by Calculated Risk on 2/03/2020 04:35:00 PM

Monday, February 03, 2020

NMHC: Apartment Market Tightness Index Decreased in January

The National Multifamily Housing Council (NMHC) released their January report: January Quarterly Survey Indicates Apartment Conditions Mixed

Certain market conditions are loosening, according to the NMHC Quarterly Survey of Apartment Market Conditions, conducted in January 2020. The Sales Volume Index slipped further below the breakeven level (50) to 43, indicating a continued softness in property sales. “This reflects some seasonal decline along with the paucity of available deals, some respondents also noted the negative impact of the new rent laws in New York,” said NMHC Chief Economist Mark Obrinsky.

Additionally, Market Tightness (48) slipped below the breakeven level (50). “Apartment markets showed some softening in line with the slower leasing in the winter months,” noted Obrinsky. “Even so, the Market Tightness Index reading of 48 was the highest January reading in five years, and slightly higher than the January average of 45 in the survey’s 21-year history.”

...

The Market Tightness Index decreased from 54 to 48, indicating the first sign of looser market conditions since January 2019. Nearly one-quarter (23 percent) of respondents reported looser market conditions than three months prior, compared to 18 percent who reported tighter conditions. Over half (59 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter, but this may be due to seasonal factors.

This followed three consecutive quarters with tighter conditions.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 2/03/2020 12:31:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined sharply from the record highs in early 2018, and have increased a little lately.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Jan 24, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 14% from a year ago, and CME futures are up 12% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war was a factor in the sharp decline with reports that lumber exports to China had declined by 40%. Now, with a pickup in housing, lumber prices are moving up again.

Construction Spending Decreased in December

by Calculated Risk on 2/03/2020 10:27:00 AM

From the Census Bureau reported that overall construction spending decreased in December:

Construction spending during December 2019 was estimated at a seasonally adjusted annual rate of $1,327.7 billion, 0.2 percent below the revised November estimate of $1,329.9 billion. The December figure is 5.0 percent above the December 2018 estimate of $1,264.8 billion.Both private and public spending decreased:

The value of construction in 2019 was $1,303.5 billion, 0.3 percent below the $1,307.2 billion spent in 2018.

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $991.2 billion, 0.1 percent below the revised November estimate of $992.2 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $336.4 billion, 0.4 percent below the revised November estimate of $337.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018. Now it is increasing again, but is still 20% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 3% above the previous peak in March 2009, and 28% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5.5%. Non-residential spending is down slightly year-over-year. Public spending is up 11.5% year-over-year.

This was below consensus expectations of a 0.5% increase in spending, however construction spending for October and November was revised up slightly.

ISM Manufacturing index Increased to 50.9 in January

by Calculated Risk on 2/03/2020 10:05:00 AM

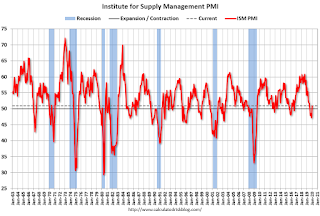

The ISM manufacturing index indicated expansion in January. The PMI was at 50.9% in January, up from 47.2% in December. The employment index was at 46.4%, up from 45.1% last month, and the new orders index was at 52.0%, up from 46.8%.

From the Institute for Supply Management: January 2020 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in January, and the overall economy grew for the 129th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The January PMI® registered 50.9 percent, an increase of 3.1 percentage points from the seasonally adjusted December reading of 47.8 percent. The New Orders Index registered 52 percent, an increase of 4.4 percentage points from the seasonally adjusted December reading of 47.6 percent. The Production Index registered 54.3 percent, up 9.5 percentage points compared to the seasonally adjusted December reading of 44.8 percent. The Backlog of Orders Index registered 45.7 percent, up 2.4 percentage points compared to the December reading of 43.3 percent. The Employment Index registered 46.6 percent, a 1.4-percentage point increase from the seasonally adjusted December reading of 45.2 percent. The Supplier Deliveries Index registered 52.9 percent, a 1.7-percentage point decrease from the December reading of 54.6 percent. The Inventories Index registered 48.8 percent, a decrease of 0.4 percentage point from the seasonally adjusted December reading of 49.2 percent. The Prices Index registered 53.3 percent, a 1.6-percentage point increase from the December reading of 51.7 percent. The New Export Orders Index registered 53.3 percent, a 6-percentage point increase from the December reading of 47.3 percent. The Imports Index registered 51.3 percent, a 2.5-percentage point increase from the December reading of 48.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 48.5%, and suggests manufacturing expanded slightly in January after five months of contraction.

Black Knight Mortgage Monitor for December; "Home-price-growth rate gained steam"

by Calculated Risk on 2/03/2020 08:59:00 AM

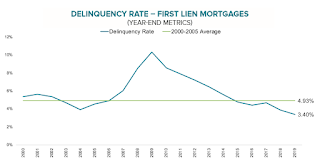

Black Knight released their Mortgage Monitor report for December today. According to Black Knight, 3.40% of mortgages were delinquent in December, down from 3.88% in December 2018. Black Knight also reported that 0.46% of mortgages were in the foreclosure process, down from 0.52% a year ago.

This gives a total of 3.86% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Low Interest Rates Make Housing Most Affordable in Two Years Despite Accelerating Price Growth; Buying Power Up 16% since Late 2018

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. Drawing upon the latest data from the Black Knight Home Price Index (HPI), this month’s report examined home price growth and affordability in the context of today’s lower-interest-rate environment. As Black Knight Data & Analytics President Ben Graboske explained, low interest rates throughout much of the back half of 2019 contributed to sharply accelerating home price growth – but also to improving affordability.

“After falling from nearly 7% year-over-year appreciation in early 2018 to a trough of 3.8% in August 2019, the national home-price-growth rate gained a good deal of steam as mortgage interest rates declined throughout the second half of last year,” said Graboske. “In fact, December marked four consecutive months of home price growth acceleration and the largest single-month acceleration in more than 6.5 years, while the annual rate of appreciation saw nearly a full percentage point increase over the last four months of 2019, closing out the year at 4.7%. The low end of the market, those homes in the bottom 20% by price, saw 6.6% annual growth, nearly three times the rate of the top 20%. That said, higher-priced homes have been more reactive to recent rate declines. The annual growth rate among the top price tier has more than tripled over the past four months – from 0.7% year-over-year in August to 2.3% as of December – while there’s been very little acceleration at the lowest end of the market.

“Still, even with home price growth accelerating, today’s low-interest-rate environment has made home affordability the best it’s been since early 2018. At that time, the housing market was red-hot, with national home price growth at 6.6% and climbing – before rising rates and tightening affordability triggered a pullback in growth rates. That’s not the case today. Despite the average home price increasing by nearly $13,000 from just over a year ago, the monthly mortgage payment required to buy that same home has actually dropped by 10% over that same span due to falling interest rates.

It now requires 20.6% of median monthly income to purchase the same home as it did just over a year ago, the smallest payment-to-income ratio we’ve seen in two years. Put another way, prospective homebuyers can now purchase a home that is $48,000 more expensive than a year ago, while still paying the same in principal and interest. That’s a 16% increase in buying power. Recent history at comparable levels of affordability suggest acceleration in home price growth may well continue in the coming months as this increased buying power puts upward pressure on home prices across the country.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows Black Knight's estimate of the mortgage payment to income ratio.

From Black Knight:

• Even with home price growth accelerating, today’s low interest-rate environment has made home affordability the best it’s been since early 2018The second graph shows the year end national delinquency rate since 2000:

• At that time, the housing market was red-hot, with national home price growth at 6.6% and climbing – before rising rates and tightening affordability triggered a pullback in growth rates

• It now requires 20.6% of median monthly income to purchase the same home as it did just over a year ago, the smallest payment-to-income ratio we’ve seen in two years

• Put another way, prospective homebuyers can now purchase a $48K more expensive home than a year ago while still paying the same in principal and interest, a 16% increase in buying power

• Recent history at comparable levels of affordability suggest acceleration in home price growth may well continue in the coming months as this increased buying power puts upward pressure on home prices across the country

• The national delinquency rate closed out 2019 at 3.4%, the lowest year-end rate of the century and down 12.4% from last yearThere is much more in the mortgage monitor.

• That's also more than 1.5% below the pre-recession average - the largest such spread in the years since the financial crisis

• When the rate of improvement slowed in mid-2019, it appeared the market was approaching a trough in mortgage delinquencies

• However, the rate of improvement picked back up again late in the year, suggesting delinquency rates could fall even further, potentially surpassing the record low hit in May 2019 by early 2020

Sunday, February 02, 2020

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 2/02/2020 11:38:00 PM

Weekend:

• Schedule for Week of February 2, 2020

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.5, up from 47.2 in December.

• Also at 10:00 AM, Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

• At 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices for January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 20 and DOW futures are up 165 (fair value).

Oil prices were down over the last week with WTI futures at $51.42 per barrel and Brent at $56.19 barrel. A year ago, WTI was at $55, and Brent was at $62 - so oil prices are down 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.46 per gallon. A year ago prices were at $2.27 per gallon, so gasoline prices are up 19 cents per gallon year-over-year.

January 2020: Unofficial Problem Bank list Decreased to 64 Institutions

by Calculated Risk on 2/02/2020 11:10:00 AM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for January 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for January 2020. During the month, the list declined by three to 64 banks after four removals and one addition. Aggregate assets were little changed at $51.3 billion. A year ago, the list held 78 institutions with assets of $55.2 billion.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and has steadily declined since then to below 100 institutions.

Enforcement actions were terminated against First Community National Bank, Cuba, MO ($130 million); SunSouth Bank, Dothan, AL ($107 million); Lafayette State Bank, Mayo, FL ($106 million); and Sunrise Bank Dakota, Onida, SD ($52 million). Added this month was Texas Citizens Bank, National Association, Pasadena, TX ($521 million).

Saturday, February 01, 2020

Schedule for Week of February 2, 2020

by Calculated Risk on 2/01/2020 08:11:00 AM

The key report scheduled for this week is the January employment report.

Other key indicators include January ISM manufacturing and non-manufacturing surveys, the December trade deficit, and January vehicle sales.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.5, up from 47.2 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.5, up from 47.2 in December.Here is a long term graph of the ISM manufacturing index.

The PMI was at 47.2% in December, the employment index was at 45.1%, and the new orders index was at 46.8%.

10:00 AM: Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices for January.

Early: the BEA will release Light vehicle sales for January. The consensus is for light vehicle sales to be 16.8 million SAAR in January, up from 16.7 million in December (Seasonally Adjusted Annual Rate).

Early: the BEA will release Light vehicle sales for January. The consensus is for light vehicle sales to be 16.8 million SAAR in January, up from 16.7 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

10:00 AM: Corelogic House Price index for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 159,000 payroll jobs added in January, down from 202,000 added in December.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $48.0 billion. The U.S. trade deficit was at $43.1 billion in November.

10:00 AM: the ISM non-Manufacturing Index for January.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, down from 216,000 last week.

8:30 AM: Employment Report for January. The consensus is for 161,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

8:30 AM: Employment Report for January. The consensus is for 161,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.There were 145,000 jobs added in December, and the unemployment rate was at 3.5%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In December the year-over-year change was 2.108 million jobs.

Note: The annual benchmark revision will be released with the January report. The preliminary estimate of the Benchmark revision "indicates a downward adjustment to March 2019 total nonfarm employment of -501,000".

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, January 31, 2020

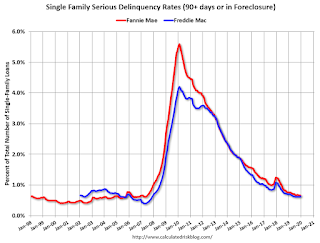

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in December

by Calculated Risk on 1/31/2020 04:09:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency was unchanged at 0.66% in December, from 0.66% in November. The serious delinquency rate is down from 0.76% in December 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This matches last month as the the lowest serious delinquency rate for Fannie Mae since June 2007.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.48% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.11% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.35% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q1 GDP Forecasts: 1.0% to 2.7%

by Calculated Risk on 1/31/2020 11:47:00 AM

From Merrill Lynch

GDP growth is likely to slow to 1.0% qoq saar in 1Q 2020. [Jan 31 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.5% for 2020:Q1 [Jan 31 estimate]And from the Altanta Fed: GDPNow

The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 2.7 percent on January 31. [Jan 31 estimate]CR Note: These very early estimates suggest real GDP growth will be between 1.0% and 2.7% annualized in Q1.