by Calculated Risk on 3/05/2020 04:32:00 PM

Thursday, March 05, 2020

Goldman: February Payrolls Preview

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 195k in February ... a 20-30k boost from weather … too early to show a meaningful impact of the coronavirus outbreak on hiring.

We estimate a one tenth decline in the unemployment rate to 3.5% ... We estimate average hourly earnings increased 0.3% month-over-month …

emphasis added

February Employment Preview

by Calculated Risk on 3/05/2020 11:37:00 AM

Special Note: The 2020 Decennial Census will increase hiring in early 2020. In reporting the employment report, the headline number should be reduced (or increased) by the change in Census temporary employment to show the underlying trend. Based on previous Census hiring, I expect the Census hired 10 to 20 thousand temporary workers in February.

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for an increase of 175,000 non-farm payroll jobs, and for the unemployment rate to be unchanged at 3.6%.

Last month, the BLS reported 225,000 jobs added in January (220,000 ex-Census).

Here is a summary of recent data:

• The ADP employment report showed an increase of 183,000 private sector payroll jobs in February. This was above consensus expectations of 170,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index increased in February to 46.9%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 35,000 in February. The ADP report indicated manufacturing jobs decreased 4,000 in February.

The ISM non-manufacturing employment index increased in February to 55.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 225,000 in February.

Combined, the ISM surveys suggest employment gains at 190,000, suggesting gains somewhat above consensus expectations.

• Initial weekly unemployment claims averaged 213,000 in February, up slightly from 212,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 211,000, down from 223,000 during the reference week the previous month.

This suggests fewer layoffs (during the reference week) in February than in January.

• The final February University of Michigan consumer sentiment index increased to 101.0 from the January reading of 99.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker decreased in February to 144,000, down from 161,000 in January, suggesting fewer jobs added in February. This suggests job growth below consensus.

• Weather: The weather was mostly warm and dry during the reference period in January, and the San Francisco Fed estimates the favorable weather boosted employment gains in January by about 100,000. It is likely some hiring for February was pulled forward to January, suggesting some payback in the February report.

• Conclusion: In general the various reports suggest employment growth somewhat above expectations, however, factoring in some payback from the nice January weather, I expect employment gains, ex-Census hiring, below expectations.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 3/05/2020 09:22:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 29 February

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 23-29 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 24 February through 2 March 2019, the industry recorded the following:

• Occupancy: -1.7% to 64.1%

• Average daily rate (ADR): +1.6% to US$129.67

• Revenue per available room (RevPAR): -0.2% to US$83.16

Occupancy and ADR declines for the week were most pronounced on the weekend (28-29 February). Also of note, U.S. airport hotels reported a 3.8% decrease in occupancy for the week.

“We continue to monitor performance in proximity to U.S. airports for early indicators of a coronavirus impact,” said Jan Freitag, STR’s senior VP of lodging insights. “What stands out are the demand patterns in airport markets that see a greater volume of international traffic. We saw declines in airport markets like Newark, Chicago, Denver, San Francisco and New York, while markets with a lot of domestic traffic like Orlando, Dallas and Atlanta were actually up for the week. The coming weeks will be important to monitor for more defined trends, especially with increased coverage around the outbreak and potential event schedule adjustments.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 appears to already be having a negative impact on occupancy. To date, this is the weakest start for a year since 2014 - and the seasonally important Spring travel season is just about to begin.

Weekly Initial Unemployment Claims Decrease to 216,000

by Calculated Risk on 3/05/2020 08:32:00 AM

The DOL reported:

In the week ending February 29, the advance figure for seasonally adjusted initial claims was 216,000, a decrease of 3,000 from the previous week's unrevised level of 219,000. The 4-week moving average was 213,000, an increase of 3,250 from the previous week's unrevised average of 209,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 213,000.

This was lower than the consensus forecast.

Wednesday, March 04, 2020

Fed's Beige Book: Economic Actvity Expanded "modest to moderate rate", Coronavirus Impacting Travel

by Calculated Risk on 3/04/2020 02:05:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before February 24th, 2020."

Economic activity expanded at a modest to moderate rate over the past several weeks, according to the majority of Federal Reserve Districts. The St. Louis and Kansas City Districts, however, reported no change during this period. Consumer spending generally picked up, but growth was uneven across the nation, including mixed reports of auto sales. Overall, growth in tourism was flat to modest. There were indications that the coronavirus was negatively impacting travel and tourism in the U.S. Manufacturing activity expanded in most parts of the country; however, some supply chain delays were reported as a result of the coronavirus and several Districts said that producers feared further disruptions in the coming weeks. Transportation activity was generally flat to up slightly aside from some Mid-Atlantic ports that saw strong volume growth. U.S. nonfinancial services firms generally experienced mild to moderate growth. Overall loan growth was flat to up modestly, according to most Districts; notable exceptions were St. Louis, New York, and Kansas City, where declines were reported. On the whole, residential home sales picked up modestly. Nonresidential real estate sales and leasing activity varied across Districts. Agricultural conditions were little changed in recent weeks while some declines in natural resource extraction were reported. Outlooks for the near-term were mostly for modest growth with the coronavirus and the upcoming presidential election cited as potential risks.

...

Employment increased at a slight to moderate pace, overall, with hiring constrained by a tight labor market. Insufficient labor lowered growth for many firms and led to delays in construction projects. Several employers changed from temporary to permanent workers in order to attract talent, and firms made efforts to retain workers such as keeping seasonal workers on staff in the off-season. While employment grew across most sectors, manufacturers, retailers, and transportation companies reported lower demand for labor in some Districts. Wages grew at a modest to moderate rate in most Districts, similar to last period, and contacts expected wage growth to continue in this range. Firms reported that the tight labor market and minimum wage increases were putting upward pressure on wages. Companies also spent more on benefits, as the cost of benefits rose and as employers expanded benefits to attract and retain workers.

emphasis added

ISM Non-Manufacturing Index increased to 57.3% in February

by Calculated Risk on 3/04/2020 10:03:00 AM

The February ISM Non-manufacturing index was at 57.3%, up from 55.5% in January. The employment index increased to 55.6%, from 54.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2020 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 121st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.This suggests faster expansion in February than in January.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 57.3 percent, which is 1.8 percentage points higher than the January reading of 55.5 percent. This represents continued growth in the non-manufacturing sector, at a faster rate. The Non-Manufacturing Business Activity Index decreased to 57.8 percent, 3.1 percentage points lower than the January reading of 60.9 percent, reflecting growth for the 127th consecutive month. The New Orders Index registered 63.1 percent; 6.9 percentage points higher than the reading of 56.2 percent in January. The Employment Index increased 2.5 percentage points in February to 55.6 percent from the January reading of 53.1 percent. The Prices Index reading of 50.8 is 4.7 percentage points lower than the January’s 55.5 percent, indicating that prices increased in February for the 33rd consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector reflected continued growth in February. Most respondents are concerned about the coronavirus and its supply chain impact. They also continue to have difficulty with labor resources. They do remain positive about business conditions and the overall economy.”

emphasis added

BEA: February Vehicles Sales decreased to 16.8 Million SAAR

by Calculated Risk on 3/04/2020 08:31:00 AM

The BEA released their estimate of February vehicle sales this morning. The BEA estimated light vehicle sales of 16.83 million SAAR in February 2020 (Seasonally Adjusted Annual Rate), down 0.5% from the revised January sales rate, and up 1.9% from February 2019.

Sales in January were revised up from 16.84 million SAAR to 16.92 million SAAR.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for February 2020 (red).

A small decline in sales last year wasn't a concern. My view - before the health crisis - was that sales would move mostly sideways at near record levels this year. Going forward, the impact of COVID-19 on vehicle sales is unclear.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 16.83 million SAAR.

Sales have been generally decreasing slightly, but are still at a high level.

ADP: Private Employment increased 183,000 in February

by Calculated Risk on 3/04/2020 08:19:00 AM

Private sector employment increased by 183,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 170,000 private sector jobs added in the ADP report.

...

“The labor market remains firm, as private-sector payrolls continued to expand in February,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Job creation remained heavily concentrated in large companies, which continue to be the strongest performer.”

Mark Zandi, chief economist of Moody’s Analytics, said, “COVID-19 will need to break through the job market firewall if it is to do significant damage to the economy. The firewall has some cracks, but judging by the February employment gain it should be strong enough to weather most scenarios.”

The BLS report will be released Friday, and the consensus is for 175,000 non-farm payroll jobs added in February.

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

by Calculated Risk on 3/04/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 15.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 28, 2020. The results for the week ending February 21, 2020, included an adjustment for the Presidents’ Day holiday.

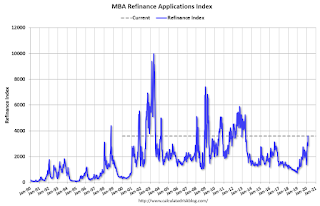

... The Refinance Index increased 26 percent from the previous week and was 224 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“The 30-year fixed rate mortgage dropped to its lowest level in more than seven years last week, amidst increasing concerns regarding the economic impact from the spread of the coronavirus, as well as the tremendous financial market volatility. Refinance demand jumped as a result, with conventional refinance applications increasing more than 30 percent," said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Given the further drop in Treasury rates this week, we expect refinance activity will increase even more until fears subside and rates stabilize.”

Added Fratantoni, “We are now at the start of the spring homebuying season. While purchase applications were down a bit for the week, they are still up about 10 percent from a year ago. The next few weeks are key in whether these low mortgage rates bring in more buyers, or if economic uncertainty causes some home shoppers to temporarily delay their search.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.57 percent from 3.73 percent, with points decreasing to 0.26 from 0.27 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, and with the further decline in rates this week, we will probably see a huge increase in refinance activity in the survey next week.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

As Fratantoni noted, a key question is will low mortgage rates bring in more buyers, or will people hold off buying a home during the health crisis (as happened in China).

Tuesday, March 03, 2020

Wednesday: ADP Employment, ISM non-Mfg, Beige Book

by Calculated Risk on 3/03/2020 09:08:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in February, down from 291,000 added in January.

• Early, Light vehicle sales for February from the BEA. The consensus is for light vehicle sales to be 16.8 million SAAR in February, unchanged from 16.8 million in January (Seasonally Adjusted Annual Rate).

• At 10:00 AM, the ISM non-Manufacturing Index for February.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.