by Calculated Risk on 1/28/2021 07:24:00 PM

Thursday, January 28, 2021

January 28 COVID-19 Test Results and Vaccinations

The reason I'm posting COVID data is this matters for the economy. From the FOMC statement yesterday:

"The path of the economy will depend significantly on the course of the virus, including progress on vaccinations."It appears the 7-day average cases has peaked. Stay safe! I'm looking forward to not posting this data soon.

"Vaccinations in the U.S. began Dec. 14 with health-care workers, and so far 27.3 million shots have been given, according to a state-by-state tally by Bloomberg and data from the Centers for Disease Control and Prevention. In the last week, an average of 1.26 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

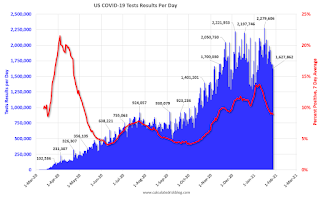

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 2,111,018 test results reported over the last 24 hours.

There were 155,333 positive tests.

Almost 87,000 US deaths have been reported so far in January, surpassing December as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.4% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It seems likely cases and hospitalizations have peaked, but are declining from a very high level.

A few Comments on December New Home Sales

by Calculated Risk on 1/28/2021 03:31:00 PM

New home sales for December were reported at 842,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down slightly, combined.

Annual sales in 2020 were at 811,000, up 18.8% from 683,000 annual sales in 2019, and the best year for new home sales since 2006.

This was at consensus expectations for December, and well above analysts forecasts for 2020. Clearly low mortgages rates, low existing home supply, and favorable demographics (something I wrote about many times over the last decade). A surging stock market have probably helped new home sales too.

Another factor in the strong headline sales rate, over the last the second half of 2020, was the delay in the selling season. Usually the strongest sales are in the March to June time frame, but this year the strongest sales months were later in the year - so the usual seasonal factors boosted sales in late Summer and Fall.

Earlier: New Home Sales increase to 842,000 Annual Rate in December; Sales up 18.8% in 2020.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

The year-over-year comparison will be easy in early 2021 - especially in March, April and May.

And on inventory: note that completed inventory is near record lows, but inventory under construction has been increasing.

Hotels: Occupancy Rate Declined 30.6% Year-over-year

by Calculated Risk on 1/28/2021 12:33:00 PM

U.S. weekly hotel occupancy remained flat from the previous week, according to STR‘s latest data through 23 January.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

17-23 January 2021 (percentage change from comparable week in 2020):

• Occupancy: 40.0% (-30.6%)

• Average daily rate (ADR): US$90.13 (-28.1%)

• Revenue per available room (RevPAR): US$36.07 (-50.1%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Note: Y-axis doesn't start at zero to better show the seasonal change.

A Few Comments on Q4 GDP and Investment; Worst Year Since WWII Drawdown

by Calculated Risk on 1/28/2021 10:51:00 AM

Earlier from the BEA: Gross Domestic Product, 4th Quarter and Year 2020 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 4.0 percent in the fourth quarter of 2020, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 33.4 percent.Real GDP was down 3.5% in 2020 from 2019. This was the worst year since 1946 (WWII drawdown). And other than WWII drawdown, this was the worst year since the Great Depression.

emphasis added

On a Q4-over-Q4 basis, GDP was down 2.5%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q4 2020, and real GDP is currently off 2.5% from the previous peak.

The advance Q4 GDP report, at 4.0% annualized, was close to expectations.

Personal consumption expenditures (PCE) increased at a 2.5% annualized rate in Q4, down from 41.0% increase in Q3.

The second graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern doesn't apply.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased at a 33.5% annual rate in Q4.

Equipment investment increased at a 24.9 annual rate, and investment in

non-residential structures increased at a 3.0% annual rate (after getting crushed over the previous year)..

Residential investment (RI) increased at a 33.5% annual rate in Q4.

Equipment investment increased at a 24.9 annual rate, and investment in

non-residential structures increased at a 3.0% annual rate (after getting crushed over the previous year)..On a 3 quarter trailing average basis, RI (red) is up solidly, equipment (green) is also up solidly, and nonresidential structures (blue) is down sharply.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP increased in Q4.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

New Home Sales increase to 842,000 Annual Rate in December; Sales up 18.8% in 2020

by Calculated Risk on 1/28/2021 10:15:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 842 thousand.

The previous three months were revised down sharply.

Sales of new single-family houses in December 2020 were at a seasonally adjusted annual rate of 842,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.6 percen above the revised November rate of 829,000 and is 15.2 percent above the December 2019 estimate of 731,000.

An estimated 811,000 new homes were sold in 2020. This is 18.8 percent above the 2019 figure of 683,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The last seven months saw the highest sales rates since 2006. This was strong year-over-year growth.

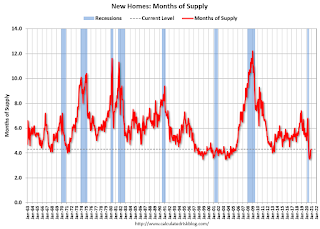

The second graph shows New Home Months of Supply.

The months of supply increased in December to 4.3 months from 4.2 months in November.

The months of supply increased in December to 4.3 months from 4.2 months in November. The all time record high was 12.1 months of supply in January 2009. The all time record low is 3.5 months, most recently in September 2020.

This is at the low end of the normal range (about 4 to 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of December was 302,000. This represents a supply of 4.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is low, and the combined total of completed and under construction is a little lower than normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2020 (red column), 55 thousand new homes were sold (NSA). Last year, 49 thousand homes were sold in December.

The all time high for December was 87 thousand in 2005, and the all time low for December was 23 thousand in 2010.

This was at expectations and sales in the three previous months were revised down slightly, combined. I'll have more later today.

Weekly Initial Unemployment Claims decreased to 847,000

by Calculated Risk on 1/28/2021 08:45:00 AM

The DOL reported:

In the week ending January 23, the advance figure for seasonally adjusted initial claims was 847,000, a decrease of 67,000 from the previous week's revised level. The previous week's level was revised up by 14,000 from 900,000 to 914,000. The 4-week moving average was 868,000, an increase of 16,250 from the previous week's revised average. The previous week's average was revised up by 3,750 from 848,000 to 851,750.This does not include the 426,856 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 447,328 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 868,000.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Regular state continued claims decreased to 4,771,000 (SA) from 4,974,000 (SA) the previous week and will likely stay at a high level until the crisis abates.

Note: There are an additional 7,334,193 receiving Pandemic Unemployment Assistance (PUA) that increased from 5,707,397 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

BEA: Real GDP increased at 4.0% Annualized Rate in Q4

by Calculated Risk on 1/28/2021 08:33:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2020 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 4.0 percent in the fourth quarter of 2020, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 33.4 percent. ...The advance Q4 GDP report, with 4.0% annualized growth, was at expectations.

The increase in real GDP reflected increases in exports, nonresidential fixed investment, personal consumption expenditures (PCE), residential fixed investment, and private inventory investment that were partly offset by decreases in state and local government spending and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

I'll have more later ...

Wednesday, January 27, 2021

Thursday: GDP, New Home Sales, Unemployment Claims

by Calculated Risk on 1/27/2021 09:02:00 PM

On Thursday, from 12:00 - 1:00 (PST), UCI Professor Chris Schwarz returns for the third year to the Irvine Chamber Business Outlook event.

Chris' presentations are great. This is free. Register here

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2020 (Advance estimate). The consensus is that real GDP increased 4.3% annualized in Q4.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for an decrease to 880 thousand from 900 thousand last week.

• At 10:00 AM, New Home Sales for December from the Census Bureau. The consensus is for 860 thousand SAAR, up from 841 thousand in November.

• At 11:00 AM, the Kansas City Fed manufacturing survey for January. This is the last of regional manufacturing surveys for January.

January 27 COVID-19 Test Results and Vaccinations

by Calculated Risk on 1/27/2021 07:39:00 PM

The reason I'm posting COVID data is this matters for the economy. From the FOMC statement today:

"The path of the economy will depend significantly on the course of the virus, including progress on vaccinations."It appears the 7-day average cases has peaked. Stay safe! I'm looking forward to not posting this data soon.

"Vaccinations in the U.S. began Dec. 14 with health-care workers, and so far 25.6 million shots have been given, according to a state-by-state tally by Bloomberg and data from the Centers for Disease Control and Prevention. In the last week, an average of 1.21 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,627,862 test results reported over the last 24 hours.

There were 151,675 positive tests.

Almost 83,000 US deaths have been reported so far in January, surpassing December as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.3% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It seems likely cases and hospitalizations have peaked, but are declining from a very high level.

FOMC Statement: No Change

by Calculated Risk on 1/27/2021 02:44:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic. Weaker demand and earlier declines in oil prices have been holding down consumer price inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus, including progress on vaccinations. The ongoing public health crisis continues to weigh on economic activity, employment, and inflation, and poses considerable risks to the economic outlook.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

emphasis added