by Calculated Risk on 2/10/2021 04:13:00 PM

Wednesday, February 10, 2021

Cleveland Fed: Key Measures Show Inflation Soft in January

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% January. The 16% trimmed-mean Consumer Price Index rose 0.1% in December. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for January here. Motor fuel was up 135% annualized in January.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 1.4%. Core PCE is for December and increased 1.4% year-over-year.

Overall inflation will not be a concern during the crisis.

Important Note: We will likely see some year-over-year jumps in some measures of inflation, since we saw some deflation in 2020. For example, we saw negative Month-to-month (MoM) core CPI and CPI readings in March, April and May 2020. Assuming positive readings in those months in 2021, the YoY change in CPI and core CPI will jump.

Fed Chair Powell: Corrected Unemployment Rate Close to 10% in January

by Calculated Risk on 2/10/2021 02:19:00 PM

From Fed Chair Powell: Getting Back to a Strong Labor Market Excerpt:

Employment in January of this year was nearly 10 million below its February 2020 level, a greater shortfall than the worst of the Great Recession's aftermath.

After rising to 14.8 percent in April of last year, the published unemployment rate has fallen relatively swiftly, reaching 6.3 percent in January. But published unemployment rates during COVID have dramatically understated the deterioration in the labor market. Most importantly, the pandemic has led to the largest 12-month decline in labor force participation since at least 1948. Fear of the virus and the disappearance of employment opportunities in the sectors most affected by it, such as restaurants, hotels, and entertainment venues, have led many to withdraw from the workforce. At the same time, virtual schooling has forced many parents to leave the work force to provide all-day care for their children. All told, nearly 5 million people say the pandemic prevented them from looking for work in January. In addition, the Bureau of Labor Statistics reports that many unemployed individuals have been misclassified as employed. Correcting this misclassification and counting those who have left the labor force since last February as unemployed would boost the unemployment rate to close to 10 percent in January.

Click on graph for larger image.

Click on graph for larger image. This graph from the Fed shows the actuall unemployment rate and some alternative estimates (mostly due to people leaving the labor force).

Las Vegas Visitor Authority: No Convention Attendance, Visitor Traffic Down 64% YoY in December

by Calculated Risk on 2/10/2021 12:23:00 PM

From the Las Vegas Visitor Authority: December 2020 Las Vegas Visitor Statistics

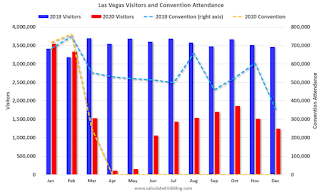

With resumption of broader COVID-related restrictions across the country and the absence of traditional seasonal special events such as NFR, Las Vegas visitation came in at approximately 1.2M in December, down - 17.6% MoM and -64.0% YoY.Here is the data from the Las Vegas Convention and Visitors Authority.

With the combined impacts of the pandemic in the course of the year, Las Vegas hosted just over 19M visitors in 2020, down -55% from 2019.

Total occupancy dropped to 30.9% from 39.3% in Nov and 85.1% during last year's robust December. Weekend occupancy for the month came in at 45.4% and midweek occupancy was 25%.Mbr .

Average daily rates among open properties reached $100 (up 6.5% from Nov but down -20% YoY) while RevPAR came in at approx. $31, down -71% vs. Dec 2019.

Click on graph for larger image.

Click on graph for larger image. The blue and red bars are monthly visitor traffic (left scale) for 2019 and 2020. The dashed blue and orange lines are convention attendance (right scale).

Convention traffic in December was down 100% compared to December 2019.

And visitor traffic was down 64% YoY.

The casinos started to reopen on June 4th (it appears about 96% of rooms have now opened).

BLS: CPI increased 0.3% in January, Core CPI Unchanged

by Calculated Risk on 2/10/2021 08:35:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.4 percent before seasonal adjustment.Inflation was below expectations in January. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The gasoline index continued to increase, rising 7.4 percent in January and accounting for most of the seasonally adjusted increase in the all items index. Although the indexes for electricity and natural gas declined, the energy index rose 3.5 percent over the month. The food index rose slightly in January, increasing 0.1 percent as an advance in the index for food away from home more than offset a decline in the index for food at home.

The index for all items less food and energy was unchanged in January. The indexes for apparel, medical care, shelter, and motor vehicle insurance all increased over the month. The indexes for recreation, used cars and trucks, airline fares, and new vehicles all declined in January.

The all items index rose 1.4 percent for the 12 months ending January, the same increase as for the period ending in December. The index for all items less food and energy also rose 1.4 percent over the last 12 months, a smaller increase than the 1.6-percent rise for the 12 months ending December.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/10/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 5, 2021.

... The Refinance Index decreased 4 percent from the previous week and was 46 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 17 percent higher than the same week one year ago.

“Mortgage rates have increased in four of the first six weeks of 2021, with jumbo rates being the only loan type that saw a decline last week. Despite some weekly volatility, Treasury rates have been driven higher by expectations of faster economic growth as the COVID-19 vaccine rollout continues,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With the 30-year fixed rate increasing to 2.96 percent – a high not seen since last November – refinances declined, and their share of total applications dipped to the lowest level in three months. Government refinance applications did buck the trend and increase, and overall activity was still 46 percent higher than a year ago. Demand for refinances is still very strong this winter.”

Added Kan, “Purchase applications cooled the first week of February, but homebuyers are still very active. Purchase activity was 17 percent higher than last year, and the average purchase loan size continued to increase, reaching another survey high of $402,200, as the higher-priced segment of the market continues to perform well.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 2.96 percent from 2.92 percent, with points increasing to 0.36 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been volatile recently depending on rates.

With near record low rates, the index remains up significantly from last year (but will be down year-over-year in early March - since rates fell sharply at the beginning of the pandemic).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 17% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, February 09, 2021

Wednesday: CPI, Fed Chair Powell Speaks

by Calculated Risk on 2/09/2021 09:26:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Roughly Unchanged From Last Week

Mortgage rates have been extremely stable given their proximity to all-time lows. Past precedent suggests one of two things when rates set records: a slow grind lower with additional periodic records or a rather abrupt bounce back in the other direction.Wednesday:

The 2nd half of 2020 was definitely characterized by the aforementioned slow grind with at least 20 separate days resulting in record low rates by December 21st. Since then, rates have gone no lower, but apart from a brief stint in early January, they really haven't gone appreciably higher either. This is made all the more impressive by the fact that the broader bond market is indeed telling mortgage rates to rise. Specifically, 10yr Treasury yields--a perennial travel companion for 30yr fixed mortgage rates--have been rising consistently since August 2020.

Mortgage rates were largely immune to that Treasury trend due to volatility at the beginning of the pandemic. Mortgage rates simply weren't able to drop as quickly as Treasury yields and have been closing the gap ever since. [30 year fixed 2.83%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for 0.4% increase in CPI, and a 0.2% increase in core CPI.

• At 2:00 PM, Speech, Fed Chair Jerome Powell, State of the U.S. Labor Market, At the Economic Club of New York Webinar

February 9 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/09/2021 07:22:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 9th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 44.4 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.53 million doses per day were administered."Here is the CDC COVID Data Tracker. This has data on vaccinations, cases and more.

The US is now averaging close to 2.0 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,611,368 test results reported over the last 24 hours.

There were 92,986 positive tests.

Over 26,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.8%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are declining from a very high level.

Denver Real Estate in January: Sales Down 10% YoY, Active Inventory Down 53%

by Calculated Risk on 2/09/2021 01:52:00 PM

From the DMAR: Monthly Indicators, January 2021

In January, the Greater Denver Metro housing market again broke an all-time record, a new inventory low with only 2,316 total properties on the market, translating into an inventory shortage and opportunity for appreciation to accelerate.The number of residential units sold in January (attached and detached) decreased to 3,015, down 10.3% from 3,361 in January 2020.

Single-family detached properties hit a record average price of $629,159, while attached properties hit a record of $397,792. Single-family home sellers saw a 101.03 percent close-to-list-price in January and a drop to five days in the MLS, down from six last month and 24 days last year. ...

“Interestingly enough, just because at the end of the month there are not many houses to choose from did not affect the amount of properties going under contract,” said Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “There were 4,459 pending properties in January, which is only a 1.09 percent decrease from last year at this time, and 2020 as a whole sang a similar note. There were more homes purchased throughout all of last year than any previous year, but at the end of every month towards the end of the year, there was not much inventory meaning the attrition rate was high.”

Active listings were at 2,316, down 53.1 from 4,941 in January 2020. This is a record low.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased 1.9% YoY in Early February

by Calculated Risk on 2/09/2021 12:04:00 PM

he National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 79.2 percent of apartment households made a full or partial rent payment by February 6 in its survey of 11.6 million units of professionally managed apartment units across the country.

This is a 1.9 percentage point, or 216,479 household decrease from the share who paid rent through February 6, 2020 and compares to 76.6 percent that had paid by January 6, 2021. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

"As we approach almost a full year of navigating the pandemic and the resulting financial distress, we remain encouraged by the COVID relief package passed at the end of 2020 that included critical support for apartment residents and the nation's rental housing industry such as $25 billion in rental assistance, extended unemployment benefits and direct payments," said Doug Bibby, NMHC President.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month compared to the same month the prior year.

This is mostly for large, professionally managed properties.

The second graph shows full month payments through January compared to the same month the prior year.

This shows a decline in rent payments year-over-year, and somewhat more of a decline over the last several months.

This shows a decline in rent payments year-over-year, and somewhat more of a decline over the last several months.BLS: Job Openings "Little Changed" at 6.6 Million in December

by Calculated Risk on 2/09/2021 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.6 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Hires decreased to 5.5 million while total separations were little changed at 5.5 million. Within separations, the quits rate and layoffs and discharges rate were little changed at 2.3 percent and 1.3 percent, respectively.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December, the most recent employment report was for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in December to 6.646 million from 6.572 million in November.

The number of job openings (yellow) were up 1.4% year-over-year. Note that job openings were declining a year ago prior to the pandemic.

Quits were down 6.9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").