by Calculated Risk on 3/04/2021 09:52:00 AM

Thursday, March 04, 2021

February Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for 148 thousand jobs added, and for the unemployment rate to increase to 6.4%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and is still worse than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 117,000 private sector jobs, below the consensus estimate of 168 thousand jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be weaker than expected.

• ISM Surveys: The ISM® manufacturing employment index increased in February to 54.4%, from 52.6% in January. This would suggest essentially approximately 5,000 manufacturing jobs added in February. ADP showed 14,000 manufacturing jobs lost.

The ISM® Services employment index decreased in February to 52.7%, from 55.2% in January. This would suggest around 145,000 service jobs added in February. Combined, the ISM surveys suggest around 150,000 private sector jobs added in February. The ISM surveys haven't been as useful as usual during the pandemic, but this suggests the report could be close to the consensus.

• Unemployment Claims: The weekly claims report showed a high number of initial unemployment claims during the reference week (include the 12th of the month), although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession! In general, weekly claims have been close to expectations.

• Weather: Weather is a wildcard every year during the winter. A harsh winter can lead to a weak jobs report, and the weather in February 2021 was especially harsh. However, most of the extreme weather was after the BLS reference week (the major winter storm started on the 13th). After the report is released, the SF Fed will update their Weather-Adjusted Employment Change

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been increasing.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been increasing.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. In January, the number of permanent job losers increased to 3.503 million from 3.370 million in December.

• Conclusion: Most of the indicators suggest a stronger report in February than in January (only 49 thousand jobs were added in January). My guess is the report will be close to the consensus (weather is a wildcard).

Weekly Initial Unemployment Claims increased to 745,000

by Calculated Risk on 3/04/2021 08:40:00 AM

The DOL reported:

In the week ending February 27, the advance figure for seasonally adjusted initial claims was 745,000, an increase of 9,000 from the previous week's revised level. The previous week's level was revised up by 6,000 from 730,000 to 736,000. The 4-week moving average was 790,750, a decrease of 16,750 from the previous week's revised average. The previous week's average was revised down by 250 from 807,750 to 807,500.This does not include the 436,696 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 427,450 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 790,750.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

Regular state continued claims decreased to 4,295,000 (SA) from 4,419,000 (SA) the previous week and will likely stay at a high level until the crisis abates.

Note: There are an additional 7,328,311 receiving Pandemic Unemployment Assistance (PUA) that decreased from 7,520,114 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 4,466,916 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 5,067,523.

Weekly claims were close to the consensus forecast.

Wednesday, March 03, 2021

Thursday: Unemployment Claims, Fed Chair Powell

by Calculated Risk on 3/03/2021 09:21:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a increase to 760 thousand from 730 thousand last week.

• At 12:05 PM, Discussion with Fed Chair Jerome Powell, Conversation on the U.S. Economy, (Watch live here) At The Wall Street Journal Jobs Summit (via livestream)

March 3 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/03/2021 07:10:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Mar 2nd.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 80.5 million doses have been given. In the last week, an average of 2.01 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US has averaged 1.5 million tests per day over the last week. The percent positive over the last 7 days was 4.2%.

There were 1,401,364 test results reported over the last 24 hours.

There were 66,836 positive tests.

Almost 5,500 US deaths have been reported in March. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

Fed's Beige Book: "Economic activity expanded modestly"

by Calculated Risk on 3/03/2021 02:15:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Atlanta based on information collected on or before February 22nd."

Economic activity expanded modestly from January to mid-February for most Federal Reserve Districts. Most businesses remain optimistic regarding the next 6-12 months as COVID-19 vaccines become more widely distributed. Reports on consumer spending and auto sales were mixed. Although a few Districts reported slight improvements in travel and tourism activity, overall conditions in the leisure and hospitality sector continued to be restrained by ongoing COVID-19 restrictions. Despite challenges from supply chain disruptions, overall manufacturing activity for most Districts increased moderately from the previous report. Among Districts reporting on nonfinancial services, activity was mixed, though most reported modest growth over the reporting period. Some Districts noted that financial institutions experienced declines in loan volumes, but most cited lower delinquency rates and elevated deposit levels. Historically low mortgage interest rates continued to spur robust demand for both new and existing homes in most Districts, and home prices continued to rise in many areas of the U.S. On balance, commercial real estate conditions in the hotel, retail, and office sectors deteriorated somewhat, while activity in the multifamily sector remained steady and the industrial segment continued to strengthen. Districts reporting on energy observed a slight uptick in activity related to oil and gas production and energy consumption. Overall, reports on agricultural conditions were somewhat improved since the previous report. Transportation activity grew modestly for many Districts.CR Note: The pandemic is still depressing activity.

...

Most Districts reported that employment levels rose over the reporting period, albeit slowly. Labor demand varied considerably by industry and by skill level, and many contacts noted continued difficulties attracting and retaining qualified workers. Labor supply shortages were noted by contacts as most acute among low-skill occupations and skilled trade positions. Constraints on labor supply included those related to COVID-19, childcare, and unemployment benefits. Overall, contacts expect modest improvements in employment levels in the near term. Several Districts reported modest wage increases for high-demand positions with many also noting upward pressure on wages to attract and retain employees. On balance, wage increases for many Districts are expected to persist or to pick up somewhat over the next several months.

emphasis added

U.S. Heavy Truck Sales up 9% Year-over-year in February

by Calculated Risk on 3/03/2021 01:05:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the February 2021 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019.

However heavy truck sales started declining in late 2019 due to lower oil prices.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Click on graph for larger image.

Heavy truck sales really declined towards the end of March 2020 due to COVID-19 and the collapse in oil prices, falling to a low of 299 thousand SAAR in May 2020, but have since rebounded.

Heavy truck sales were at 489 thousand SAAR in February, down from 530 thousand SAAR in January, but up 9% from 448 thousand SAAR in February 2020.

The year-over-year comparison will be easy for the next several months because of the collapse in sales in the early months of the pandemic.

ISM® Services Index decreased to 55.3% in February

by Calculated Risk on 3/03/2021 10:13:00 AM

(Posted with permission). The February ISM® Services index was at 55.3%, down from 58.7% last month. The employment index decreased to 52.7%, from 55.2%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management®: February 2021 Services ISM® Report On Business®

Economic activity in the services sector grew in February for the ninth month in a row, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.This was below expectations, and the report showed a decline for the employment index.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “The Services PMI® registered 55.3 percent, 3.4 percentage points lower than the January reading of 58.7 percent. This reading indicates the ninth straight month of growth for the services sector, which has expanded for all but two of the last 133 months.

emphasis added

February Vehicles Sales decreased to 15.67 Million SAAR

by Calculated Risk on 3/03/2021 08:29:00 AM

The BEA released their estimate of light vehicle sales for February this morning. The BEA estimates sales of 15.67 million SAAR in February 2021 (Seasonally Adjusted Annual Rate), down 5.7% from the January sales rate, and down 6.6% from February 2020.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for February (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased, but are still down year-over-year,

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 15.673 million SAAR.

Note: dashed line is current estimated sales rate of 15.673 million SAAR.ADP: Private Employment increased 117,000 in February

by Calculated Risk on 3/03/2021 08:20:00 AM

Private sector employment increased by 117,000 jobs from January to February according to the February ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast of 168,000 for this report.

The labor market continues to post a sluggish recovery across the board,” said Nela Richardson, chief economist, ADP. “We’re seeing large-sized companies increasingly feeling the effects of COVID-19, while job growth in the goods producing sector pauses. With the pandemic still in the driver’s seat, the service sector remains well below its pre-pandemic levels; however, this sector is one that will likely benefit the most over time with reopenings and increased consumer confidence.

emphasis added

The BLS report will be released Friday, and the consensus is for 148 thousand non-farm payroll jobs added in February. The ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/03/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 26, 2021.

... The Refinance Index increased 0.1 percent from the previous week and was 7 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 1 percent higher than the same week one year ago.

“Mortgage rates jumped last week on market expectations of stronger economic growth and higher inflation. The 30-year fixed rate experienced its largest single-week increase in almost a year, reaching 3.23 percent – the highest since July 2020,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The overall share of refinances declined for the fourth consecutive week, and conventional refinance applications fell more than 2 percent to the lowest level in four months. Government refinance applications historically lag the more rate-sensitive movements of conventional applications, and that was true last week, as both FHA and VA refinancing volumes increased.”

Added Kan, “The housing market is entering the busy spring buying season with strong demand. Purchase applications increased, with a rise in government applications – likely first-time buyers – pulling down the average loan size for the first time in six weeks.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.23 percent from 3.08 percent, with points increasing to 0.48 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

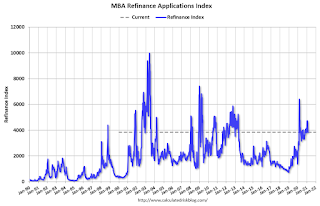

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been volatile recently depending on rates.

With near record low rates, the index remains up from last year (but will be down year-over-year next week - since rates fell sharply at the beginning of the pandemic).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 1% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).