by Calculated Risk on 2/22/2021 04:44:00 PM

Monday, February 22, 2021

MBA Survey: "Share of Mortgage Loans in Forbearance Declines to 5.22%"

Note: This is as of February 14th.

From the MBA: Share of Mortgage Loans in Forbearance Declines to 5.22%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 5.29% of servicers’ portfolio volume in the prior week to 5.22% as of February 14, 2021. According to MBA’s estimate, 2.6 million homeowners are in forbearance plans.

...

“The share of loans in forbearance has declined for three weeks in a row, with portfolio and PLS loans decreasing the most this week. This decline was due to a sharp increase in borrower exits, particularly for IMB servicers,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Requests for new forbearances dropped to 6 basis points, matching a survey low.”

Fratantoni added, “The housing market is quite strong, with home sales, home construction, and home price data all testifying to this strength. Policymakers and the mortgage industry have helped enable this during the pandemic by providing millions of homeowners support in the form of forbearance. The decision to extend the allowable duration of forbearance plans should provide for a smoother transition this year as the job market continues to recover.” emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, then trended down - and has mostly moved slowly down recently.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.07% to 0.06%."

February Vehicle Sales Forecast: "Weather Weakens US Sales"

by Calculated Risk on 2/22/2021 02:17:00 PM

From WardsAuto: U.S. Light Vehicle Sales & Inventory Forecast, February 2021 (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for February (Red).

Sales have bounced back from the April low, but will likely be down around 7% year-over-year in February. The weather has impacted sales this month.

The Wards forecast of 15.6 million SAAR, would be down about 6% from January.

House Prices and Inventory

by Calculated Risk on 2/22/2021 11:36:00 AM

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Click on graph for larger image.

Click on graph for larger image.This graph below shows existing home months-of-supply (from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through November 2020).

There is a clear relationship, and this is no surprise (but interesting to graph).

If months-of-supply is high, prices decline. If months-of-supply is low, prices rise.

In the existing home sales report released last week, the NAR reported months-of-supply at 1.9 months in January. There is a seasonal pattern to inventory, but this is a record low - and prices are increasing sharply.

Housing Inventory Feb 22nd Update: At Record Lows

by Calculated Risk on 2/22/2021 11:08:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 2/22/2021 08:47:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019-2020 (Blue) and 2020-2021 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of February 21st.

The seven day average is down 58.8% from last year (41.2% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - but TSA data has mostly moved sideways.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through February 20 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays. Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York. Dining in Texas declined sharply due to the weather.

This data shows domestic box office for each week (red) and the maximum and minimum for the years 2016 through 2019. Blue is 2020 and Red is 2021.

This data shows domestic box office for each week (red) and the maximum and minimum for the years 2016 through 2019. Blue is 2020 and Red is 2021. Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $8 million last week (compared to usually around $200 million per week at this time of year).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

This data is through February 13th. Hotel occupancy is currently down 29.0% year-over-year. Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. At one point, gasoline supplied was off almost 50% YoY. Red is for 2021.

As of February 12th, gasoline supplied was off about 4.5% (about 95.5% of the same week in 2019).

Note: People driving instead of flying might have boosted gasoline consumption.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through February 20th for the United States and several selected cities.

This data is through February 20th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 50% of the January 2020 level. It is at 44% in Chicago, and 32% in Houston (weather related decline) - and mostly moving sideways, and moving up a little recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data since early 2020.

This graph is from Todd W Schneider. This is daily data since early 2020.This data is through Friday, February 19th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, February 21, 2021

Sunday Night Futures

by Calculated Risk on 2/21/2021 09:11:00 PM

Weekend:

• Schedule for Week of February 21, 2021

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $59.24 per barrel and Brent at $62.91 barrel. A year ago, WTI was at $53, and Brent was at $59 - so WTI oil prices are UP about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.64 per gallon. A year ago prices were at $2.47 per gallon, so gasoline prices are up $0.17 per gallon year-over-year.

February 21 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/21/2021 07:00:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Feb 21st.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 63.1 million doses have been given. In the last week, an average of 1.33 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.3 million tests per day over the last week. The percent positive over the last 7 days was 4.9%.

There were 1,225,773 test results reported over the last 24 hours.

There were 58,429 positive tests.

Almost 57,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

Graham: "Time to Wake Up To The New Mortgage Rate Reality"

by Calculated Risk on 2/21/2021 10:18:00 AM

A few excerpts from an article by Matthew Graham at MortgageNewsDaily: Time to Wake Up To The New Mortgage Rate Reality

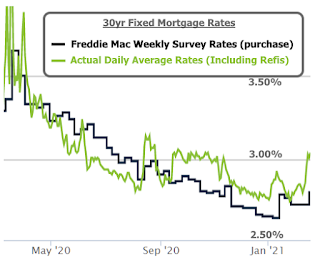

There's no precedent for the winning streak enjoyed by mortgage rates in the 2nd half of 2020. We've never seen so many new record lows in the same year, and we never spent as much time at those lows (not even close). All of the above makes it easy to get lulled into a false sense of low-rate security, but it's time to wake up.

...

Following the Georgia senate election, we've been tracking a surge in bond market volatility based on the expectation that it would increasingly spill over to the mortgage rate world.

As of this week, that spillover arrived in grand fashion with many lenders quoting rates that are as much as three eighths of a point higher than they were last week. That means if you were looking at something in the 2.75% neighborhood on Friday, it could be 3.125% today....

Click on graph for larger image.

Click on graph for larger image."But wait... I heard that mortgage rates are still really low and that they only went up a tiny amount this week!"CR Note: Rates are still historically very low, however we will likely see a slowdown in refinance activity. Purchase activity will likely remain strong (rising rates sometimes pushes people to buy since they don't want to miss out). The best case scenario for the economy (pandemic ending, etc), could lead to a slowdown for housing for two reasons: higher mortgage rates, and more inventory (from record lows).

Well, that depends on your perspective. Is 3.125% still really low for the average 30yr fixed mortgage rate? Yes! That was the all-time low before covid. But is it much higher relative to the past few weeks and months? Here too, it depends on your perspective, so let's leave it at this: rates rose more this week than on any other week in the past 11 months.

If you've heard that rates only rose slightly, it may have to do with headlines quoting Freddie Mac's weekly survey. While that survey is accurate over time, it doesn't capture short-term volatility. It also tends to stop measuring most of any given week's volatility on Monday, and Monday was a holiday! As such, it's lagging the reality on the street.

Saturday, February 20, 2021

February 20 COVID-19 Test Results and Vaccinations; Hospitalizations Below Summer Peak

by Calculated Risk on 2/20/2021 06:52:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Feb 19th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 60.5 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.49 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.35 million tests per day over the last week. The percent positive over the last 7 days was 4.9%.

There were 1,274,526 test results reported over the last 24 hours.

There were 71,951 positive tests.

Almost 56,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

Schedule for Week of February 21, 2021

by Calculated Risk on 2/20/2021 08:11:00 AM

The key reports this week are January New Home sales and the second estimate of Q4 GDP.

Other key reports include Case-Shiller house prices and Personal Income and Outlays for January.

For manufacturing, the February Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

9:00 AM: FHFA House Price Index for December 2020. This was originally a GSE only repeat sales, however there is also an expanded index.

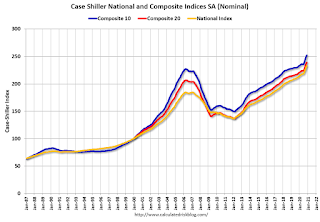

9:00 AM: S&P/Case-Shiller House Price Index for December.

9:00 AM: S&P/Case-Shiller House Price Index for December.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 9.1% year-over-year increase in the Comp 20 index for December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is for 855 thousand SAAR, up from 842 thousand in December.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 845 thousand from 861 thousand last week.

8:30 AM: Gross Domestic Product, 4th quarter 2020 (Second estimate). The consensus is that real GDP increased 4.1% annualized in Q4, up from the advance estimate of 4.0%.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.1% decrease in durable goods orders.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 0.1% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of regional manufacturing surveys for February.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 10.0% increase in personal income, and for a 2.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 61.0, down from 63.8 in January.

10:00 AM: University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 76.2.