by Calculated Risk on 2/10/2020 07:22:00 PM

Monday, February 10, 2020

Tuesday: Job Openings, Fed Chair Powell Testimony, NY Fed Household Debt and Credit

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 10:00 AM, Job Openings and Labor Turnover Survey for December from the BLS.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

• At 11:00 AM, NY Fed: Q4 Quarterly Report on Household Debt and Credit

Payroll Employment and Seasonal Factors

by Calculated Risk on 2/10/2020 02:36:00 PM

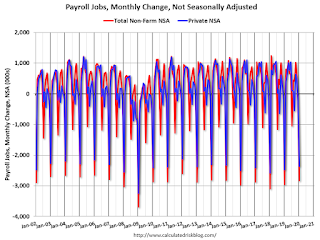

This might be a good time to review the seasonal pattern for employment.

Even in the best of years there are a significant number of jobs lost in the months of January and July. In 1994, when the economy added almost 3.9 million jobs, there were 2.25 million lost in January 1994 (not seasonally adjusted, NSA), and almost 1 million payroll jobs lost in July of that year.

This year, in January 2020, 2.83 million total jobs were lost (NSA). On a seasonally adjusted basis, the BLS reported 225 thousand jobs (SA) added in January.

A clear example of the a seasonal pattern is that teachers leave the workforce every year in July. And then those teachers return to the payrolls in September and early October. Since this happens every year, the BLS applies a seasonal adjustment before reporting the headline number.

For the private sector, there are always a large number of jobs lost in January (retailers and others cutting jobs) and in September (summer hires let go).

This graph shows the seasonal pattern since 2002 for both total nonfarm jobs and private sector only payroll jobs. Notice the large spike down every January.

Also notice the spike down in July (red) that is related to teachers leaving the labor force.

The key point is this is a series that NEEDS a seasonal adjustment. There is significant, but predictable, seasonal variation in employment.

Las Vegas: Record Convention Traffic in 2019, Visitor Traffic Increases

by Calculated Risk on 2/10/2020 11:44:00 AM

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then both Las Vegas visitor and convention traffic has recovered.

Visitor traffic was up 1.0% from 2018, and about 1.0% below the record set in 2016.

Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention traffic was up 2.3% in 2019 compared to 2018, and was slightly above the previous record set in 2017.

There were many housing related conventions during the housing bubble, so it took some time for convention traffic to recover. Now there are marijuana conventions boosting traffic!

From the Las Vegas Convention and Visitors Authority:

While usually a relatively slower convention month, December 2019 bucked the trend as the destination enjoyed particularly strong convention attendance estimated at 356,100, +60.6% over last December; the YoY increase is largely due to the scheduling of Amazon Web Services (65k attendees) and Marijuana Business Conference (35k attendees) in December this year vs. November in 2018, plus the rotation of American Society of Health‐System Pharmacists (20k attendees) into the destination.

Seattle Real Estate in January: Sales up 17.2% YoY, Inventory down 32.9% YoY

by Calculated Risk on 2/10/2020 10:03:00 AM

The Northwest Multiple Listing Service reported Home buyers in Western Washington “hit the ground running” in January

“All indicators point to a vigorous spring market,” suggested broker Dean Rebhuhn when reviewing just-released statistics from Northwest Multiple Listing Service. The report covering 23 counties shows pending sales outgained new listings, record-low inventory that’s down 33% from a year ago, and double-digit price increases.The press release is for the Northwest. In King County, sales were up 5.7% year-over-year, and active inventory was down 42.6% year-over-year.

...

Northwest MLS members tallied 5,074 closed sales during January for a 4.3% increase from the year-ago total of 4,865. Median prices jumped 10.7% from a year ago.

…

At the end of January, the MLS database totaled only 7,791 active listings of single family homes and condos, well-below the year-ago figure of 11,687 (down 33.3%). A check of records dating to 2005 shows the selection is at a new low level, shrinking below the previous low of 7,921 reported for February 2018. In fact, for the 15 year span from 2005-2019 (180 months), inventory has dipped below 10,000 listings during only eight of those months.

Measured by months of supply (the ratio of active listings to closed sales), there was 1.54 months of inventory system-wide at the end of January.

emphasis added

In Seattle, sales were up 17.2% year-over-year, and inventory was down 32.9% year-over-year.. This puts the months-of-supply in Seattle at just 1.38 months.

Sunday, February 09, 2020

Sunday Night Futures

by Calculated Risk on 2/09/2020 07:52:00 PM

Weekend:

• Schedule for Week of February 9, 2020

• Weather Adjusted Employment Gains in January

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 11 and DOW futures are down 90 (fair value).

Oil prices were down over the last week with WTI futures at $49.86 per barrel and Brent at $53.98 barrel. A year ago, WTI was at $53, and Brent was at $61 - so oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.43 per gallon. A year ago prices were at $2.28 per gallon, so gasoline prices are up 15 cents per gallon year-over-year.

Hotels: Occupancy Rate Increases Year-over-year, Concerns about 2019-nCoV

by Calculated Risk on 2/09/2020 12:40:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 1 February

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 26 January through 1 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 27 January through 2 February 2019, the industry recorded the following:

• Occupancy: +1.7% to 57.6%

• Average daily rate (ADR): +2.2% to US$127.94

• Revenue per available room (RevPAR): +4.0% to US$73.73

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 is off to a solid start, however, STR notes that the new coronavirus could have a significant negative impact on hotels:

As fears over an outbreak of the new coronavirus centered in Wuhan, China, continue to restrict travel, visits to the U.S. from China could drop by 25% in 2020, according to analysis by Tourism Economics.This analysis was based on historical data from SARS. Based on more recent data, it appears the new coronavirus will have a larger impact than SARS.

Speaking on a webinar Thursday titled “U.S. economy and hotel industry 2020 outlook: Navigating the slowdown,” Adam Sacks, president of Tourism Economics, said a 25% drop in Chinese visitors to the U.S. means a loss of 4 million hotel roomnights and $5.8 billion in visitor spending in 2020, and ultimately 7.8 million roomnights and $10.3 billion in spending through 2024.

Seasonally, the 4-week average of the occupancy rate will increase over the next several months.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, February 08, 2020

Weather Adjusted Employment Gains in January

by Calculated Risk on 2/08/2020 11:07:00 AM

The weather boosted employment gains in January. The question is: how much?

The BLS reported 226 thousand people were employed in non-agriculture industries, with a job, but not at work due to bad weather. The average for January over the previous 10 years was 347 thousand.

The BLS also reported 744 thousand people were usually full time employees, but were working part time in January due to bad weather. The average for January over the previous 10 years was 1.2 million.

Both of the series suggest weather negatively impacted employment less than usual (boosting seasonally adjusted employment).

The San Francisco Fed estimates Weather-Adjusted Change in Total Nonfarm Employment (monthly change, seasonally adjusted). They use local area weather to estimate the impact on employment. For January, the BLS reported 225 thousand jobs added, the San Francisco Fed estimates that weather adjusted employment gains were 125 thousand.

So we should expect some payback in coming months. (Note: One of the reasons I took the "over" in January was because of the weather)

Schedule for Week of February 9, 2020

by Calculated Risk on 2/08/2020 08:11:00 AM

The key reports this week are January CPI and retail sales.

For manufacturing, the January Industrial Production report will be released.

Fed Chair Powell testifies to Congress this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for January.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in November to 6.800 million from 7.361 million in October.

The number of job openings (yellow) were down 11% year-over-year, and Quits were up 5% year-over-year.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

11:00 AM: NY Fed: Q4 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212,000 initial claims, up from 202,000 last week.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 0.3% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. In December, Retail and Food service sales, ex-gasoline, increased by 5.5% on a YoY basis.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 76.8%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 99.3.

Friday, February 07, 2020

The Headline Job Streak Survives, The ex-Census Job Streak Ended in 2019

by Calculated Risk on 2/07/2020 02:58:00 PM

A few weeks ago I wrote The Record Job Streak: A few Comments. I noted that the streak of consecutive positive headline job reports had reached 111 months, but the streak might be over when the annual benchmark revision was released.

The headline job streak lives!

With the benchmark revision, February 2019 was revised down to +1 thousand jobs added - so the streak barely survived - and the streak is now at 112 months. If the headline job streak continues into 2020, then the headline streak will probably end in June 2020 when a large number of temporary Census workers are let go.

The job streak ex-Census was even longer (adjusting for temporary Census hires). Prior to the benchmark release, the ex-Census streak was at 118 months. However, with the revisions, the ex-Census job streak ended in February 2019 at 107 months. It is possible that the ex-Census streak will be resurrected with the next benchmark release, but for now it is over.

AAR: January Rail Carloads down 5.9% YoY, Intermodal Down 5.4% YoY

by Calculated Risk on 2/07/2020 02:46:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail volumes fell again in January, but there were glimmers of hope. Nine of the 20 carload categories the AAR tracks had year-over-year gains in January 2020, the most in a year, and several other commodities had carload declines in January that were smaller than they’ve been in recent months.

Total U.S. rail carloads fell 5.9%, or 73,110 carloads, in January 2020 from January 2019, their 12th straight decline.

...

U.S. intermodal originations fell 5.4%, or 71,081 units, in January and have now fallen for 12 consecutive months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

Total originated carloads on U.S. railroads fell 5.9% (73,110 carloads) in January 2020 from January 2019, their 12th consecutive monthly decline. Weekly average total carloads in January 2020 were 233,147, the second-lowest weekly average for any month since January 1988, when our data begin. (Only December 2019 was lower, at 232,026.)

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):Meanwhile, total U.S. intermodal originations (which are not included in the carload numbers) were down 5.4% (71,081 containers and trailers) in January, also their 12th consecutive monthly decline