by Calculated Risk on 3/14/2021 10:53:00 AM

Sunday, March 14, 2021

FOMC Preview

Expectations are there will be no change to rate policy when the FOMC meets on Tuesday and Wednesday this week, but that the FOMC will upgrade their outlook.

Here are some comments from Merrill Lynch economists:

"The FOMC meeting on the 17th will be one of the most critical events for the Fed in some time. We believe Fed Chair Powell will have to strike the right balance between a more upbeat assessment of the outlook and the asymmetric FAIT [flexible average inflation targeting] reaction function. The result will be an acknowledgement that liftoff is earlier than believed back in mid-December but that it is still later than markets currently believe. ...For review, below are the December FOMC projections.

[W]e expect the latest projections to show material upward revisions from the December SEP. We expect growth this year to be revised by at least 1.5ppt to a range of 5.7% - 6.0% 4Q/4Q reflecting the effects of the American Rescue Plan and the improving outlook on the virus situation. ... The unemployment rate is likely to be revised down across the forecast horizon, showing a faster reduction in labor market slack. However, it will be relatively modest compared to the upgrade in growth, suggesting a stronger labor force recovery. This will in turn support modest upward revisions to core PCE inflation such that the 2023 forecast will show an overshoot of the Fed’s target. These ingredients — the unemployment rate at pre-pandemic levels and inflation modestly above target – will be enough to warrant one hike by the Fed in 2023."

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | -2.5 to -2.2 | 3.7 to 5.0 | 3.0 to 3.5 | 2.2 to 2.7 |

Note that GDP decreased 2.4% Q4-over-Q4 in Q4 2020. That was close to the bottom of the December projections. GDP would have to increase 10.4% in Q1 to return to the pre-recession peak in Q4 2019 (unlikely).

Many forecasters are optimistic about a very strong recovery in 2021, for example, from Goldman Sachs economists this weekend:

"In light of the larger fiscal package just enacted, we now expect slightly higher GDP growth of +6% / +11% / +8.5% / +6.5% in 2021Q1-Q4 which implies +7.0% in 2021 on a full-year basis (vs. +5.5% consensus) and +8.0% on a Q4/Q4 basis (vs. +6.0% consensus)."

The unemployment rate was at 6.2% in February.

Merrill's view is the unemployment rate forecasts will be revised down, but "will be relatively modest compared to the upgrade in growth". The decline in the unemployment rate depends on both job growth, and the participation rate. A strong labor market will probably encourage people to return to the labor force, and the improvements in the unemployment rate might be slower than some expect.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 6.7 to 6.8 | 4.7 to 5.4 | 3.8 to 4.6 | 3.5 to 4.3 |

As of January 2020, PCE inflation was up 1.5% from January 2020.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.2 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.1 |

PCE core inflation was up 1.5% in January year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.4 | 1.7 to 1.8 | 1.8 to 2.0 | 1.9 to 2.1 |

My guess is core PCE inflation (year-over-year) will increase in 2021 (from the current 1.5%), but I think too much inflation will NOT be a concern in 2021. Since we saw negative MoM PCE and core PCE readings in March and April, we should ignore a jump in YoY inflation in March, April and May.

Saturday, March 13, 2021

March 13 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/13/2021 06:16:00 PM

From Bloomberg on vaccinations as of Mar 13th:

"So far, 106 million doses have been given. In the last week, an average of 2.54 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that four days ago, Missouri reported 81,000 previously unreported cases, and that caused the spike in total cases (and an increase in 7 day average).

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Schedule for Week of March 14, 2021

by Calculated Risk on 3/13/2021 08:11:00 AM

The key reports this week are February Retail Sales and Housing Starts.

For manufacturing, the February Industrial Production report and the March NY and Philly Fed manufacturing surveys will be released.

The FOMC meets this week, and no change to policy is expected.

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 14.5, up from 12.1.

10:00 AM: State Employment and Unemployment (Monthly) for January 2021

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.5% decrease in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.5% decrease in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 8.6% on a YoY basis in January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 75.8%.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 83, down from 84. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. This graph shows single and total housing starts since 1968.

The consensus is for 1.570 million SAAR, down from 1.580 million SAAR.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a increase to 715 thousand from 712 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of 24.5, up from 23.1.

No major economic releases scheduled.

Friday, March 12, 2021

March 12 COVID-19 Test Results and Vaccinations; Over 100 Million Doses Administered

by Calculated Risk on 3/12/2021 06:00:00 PM

From Bloomberg on vaccinations as of Mar 12th:

"So far, 101 million doses have been given. In the last week, an average of 2.30 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that three days ago, Missouri reported 81,000 previously unreported cases, and that caused the spike in total cases (and an increase in 7 day average).

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

South Carolina Real Estate in February: Sales Up 13% YoY, Inventory Down 46% YoY

by Calculated Risk on 3/12/2021 02:00:00 PM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

From the South Carolina Realtors for the entire state:

Closed sales in February 2021 were 7,127, up 13.4% from 6,284 in February 2020.

Active Listings in February 2021 were 14,253, down 46.3% from 26,521 in February 2020.

Months of Supply was 1.6 Months in February 2021, compared to 3.2 Months in February 2020.

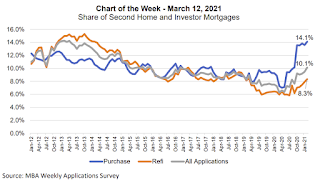

MBA: Share of Second Home and Investor Mortgage Applications

by Calculated Risk on 3/12/2021 12:49:00 PM

From the MBA:

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property. In February 2021, 10.1 percent of all applications in the retail and consumer direct channels were for a non‐primary residence. This was an increase from 9.5 percent the previous month. 2019 and 2020 saw annual averages of approximately 8 percent. Breaking down the categories, second‐home transactions accounted for 3.6 percent of all applications and investment properties were 6.5 percent, totaling 10.1 percent. Average loan sizes as of February 2021 were $430,000 for second homes and $263,000 for investment properties.

Within purchase mortgages, the second home and investment property share was 14.1 percent of applications in February 2021, an increase from 13.6 percent in January and up from the annual averages of 9 percent in 2019 and 10 percent in 2020. Purchase activity in these property types has been increasing with the start of the spring buying season. Furthermore, demand is rising because of the rise in remote work and the desire to live further away from more densely populated urban areas. Refinancing of second homes and investment properties has also seen an increase – the result of homeowners taking advantage of record‐low mortgage rates.

Click on graph for larger image.

Click on graph for larger image.Recognizing that compositional measures are impacted by the mix of applications, we also examined the year‐over‐year trends in the number of applications for these loan categories. Second home applications were up 37 percent compared to February 2020 and investor applications were up 110.6 percent, while overall applications were up 26.8 percent, which highlights the fact that the pace of growth has been higher for second homes and investment properties.CR Note: The Fannie and Freddie announcement will push up mortgage rates on 2nd homes and investor buying.

Lenders were focused this week on announcements from Fannie Mae and Freddie Mac to limit the share of loans they could sell to the GSEs to 7 percent of their portfolios, well below the run ‐rate in the market at this time.

Q1 GDP Forecasts: Around 5.5% SAAR

by Calculated Risk on 3/12/2021 11:34:00 AM

There was a research note out yesterday that suggested GDP could be back to pre-recession levels by the end of Q1 2021.

Real GDP peaked at $19.254 trillion in Q4 2019 SAAR (Seasonally Adjusted, Annual Rate, 2012 Dollars). In Q4 2020, real GDP was at $18.784 trillion. To increase to the previous peak, real GDP would have to increase at a 10.4% annual rate in Q1 (or upward revisions to previous quarters). That is very unlikely.

From Merrrill Lynch:

We continue to track 5.5% for 1Q GDP. [Mar 12 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 8.6% for 2021:Q1 and 4.0% for 2021:Q2. [Mar 12 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 8.4 percent on March 8, up from 8.3 percent on March 5. [Mar 8 estimate]

Mortgage Equity Withdrawal in Q4 2020

by Calculated Risk on 3/12/2021 10:00:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q4 2020, the Net Equity Extraction was $81 billion, or 1.9% of Disposable Personal Income (DPI) . This is the second highest level of MEW since 2007 (Q3 was higher), but nothing like the amount of equity extraction during the housing bubble as a percent of DPI.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

MEW has been mostly positive for the last five years.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $149 billion in Q4.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 3/12/2021 08:26:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of March 9th.

From Black Knight: Forbearances See Largest Weekly Decline Since Beginning Of 2021

The number of active forbearance plans fell by 77,000 (-2.9%) this week, marking the largest weekly decline since early January 2021. This week’s decline was due to a combination of February month-end expirations as well as the proactive extension and removal of borrowers who were set to see their plans expire at the end of March.The number of loans in forbearance has declined slightly over the last few months.

As of March 9, 2.6 million homeowners remain in forbearance, marking the first time that the forbearance rate has fallen below 5% since early April 2020.

Click on graph for larger image.

While month-end expirations scheduled for the end of March are down from 1.1 million a week ago, there are still more than 800,000 plans currently listed with March month-end expirations. This represents a daunting task for servicers: the need to review hundreds of thousands of upcoming expirations for removal or extension based on recently revised HUD and FHFA allowable terms of up to 18 months for early forbearance entrants.

Early extension activity suggests that servicers are continuing to approach forbearance plans in three-month increments, with the bulk of would-be March expirations being extended out through June.

With more than 800,000 plans still listed with March month-end expirations we’ll be watching the numbers closely over the next few weeks for elevated levels of removal and extension activity.

emphasis added

Thursday, March 11, 2021

March 11 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/11/2021 05:14:00 PM

From Bloomberg on vaccinations as of Mar 11th:

"So far, 98.2 million doses have been given. In the last week, an average of 2.23 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that two days ago, Missouri reported 81,000 previously unreported cases, and that caused the spike in total cases (and an increase in 7 day average).

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.