by Calculated Risk on 3/03/2021 08:20:00 AM

Wednesday, March 03, 2021

ADP: Private Employment increased 117,000 in February

Private sector employment increased by 117,000 jobs from January to February according to the February ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast of 168,000 for this report.

The labor market continues to post a sluggish recovery across the board,” said Nela Richardson, chief economist, ADP. “We’re seeing large-sized companies increasingly feeling the effects of COVID-19, while job growth in the goods producing sector pauses. With the pandemic still in the driver’s seat, the service sector remains well below its pre-pandemic levels; however, this sector is one that will likely benefit the most over time with reopenings and increased consumer confidence.

emphasis added

The BLS report will be released Friday, and the consensus is for 148 thousand non-farm payroll jobs added in February. The ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/03/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 26, 2021.

... The Refinance Index increased 0.1 percent from the previous week and was 7 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 1 percent higher than the same week one year ago.

“Mortgage rates jumped last week on market expectations of stronger economic growth and higher inflation. The 30-year fixed rate experienced its largest single-week increase in almost a year, reaching 3.23 percent – the highest since July 2020,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The overall share of refinances declined for the fourth consecutive week, and conventional refinance applications fell more than 2 percent to the lowest level in four months. Government refinance applications historically lag the more rate-sensitive movements of conventional applications, and that was true last week, as both FHA and VA refinancing volumes increased.”

Added Kan, “The housing market is entering the busy spring buying season with strong demand. Purchase applications increased, with a rise in government applications – likely first-time buyers – pulling down the average loan size for the first time in six weeks.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.23 percent from 3.08 percent, with points increasing to 0.48 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

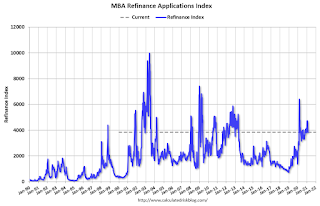

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been volatile recently depending on rates.

With near record low rates, the index remains up from last year (but will be down year-over-year next week - since rates fell sharply at the beginning of the pandemic).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 1% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, March 02, 2021

Wednesday: ADP Employment, ISM Services, Beige Book

by Calculated Risk on 3/02/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 168,000 payroll jobs added in February, down from 174,000 added in January.

• At 10:00 AM, the ISM Services Index for February.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

March 2 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/02/2021 06:42:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Mar 2nd.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 78.6 million doses have been given. In the last week, an average of 1.94 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US has averaged 1.5 million tests per day over the last week. The percent positive over the last 7 days was 4.2%.

There were 1,349,529 test results reported over the last 24 hours.

There were 54,248 positive tests.

Over 3,100 US deaths have been reported in March. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

CFPB: "Over 11 Million Families At Risk Of Losing Housing"

by Calculated Risk on 3/02/2021 01:32:00 PM

From the CFPB: New Report From Consumer Financial Protection Bureau Finds Over 11 Million Families At Risk Of Losing Housing

Today, the Consumer Financial Protection Bureau (CFPB) issued a report that warns of widespread evictions and foreclosures once federal, state, and local pandemic protections come to an end, absent additional public and private action. Over 11 million families are behind on their rent or mortgage payments: 2.1 million families are behind at least three months on mortgage payments, while 8.8 million are behind on rent. Homeowners alone are estimated to owe almost $90 billion in missed payments. The last time this many families were behind on their mortgages was during the Great Recession.Here is the report: Housing insecurity and the COVID-19 pandemic

“We have very little time to prevent millions of families from losing their homes to eviction and foreclosure,” warns CFPB Acting Director Dave Uejio. “At the CFPB, we are working hard to help homeowners and renters as the U.S. begins to turn a painful crisis, caused by the pandemic, into a robust recovery. We know small landlords are struggling, too, with many dipping into savings or using credit cards to make it through the pandemic. We want everyone—homeowners and renters, landlords, and mortgage servicers—to have the tools they need now to avoid unnecessary evictions and foreclosures.”

CR Notes: Most of the homeowners in forbearance will be able to restructure their loans once they are able to return to work, and I do not expect a large number of foreclosures.

Demographics: Renting vs. Owning

by Calculated Risk on 3/02/2021 10:49:00 AM

It was 11 years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers in 2011 were 1) very low new supply for apartments, and 2) strong demand (both favorable demographics, and people moving from owning to renting). The move "from owning to renting" ended several years ago, and demographics for apartments are much less favorable than a decade ago.

NOTE: This graph uses the Vintage 2019 estimates. There are questions about these estimates, and we will have much better data when the 2020 Decennial Census data is released.

Click on graph for larger image.

Click on graph for larger image.This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group last decade (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over this decade.

This demographics is now positive for home buying, and this is a key reason I've expected single family housing starts to increase this decade.

CoreLogic: House Prices up 10.0% Year-over-year in January

by Calculated Risk on 3/02/2021 08:35:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: In High Gear: Annual US Home Price Appreciation Reaches Double Digits in January, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2021.

2020 was a landmark year for the housing market. Factors such as record-low mortgage rates encouraged first-time homebuyers to dip their toe into the housing market and allowed home price growth to remain strong, despite economic uncertainty. The momentum continued into 2021, with home price growth experiencing its first double-digit annual appreciation since November 2013 in January at 10%. However, as we look forward to the rest of 2021, we may expect to see challenges for some prospective homeowners.

...

“Record-low mortgage rates were a significant driving force behind last year’s rebound in housing market activity,” said Frank Martell, president and CEO of CoreLogic. “However, heavy competition for the few houses on the market drove home prices to historic highs, and mortgage rates are no longer enough to sway the affordability challenges for consumers. While new construction may help balance home prices towards the end of 2021, we may expect to see demand slow in the medium-term.”

...

Nationally, home prices increased 10% in January 2021, compared with January 2020. On a month-over-month basis, home prices increased by 0.9% compared to December 2020.

“Despite first-time buyers driving high demand, entry-level homes remain in short supply,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Homes priced below 75% of the local median price had 14% annual appreciation, negating most of the benefits of record-low mortgage rates. When interest rates rise, the affordability squeeze for first-time buyers will become even more of a challenge.”

emphasis added

Monday, March 01, 2021

March 1 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/01/2021 07:06:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Mar 1st.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 76.9 million doses have been given. In the last week, an average of 1.82 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US has averaged 1.5 million tests per day over the last week. The percent positive over the last 7 days was 4.4%.

There were 1,224,488 test results reported over the last 24 hours.

There were 48,092 positive tests.

Over 1,200 US deaths have been reported in March. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

MBA Survey: "Share of Mortgage Loans in Forbearance Increases Slightly to 5.23%"

by Calculated Risk on 3/01/2021 04:00:00 PM

Note: This is as of February 21st.

From the MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.23%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased by 1 basis point from 5.22% of servicers’ portfolio volume in the prior week to 5.23% as of February 21, 2021. According to MBA’s estimate, 2.6 million homeowners are in forbearance plans.

...

"A small increase in new forbearance requests, coupled with exits decreasing to match a survey low, led to the overall share of loans in forbearance increasing for the first time in five weeks,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The largest rise in the forbearance share was for portfolio and PLS loans, due to increases for both Ginnie Mae buyouts and other portfolio/PLS loans.”

Fratantoni added, “The winter storm that impacted Texas and other states did lead to some temporary disruptions at servicer call centers, but these centers quickly returned to full operations.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, then trended down - and has mostly moved slowly down recently.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.06% to 0.07%."

Update: Framing Lumber Prices More Than Double Year-over-year

by Calculated Risk on 3/01/2021 01:14:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME framing futures through Mar 1st.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Clearly there is another surge in demand for lumber.