by Calculated Risk on 2/07/2021 06:49:00 PM

Sunday, February 07, 2021

February 7 COVID-19 Test Results and Vaccinations

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 7th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 42 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.46 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,480,757 test results reported over the last 24 hours.

There were 96,003 positive tests. The first day with under 100,000 cases since November 2nd.

Almost 22,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

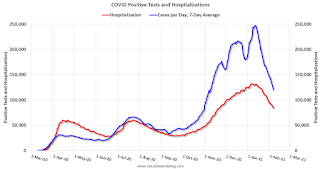

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 6.5%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are declining from a very high level.

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 2/07/2021 10:14:00 AM

Note: I usually post this monthly, but I hesitated recently due to the COVID-19 pandemic. But I've received a number of requests lately - the recent numbers are ugly.

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

The first graph is for private employment only.

Trump is in Orange.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 824,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 387,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,511,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), and 11,828,000 under President Obama (dark blue).

During Trump's term, the economy lost 2,181,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 271,000 jobs).

During Trump's term, the economy lost 800,000 public sector jobs.

Saturday, February 06, 2021

February 6 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/06/2021 06:33:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 6th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 40.5 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.43 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,847,899 test results reported over the last 24 hours.

There were 113,927 positive tests.

Over 20,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 6.2%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are declining from a very high level.

Q1 GDP Forecasts

by Calculated Risk on 2/06/2021 11:40:00 AM

Some forecasters have increased their 2021 forecasts significantly, and see possible further upside. However, there is ongoing concern about the pandemic, and the impact of the COVID variants.

From Merrrill Lynch:

2021 is poised for a robust rebound in real activity, with growth likely to reach 6.0%. Strong fiscal support and a successful vaccine rollout will provide a spark particularly in 2Q and 3Q. [Q1 GDP of 4.0%] [Feb 5 estimate] emphasis addedFrom Goldman Sachs:

We left our Q1 GDP tracking estimate unchanged at +5.0%. [Feb 5 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 6.8% for 2021:Q1. [Feb 5 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 4.6 percent on February 5, down from 6.0 percent on February 1 [Feb 5 estimate]

Schedule for Week of February 7, 2021

by Calculated Risk on 2/06/2021 08:11:00 AM

The key report this week is January CPI.

Fed Chair Jerome Powell speaks on Wednesday on the "State of the U.S. Labor Market"

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for January.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in November to 6.527 million from 6.632 million in October.

The number of job openings (yellow) were down 3.9% year-over-year, and Quits were down 10.5% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.4% increase in CPI, and a 0.2% increase in core CPI.

2:00 PM: Speech, Fed Chair Jerome Powell, State of the U.S. Labor Market, At the Economic Club of New York Webinar

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 760 thousand from 779 thousand last week.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 80.5.

Friday, February 05, 2021

February 5 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/05/2021 07:38:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 5th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 38.5 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.36 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 1.5 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,879,114 test results reported over the last 24 hours.

There were 131,146 positive tests.

Over 17,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 7.0%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are declining from a very high level.

AAR: January Rail Carloads down 2.1% YoY, Intermodal Up 12.1% YoY

by Calculated Risk on 2/05/2021 02:45:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail volumes in January 2021 weren’t exemplary, but they were encouraging. Total carloads averaged 232,576 per week in January, the highest weekly average for any month in a year. Ten out of 20 carload categories had higher volumes in January 2021 than in January 2020. In January 2021, U.S. intermodal volume and carloads of chemicals were both higher than ever before (on a weekly average basis); carloads of grain were higher than in any month since October 2007 and the eleventh most for any month on record; and carloads for several other major carload categories, including primary metal products, lumber, paper, and iron and steel scrap, were higher than they’ve been since the pandemic began. Total carloads excluding coal were up 2.3% in January 2021 over January 2020, their second yearover-year increase in a row following 22 straight year-over-year monthly declines.

emphasis added

Click on graph for larger image.

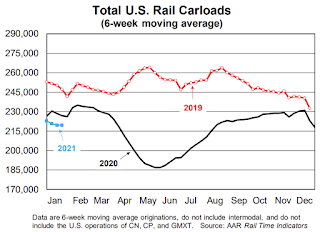

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

U.S. railroads originated 930,303 total carloads in January 2021, down 2.1% (19,799 carloads) from January 2020. January 2021 was the 24th consecutive month with a year-over-year decline for total carloads, but 2.1% is the smallest percentage decline in 21 months.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. railroads originated 1.17 million intermodal containers and trailers in January 2021, an average of 293,305 per week — a new all-time record and up 12.1% (126,548 units) over January 2020.Note that rail traffic was weak prior to the pandemic, however intermodal has come back strong.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 2/05/2021 01:21:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of February 2nd.

From Black Knight: End of January Sees Reduction Of 45k Forbearance Plans, But Overall Recovery Remains Stalled

New data from our McDash Flash Forbearance Tracker shows that the end of the month brought about an expected reduction of 45,000 (-1.6%) active forbearance plans, driven by month-end expirations. Servicers still have an additional 47,000 plans with Jan. 31 expiration dates on their books, which opens up the potential for additional modest declines in volumes over the next few days as these plans are reviewed for extension/removal.The number of loans in forbearance has moved mostly sideways for the last few months.

...

As of Feb. 2, there are now 2.72 million homeowners in active COVID-19-related forbearance plans. This is 5.1% of all U.S. mortgage-holders. While this is the lowest such volume of forbearances seen since late April, volumes have been stuck in the 2.72-2.81 million range since early November. As we move toward the middle of February, it will be worth focusing on the trend of mid-and late month increases in active forbearance plans.

Click on graph for larger image.

Looking ahead to February’s month-end, some 390,000 plans are set to expire, representing one (and potentially the last) moderate opportunity for improvement in forbearance volumes before the first wave of plans is set to reach their 12-month expiration at the end of March. At Black Knight, we will be especially interested in what the next couple months bring as far as forbearance-related recovery and will continue to closely monitor the data.

emphasis added

Trade Deficit Decreased to $66.6 Billion in December

by Calculated Risk on 2/05/2021 10:50:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $66.6 billion in December, down $2.4 billion from $69.0 billion in November, revised.

December exports were $190.0 billion, $6.2 billion more than November exports. December imports were $256.6 billion, $3.8 billion more than November imports.

...

For 2020, the goods and services deficit increased $101.9 billion, or 17.7 percent, from 2019. Exports decreased $396.4 billion or 15.7 percent. Imports decreased $294.5 billion or 9.5 percent. emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in December.

Exports are down 10.2% compared to December 2019; imports are unchanged compared to December 2019.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports much more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $38.30 per barrel in December, up from $35.68 per barrel in November, and down from 51.48 in December 2019.

The trade deficit with China increased to $27.2 billion in December, from $24.83 billion in December 2019.

Comments on January Employment Report

by Calculated Risk on 2/05/2021 09:26:00 AM

The headline jobs number in the January employment report was below expectations, and employment for the previous two months was revised down significantly. In addition, the annual benchmark revision showed 250 thousand fewer jobs in March 2020 than previously reported.

Earlier: January Employment Report: 49 Thousand Jobs, 6.3% Unemployment Rate

In January, the year-over-year employment change was minus 9.603 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report. (ht Joe Weisenthal at Bloomberg)

This data is only available back to 1994, so there is only data for three recessions.

In January, the number of permanent job losers increased to 3.503 million from 3.370 million in December.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased in January to 81.1% from 81.0% in December, and the 25 to 54 employment population ratio increased to 76.4% from 76.3% in December.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 6.0 million, changed little in January. This measure is 1.6 million higher than the February level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in January to 5.954 million from 6.170 million in December.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.1% in December. This is down from the record high in April 22.9% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.023 million workers who have been unemployed for more than 26 weeks and still want a job.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was below expectations, and the previous two months were revised down 159,000 combined. The headline unemployment rate was declined to 6.3%.