by Calculated Risk on 1/07/2021 07:51:00 PM

Thursday, January 07, 2021

January 7 COVID-19 Test Results; Record 7-Day Deaths and Cases

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,914,839 test results reported over the last 24 hours.

There were 266,197 positive tests.

Over 19,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.9% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record 7-Day Deaths

• Record 7-Day Cases

Goldman December Payrolls Preview

by Calculated Risk on 1/07/2021 03:10:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls declined 50k in December ... most of the Big Data employment signals we track indicate an outright decline in payrolls. Additionally, restaurant seatings fell back to July levels, and initial claims rose for the first time since April. ... We estimate the unemployment rate rebounded a tenth to 6.8%CR Note: The consensus is for 70 thousand jobs added, and for the unemployment rate to increase to 6.8%.

emphasis added

December Employment Preview

by Calculated Risk on 1/07/2021 01:05:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for 70 thousand jobs added, and for the unemployment rate to increase to 6.8%.

• ADP Report: The ADP employment report showed a loss of 123,000 private sector jobs, well below the consensus estimate of 88 thousand jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be weaker than expected.

• ISM Surveys: The ISM manufacturing employment index increased in December to 51.5%, up from 48.4% in November. This would suggest essentially approximately 10,000 manufacturing jobs lost in December. ADP showed 21,000 manufacturing jobs lost.

The ISM Services employment index decreased in December to 48.2% from 51.5% in November. This would suggest around 25,000 service jobs added in December. Combined, the ISM surveys suggest around 15,000 private sector jobs added in December. The ISM surveys haven't been as useful as usual during the pandemic, but this does suggest the report could be weaker than expected.

• Unemployment Claims: The weekly claims report showed a high number of total continuing unemployment claims during the reference week, although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession!

Click on graph for larger image.

In 2019, retailers hired 79,500 seasonal employees (NSA) in December. That translated to a gain of 41,000 SA. Brick and Mortar retailers will be more cautious this year, and retail might decline a little SA in December.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.

This data is only available back to 1994, so there is only data for three recessions. In November, the number of permanent job losers increased to 3.743 million from 3.684 million in October.

• Conclusion: Most of the indicators suggest a weak report in December. My guess is the report will be lower than the consensus, and could show jobs lost in December.

Hotels: Occupancy Rate Declined 17.2% Year-over-year

by Calculated Risk on 1/07/2021 11:49:00 AM

Thanks to a travel boost leading into the New Year’s holiday, U.S. weekly hotel occupancy improved noticeably from the previous week, according to STR‘s latest data through 2 January.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

27 December 2020 through 2 January 2021 (percentage change from comparable week in 2019/2020):

• Occupancy: 40.6% (-17.2%)

• Average daily rate (ADR): US$107.93 (-21.5%)

• Revenue per available room (RevPAR): US$43.81 (-35.1%)

Hotel demand jumped in week-over-comparisons while TSA checkpoint counts showed five days with more than 1 million passengers. Substantial hotel demand growth is not expected to continue as leisure travel once again dissipates after the holidays.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect business travel would start to pick up in the new year, but there will probably not be much pickup early this year.

Note: Y-axis doesn't start at zero to better show the seasonal change.

ISM Services Index Increased to 57.2% in December

by Calculated Risk on 1/07/2021 10:09:00 AM

The December ISM Services index was at 57.2%, up from 55.9% last month. The employment index decreased to 48.2%, from 51.5%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: Services PMI™ at 57.2%; December 2020 Services ISM® Report On Business®

Economic activity in the services sector grew in December for the seventh month in a row, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: "The Services PMI™ registered 57.2 percent, 1.3 percentage points higher than the November reading of 55.9 percent. This reading represents a seventh straight month of growth for the services sector, which has expanded for all but two of the last 131 months.

emphasis added

Trade Deficit Increased to $68.1 Billion in November

by Calculated Risk on 1/07/2021 08:54:00 AM

From the Department of Commerce reported:

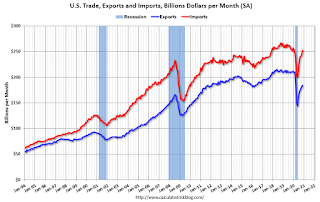

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $68.1 billion in November, up $5.0 billion from $63.1 billion in October, revised.

November exports were $184.2 billion, $2.2 billion more than October exports. November imports were $252.3 billion, $7.2 billion more than October imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in November.

Exports are down 12.5% compared to November 2019; imports are unchanged compared to November 2019.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports much more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $35.68 per barrel in November, down from $36.23 per barrel in October, and down from $51.91 in November 2019.

The trade deficit with China increased to $30.7 billion in November, from $26.3 billion in November 2019.

Weekly Initial Unemployment Claims at 787,000

by Calculated Risk on 1/07/2021 08:39:00 AM

The DOL reported:

In the week ending January 2, the advance figure for seasonally adjusted initial claims was 787,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 787,000 to 790,000. The 4-week moving average was 818,750, a decrease of 18,750 from the previous week's revised average. The previous week's average was revised up by 750 from 836,750 to 837,500.This does not include the 161,460 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 310,462 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 818,750.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 5,072,000 (SA) from 5,198,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 8,383,387 receiving Pandemic Unemployment Assistance (PUA) that decreased from 8,453,940 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, January 06, 2021

Thursday: Unemployment Claims, Trade Deficit, ISM Services

by Calculated Risk on 1/06/2021 09:26:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released.

• Also at 8:30 AM, Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $64.5 billion. The U.S. trade deficit was at $63.1 billion in October.

• At 10:00 AM, the ISM Services Index for December.

January 6 COVID-19 Test Results; Record Hospitalizations, Record 7-Day Cases

by Calculated Risk on 1/06/2021 07:21:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,605,799 test results reported over the last 24 hours.

There were 243,346 positive tests.

Over 15,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 15.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

• Record 7-Day Cases

FOMC Minutes: "Uncertainty surrounding the economic outlook"

by Calculated Risk on 1/06/2021 02:58:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 15-16, 2020. A few excerpts:

Participants continued to see the uncertainty surrounding the economic outlook as elevated, with the path of the economy highly dependent on the course of the virus. The positive vaccine news was seen as reducing downside risks over the medium term, and a number of participants saw risks to economic activity as more balanced than earlier. Still, participants saw significant uncertainties regarding how quickly the deployment of vaccines would proceed as well as how different members of the public would respond to the availability of vaccines. Participants cited several downside risks that could threaten the economic recovery. These risks included the possibility of significant additional fiscal policy support not materializing in a timely manner, the potential for further adverse pandemic developments—which could lead to more-stringent restrictions, more-severe business failures, and more permanent job losses—and the chance that trade negotiations between the United Kingdom and the European Union would not be concluded successfully before the December 31 deadline. As upside risks, participants mentioned the prospect that the release of pent-up demand, spurred by wider-scale vaccinations and easing of social distancing, could boost spending and bring individuals back to the labor force more quickly than currently expected as well as the possibility that fiscal policy developments could see measures that were larger than expected in amount or economic impact. Regarding inflation, participants generally viewed the risks as having become more balanced than they were earlier in the year, though most still viewed the risks as being weighted to the downside. As an upside risk to inflation, a few participants noted the potential for a stronger-than-expected recovery, coupled with the possible emergence of pandemic-related supply constraints, to boost inflation.

emphasis added