by Calculated Risk on 2/14/2020 01:25:00 PM

Friday, February 14, 2020

Sacramento Housing in January: Sales Up 5.6% YoY, Active Inventory down 32.7% YoY

From SacRealtor.org: January 2020 Statistics – Sacramento Housing Market – Single Family Homes

January ended with 944 sales, down 24.1% from December. Compared to one year ago (894), the current figure is up 5.6%.1) Overall sales increased to 944 in January, up from 894 in January 2019. Sales were down from December 2019 (previous month), and up 5.6% from January 2019.

...

The Active Listing Inventory increased 7.1% from December to January, from 1,315 units to 1,409 units. Compared with January 2019 (2,095), inventory is down 32.7%. The Months of Inventory increased from 1.1 to 1.5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Median DOM (days on market) decreased from 19 to 17 and the Average DOM increased from 32 to 33. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,409, down from 2,095 in January 2019. That is down 32.7% year-over-year. This is the ninth consecutive month with a YoY decline in inventory, following 20 months of YoY increases in inventory.

Q1 GDP Forecasts: 0.7% to 2.4%

by Calculated Risk on 2/14/2020 11:42:00 AM

From Merrill Lynch:

The data cut our 4Q 2019 GDP tracking estimate by 0.1pp to 2.0% and our 1Q 2020 estimate by 0.3pp to 0.7% qoq saar. [Feb 14 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.4% for 2020:Q1. News from this week’s data decreased the nowcast for 2020:Q1 by 0.3 percentage point. [Feb 14 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 2.4 percent on February 14, down from 2.7 percent on February 7. [Feb 14 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.7% and 2.4% annualized in Q1.

Industrial Production Decreased in January

by Calculated Risk on 2/14/2020 09:22:00 AM

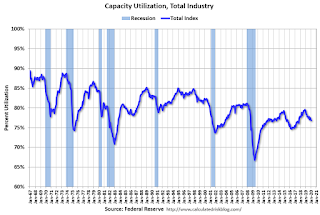

From the Fed: Industrial Production and Capacity Utilization

Industrial production declined 0.3 percent in January, as unseasonably warm weather held down the output of utilities and as a major manufacturer significantly slowed production of civilian aircraft. The index for manufacturing edged down 0.1 percent in January; excluding the production of aircraft and parts, factory output advanced 0.3 percent. The index for mining rose 1.2 percent. At 109.2 percent of its 2012 average, total industrial production was 0.8 percent lower in January than it was a year earlier. Capacity utilization for the industrial sector fell 0.3 percentage point in January to 76.8 percent, a rate that is 3.0 percentage points below its long-run (1972–2019) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.8% is 3.0% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in December to 109.2. This is 25.4% above the recession low, and 3.7% above the pre-recession peak.

The change in industrial production was below consensus expectations.

Retail Sales increased 0.3% in January

by Calculated Risk on 2/14/2020 08:41:00 AM

On a monthly basis, retail sales increased 0.3 percent from December to January (seasonally adjusted), and sales were up 4.4 percent from January 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for January 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $529.8 billion, an increase of 0.3 percent from the previous month, and 4.4 percent above January 2019. Total sales for the November 2019 through January 2020 period were up 4.4 percent from the same period a year ago. The November 2019 to December 2019 percent change was revised from up 0.3 percent to up 0.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.3% in January.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.The increase in January was at expectations, however sales in November and December were revised down.

Thursday, February 13, 2020

Friday: Retail Sales, Industrial Production

by Calculated Risk on 2/13/2020 07:25:00 PM

Friday:

• At 8:30 AM ET, Retail sales for January is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 76.8%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 99.3.

Hotels: Occupancy Rate Decreases Year-over-year

by Calculated Risk on 2/13/2020 03:53:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 8 February

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 2-8 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 February 2019, the industry recorded the following:

• Occupancy: -1.4% to 59.0%

• Average daily rate (ADR): +1.5% to US$128.75

• Revenue per available room (RevPAR): 0.0% at US$75.98

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 is off to a solid start, however, STR notes that the new coronavirus could have a significant negative impact on hotels.

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in January, Core PCE below 2%

by Calculated Risk on 2/13/2020 11:36:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.7% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for January here. Motor fuel decreased at a 17.3% annualized rate in January.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.8% annualized rate) in January. The CPI less food and energy rose 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.3%. Core PCE is for December and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.7% annualized and trimmed-mean CPI was at 2.9% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

Weekly Initial Unemployment Claims Increase to 205,000

by Calculated Risk on 2/13/2020 08:37:00 AM

The DOL reported:

In the week ending February 8, the advance figure for seasonally adjusted initial claims was 205,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 202,000 to 203,000. The 4-week moving average was 212,000, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 211,750 to 212,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 212,000.

This was lower than the consensus forecast.

BLS: CPI increased 0.1% in January, Core CPI increased 0.2%

by Calculated Risk on 2/13/2020 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in January on a seasonally adjusted basis, after rising 0.2 percent in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.5 percent before seasonal adjustment.Overall inflation was slightly lower than expectations in January. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.2 percent in January after increasing 0.1 percent in December.

...

The all items index increased 2.5 percent for the 12 months ending January, the largest 12-month increase since the period ending October 2018. The index for all items less food and energy rose 2.3 percent over the last 12 months, the same 12-month increase as reported in the previous 3 months.

emphasis added

Wednesday, February 12, 2020

Thursday: CPI, Unemployment Claims

by Calculated Risk on 2/12/2020 08:12:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 212,000 initial claims, up from 202,000 last week.

• Also at 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.