by Calculated Risk on 3/15/2021 03:09:00 PM

Monday, March 15, 2021

Boston Real Estate in February: Sales Up 7% YoY, Inventory Down 13% YoY

Note: I'm posting data for many local markets around the U.S. The story is the same just about everywhere ... inventory is at record lows.

For Boston (single family and condos):

Closed sales in February 2021 were 1,233, up 6.7% from 1,156 in February 2020.

Active Listings in February 2021 were 2,968, down 12.7% from 3,398 in February 2020.

Second Home Market: South Lake Tahoe

by Calculated Risk on 3/15/2021 12:05:00 PM

Last week, from Jann Swanson at MortgageNewsDaily: Fannie Warns Lenders on Investment Properties and 2nd Homes. This action will result in higher interest rates on 2nd home and investment property mortgages.

I'm looking at data for some second home markets - and will track those markets to see if there is an impact from the lending changes.

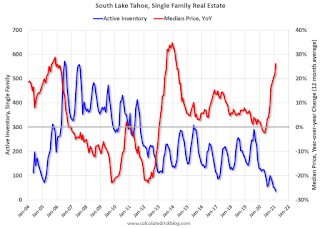

This graph is for South Lake Tahoe since 2004 through February 2021, and shows inventory (blue), and the year-over-year change in the median price (12 month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Note that inventory was high while prices were declining - and significantly lower inventory in 2012 suggested the bust was over. (Tracking inventory helped me call the bottom for housing way back in February 2012, see:The Housing Bottom is Here)

Currently inventory is at a record low, and prices are up sharply. This will be interesting to watch.

Housing Inventory March 15th Update: At Record Lows

by Calculated Risk on 3/15/2021 10:51:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

BLS: January Unemployment rates down in 33 States

by Calculated Risk on 3/15/2021 10:08:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in January in 33 states and the District of Columbia and stable in 17 states, the U.S. Bureau of Labor Statistics reported today. Forty-eight states and the District had jobless rate increases from a year earlier and two states had little change. The national unemployment rate, 6.3 percent, fell by 0.4 percentage point over the month, but was 2.8 points higher than in January 2020.Hawaii is being impacted by the lack of tourism.

Nonfarm payroll employment increased in 20 states, decreased in 2 states, and was essentially unchanged in 28 states and the District of Columbia in January 2021. Over the year, nonfarm payroll employment decreased in 48 states and the District and was essentially unchanged in 2 states.

...

Hawaii and California had the highest unemployment rates in January, 10.2 percent and 9.0 percent, respectively, while South Dakota and Utah had the lowest rates, 3.1 percent each.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 3/15/2021 08:31:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of March 14th.

The seven day average is down 51.1% from the same week in 2019 (48.9% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - and TSA data has moved up in 2021.

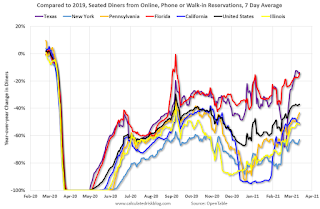

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 13, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is picking up again.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $21 million last week, down about 89% from the median for the week.

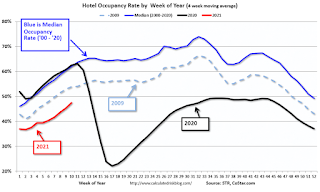

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Even when occupancy increases to 2009 levels, hotels will still be hurting.

This data is through March 6th. Hotel occupancy is currently down 20.5% year-over-year (down 26.7% compared to same week in 2019). Starting next week, the year-over-year comparisons will be easy - since occupancy declined sharply at the onset of the pandemic - but occupancy will still be down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

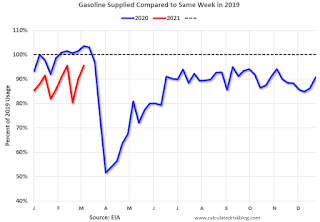

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of March 5th, gasoline supplied was off about 4.5% (about 95.5% of the same week in 2019).

Gasoline supplied will be up year-over-year soon, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through March 11th for the United States and several selected cities.

This data is through March 11th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 56% of the January 2020 level. It is at 50% in Chicago, and 59% in Houston (the dip was a weather related decline) - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, March 12th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, March 14, 2021

Sunday Night Futures

by Calculated Risk on 3/14/2021 08:07:00 PM

Weekend:

• Schedule for Week of March 14, 2021

• FOMC Preview

Monday:

• 8:30 AM ET, The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 14.5, up from 12.1.

• 10:00 AM, State Employment and Unemployment (Monthly) for January 2021

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 4 and DOW futures are up 75 (fair value).

Oil prices were down over the last week with WTI futures at $65.91 per barrel and Brent at $69.48 per barrel. A year ago, WTI was at $29, and Brent was at $28 - so WTI oil prices are UP more than double year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.86 per gallon. A year ago prices were at $2.21 per gallon, so gasoline prices are up $0.65 per gallon year-over-year.

March 14 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/14/2021 06:55:00 PM

From Bloomberg on vaccinations as of Mar 13th:

"So far, 107 million doses have been given. In the last week, an average of 2.39 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that last week, Missouri reported 81,000 previously unreported cases, and that caused the spike in total cases (and an increase in 7 day average).

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

FOMC Preview

by Calculated Risk on 3/14/2021 10:53:00 AM

Expectations are there will be no change to rate policy when the FOMC meets on Tuesday and Wednesday this week, but that the FOMC will upgrade their outlook.

Here are some comments from Merrill Lynch economists:

"The FOMC meeting on the 17th will be one of the most critical events for the Fed in some time. We believe Fed Chair Powell will have to strike the right balance between a more upbeat assessment of the outlook and the asymmetric FAIT [flexible average inflation targeting] reaction function. The result will be an acknowledgement that liftoff is earlier than believed back in mid-December but that it is still later than markets currently believe. ...For review, below are the December FOMC projections.

[W]e expect the latest projections to show material upward revisions from the December SEP. We expect growth this year to be revised by at least 1.5ppt to a range of 5.7% - 6.0% 4Q/4Q reflecting the effects of the American Rescue Plan and the improving outlook on the virus situation. ... The unemployment rate is likely to be revised down across the forecast horizon, showing a faster reduction in labor market slack. However, it will be relatively modest compared to the upgrade in growth, suggesting a stronger labor force recovery. This will in turn support modest upward revisions to core PCE inflation such that the 2023 forecast will show an overshoot of the Fed’s target. These ingredients — the unemployment rate at pre-pandemic levels and inflation modestly above target – will be enough to warrant one hike by the Fed in 2023."

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | -2.5 to -2.2 | 3.7 to 5.0 | 3.0 to 3.5 | 2.2 to 2.7 |

Note that GDP decreased 2.4% Q4-over-Q4 in Q4 2020. That was close to the bottom of the December projections. GDP would have to increase 10.4% in Q1 to return to the pre-recession peak in Q4 2019 (unlikely).

Many forecasters are optimistic about a very strong recovery in 2021, for example, from Goldman Sachs economists this weekend:

"In light of the larger fiscal package just enacted, we now expect slightly higher GDP growth of +6% / +11% / +8.5% / +6.5% in 2021Q1-Q4 which implies +7.0% in 2021 on a full-year basis (vs. +5.5% consensus) and +8.0% on a Q4/Q4 basis (vs. +6.0% consensus)."

The unemployment rate was at 6.2% in February.

Merrill's view is the unemployment rate forecasts will be revised down, but "will be relatively modest compared to the upgrade in growth". The decline in the unemployment rate depends on both job growth, and the participation rate. A strong labor market will probably encourage people to return to the labor force, and the improvements in the unemployment rate might be slower than some expect.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 6.7 to 6.8 | 4.7 to 5.4 | 3.8 to 4.6 | 3.5 to 4.3 |

As of January 2020, PCE inflation was up 1.5% from January 2020.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.2 | 1.7 to 1.9 | 1.8 to 2.0 | 1.9 to 2.1 |

PCE core inflation was up 1.5% in January year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | 2023 |

| Dec 2020 | 1.4 | 1.7 to 1.8 | 1.8 to 2.0 | 1.9 to 2.1 |

My guess is core PCE inflation (year-over-year) will increase in 2021 (from the current 1.5%), but I think too much inflation will NOT be a concern in 2021. Since we saw negative MoM PCE and core PCE readings in March and April, we should ignore a jump in YoY inflation in March, April and May.

Saturday, March 13, 2021

March 13 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/13/2021 06:16:00 PM

From Bloomberg on vaccinations as of Mar 13th:

"So far, 106 million doses have been given. In the last week, an average of 2.54 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

Note that four days ago, Missouri reported 81,000 previously unreported cases, and that caused the spike in total cases (and an increase in 7 day average).

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Schedule for Week of March 14, 2021

by Calculated Risk on 3/13/2021 08:11:00 AM

The key reports this week are February Retail Sales and Housing Starts.

For manufacturing, the February Industrial Production report and the March NY and Philly Fed manufacturing surveys will be released.

The FOMC meets this week, and no change to policy is expected.

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 14.5, up from 12.1.

10:00 AM: State Employment and Unemployment (Monthly) for January 2021

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.5% decrease in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.5% decrease in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 8.6% on a YoY basis in January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 75.8%.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 83, down from 84. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. This graph shows single and total housing starts since 1968.

The consensus is for 1.570 million SAAR, down from 1.580 million SAAR.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a increase to 715 thousand from 712 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of 24.5, up from 23.1.

No major economic releases scheduled.