by Calculated Risk on 3/12/2020 02:20:00 PM

Thursday, March 12, 2020

Fed's Flow of Funds: Household Net Worth Increased in Q4

The Federal Reserve released the Q4 2019 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $118.4 trillion during the fourth quarter of 2019. The value of directly and indirectly held corporate equities increased $2.6 trillion and the value of real estate increased $0.1 trillion.

Household debt increased 4.1 percent at an annual rate in the fourth quarter of 2019. Consumer credit grew at an annual rate of 4.5 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 3.1 percent.

Click on graph for larger image.

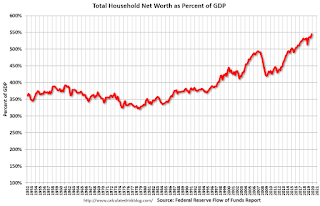

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

Net Worth as a percent of GDP decreased slightly in Q4.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

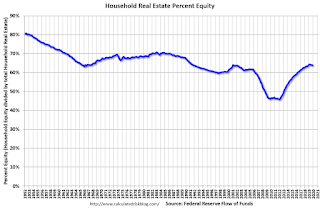

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2019, household percent equity (of household real estate) was at 63.8% - down from Q3.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 63.8% equity - and about 2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $86 billion in Q4.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 48.8% (the lowest since 2001), down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, decreased slightly in Q4, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

Note: Household net worth looks to decline sharply in Q1 2020.

Hotels: Occupancy Rate Decreased Sharply Year-over-year

by Calculated Risk on 3/12/2020 09:54:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 7 March

Reflecting concerns and cancellations around the COVID-19 outbreak, the U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 1-7 March 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 March 2019, the industry recorded the following:

• Occupancy: -7.3% to 61.8%

• Average daily rate (ADR): -4.6% to US$126.01

• Revenue per available room (RevPAR): -11.6% to US$77.82

Performance declines were uniform across chain scales, classes and location types.

“The question over the last several weeks was ‘when’, not ‘if’ this impact would hit—well, when has arrived,” said Jan Freitag, STR’s senior VP of lodging insights. “Like so many other areas of the world, concerns around the coronavirus outbreak have now hit U.S. hotel occupancy hard. Not a surprise given the amount of event-related news we have seen, but group cancellations were felt across the markets and classes in addition to consistent declines in the transient segment. ADR is starting to decline as well, rapidly in the case of San Francisco. This is quite likely the beginning of a bad run that will get worse before it gets better.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 is now having a negative impact on occupancy. To date, this is the weakest start for a year since 2013 - and the seasonally important Spring travel season is just beginning.

Weekly Initial Unemployment Claims Decrease to 211,000

by Calculated Risk on 3/12/2020 08:33:00 AM

The DOL reported:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 211,000, a decrease of 4,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 216,000 to 215,000. The 4-week moving average was 214,000, an increase of 1,250 from the previous week's revised average. The previous week's average was revised down by 250 from 213,000 to 212,750.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 214,000.

This was lower than the consensus forecast.

Note: Companies have just started announcing layoffs related to COVID-19. So we should expect weekly claims to increase in the coming weeks.

Wednesday, March 11, 2020

Thursday: Unemployment Claims, PPI, Flow of Funds

by Calculated Risk on 3/11/2020 07:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Rising at Fastest Pace in Years

Mortgage rates continued a relentless surge higher today. The move began in earnest yesterday for two key reasons: bond market panic and mortgage market over-supply. If you take nothing else away from the following, the important part to understand is that rates are absolutely significantly higher than they were this morning, yesterday, and on Monday morning. The pace of that move has been the fastest since the 2 days following the 2016 presidential election, and one of only a handful of 2-day periods with more than a 3/8ths bump to the conventional 30yr fixed rate. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.5-3.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 216 thousand the previous week.

• At 8:30 AM, The Producer Price Index for February from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.2% increase in core PPI.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

Houston Real Estate in February: Sales up 14.9% YoY, Inventory Up 3.8% YoY

by Calculated Risk on 3/11/2020 11:49:00 AM

This is prior to COVID-19 and also prior to the collapse in oil prices.

From the HAR: Houston Home Sales Gain Momentum in February

The Houston real estate market built upon its strong 2020 start by registering an eighth consecutive month of positive home sales in February. Consumer activity was once again largely fueled by some of the lowest interest rates of all time. ...Sales in Houston set a record in 2019 and were off to a strong start in 2020. The decline in oil prices will hit Texas hard, and sales will also likely be impacted by COVID-19 - although record low mortgage rates will help.

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 6,044 single-family homes sold in February compared to 5,339 a year earlier, accounting for a 13.2 percent increase.

...

Sales of all property types totaled 7,393, up 14.9 percent from February 2019. Total dollar volume for the month jumped 19.4 percent to slightly more than $2.1 billion. .

“The Houston housing market gained momentum in February, thanks largely to record low mortgage rates that some economists say could drop even further,” said HAR Chairman John Nugent with RE/MAX Space Center. “Concerns have been raised about the possible effects the coronavirus outbreak might have on our real estate market and others around the country, and that is something HAR is monitoring. Coronavirus was not a factor in the February housing data, but obviously with the losses that Wall Street has suffered as well as declining oil prices, we are keeping a watchful eye on housing market activity.”

...

Total active listings, or the total number of available properties, rose 3.8 percent to 40,091.. … Single-family homes inventory recorded a 3.5-months supply in February, down fractionally from a 3.6-months supply a year earlier.

emphasis added

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in February, Core PCE below 2%

by Calculated Risk on 3/11/2020 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.7% annualized rate) in February. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for January here. Motor fuel decreased at a 33.5% annualized rate in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.1% annualized rate) in February. The CPI less food and energy rose 0.2% (2.7% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.4%. Core PCE is for January and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.7% annualized and trimmed-mean CPI was at 2.3% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%). This is all pre-COVID-19.

LA area Port Traffic Down Year-over-year in February

by Calculated Risk on 3/11/2020 09:13:00 AM

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.6% in February compared to the rolling 12 months ending in January. Outbound traffic was up 0.4% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Because of the timing of the New Year, we would have expected traffic to decline in February without an impact from COVID-19.

In general imports both imports and exports have turned down recently - and will probably be negatively impacted by COVID-19 over the next several months.

BLS: CPI increased 0.1% in February, Core CPI increased 0.2%

by Calculated Risk on 3/11/2020 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in February on a seasonally adjusted basis, the same increase as in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.3 percent before seasonal adjustment.Overall inflation was close to expectations in February. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.2 percent in February, the same increase as in January.

...

The all items index increased 2.3 percent for the 12 months ending February, a smaller increase than the 2.5-percent figure for the period ending January. The index for all items less food and energy rose 2.4 percent over the last 12 months.

emphasis added

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

by Calculated Risk on 3/11/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 55.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 6, 2020.

In response to the current interest rate environment, MBA now forecasts total mortgage originations to come in around $2.61 trillion this year – a 20.3 percent gain from 2019’s volume ($2.17 trillion). Refinance originations are expected to double earlier MBA projections, jumping 36.7 percent to around $1.23 trillion. Purchase originations are now forecasted to rise 8.3 percent to $1.38 trillion.

... The Refinance Index increased 79 percent from the previous week to the highest level since April 2009, and was 479 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

“Market uncertainty around the coronavirus led to a considerable drop in U.S. Treasury rates last week, causing the 30-year fixed rate to fall and match its December 2012 survey low of 3.47 percent. Homeowners rushed in, with refinance applications jumping 79 percent – the largest weekly increase since November 2008,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With last week’s increase, the refinance index hit its highest level since April 2009. The purchase market also had a solid week, with activity nearly 12 percent higher than a year ago. Prospective buyers continue to be encouraged by improving housing inventory levels in some markets and very low rates.”

Added Kan, “Taking into the account the current economic situation and how much rates have fallen, MBA is nearly doubling its 2020 refinance originations forecast to $1.2 trillion, a 37 percent increase from 2019 and the strongest refinance volume since 2012. As lenders handle the wave in applications and manage capacity, mortgage rates will likely stabilize but remain low for now. This in turn will support borrowers looking to refinance or purchase a home this spring.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to the lowest level since December 2012, equaling the lowest level in survey history at 3.47 percent, from 3.57 percent with points increasing to 0.27 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With record lower rates, we saw a huge increase in refinance activity in the survey this week.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 12% year-over-year.

A key question is will low mortgage rates bring in more buyers, or will people hold off buying a home during the health crisis (as happened in China). So far people are still buying according to this survey.

Tuesday, March 10, 2020

Me on NPR The Indicator from Planet Money with Cardiff Garcia

by Calculated Risk on 3/10/2020 06:08:00 PM

Cardiff Garcia interviewed me yesterday at NPR The Indicator from Planet Money: Tracking The Impact Of Coronavirus In Real Time. Thanks to Cardiff for having me on!

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.