,000 lower than previously reported.

...

In December, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $28.32. Over the last 12 months, average hourly earnings have increased by 2.9 percent.

emphasis added

Click on graph for larger image.

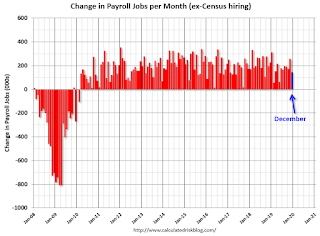

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 145 thousand in December (private payrolls increased 139 thousand).

Payrolls for October and November were revised down 14 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.108 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in December at 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was unchanged in December at 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 61.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in December at 3.5%.

This was below consensus expectations of 160,000 jobs added, and October and November were revised down by 14,000 combined.

I'll have much more later ...

Thursday, January 09, 2020

Friday: Employment Report

by Calculated Risk on 1/09/2020 08:14:00 PM

My December Employment Preview.

Goldman's December Payrolls preview.

Friday:

• At 8:30 AM ET, Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

Goldman: December Payrolls Preview

by Calculated Risk on 1/09/2020 04:56:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 185k in December … We estimate an unchanged unemployment rate at 3.5% … we estimate average hourly earnings increased 0.2% month-over-month, lowering the year-over-year rate to 3.0%

emphasis added

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 1/09/2020 02:35:00 PM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is expanding solidly now.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

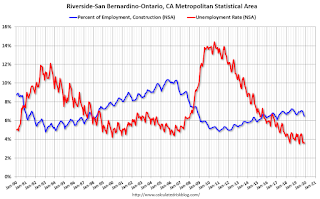

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, and is down to 3.6% (down from 14.4% in 2010). And construction employment is up from the lows (as a percent of total employment), but still well below the bubble years.

So the unemployment rate has fallen to a record low, and the economy isn't as heavily depending on construction. Overall the Inland Empire economy is in much better shape today.

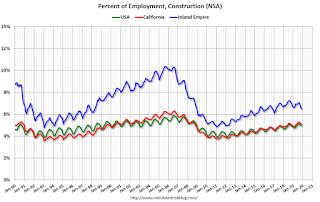

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..Clearly the Inland Empire is more dependent on construction than most areas. Construction has picked up as a percent of total employment, but the economy in California and the U.S. is not as dependent on construction as during the bubble years.

December Employment Preview

by Calculated Risk on 1/09/2020 10:03:00 AM

Special Note: The 2020 Decennial Census will start increasing hiring in early 2020. In reporting the employment report, the headline number should be reduced (or increased) by the change in Census temporary employment to show the underlying trend.

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for an increase of 160,000 non-farm payroll jobs, and for the unemployment rate to be unchanged at 3.5%.

Last month, the BLS reported 266,000 jobs added in November (including the end of the GM strike).

Here is a summary of recent data:

• The ADP employment report showed an increase of 202,000 private sector payroll jobs in December. This was well above consensus expectations of 156,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in December to 45.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 45,000 in December. The ADP report indicated manufacturing jobs decreased 7,000 in December.

The ISM non-manufacturing employment index decreased in December to 55.2%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 215,000 in December.

Combined, the ISM surveys suggest employment gains at 170,000 suggesting gains close to consensus expectations.

• Initial weekly unemployment claims averaged 224,000 in December, up from 219,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 235,000, up from 228,000 during the reference week the previous month.

This suggest a few more layoffs (during the reference week) in December than in November.

• The final December University of Michigan consumer sentiment index increased to 99.3 from the October reading of 96.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker declined sharply in December to 54K, down from 195K in November, suggesting fewer jobs added in December.

• Conclusion: There have been some large misses by the consensus in the month of December (high and low), Since November was surprisingly strong (even with the end of the GM strike), my guess is December will be at or below the consensus forecast.

Weekly Initial Unemployment Claims Decrease to 214,000

by Calculated Risk on 1/09/2020 08:35:00 AM

The DOL reported:

In the week ending January 4, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 224,000, a decrease of 9,500 from the previous week's revised average. The previous week's average was revised up by 250 from 233,250 to 233,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,000.

This was lower than the consensus forecast.

Wednesday, January 08, 2020

Four Bank Failures in 2019

by Calculated Risk on 1/08/2020 04:08:00 PM

There were four bank failures in 2019. This was up from zero in 2018. The median number of failures since the FDIC was established in 1933 was 7 - so 4 failures in 2019 was well below the median.

The great recession / housing bust / financial crisis related failures have been behind us for a few years.

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. Also, a large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s than during the recent crisis, the recent financial crisis was much worse (larger banks failed and were bailed out).

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Houston Real Estate in December: Sales up 14.7% YoY, Inventory Up 3.6%, Record Sales Year

by Calculated Risk on 1/08/2020 12:06:00 PM

From the HAR: The Houston Housing Market Charges Across the Finish Line for a Record 2019

Low mortgage interest rates, healthy employment growth and a stable supply of homes created fertile ground for the Houston real estate market, which blossomed to record levels in 2019. Single-family home sales for the full year surpassed 2018’s record volume by nearly five percent. December delivered the year’s strongest percentage increase in single-family home sales. However, as 2020 gets underway, housing inventory has shrunk slightly, which could narrow options for consumers that may be hoping to buy a home in the new year.Sales set a record in 2019 and were strong in December.

According to the Houston Association of Realtors’ (HAR) latest annual report, 2019 single-family home sales rose 4.8 percent to 86,205. Sales of all property types totaled 102,593, which represents a 4.3-percent increase over 2018’s record volume and marks the first time that total property sales have ever broken the 100,000 level. Total dollar volume for 2019 climbed 6.7 percent to a record-breaking $30 billion.

...

December single-family home sales jumped 14.3 percent year-over-year with 7,505 units sold. That marks the greatest one-month percentage increase of the year; Total December property sales increased 14.7 percent to 8,879 units;

…

Total active listings, or the total number of available properties, rose 3.6 percent from December 2018 to 38,504. Single-family homes inventory narrowed slightly from a 3.5-months supply to 3.4 months.

emphasis added