by Calculated Risk on 1/18/2021 08:27:00 AM

Monday, January 18, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019-2020 (Blue) and 2020-2021 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of January 17th.

The seven day average is down 59.0% from last year (41.0% of last year). (Dashed line)

There has been a slow increase from the bottom, with ups and downs due to the Thanksgiving and Christmas holidays.

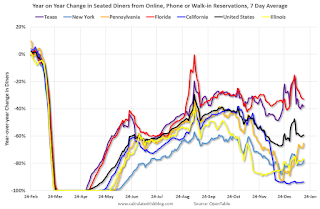

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through January 16, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays. Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York. Note that California dining is off sharply with the orders to close.

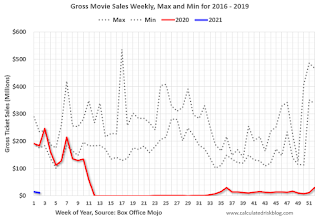

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Red is 2020 and Blue is 2021. Data is from BoxOfficeMojo through January 14th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Red is 2020 and Blue is 2021. Data is from BoxOfficeMojo through January 14th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $11 million last week (compared to usually around $200 million per week at this time of year).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

This data is through January 9th. Hotel occupancy is currently down 28.3% year-over-year. Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Red is for 2020. At one point, gasoline supplied was off almost 50% YoY. Blue is for 2021.

As of January 8th, gasoline supplied was off about 12.1% (about 87.9% of the same week in 2019).

Note: People driving instead of flying might have boosted gasoline consumption over the summer.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through January 16th for the United States and several selected cities.

This data is through January 16th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 46% of the January level. It is at 35% in Chicago, and 51% in Houston - and mostly moving sideways.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data since early 2020.

This graph is from Todd W Schneider. This is daily data since early 2020.This data is through Friday, January 15th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, January 17, 2021

January 17 COVID-19 Test Results

by Calculated Risk on 1/17/2021 06:45:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,836,498 test results reported over the last 24 hours.

There were 185,518 positive tests.

Over 52,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.1% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

Update: The Inland Empire

by Calculated Risk on 1/17/2021 01:01:00 PM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. However, prior to the pandemic, the Inland Empire was coming back strong.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate was falling before the pandemic, and was down to 3.6% (down from 14.4% in 2010). During the pandemic, the unemployment rate increased to 15.1%, but is down to 7.9%.

So the Inland Empire economy isn't as heavily depending on construction as during the bubble.

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..Clearly the Inland Empire is more dependent on construction than most areas. Construction employment - as a percent of total employment - has picked up, but is still below the levels during the housing bubble.

Saturday, January 16, 2021

January 16 COVID-19 Test Results; Over 50,000 Deaths in January Already

by Calculated Risk on 1/16/2021 07:11:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 2,015,414 test results reported over the last 24 hours.

There were 215,449 positive tests.

Over 50,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.7% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

Schedule for Week of January 17, 2021

by Calculated Risk on 1/16/2021 08:11:00 AM

The key reports this week are December housing starts and existing home sales.

For manufacturing, the January Philly Fed manufacturing survey will be released.

All US markets will be closed in observance of Martin Luther King Jr. Day

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 86, unchanged from 86 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 985 thousand from 965 thousand last week.

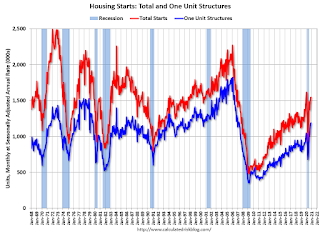

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. This graph shows single and total housing starts since 1968.

The consensus is for 1.560 million SAAR, up from 1.547 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 12.3, up from 9.1.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 6.55 million SAAR, down from 6.69 million.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 6.55 million SAAR, down from 6.69 million.The graph shows existing home sales from 1994 through the report last month.

Friday, January 15, 2021

January 15 COVID-19 Test Results

by Calculated Risk on 1/15/2021 07:30:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 2,279,606 test results reported over the last 24 hours.

There were 243,996 positive tests.

Over 46,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.7% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

Phoenix Real Estate in December: Sales Up 27.4% YoY, Active Inventory Down 52% YoY

by Calculated Risk on 1/15/2021 04:33:00 PM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 9,666 in December, up from 8,886 in November, and up from 7,585 in December 2019. Sales were down 8.8% from November 2020 (previous month), and up 27.4% from December 2019.

2) Active inventory was at 5,969, down from 12,425 in November 2019. That is down 52% year-over-year.

3) Months of supply decreased to 1.01 in December from 1.40 in November. This is very low.

Sales are reported at the close of escrow, so these sales were mostly signed in October and November.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 1/15/2021 02:20:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of January 5th.

From Black Knight: Slow Improvement in Forbearance Numbers Continues

The number of mortgages in active forbearance declined slightly once again this week, continuing the trend of very slow improvement seen in recent weeks. Total active forbearance plans are now down 1.5% from last month. This gradual rate of improvement sets the stage for a large number of plans to still be in active status when the first wave of forbearances begins to expire at the end of March.

...

New plans edged higher thanks to an increase in restart activity, but overall, these numbers remain below pre-holiday levels. Forbearance starts were up 10,000 from last week but remain below the weekly average heading into the holidays by 22,000. With some 370,000 active plans up for review for extension/removal through the end of January, the potential for additional removals remains, although it’s expected to be more moderate than what had been seen early in the recovery.

...

Click on graph for larger image.

Overall, as of Jan. 12, 5.1% of all mortgages are in forbearance, which equates to 2.73 million. Altogether, they represent $545 billion in unpaid principal, a staggering number for the U.S. housing market. Of the homeowners in active forbearance, about 15% have remained current on their mortgage payments, and 83% have had their plans extended at some point since the pandemic began to impact the American economy last March.

emphasis added

Q4 GDP Forecasts

by Calculated Risk on 1/15/2021 12:36:00 PM

From Merrrill Lynch:

We revise up 1Q 2021 GDP growth to 4.0% qoq saar from 1.0%, but take down 2Q to 5.0% from 7.0%, reflecting the earlier passage of stimulus in December. This leaves annual 2021 growth at 5.0% from 4.6% previously, with risks tilted to the upside if additional stimulus makes it through Washington in coming months. We continue to track 5.0% qoq saar for 4Q 2020 GDP. [Jan 15 estimate] emphasis addedFrom the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.5% for 2020:Q4 and 6.2% for 2021:Q1. [Jan 15 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 7.4 percent on January 15, down from 8.7 percent on January 8. [Jan 15 estimate]

CAR on California December Housing: Sales up 28% YoY, Active Listings down 47% YoY

by Calculated Risk on 1/15/2021 11:41:00 AM

The CAR reported: California housing market ends year on high note as sales continue strong in December and median price reaches another record high, C.A.R. reports

Despite a global pandemic that lingered most of the year, two lockdowns and a struggling economy, California’s housing market closed out 2020 on a high note, recording solid sales and a fifth record-high median price in December, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in October and November.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 509,750 units in December, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the December pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

December home sales ticked up 0.2 percent from 508,820 in November and were up 28 percent from a year ago, when 398,370 homes were sold on an annualized basis. The year-over-year, double-digit sales gain was the fifth consecutive and the largest yearly gain since May 2009. For the year as a whole, annual home sales rose to a preliminary 411,870 closed escrow sales in California, up 3.5 percent from 2019’s pace of 397,960.

...

“Home prices, which usually peak during the summer, were unseasonably strong in December,” said C.A.R. Vice President and Chief Economist Jordan Levine. “The imbalance between supply and demand continues to fuel home price gains as would-be home sellers remain reluctant to list their homes during the pandemic, contributing to a more-than-40-percent year-over-year decline in active listings for the seventh straight month.”

...

Active listings fell 47.1 percent from last year and continued to drop more than 40 percent on a year-over-year basis for the seventh straight month. On a month-to-month basis, for-sale properties dropped 18.6 percent in December, higher than the 5-year average of -14.0 percent, observed between 2015 and 2019.

emphasis added