by Calculated Risk on 2/25/2020 08:18:00 PM

Tuesday, February 25, 2020

Wednesday: New Home Sales

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for January from the Census Bureau. The consensus is for 715 thousand SAAR, up from 694 thousand in December.

Real House Prices and Price-to-Rent Ratio in December

by Calculated Risk on 2/25/2020 05:07:00 PM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 3.8% year-over-year in December

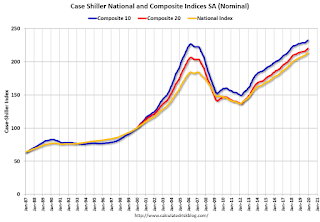

It has been almost thirteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 15.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 6.6% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.0% below the bubble peak.

The year-over-year growth in prices increased to 3.8% nationally, as expected with lower mortgage rates and fewer homes for sell.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $291,000 today adjusted for inflation (45%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

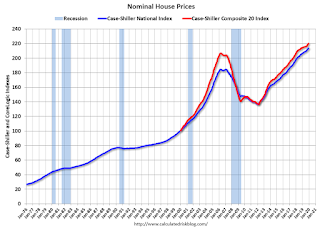

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to March 2005 levels, and the Composite 20 index is back to July 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways recently.

On a price-to-rent basis, the Case-Shiller National index is back to March 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

FDIC: Fewer Problem banks, Residential REO Declined in Q4

by Calculated Risk on 2/25/2020 11:45:00 AM

The FDIC released the Quarterly Banking Profile for Q4 2019 today:

For the 5,177 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC), aggregate net income totaled $55.2 billion in fourth quarter 2019, a decline of $4.1 billion (6.9 percent) from a year ago. The decline in net income was led by lower net interest income and higher expenses. Financial results for fourth quarter 2019 are included in the FDIC's latest Quarterly Banking Profile released today.

...

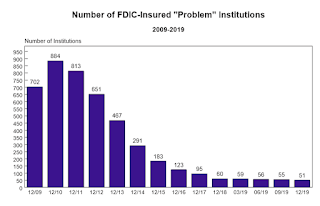

The Number of Banks on the "Problem Bank List" Remained Low: The number of problem banks fell from 55 to 51 during the fourth quarter, the lowest number of problem banks since fourth quarter 2006. Total assets of problem banks declined from $48.8 billion in the third quarter to $46.2 billion.

The Deposit Insurance Fund's Reserve Ratio Stood at 1.41 Percent: The Deposit Insurance Fund (DIF) balance totaled $110.3 billion in the fourth quarter, up $1.4 billion from the end of last quarter. The quarterly increase was led by assessment income and interest earned on investment securities held by the DIF. The reserve ratio remained unchanged from the previous quarter at 1.41 percent.

Mergers and New Bank Openings Continued in the Fourth Quarter: During the fourth quarter, three new banks opened, 77 institutions were absorbed by mergers, and three banks failed.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined slightly.

This graph from the FDIC shows the number of problem banks declined to 51 institutions from 60 at the end of 2018.

Note: The number of assets for problem banks increased significantly in 2018 when Deutsche Bank Trust Company Americas was added to the list (it must still be on the list given the assets of problem banks).

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $2.65 billion in Q4 2018 to $2.27 billion in Q4 2019. This is the lowest level of REOs since Q1 2006.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $2.65 billion in Q4 2018 to $2.27 billion in Q4 2019. This is the lowest level of REOs since Q1 2006.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, FDIC REOs are probably close to a bottom.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 2/25/2020 11:10:00 AM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through December 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors have started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Richmond Fed: Manufacturing Activity Softened in February

by Calculated Risk on 2/25/2020 10:13:00 AM

From the Richmond Fed: Manufacturing Activity Softened in February

Fifth District manufacturing activity softened in February, according to the most recent survey from the Richmond Fed. The composite index fell from 20 in January to −2 in February. All three components of the composite index — shipments, new orders, and employment — moved lower from January. Firms also reported a decrease in backlog of orders. Still, the index for local business conditions remained positive, and manufacturers were optimistic that activity would improve in the coming months.

Survey results suggest that firms saw continued growth in employment and wages in February. However firms continued to struggle to find workers with the necessary skills, as this index dropped to −35.

emphasis added

Case-Shiller: National House Price Index increased 3.8% year-over-year in December

by Calculated Risk on 2/25/2020 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller Index Shows Growth in Annual Home Price Gains to End 2019

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.8% annual gain in December, up from 3.5% in the previous month. The 10-City Composite annual increase came in at 2.4%, up from 2.0% in the previous month. The 20-City Composite posted a 2.9% year-over-year gain, up from 2.5% in the previous month.

Phoenix, Charlotte and Tampa reported the highest year-over-year gains among the 20 cities. In December, Phoenix led the way with a 6.5% year-over-year price increase, followed by Charlotte with a 5.3% increase and Tampa with a 5.2% increase. Twelve of the 20 cities reported greater price increases in the year ending December 2019 versus the year ending November 2019.

...

The National Index posted a month-over-month increase of 0.1%, while the 10-City Composite posted a 0.1% increase and the 20-City Composite did not post any gains before seasonal adjustment in December. After seasonal adjustment, the National Index posted a month-over-month increase of 0.5%, while the 10-City and 20-City Composites both posted 0.4% increases. In December, 10 of 20 cities reported increases before seasonal adjustment while 19 of 20 cities reported increases after seasonal adjustment.

"The U.S. housing market continued its trend of stable growth in December,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “December’s results bring the National Composite Index to a 3.8% increase for calendar 2019. This marks eight consecutive years of increasing housing prices (an increase which is echoed in our 10- and 20-City Composites). At the national level, home prices are 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. Results for 2019 were broad-based, with gains in every city in our 20-City Composite.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 2.6% from the bubble peak, and up 0.4% in December (SA) from November.

The Composite 20 index is 6.5% above the bubble peak, and up 0.4% (SA) in December.

The National index is 15% above the bubble peak (SA), and up 0.5% (SA) in December. The National index is up 59% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.4% compared to December 2018. The Composite 20 SA is up 2.9% year-over-year.

The National index SA is up 3.5% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, February 24, 2020

Tuesday: Case-Shiller House Prices

by Calculated Risk on 2/24/2020 09:40:00 PM

From Matthew Graham at Mortgage News Daily: Important Lessons From Near-Record Low Mortgage Rates

Mortgage rates continue to carve out the unlikeliest of victories in 2020 with significant help from coronavirus. The epidemic has taken a year that was almost certain to start off with a steady move toward higher rates and turned it into one of the strongest starts on record. In fact, when it comes to the combination of ground covered and levels achieved, no other year has started off any better. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.375 - 3.5%]Tuesday:

emphasis added

• At 9:00 AM ET, FHFA House Price Index for December 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 2.8% year-over-year increase in the Comp 20 index for December.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

House Prices and Inventory

by Calculated Risk on 2/24/2020 01:06:00 PM

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

This graph below shows existing home months-of-supply (from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999).

There is a clear relationship, and this is no surprise (but interesting to graph).

If months-of-supply is high, price decline. If months-of-supply is low, prices rise.

In the existing home sales report released last week, the NAR reported months-of-supply at 3.1 months in January.

My current expectation is inventory will hold at low levels or decrease this year, and house price growth will increase compared to 2019.

Dallas Fed: "Texas Manufacturing Expansion Continues"

by Calculated Risk on 2/24/2020 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Growth in Texas factory activity accelerated further in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose six points to 16.4, suggesting stronger output growth than last month.Another soft report from the Dallas Fed.

Other measures of manufacturing activity pointed to continued expansion in February, though demand growth decelerated. The new orders index fell nine points to 8.4, down from a 15-month high in January but still slightly above average. Similarly, the growth rate of orders index fell but remained above average, edging down from 6.1 to 3.6. The capacity utilization and shipments indexes held steady at 11.3 and 8.5, respectively.

Perceptions of broader business conditions were slightly more optimistic in February. The general business activity index edged up to 1.2 and the company outlook index ticked up to 3.6, though both readings remain slightly below average. The index measuring uncertainty regarding companies’ outlooks moved up eight points to 11.0 after receding in the prior two months.

Labor market measures suggested flat employment levels and slightly longer workweeks this month. The employment index stayed near zero for a second month in a row, coming in at -0.9.

emphasis added

"Chicago Fed National Activity Index Points to an Uptick in Economic Growth in January"

by Calculated Risk on 2/24/2020 09:13:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Points to an Uptick in Economic Growth in January

The Chicago Fed National Activity Index (CFNAI) increased to –0.25 in January from –0.51 in December. All four broad categories of indicators that make up the index increased from December, but only one of the four categories made a positive contribution to the index in January. The index’s three-month moving average, CFNAI-MA3, moved up to –0.09 in January from –0.23 in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in January (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.