by Calculated Risk on 3/18/2020 08:31:00 PM

Wednesday, March 18, 2020

Thursday: Unemployment Claims, Philly Fed Mfg

Weekly Claims will be huge this week (reported next week), but we will probably also see an increase in the claims reported for last week. The Philly Fed survey for March will probably be much weaker than the forecast.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 211 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 10.0, down from 36.7.

Update: COVID-19 Tests per Day

by Calculated Risk on 3/18/2020 05:18:00 PM

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with about one-fifth of the US population, so the US needs to test 70,000 to 100,000 per day.

The US conducted 22,408 tests in the last 24 hours. That is progress, but the US needs the ability to conduct about 70,000 to 100,000 per day.

This data is from the COVID Tracking Project.

Testing it getting better, but is still too low.

Test. Test. Test.

Stay Healthy!

Update: Decline in Restaurant Traffic

by Calculated Risk on 3/18/2020 02:45:00 PM

There are some sectors that will be hit hard over the next several months: hotels, airlines, restaurants, movie theaters, sporting events, and convention centers. People will probably avoid these places as part of social distancing.

Thanks to OpenTable for providing this restaurant data:

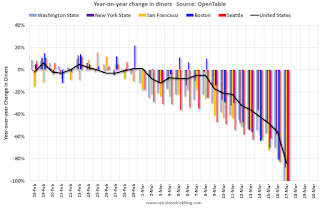

This data shows the year-over-year change in diners as tabulated by OpenTable for the US, the states of Washington and New York, and a few impacted cities (Seattle, San Francisco, and Boston).

This data is updated through March 17, 2020.

The US was off 84% YoY as of yesterday.

As of yesterday, San Francisco was off 100% YoY, Boston was off 100% YoY, and Seattle was off 100%. Going forward, restaurants are closing in many states (except take out and pick up)

As of March 17th, 13 states and D.C. were off 100%, Soon it will be all states.

Clearly the US will need to help the employees (and owners) of these impacted sectors.

Lawler: Early Read on Existing Home Sales in February; Lawler "I doubt anyone really cares"

by Calculated Risk on 3/18/2020 01:50:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.58 million in February , up 2.2% from January’s preliminary pace and up 3.7% from last February’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of February was down by about 12.3% from a year earlier.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 7.5% from last January.

There are a few things worth noting. First, of course, closed sales in February were not impacted by the current pandemic. Second, some realtor/MLS reports that I use for the “early read” have not yet been released. And finally, getting the seasonal adjustment “right” for February is tricky. 2020 is a leap year, and typically the February existing home sales seasonal factor is significantly higher in a leap year than in other years. However, this February’s “extra day” was on a weekend, and since not many home sales close on a weekend, the “leap year” effect on this February’s seasonal factor should be pretty modest.

CR Note: The National Association of Realtors (NAR) is scheduled to release February existing home sales on Friday, March 20, 2020 at 10:00 AM ET. The consensus is for 5.50 million SAAR.

Phoenix Real Estate in February: Sales up 13.6% YoY, Active Inventory Down 43.5% YoY

by Calculated Risk on 3/18/2020 11:44:00 AM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 7,279 in February, up from 6,328 in January, and up from 6,409 in February 2019. Sales were up 15.0% from January 2019 (last month), but up 13.6% from February 2019.

2) Active inventory was at 10,590, down from 18,990 in February 2019. That is down 43.5% year-over-year.

3) Months of supply decreased to 2.14 in February from 2.54 months in January. This remains low.

This was another market with increasing sales and falling inventory.

With the COVID-19 crisis, everything will change for the duration of the crisis. My guess is sales will decline sharply, and inventory will probably stay low (no one wants strangers in their homes).

AIA: Architecture Billings Index increased in February, Expected to decline rapidly

by Calculated Risk on 3/18/2020 11:07:00 AM

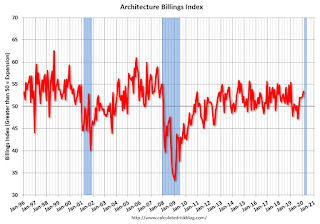

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Design services saw increase in February but economic footings are rapidly shifting

Demand for design services in February increased at a solid pace for the sixth month in a row, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 53.4 for February reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). During February, both the new project inquiries and design contracts scores moderated slightly but remained in positive territory, posting scores of 56.5 and 52.0 respectively.

“Business conditions at architecture firms have been surprisingly positive so far this year. However, firms were just beginning to feel the impact of the dramatic slowdown caused by COVID-19 as this survey was being conducted in early March.” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The rapid pull-back in activity throughout the economy will obviously be felt in the design and construction sector, and architecture firms will be one of the first to see how these events play out.”

...

• Regional averages: South (56.7); West (52.1); Midwest (51.3); Northeast (45.3)

• Sector index breakdown: mixed practice (51.6); commercial/industrial (51.5); multi-family residential (51.2); institutional (51.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.4 in February, up from 52.2 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some increase in CRE investment in 2020.

However, this will all change in the next survey - when activity will decline significantly.

Comments on February Housing Starts

by Calculated Risk on 3/18/2020 09:01:00 AM

This was all pre-crisis. This will change sharply soon, and housing starts will collapse for the duration of the crisis.

Earlier: Housing Starts decreased to 1.599 Million Annual Rate in February

Total housing starts in February were well above expectations and revisions to prior months were positive.

The housing starts report showed starts were down 1.5% in February compared to January (only because January was revised up), and starts were up 39.2% year-over-year compared to February 2019.

These were strong numbers! Starts in January were revised up to the highest level for starts since December 2006 (end of the bubble). However, the weather was very nice again in February (just like in December and January), and the weather probably had an impact on the seasonally adjusted housing starts number.

Single family starts were up 35.4% year-over-year, and multi-family starts were up 44.3% YoY.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 39.2% in February compared to February 2019.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons are easy early in the year.

Starts will collapse over the next few months due to COVID-19.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts- although starts are picking up a little again.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions once the crisis ends.

Housing Starts decreased to 1.599 Million Annual Rate in February

by Calculated Risk on 3/18/2020 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,599,000. This is 1.5 percent below the revised January estimate of 1,624,000, but is 39.2 percent above the February 2019 rate of 1,149,000. Single‐family housing starts in February were at a rate of 1,072,000; this is 6.7 percent above the revised January figure of 1,005,000. The February rate for units in buildings with five units or more was 508,000.

Building Permits:

Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,464,000. This is 5.5 percent below the revised January rate of 1,550,000, but is 13.8 percent above the February 2019 rate of 1,287,000. Single‐family authorizations in February were at a rate of 1,004,000; this is 1.7 percent above the revised January figure of 987,000. Authorizations of units in buildings with five units or more were at a rate of 415,000 in February.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were down in February compared to January. Multi-family starts were up 47.6% year-over-year in February.

Multi-family is volatile month-to-month, and had been mostly moving sideways the last several years - but increased sharply recently.

Single-family starts (blue) increased in February, and were up 35.4% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in February were well above expectations and revisions were positive.

I'll have more later …

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 3/18/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 13, 2020.

... The Refinance Index decreased 10 percent from the previous week and was 402 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index remained unchanged compared with the previous week and was 11 percent higher than the same week one year ago.

...

“The ongoing situation around the coronavirus led to further stress in the financial markets late last week, with unprecedented volatility and widening spreads. This drove mortgage rates back up to their highest levels since mid-February and led to a 10 percent decrease in refinance applications. However, refinance activity remains very high. Excluding the spike two weeks ago, the index remained at its highest level since October 2012, and refinancing accounted for almost 75 percent of all applications,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The Federal Reserve’s rate cut and other monetary policy measures to help the economy should help to bring down mortgage rates in the coming weeks, spurring more refinancing. Amidst these challenging times, the savings that households can gain from refinancing will help bolster their own financial circumstances and support the broader economy.”

Added Kan, “Purchase activity was flat but remained over 10 percent higher than a year ago. The purchase market was on firm footing to start the year and has so far held steady through the current uncertainty. Looking ahead, a gloomier outlook may cause some prospective homebuyers to delay their home search, even with these lower mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.74 percent from 3.47 percent, with points increasing to 0.37 from 0.27 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With record lower rates, we saw a huge increase in refinance activity in the survey over the last two weeks.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 11% year-over-year.

A key question is will low mortgage rates bring in more buyers, or will people hold off buying a home during the health crisis (as happened in China). So far people are still buying according to this survey.

Tuesday, March 17, 2020

Wednesday: Housing Starts

by Calculated Risk on 3/17/2020 07:45:00 PM

Housing Starts is for February (pre-crisis), but the MBA purchase index is for last week - and might indicate if people have stopped buying.

Tuesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for February. The consensus is for 1.500 million SAAR, down from 1.567 million SAAR.

• During the day, The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).