by Calculated Risk on 3/31/2020 11:28:00 AM

Tuesday, March 31, 2020

The Economic Outlook

This is a healthcare crisis, and the economic outlook is based on presumptions about the course of the pandemic. A key model suggests peak healthcare resource use will be around April 15th, but the peak will not be until May in many areas of the country. Of course, this requires cooperation of the public.

Before areas can start easing restrictions, the US will need to have sufficient healthcare services and equipment, masks for everyone (it seems likely that it will be recommended that everyone wear a mask), and adequate testing to do surveillance monitoring. Right now, we are well short of all of these requirements, but making progress. It is possible we could see some restriction easing in June.

Some impacts are already clear: travel is down significantly impacting airlines and hotels, restaurants (except takeout and delivery) and movie theaters are closed. Many local businesses are closed too - like gyms, barber shops, and flower stands.

Also I expect new and existing home sales will decline sharply, although both residential and commercial construction is ongoing in many places.

Goldman Sachs economists wrote today:

We are making further significant adjustments to our GDP and employment estimates. We now forecast real GDP growth of -9% in Q1 and -34% in Q2 in qoq annualized terms (vs. -6% and -24% previously) and see the unemployment rate rising to 15% by midyear (vs. 9% previously). However, we have upgraded our expectations for the recovery after midyear, with a 19% qoq annualized GDP gain in Q3 (vs. 12% previously). Our estimates imply that a bit more than half of the near-term output decline is made up by year end and that real GDP falls 6.2% in 2020 on an annual-average basis (vs. 3.7% in our previous forecast).Unlike the great recession, when the situation kept getting worse month after month, the worst economic impact will probably be early, in the months of April and May. Although there is a concern that missed payments will ripple through the system leading to financial problems. This was the purpose of the $2+ Trillion disaster relief package - to help people pay their bills including rent and mortgage (Note: This was NOT a "stimulus" package, this was disaster relief).

My current guess is the economy will start growing - slowly - in June (maybe July). But growth will likely be slow at first as people put their toes in the water. I don't expect a "V" shaped recovery unless there is an effective treatment or a vaccine, then growth will pick up quicker.

This is all subject to the course of the pandemic. Stay healthy!

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 3/31/2020 10:29:00 AM

Note: With COVID-19, there will be far fewer real estate transaction for several months. This could distort the house price indexes - since there will be far fewer repeat sales.

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

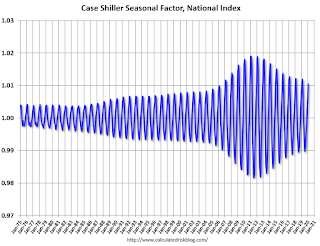

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through January 2020). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors have started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Case-Shiller: National House Price Index increased 3.9% year-over-year in January

by Calculated Risk on 3/31/2020 09:11:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller Index Shows Continued Growth In Annual Home Price Gains To Start 2020

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.9% annual gain in January, up from 3.7% in the previous month. The 10-City Composite annual increase came in at 2.6%, up from 2.3% in the previous month. The 20-City Composite posted a 3.1% year-over-year gain, up from 2.8% in the previous month.

Phoenix, Seattle and Tampa reported the highest year-over-year gains among the 20 cities. In January, Phoenix led the way with a 6.9% year-over-year price increase, followed by 5.1% increases in Seattle and Tampa. Fourteen of the 20 cities reported higher price increases in the year ending January 2020 versus the year ending December 2019.

...

The National Index and 20-City Composite were flat month-over-month, while the 10-City Composite posted a 0.1% decrease before seasonal adjustment in January. After seasonal adjustment, the National Index posted a month-over-month increase of 0.5%, while the 10-City and 20-City Composites both posted 0.3% increases. In January, 10 of 20 cities reported increases before seasonal adjustment while 18 of 20 cities reported increases after seasonal adjustment.

"The trend of stable growth established in 2019 continued into the first month of the new year,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index rose by 3.9% in January 2020, and the 10- and 20-City Composites also advanced (by 2.6% and 3.1% respectively). Results for the month were broad-based, with gains in every city in our 20-City Composite; 14 of the 20 cities saw accelerating prices. As has been the case since mid-2019, after a long period of decelerating price increases, the National, 10-City, and 20-City Composites all rose at a faster rate in January than they had done in December.

…

“It is important to bear in mind that today’s report covers real estate transactions closed during the month of January. The COVID-19 pandemic did not begin to take hold in the U.S. until late February, and thus whatever impact it will have on housing prices is not reflected in today’s data.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 2.9% from the bubble peak, and up 0.3% in January (SA) from December.

The Composite 20 index is 6.8% above the bubble peak, and up 0.3% (SA) in January.

The National index is 16% above the bubble peak (SA), and up 0.5% (SA) in January. The National index is up 57% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.5% compared to January 2019. The Composite 20 SA is up 3.1% year-over-year.

The National index SA is up 3.9% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, March 30, 2020

Tuesday: Case-Shiller House Prices

by Calculated Risk on 3/30/2020 10:03:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 3.2% year-over-year increase in the Comp 20 index for December.

• At 9:45 AM ET Chicago Purchasing Managers Index for March. The consensus is for a reading of 40.0, down from 49.0 in February.

March 30 Update: US COVID-19 Tests per Day #TestAndTrace

by Calculated Risk on 3/30/2020 05:09:00 PM

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day.

When I first started posting this data (thanks to the COVID Tracking Project), testing was so low, that just tracking the number of tests made sense.

The percentage positive is also critical. Unfortunately some states and labs don't report all negative tests, although that is supposed to change soon.

The real key is to have enough tests that the US can test all people with symptoms (even mild), all close contacts of those testing positive (aka Test-and-Trace), healthcare workers and first responders fairly regularly (upon request), staff at retirement communities and nursing homes, and those people that regularly visit those facilities (it is a burden on older people not see their families).

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I include all tests in the total including pending.

The percent positive excludes the pending tests.

There were 113,336 tests reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 19%.

Testing must continue to be expanded until the percent positive declines to 5% or lower. This is based on results from South Korea.

Test. Test. Test. Protect healthcare workers first!

TSA checkpoint travel numbers

by Calculated Risk on 3/30/2020 03:24:00 PM

The TSA is providing daily travel numbers. (ht @conorsen)

This is another measure that will be useful to track as the economy starts to reopen.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

Movie Box Office

by Calculated Risk on 3/30/2020 12:59:00 PM

When the eventual recovery starts, it will be interesting to track hotel occupancy, restaurant traffic and movie box office data.

Currently almost all theaters in the US are closed and box office is close to zero. Note: the 4-week average hasn't fallen to zero yet, but the average will be at zero in a couple of weeks.

This data shows the 4-week average of domestic box office for this year (red) and the maximum and minimum for the previous four years.

This data is through the week ending March 26, 2020.

The red line (2020) will fall to zero in a couple of weeks and remain there until theaters start to open again. This will be useful to track when the economy starts to reopen.

Dallas Fed: "Texas Manufacturing Activity Contracts Suddenly, Outlook Worsens", Record Low Activity Index

by Calculated Risk on 3/30/2020 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Activity Contracts Suddenly, Outlook Worsens

Texas factory activity declined sharply in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, plummeted from 16.4 to -35.3, suggesting a notable contraction in output since last month.This was the last of the regional Fed surveys for March.

Other measures of manufacturing activity also point to a sudden decline in March. The new orders index dropped to -41.3, its lowest reading since March 2009 during the Great Recession. Similarly, the growth rate of orders index fell to -44.9. The capacity utilization and shipments indexes fell to -33.4 and -33.8, respectively, also the lowest readings since the Great Recession. Capital expenditures declined sharply, with the index dropping from 6.9 to -34.3.

Perceptions of broader business conditions turned quite pessimistic in March. The general business activity index plunged from 1.2 to -70.0, and the company outlook index fell from 3.6 to -65.6. Both March readings are the lowest since the survey began in June 2004. The index measuring uncertainty regarding companies’ outlooks surged from 11.0 to 62.6.

Labor market measures indicate employment declines and shorter workweeks this month. The employment index fell to -23.0 from its near-zero reading in February.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The ISM manufacturing index for March will be released on Wednesday, April 1st. The consensus is for the ISM to be at 45.0, down from 50.1 in February. Based on these regional surveys, the ISM manufacturing index will likely be even lower than the consensus in March (it depends on the timing during the month of the different surveys).

NAR: "Pending Home Sales Increase 2.4% in February"

by Calculated Risk on 3/30/2020 10:03:00 AM

From the NAR: Pending Home Sales Increase 2.4% in February

ending home sales rose in February, climbing for the second consecutive month, according to the National Association of Realtors®. Each of the four major regions saw an increase in month-over-month contract activity, as well as growth in year-over-year pending home sales transactions compared to one year ago.This was well above expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April. Some of these sales will be cancelled or delayed due to COVID-19.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, grew 2.4% to 111.5 in February. Year-over-year contract signings increased 9.4%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI rose 2.8% to 96.3 in February, 5.9% higher than a year ago. In the Midwest, the index increased 4.5% to 110.1 last month, 14.9% higher than in February 2019.

Pending home sales in the South inched up 0.1% to an index of 129.2 in February, a 7.1% increase from February 2019. The index in the West grew 4.6% in February 2020 to 97.1, a jump of 10.8% from a year ago.

emphasis added

Sunday, March 29, 2020

Sunday Night Futures: Oil Prices Lowest Since Feb 2002

by Calculated Risk on 3/29/2020 07:18:00 PM

Weekend:

• Schedule for Week of March 29, 2020

Monday:

• At 10:00 AM ET, Pending Home Sales Index for February. The consensus is for a 1.0% decrease in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 50 and DOW futures are down 409 (fair value).

Oil prices were down over the last week with WTI futures at $20.33 per barrel and Brent at $23.54 barrel. A year ago, WTI was at $60, and Brent was at $68 - so oil prices are down almost two-thirds year-over-year.

This is the lowest for WTI since February 25, 2002 (oil prices declined following 9/11)

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.96 per gallon. A year ago prices were at $2.70 per gallon, so gasoline prices are down 74 cents per gallon year-over-year.