by Calculated Risk on 1/20/2021 07:00:00 AM

Wednesday, January 20, 2021

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 15, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 87 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 15 percent higher than the same week one year ago.

“Mortgage rates increased across the board last week, with the 30-year fixed rate rising to 2.92 percent – its highest level since November 2020 – and the 15-year fixed rate increasing for the first time in seven weeks to 2.48 percent. Market expectations of a larger than anticipated fiscal relief package, which is expected to further boost economic growth and lower unemployment, have driven Treasury yields higher the last two weeks,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “After a post-holiday surge of refinances, higher rates chipped away at demand. There was a 5 percent drop in refinance activity, driven by a 13.5 percent pullback in government refinances.”

Added Kan, “Purchase applications remained strong based on current housing demand, rising over the week and up a noteworthy 15 percent from last year. Homebuyers in early 2021 continue to seek newer, larger homes. The average loan size for purchase loans jumped to $384,000, the second highest level in the survey.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 2.92 percent from 2.88 percent, with points increasing to 0.37 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year. Note that refinance activity really picked up in February 2020.

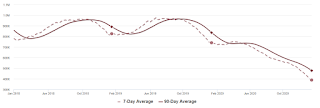

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, January 19, 2021

Wednesday: Homebuilder Survey

by Calculated Risk on 1/19/2021 09:03:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 86, unchanged from 86 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

January 19 COVID-19 Test Results

by Calculated Risk on 1/19/2021 06:44:00 PM

The testing data is probably still light due to the holiday, but it is possible the 7-day average cases has peaked. Stay safe! I'm looking forward to not posting this data in a few months.

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,698,121 test results reported over the last 24 hours.

There were 144,047 positive tests.

Over 55,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.5% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.37%"

by Calculated Risk on 1/19/2021 04:00:00 PM

Note: This is as of January 10th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.37%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased from 5.46% of servicers’ portfolio volume in the prior week to 5.37% as of January 10, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“The week of January 10th saw the largest – and only the second – decrease in the share of loans in forbearance in nine weeks, with declines across almost every tracked loan category,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The rate of exits from forbearance has picked up a bit over the past two weeks but remains much lower than what was seen in October and early November.”

Fratantoni added, “Job market data continue to indicate weakness, and that means many homeowners who remain unemployed will need ongoing relief in the form of forbearance. While new forbearance requests remain relatively low, the availability of relief remains a necessary support for many homeowners.”

emphasis added

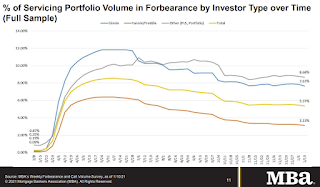

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.07%."

Update Then and Now: With Column Excluding Pandemic

by Calculated Risk on 1/19/2021 03:01:00 PM

A few indicators comparing four years ago and today (and a column after three years - excluding the pandemic) ...

| Jan-17 | Jan-20 | Dec-20 | |

|---|---|---|---|

| Vehicle Sales1 | 16.7 | 16.9 | 16.4 |

| Employment change2 | 2,591 | 2,195 | -704 |

| Unemployment Rate3 | 4.7% | 3.5% | 6.7% |

| Participation Rate4 | 62.8% | 63.4% | 61.5% |

| Housing Starts5 | 1,056 | 1,262 | 1,278 |

| New Home Sales6 | 486 | 644 | 679 |

| Mortgage Delinquency Rate7 | 6.1% | 4.6% | 8.3% |

| GDP Growth8 | 2.3% | 2.5% | 1.0% |

| Budget Deficit9 | 3.2% | 4.6% | 16.0% |

| S&P 50010 | 2,269 | 3,317 | 3,800 |

| 1millions, SAAR (average previous 4 years, or 3 years for Jan 2020) 2Thousands (Average previous 4 years, or 3 years for Jan 2020) 3Most Recent Month 4Most Recent Month 5Thousands, SAAR (average previous 4 years, or 3 years for Jan 2020) 6Thousands, SAAR (average previous 4 years, or 3 years for Jan 2020) 7Annual GDP growth (over previous 4 years, or 3 years for Jan 2020). Q4 2020 estimated at 5.0% annual rate. 8Source: MBA, Quarterly including in-foreclosure (most recent quarter) 9Source: CBP: Annual, fiscal 2016, 2019, and 2020 10Jan 20, 2017, Jan 21, 2020 and Jan 19, 2021 | |||

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/19/2021 01:41:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.62 million in December, down 1.0% from November’s preliminary pace and up 19.7% from last December’s seasonally adjusted pace.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY decline in the inventory of existing homes for sale was slightly greater in December than November, though what that means for the NAR inventory estimate is unclear. As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 13% from last December.

CR Note: The National Association of Realtors (NAR) is scheduled to release December existing home sales on Friday, January 22, 2021 at 10:00 AM ET. The consensus is for 6.55 million SAAR.

Then and Now

by Calculated Risk on 1/19/2021 11:58:00 AM

A few indicators comparing four years ago and today ...

| Jan-17 | Dec-20 | |

|---|---|---|

| Vehicle Sales1 | 16.7 | 16.4 |

| Employment change2 | 10,364 | -2,818 |

| Unemployment Rate3 | 4.7% | 6.7% |

| Participation Rate4 | 62.8% | 61.5% |

| Housing Starts5 | 1,056 | 1,278 |

| New Home Sales6 | 486 | 679 |

| Mortgage Delinquency Rate7 | 6.1% | 8.3% |

| Budget Deficit8 | 3.2% | 16.0% |

| S&P 5009 | 2,269 | 3,790 |

| 1millions, SAAR (average previous 4 years) 2Thousands (over previous 4 years) 3Most Recent Month 4Most Recent Month 5Thousands, SAAR (average previous 4 years) 6Thousands, SAAR (average previous 4 years) 7Source: MBA, Quarterly including in-foreclosure (most recent quarter) 8Annual, fiscal 2016 vs. 2020 9Jan 20, 2017 vs Jan 19, 2021 | ||

A Positive Note from Merrill: "A light at the end of the COVID cave"

by Calculated Risk on 1/19/2021 08:56:00 AM

Normally we write about COVID news in the back, but now it deserves front-page coverage; With COVID cases falling and vaccines accelerating, this is probably the beginning of the end of the COVID crisis. Here we argue:

• Renewed restrictions and the end to the holiday season seem to be bending the cases curve.

• The vaccine rollout should continue to accelerate as new resources and effort is put into the project.

• There is one major caveat: new more contagious strains have arrived in the US.

...

What does this mean for the economy? We continue to see upside risks to our above consensus forecast. We think the vulnerable population will be inoculated by March/April, cutting hospitalizations dramatically, and allowing a partial reopening. Michelle Meyer and team have already boosted their GDP forecast for 2021 from 4.6% to 5.0% based on a somewhat earlier and bigger stimulus package. Moreover, like most forecasters they have not incorporated the impact of a second package.

Monday, January 18, 2021

January 18 COVID-19 Test Results

by Calculated Risk on 1/18/2021 06:52:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 2,079,206 test results reported over the last 24 hours.

There were 150,385 positive tests.

Over 53,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

Housing Inventory Weekly Update: Starting the Year at Record Lows

by Calculated Risk on 1/18/2021 11:43:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year, and I'll be using some weekly sources.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.