by Calculated Risk on 2/19/2021 07:12:00 PM

Friday, February 19, 2021

February 19 COVID-19 Test Results and Vaccinations; Hospitalizations Decline to Summer Peak

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Feb 18th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 59.1 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.58 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.4 million tests per day over the last week. The percent positive over the last 7 days was 4.8%.

There were 1,878,276 test results reported over the last 24 hours.

There were 74,676 positive tests.

Almost 54,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

CAR on California January Housing: Sales up 23% YoY, Active Listings down 53% YoY

by Calculated Risk on 2/19/2021 02:08:00 PM

The CAR reported: California housing market momentum continues into new year, C.A.R. reports

California’s housing market kicked off the year on a positive note, following up on December’s strong showing with double-digit price and sales growth on a yearly basis in January, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in November and December.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 484,730 in January, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the January pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

January home sales decreased 4.9 percent from 509,750 in December and were up 22.5 percent from a year ago, when 395,700 homes were sold on an annualized basis. The year-over-year, double-digit sales gain was the sixth consecutive and the third straight month that sales increased more than 20 percent from a year ago.

...

“Despite an economy that’s slow to recover, the momentum from late last year continued into January, driven by strong growth in California’s core housing markets, especially in the San Francisco Bay Area, where the higher cost areas experienced the most sales growth,” said C.A.R. President Dave Walsh, vice president and manager of the Compass San Jose office. “Home prices continued to power through the traditional slow season in January with the largest annual price gain in nearly seven years.”

...

Homeowners reluctant to list their homes for sale during the pandemic is contributing to a shortage of active listings. As a result, C.A.R.’s Unsold Inventory Index (UII) remains extremely low at 1.5 months in January and was down sharply from 3.4 months in January 2020. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

Active listings fell 53.4 percent from last year and continued to drop more than 40 percent on a year-over-year basis for the eighth straight month. On a month-to-month basis, for-sale properties dropped 10.7 percent in January.

emphasis added

Q1 GDP Forecasts: Movin' on up

by Calculated Risk on 2/19/2021 12:28:00 PM

From Merrrill Lynch:

Retail sales boosted our 1Q21 GDP tracking estimate by 1.5pp to 5.5% qoq saar. [Feb 19 estimate] emphasis addedFrom Goldman Sachs:

We boosted our Q1 GDP tracking estimate by 1pp to +6.0% (qoq ar). [Feb 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 8.3% for 2021:Q1. [Feb 19 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 9.5 percent on February 18 [Feb 18 estimate]

Comments on January Existing Home Sales

by Calculated Risk on 2/19/2021 10:42:00 AM

Earlier: NAR: Existing-Home Sales Increased to 6.69 million in January

A few key points:

1) This was the highest sales rate for January since 2005, and the 2nd highest sales for January on record. Some of the increase over the last seven months was probably related to pent up demand from the shutdowns in March and April. Other reasons include record low mortgage rates, a move away from multi-family rentals, strong second home buying (to escape the high-density cities), a strong stock market and favorable demographics.

2) Inventory is very low, and was down 25.7% year-over-year (YoY) in January. Also, as housing economist Tom Lawler has noted, the local MLS data shows even a larger decline in active inventory (the NAR appears to include some pending sales in inventory). Lawler noted:

"As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months."Months-of-supply is at a record low. Inventory will be important to watch in 2021, see: Some thoughts on Housing Inventory

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales by month for 2020 and 2021.

The year-over-year comparisons will be easy in the first half of 2021 - especially in April, May and June - and then difficult in the second half of the year.

Sales NSA in January (367,000) were 15.8% above sales last year in January (317,000). This was the highest sales for January (NSA) since 2006.

NAR: Existing-Home Sales Increased to 6.69 million in January

by Calculated Risk on 2/19/2021 10:18:00 AM

From the NAR: Existing-Home Sales Tick Up 0.6% in January

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 0.6% from December to a seasonally-adjusted annual rate of 6.69 million in January. Sales in total climbed year-over-year, up 23.7% from a year ago (5.41 million in January 2020).Note: December was revised down from 6.76 million to 6.65 million SAAR.

Total housing inventory at the end of January amounted to 1.04 million units, down 1.9% from December and down 25.7% from one year ago (1.40 million). Unsold inventory sits at a 1.9-month supply at the current sales pace, equal to December's supply and down from the 3.1-month amount recorded in January 2020. NAR first began tracking the single-family home supply in 1982.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (6.69 million SAAR) were up 0.6% from last month, and were 23.7% above the January 2020 sales rate.

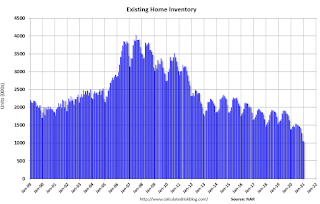

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.04 million in January from 1.06 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.04 million in January from 1.06 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 25.7% year-over-year in January compared to January 2020.

Inventory was down 25.7% year-over-year in January compared to January 2020. Months of supply was unchanged at 1.9 months in January (tied for all time low).

This was above the consensus forecast. I'll have more later.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 2/19/2021 08:21:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of February 16th.

From Black Knight: Slow and Steady Improvement in Forbearances Continues, Despite Weekly Increase

As expected, the trend of mid-month forbearance increases continued this week. New data from our McDash Flash Forbearance Tracker shows that the number of active forbearance plans increased by 15,000 (0.6%), with portfolio-held and privately securitized mortgages accounting for the largest weekly increase at 12,000 (1.8%). FHA/VA forbearances saw an increase of 5,000 (0.4%), while the GSEs experienced some small improvement – they saw a decrease of 2,000 forbearance plans (-0.2%) this week.The number of loans in forbearance has declined slightly over the last few months.

Despite the weekly increases, the overall monthly rate of decline held steady at -2% month-over-month. This continues the trend of very slow but consistent improvement in the number of outstanding forbearance cases.

As of Feb. 16, 2.69 million (5.1% of) U.S. homeowners remain in forbearance. This is made up of 9.2% of FHA/VA mortgages, 3.2% of GSE mortgages and 5.1% of portfolio/privately securitized mortgages.

Click on graph for larger image.

New plan starts hit a post-pandemic low this week, while just one of every 77 homeowners who entered the week in forbearance left their plans, one of the lowest removal rates seen yet.

Some 204,000 forbearance plans are scheduled to scheduled term expirations at the end of February, suggesting that any decline in forbearance volumes in the coming weeks is likely to be limited.

emphasis added

Thursday, February 18, 2021

Friday: Existing Home Sales

by Calculated Risk on 2/18/2021 09:21:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 6.60 million SAAR, down from 6.76 million.

Housing economist Tom Lawler expects the NAR to report sales at a seasonally adjusted annual rate of 6.48 million for January.

February 18 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/18/2021 07:20:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 18th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 59.1 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.58 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.4 million tests per day over the last week. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,356,782 test results reported over the last 24 hours.

There were 66,824 positive tests.

Over 51,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 7 days was 5.1%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are still above the previous peaks.

LA Area Port Traffic: Strong Imports, Weak Exports in January

by Calculated Risk on 2/18/2021 02:12:00 PM

Note1: Import traffic is so heavy - ships are backed up waiting to unload in LA. "some vessels are spending almost as much time at anchor as it takes to traverse the Pacific Ocean."

Note2: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

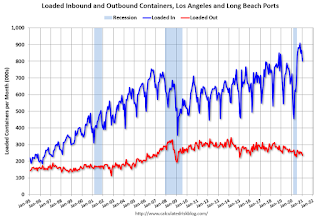

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 0.9% in January compared to the rolling 12 months ending in December. Outbound traffic was down 0.7% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 11% YoY in December, and exports were down 8% YoY.

Hotels: Occupancy Rate Declined 29.0% Year-over-year

by Calculated Risk on 2/18/2021 11:53:00 AM

U.S. hotel occupancy increased more than 4 percentage points from the previous week, according to STR‘s latest data through Feb. 13.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Feb. 7-13, 2021 (percentage change from comparable week in 2020):

• Occupancy: 45.1% (-29.0%)

• Average daily rate (ADR): US$99.21 (-25.7%)

• Revenue per available room (RevPAR): US$44.72 (-47.2%)

Boosted by Valentine’s Day and the long weekend with Presidents Day, U.S. weekend occupancy (Friday/Saturday) came in at 58.5%, which was the highest level in the metric since mid-October. Elevated occupancy during the weekend of Presidents Day occurred during previous recessions as well.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Note: Y-axis doesn't start at zero to better show the seasonal change.