by Calculated Risk on 3/11/2021 02:37:00 PM

Thursday, March 11, 2021

Hotels: Occupancy Rate Declined 26.7% Compared to Same Week in 2019

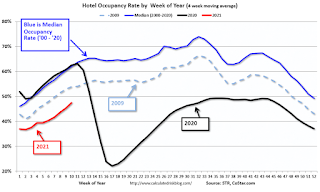

Note: Starting next week, the year-over-year comparisons will be easy - since occupancy declined sharply at the onset of the pandemic - but occupancy will still be down significantly from normal levels.

The occupancy rate is down 26.7% compared to the same week in 2019.

U.S. weekly hotel occupancy reached a 20-week high, according to STR‘s latest data through March 6.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Feb. 28 through March 6, 2021 (percentage change from comparable week in 2020):

• Occupancy: 49.0% (-20.5%)

• Average daily rate (ADR): US$98.30 (-21.9%)

• Revenue per available room (RevPAR): US$48.13 (-37.9%)

While demand has improved in in many states, most markets remain deep in recessionary territory when indexed to 2019 levels. Year-over-year comparisons with 2020 are beginning to turn favorable as the country hits the one-year anniversary of its earliest pandemic restrictions.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Portland Real Estate in February: Sales Up 4% YoY, Inventory Down 44% YoY

by Calculated Risk on 3/11/2021 01:20:00 PM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

For Portland, OR:

Closed sales in February 2021 were 1,978, up 4.3% from 1,897 in February 2020.

Active Listings in February 2021 were 1,993, down 44.3% from 3,580 in February 2020.

Months of Supply was 1.0 Months in February 2021, compared to 1.9 Months in February 2020.

Fed's Flow of Funds: Household Net Worth Increased $6.9 Trillion in Q4

by Calculated Risk on 3/11/2021 12:24:00 PM

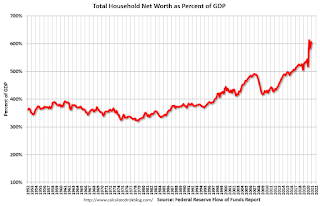

The Federal Reserve released the Q4 2020 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $130.2 trillion during the fourth quarter of 2020. The value of directly and indirectly held corporate equities increased $4.9 trillion and the value of real estate increased $0.9 trillion.

Household debt increased 6.5 percent at an annual rate in the fourth quarter of 2020. Consumer credit grew at an annual rate of 2.3 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 5.2 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

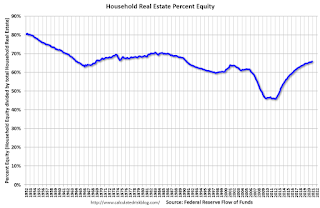

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2020, household percent equity (of household real estate) was at 65.9% - up from 65.5% in Q3.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 65.9% equity - and about 1.5 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 GDP.Mortgage debt increased by $149 billion in Q4.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 50.9% - down from Q3 - and down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q4, and is above the average of the last 30 years.

BLS: Job Openings "Changed Little" at 6.9 Million in January

by Calculated Risk on 3/11/2021 10:12:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings changed little at 6.9 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.3 million while total separations decreased to 5.3 million. Within separations, the quits rate and layoffs and discharges rate changed little at 2.3 percent and 1.2 percent, respectively.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in January to 6.917 million from 6.752 million in December.

The number of job openings (yellow) were down 3.3% year-over-year. Note that job openings were declining a year ago prior to the pandemic.

Quits were down 7.2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

CoreLogic: 1.5 Million Homes with Negative Equity in Q4 2020

by Calculated Risk on 3/11/2021 08:57:00 AM

From CoreLogic: Home Equity Continues to Soar: Homeowners Gained Over $1.5 Trillion in Equity in 2020, CoreLogic Reports

CoreLogic® ... today released the Home Equity Report for the fourth quarter of 2020. The report shows U.S. homeowners with mortgages (which account for roughly 62% of all properties) have seen their equity increase by 16.2% year over year, representing a collective equity gain of over $1.5 trillion, and an average gain of $26,300 per homeowner, since the fourth quarter of 2019.

As competition for the dwindling supply of for-sale homes drove prices up, average annual homeowner equity gains in the fourth quarter of 2020 reached the highest level since 2013. For current owners, these gains have created a buffer against financial difficulties brought on by the pandemic, and enabled means for pursuing renovations as people are spending more time at home. For the broader market, home equity gains have also reduced the risk of homes falling underwater and pushing distressed sales into the market.

“Compared with a year earlier, home prices in December 2020 were up sharply — 9.2%, according to the CoreLogic Home Price Index — boosting the amount of home equity for the average homeowner with a mortgage to more than $200,000,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This equity growth has enabled many families to finance home remodeling, such as adding an office or study, further contributing to last year’s record level in home improvement spending.”

“Positive factors like record-low interest rates and a booming housing market encouraged many families to enter homeownership,” said Frank Martell, president and CEO of CoreLogic. “This growing bank of personal wealth that homeownership affords was noticed by many but in particular for first-time buyers who want a piece of the cake. As a result, we may see more of those currently renting start to enter the market in the near future.”

...

Negative equity, also referred to as underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the fourth quarter of 2020, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

• Quarterly change: From the third quarter of 2020 to the fourth quarter of 2020, the total number of mortgaged homes in negative equity decreased by 8% to 1.5 million homes or 2.8% of all mortgaged properties.

• Annual change: In the fourth quarter of 2019, 1.9 million homes, or 3.6% of all mortgaged properties, were in negative equity. This number decreased by 21%, or 410,000 properties, in the fourth quarter of 2020.

• National aggregate value: The national aggregate value of negative equity was approximately $280.2 billion at the end of the fourth quarter of 2020. This is down quarter over quarter by approximately $3.4 billion, or 1.2%, from $283.6 billion in the third quarter of 2020, and down year over year by approximately $7.5 billion, or 2.6%, from $287.7 billion in the fourth quarter of 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q4 to Q3 2020 equity distribution by LTV. There are still quite a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.9 million to 1.5 million.

Weekly Initial Unemployment Claims decreased to 712,000

by Calculated Risk on 3/11/2021 08:38:00 AM

The DOL reported:

In the week ending March 6, the advance figure for seasonally adjusted initial claims was 712,000, a decrease of 42,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 745,000 to 754,000. The 4-week moving average was 759,000, a decrease of 34,000 from the previous week's revised average. The previous week's average was revised up by 2,250 from 790,750 to 793,000.This does not include the 478,001 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 436,138 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 759,000.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

Regular state continued claims decreased to 4,144,000 (SA) from 4,337,000 (SA) the previous week and will likely stay at a high level until the crisis abates.

Note: There are an additional 8,387,194 receiving Pandemic Unemployment Assistance (PUA) that increased from 7,329,172 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,454,740 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 4,468,389.

Weekly claims were lower than the consensus forecast.

Wednesday, March 10, 2021

Thursday: Unemployment Claims, Job Openings, Flow of Funds

by Calculated Risk on 3/10/2021 09:17:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a increase to 760 thousand from 745 thousand last week.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

March 10 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/10/2021 05:17:00 PM

From Bloomberg on vaccinations as of Mar 10th:

"So far, 95.7 million doses have been given. In the last week, an average of 2.17 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that yesterday, Missouri reported 81,000 previously unreported cases, and that caused the spike in total cases (and increase in 7 day average).

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Colorado Real Estate in February: Sales Up 5% YoY, Inventory Down 64% YoY

by Calculated Risk on 3/10/2021 02:54:00 PM

From the Colorado Realtors for the entire state:

Closed sales for Single Family and Townhouse-Condo in February 2021 were 7,712, up 4.6% from 7,374 in February 2020.

Active Listings for Single Family and Townhouse-Condo in February 2021 were 7,119, down 63.5% from 19,500 in February 2020.

Months of Supply was 0.7 Months in February 2021, compared to 2.0 Months in February 2020.

Atlanta Real Estate in February: Sales Up 5% YoY, Inventory Down 57% YoY

by Calculated Risk on 3/10/2021 02:19:00 PM

From the GAMLS for Atlanta:

Total Residential Units Sold in February 2021 were 6,688, up 5.1% from 6,363 in February 2020.

Active Residential Listings in February 2021 were 7,767, down 57.2% from 18,163 in February 2020.

Months of Supply was 0.94 Months in February 2021, compared to 2.37 Months in February 2020.

This graph from the Georgia MLS shows inventory in Atlanta over the last several years - and the sharp decline in inventory at the start of the pandemic.