by Calculated Risk on 2/05/2021 08:46:00 AM

Friday, February 05, 2021

January Employment Report: 49 Thousand Jobs, 6.3% Unemployment Rate

From the BLS:

The unemployment rate fell by 0.4 percentage point to 6.3 percent in January, while nonfarm payroll employment changed little (+49,000), the U.S. Bureau of Labor Statistics reported today. The labor market continued to reflect the impact of the coronavirus (COVID-19) pandemic and efforts to contain it. In January, notable job gains in professional and business services and in both public and private education were offset by losses in leisure and hospitality, in retail trade, in health care, and in transportation and warehousing.

...

The change in total nonfarm payroll employment for November was revised down by 72,000, from +336,000 to +264,000, and the change for December was revised down by 87,000, from -140,000 to -227,000. With these revisions, employment in November and December combined was 159,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In January, the year-over-year change was negative 9.603 million jobs.

Total payrolls increased by 49 thousand in January. Private payrolls increased by 6 thousand.

Payrolls for November and December were revised down 159 thousand, combined.

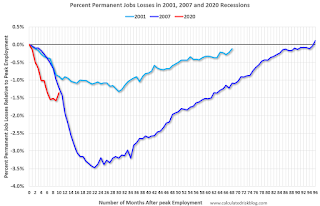

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and is still worse than the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 61.4% in January. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 61.4% in January. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 57.5% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

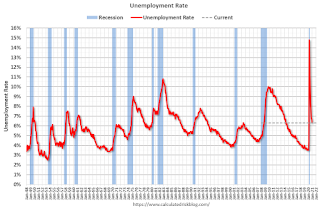

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in January to 6.3%.

This was below consensus expectations, and November and December were revised down by 159,000 combined.

On the annual benchmark revision:

The total nonfarm employment level for March 2020 was revised downward by 250,000 (on a not seasonally adjusted basis, -121,000 or -0.1 percent). Not seasonally adjusted, the absolute average benchmark revision over the past 10 years is 0.2 percent.I'll have much more later ...

The over-the-year change in total nonfarm employment for March 2020 was revised from +808,000 to +577,000 (seasonally adjusted).

Thursday, February 04, 2021

Friday: Employment Report, Trade Deficit

by Calculated Risk on 2/04/2021 09:30:00 PM

My January Employment Preview

Goldman January Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for January. The consensus is for 50 thousand jobs added, and for the unemployment rate to be unchanged at 6.7%. There were 140 thousand jobs lost in December, and the unemployment rate was at 6.7%.

This graph shows the job losses from the start of the employment recession, in percentage terms through November.

The current employment recession was by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

• Also at 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $65.7 billion. The U.S. trade deficit was at $68.1 billion in November.

February 4 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/04/2021 07:09:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will be available soon.

From Bloomberg on vaccinations as of Feb 4th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 32.7 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.34 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 1.5 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,678,444 test results reported over the last 24 hours.

There were 123,907 positive tests.

Almost 14,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

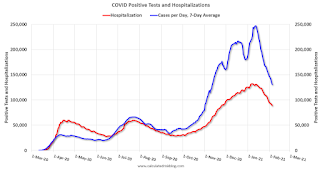

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 7.4%. The percent positive is calculated by dividing positive results by total tests (including pending).

It seems likely cases and hospitalizations have peaked, but are declining from a very high level.

Goldman January Payrolls Preview

by Calculated Risk on 2/04/2021 03:41:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 200k ... We also expect fewer seasonal layoffs of retail, leisure, and temp help workers, due to already-depressed employment levels in those industries ... We estimate an unchanged unemployment rate at 6.7%.CR Note: The consensus is for 50 thousand jobs added, and for the unemployment rate to be unchanged at 6.7%.

emphasis added

Hotels: Occupancy Rate Declined 29.6% Year-over-year

by Calculated Risk on 2/04/2021 01:06:00 PM

U.S. weekly hotel occupancy remained relatively flat from the previous week, according to STR‘s latest data through Jan. 30.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Jan. 24-30, 2021 [percentage change from comparable week in 2020]:

• Occupancy: 40.4% [-29.6%]

• Average daily rate [ADR]: US$89.62 [-29.8%]

• Revenue per available room [RevPAR]: US$36.23 [-50.6%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Note: Y-axis doesn't start at zero to better show the seasonal change.

January Employment Preview

by Calculated Risk on 2/04/2021 11:08:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for 50 thousand jobs added, and for the unemployment rate to be unchanged at 6.7%.

• ADP Report: The ADP employment report showed a gain of 174,000 private sector jobs, well above the consensus estimate of 45 thousand jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be stronger than expected.

• ISM Surveys: The ISM manufacturing employment index increased in January to 52.6%, up from 51.7% last month. This would suggest essentially approximately 5,000 manufacturing jobs lost in January. ADP showed 1,000 manufacturing jobs added.

The ISM Services employment index increased in January to 55.2%, from 48.7% in December. This would suggest around 215,000 service jobs added in January. Combined, the ISM surveys suggest around 210,000 private sector jobs added in January. The ISM surveys haven't been as useful as usual during the pandemic, but this does suggest the report could be stronger than expected.

• Unemployment Claims: The weekly claims report showed a high number of total continuing unemployment claims during the reference week, although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession! In general, weekly claims have been lower than expected, and this suggests the employment report could be stronger than expected.

• Weather: Weather is a wildcard every year during the winter. A mild winter can lead to a stronger jobs report, and it appears January 2021 was mild, suggesting a stronger than expected jobs report. After the report is released, the SF Fed will update their Weather-Adjusted Employment Change

• Seasonal Factor: The pandemic has caused problems with the seasonal factor, and the January report might be impacted significantly. Every January, the economy loses about 2.9 million jobs (NSA), and the seasonal factor accounts for those expected job losses. However, it seems likely that fewer jobs were lost (NSA) this January, and that would boost the headline number (seasonally adjusted). This is something to watch.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been increasing, but declined in December.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been increasing, but declined in December.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. In December, the number of permanent job losers decreased to 3.370 million from 3.718 million in November. This is good news.

• Conclusion: Most of the indicators suggest a stronger report in January. My guess is the report will be higher than the consensus.

Weekly Initial Unemployment Claims decreased to 779,000

by Calculated Risk on 2/04/2021 08:40:00 AM

The DOL reported:

In the week ending January 30, the advance figure for seasonally adjusted initial claims was 779,000, a decrease of 33,000 from the previous week's revised level. The previous week's level was revised down by 35,000 from 847,000 to 812,000. The 4-week moving average was 848,250, a decrease of 1,250 from the previous week's revised average. The previous week's average was revised down by 18,500 from 868,000 to 849,500.This does not include the 348,912 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 403,590 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 848,250.

The previous week was revised down.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Regular state continued claims decreased to 5,188,141 (SA) from 5,446,993 (SA) the previous week and will likely stay at a high level until the crisis abates.

Note: There are an additional 7,217,713 receiving Pandemic Unemployment Assistance (PUA) that decreased from 7,343,682 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, February 03, 2021

February 3 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/03/2021 06:36:00 PM

From Bloomberg on vaccinations as of Feb 3rd.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 32.7 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.34 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 1.5 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,442,998 test results reported over the last 24 hours.

There were 116,960 positive tests.

Almost 9,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 8.1%. The percent positive is calculated by dividing positive results by total tests (including pending).

It seems likely cases and hospitalizations have peaked, but are declining from a very high level.

The Changing Mix of Light Vehicle Sales

by Calculated Risk on 2/03/2021 03:42:00 PM

The bounce back in gasoline prices made me take another look at the mix of vehicles being sold.

This graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through January 2021.

Over time the mix has changed more and more towards light trucks and SUVs.

Only when oil prices are high, does the trend slow or reverse.

The percent of light trucks and SUVs was at 77.7% in January 2021.

January Vehicles Sales increased to 16.63 Million SAAR

by Calculated Risk on 2/03/2021 11:48:00 AM

The BEA released their estimate of light vehicle sales for January this morning. The BEA estimates sales of 16.63 million SAAR in January 2021 (Seasonally Adjusted Annual Rate), up 2.5% from the December sales rate, and down 1.5% from January 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for January (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased, but are still down year-over-year,

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 16.63 million SAAR.

Note: dashed line is current estimated sales rate of 16.63 million SAAR.