by Calculated Risk on 2/09/2021 10:08:00 AM

Tuesday, February 09, 2021

BLS: Job Openings "Little Changed" at 6.6 Million in December

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.6 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Hires decreased to 5.5 million while total separations were little changed at 5.5 million. Within separations, the quits rate and layoffs and discharges rate were little changed at 2.3 percent and 1.3 percent, respectively.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December, the most recent employment report was for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in December to 6.646 million from 6.572 million in November.

The number of job openings (yellow) were up 1.4% year-over-year. Note that job openings were declining a year ago prior to the pandemic.

Quits were down 6.9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Small Business Optimism Decreased in January

by Calculated Risk on 2/09/2021 08:38:00 AM

Most of this survey is noise, but sometimes there is some information.

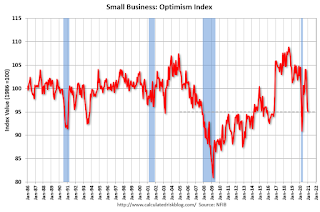

From the National Federation of Independent Business (NFIB): January [2021] Report

The NFIB Small Business Optimism Index declined in January to 95.0, down 0.9 from December and three points below the 47-year average of 98. ... “As Congress debates another stimulus package, small employers welcome any additional relief that will provide a powerful fiscal boost as their expectations for the future are uncertain,” said NFIB Chief Economist Bill Dunkelberg. “The COVID-19 pandemic continues to dictate how small businesses operate and owners are worried about future business conditions and sales.”

...

NFIB’s monthly jobs report showed job growth continued in January. Firms increased employment by 0.36 workers per firm on average over the past few months, up from 0.30 in December, a strong 2-month performance. However, the hiring remains uneven geographically and by industry.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index declined in January.

Monday, February 08, 2021

Tuesday: Job Openings

by Calculated Risk on 2/08/2021 09:11:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS.

February 8 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/08/2021 07:13:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 8th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 43.1 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.47 million doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,434,298 test results reported over the last 24 hours.

There were 77,737 positive tests. This is the fewest daily positive cases since October.

Over 23,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.4%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are declining from a very high level.

MBA Survey: "Share of Mortgage Loans in Forbearance Declines to 5.35%"

by Calculated Risk on 2/08/2021 04:00:00 PM

Note: This is as of January 31st.

From the MBA: Share of Mortgage Loans in Forbearance Declines to 5.35%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 3 basis points from 5.38% of servicers’ portfolio volume in the prior week to 5.35% as of January 31, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“The share of loans in forbearance decreased at the end of January across all investor categories. Almost 14 percent of homeowners in forbearance were reported as current on their payments at the end of last month, but the share has declined nearly every month from 28 percent in May,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While new forbearance requests increased slightly at the end of January, the rate of exits picked up somewhat but remained much lower than in recent months. We are anticipating a sharp increase in exits in March and April as borrowers hit the 12-month expiration of their forbearance plans.”

Fratantoni added, “The job market rebounded slightly in January following a decline in December, but there are still 6.5 percent fewer jobs in the U.S. economy compared to February 2020. The proportion of long-term unemployed also remains troubling, with 4 million people who have been actively looking for work for 27 weeks or more. These are the homeowners who are likely to still be in forbearance and need additional support until the job market recovers to a greater extent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, then trended down - and has mostly moved sideways recently.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.06% to 0.07%."

Housing Inventory Weekly Update: At Record Lows

by Calculated Risk on 2/08/2021 02:15:00 PM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year, and I'll be using some weekly sources.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Northwest Real Estate in January: Sales up 16% YoY, Inventory down 43% YoY

by Calculated Risk on 2/08/2021 12:24:00 PM

Note: Inventory is down sharply in the Northwest almost everywhere except Seattle. And inventory is low in Seattle too, but was even lower a year ago.

The Northwest Multiple Listing Service reported Pandemic presents new option for home buyers

as market “kept foot firmly on the accelerator”

Some brokers are reporting up to 40 private showings for a single listing, according to Scott. “To compete in today’s ultra-competitive market, we’re seeing some buyers front-loading their offer above the list price,” he reported, explaining, “This is done in an attempt to ‘stop the action’ and push the sellers to accept their offer before the set review date.”The press release is for the Northwest MLS area. There were 5,896 closed sales in January 2021, up 16.2% from 5,074 sales in January 2020. Inventory for the Northwest is down 43%.

“The ongoing combination of very low mortgage rates and escalating prices has both buyers and sellers taking advantage of the market. Buyers are finding well-priced homes in good condition, and sellers are seeing many multiple offer situations,” reported Dean Rebhuhn, broker-owner at Village Homes and Properties. Lower prices near I-5 locations in Lewis, Cowlitz, and Thurston counties continue to attract buyers, observed Rebhuhn, who credited job opportunities and desirable lifestyles as market drivers.

James Young, director of the Washington Center for Real Estate Research at the University of Washington, said the search for value in outer areas has continued unabated, despite further lockdowns in January. “It is difficult to think of the last time when nearly every Western Washington county with the exception of Clallam, King and Jefferson had double-digit percentage price growth,” he remarked. This year’s “extraordinarily low inventory” (down 43% overall) suggests continued price growth into the spring as demand remains high and interest rates remain low, according to Young.

“It is somewhat of a ‘prisoner’s dilemma’ for the housing market in Western Washington,” Young commented. “Those who own do not want to sell because there is little inventory to buy. They will stay put. Those who want to buy (and get on the housing ladder) cannot get into the market because there is little available for sale.”

emphasis added

In King County, sales were up 20.5% year-over-year, and active inventory was down 12% year-over-year.

In Seattle, sales were up 28.7% year-over-year, and inventory was UP 47% year-over-year. (inventory in Seattle was extremely low last year). This puts the months-of-supply in Seattle at just 1.6 months.

Las Vegas Real Estate in January: Sales up 13% YoY, Inventory down 50% YoY

by Calculated Risk on 2/08/2021 10:41:00 AM

This report is for closed sales in January; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in November and December.

The Las Vegas Realtors reported Southern Nevada housing market starts year with prices still rising, supply shrinking; LVR housing statistics for January 2021

LVR reported a total of 3,262 existing local homes, condos and townhomes were sold during January. Compared to the same time last year, January sales were up 15.5% for homes and up 5.4% for condos and townhomes.1) Overall sales were up 13.4% year-over-year to 3,262 in January 2021 from 2,875 in January 2020.

According to LVR, the total number of existing local homes, condos, townhomes and other residential properties sold in Southern Nevada during 2020 was 41,617. That’s up from 41,269 total sales in 2019. By comparison, LVR reported 42,876 total sales in 2018 and 45,388 in 2017.

…

By the end of January, LVR reported 2,315 single-family homes listed for sale without any sort of offer. That’s down 52.8% from one year ago. For condos and townhomes, the 847 properties listed without offers in January represent a 40.3% drop from one year ago.

...

Despite the coronavirus crisis and economic downturn, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 1.2% of all existing local property sales in January. That compares to 2.7% of all sales one year ago, 2.8% two years ago, 4.3% three years ago and 11% four years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 6,324 in January 2020 to 3,162 in January 2021. Note: Total inventory was down 50% year-over-year. And months of inventory is low.

3) Low level of distressed sales.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 2/08/2021 08:45:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

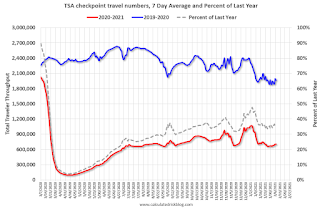

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019-2020 (Blue) and 2020-2021 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of February 7th.

The seven day average is down 64.0% from last year (36.0% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - but TSA data has mostly moved sideways.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through February 7, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays. Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York. Note that California dining picked up now after the orders to close was lifted.

This data shows domestic box office for each week (red) and the maximum and minimum for the years 2016 through 2019. Blue is 2020 and Red is 2021.

This data shows domestic box office for each week (red) and the maximum and minimum for the years 2016 through 2019. Blue is 2020 and Red is 2021. Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $13 million last week (compared to usually around $150 million per week at this time of year).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

This data is through January 30th. Hotel occupancy is currently down 29.6% year-over-year. Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

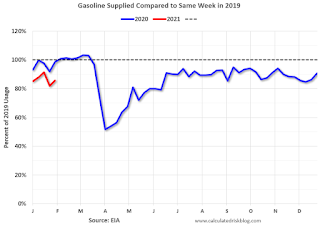

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. At one point, gasoline supplied was off almost 50% YoY. Red is for 2021.

As of January 29th, gasoline supplied was off about 14.4% (about 85.6% of the same week in 2019).

Note: People driving instead of flying might have boosted gasoline consumption.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through February 6th for the United States and several selected cities.

This data is through February 6th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 47% of the January 2020 level. It is at 39% in Chicago, and 53% in Houston - and mostly moving sideways, and moving up a little recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data since early 2020.

This graph is from Todd W Schneider. This is daily data since early 2020.This data is through Friday, February 5th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, February 07, 2021

Sunday Night Futures

by Calculated Risk on 2/07/2021 08:51:00 PM

Weekend:

• Schedule for Week of February 7, 2021

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 12 and DOW futures are up 75 (fair value).

Oil prices were up over the last week with WTI futures at $57.36 per barrel and Brent at $59.85 barrel. A year ago, WTI was at $52, and Brent was at $58 - so WTI oil prices are UP about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.46 per gallon. A year ago prices were at $2.43 per gallon, so gasoline prices are up $0.03 per gallon year-over-year.