by Calculated Risk on 3/22/2021 12:09:00 PM

Monday, March 22, 2021

Comments on February Existing Home Sales

Earlier: NAR: Existing-Home Sales Decreased to 6.22 million in February

A few key points:

1) This was the highest sales rate for February since 2006, and the 2rd highest sales for February on record. Some of the increase over the last eight months was probably related to pent up demand from the shutdowns in March and April. Other reasons include record low mortgage rates, a move away from multi-family rentals, strong second home buying (to escape the high-density cities), a strong stock market and favorable demographics.

2) Inventory is very low, and was down 29.5% year-over-year (YoY) in January. Also, as housing economist Tom Lawler has noted, the local MLS data shows even a larger decline in active inventory (the NAR appears to include some pending sales in inventory). Lawler noted:

"As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months."

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales by month for 2020 and 2021.

The year-over-year comparisons will be easy in the first half of 2021 - especially in April, May and June - and then difficult in the second half of the year.

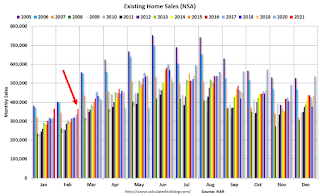

The second graph shows existing home sales for each month, Not Seasonally Adjusted (NSA), since 2005.

Sales NSA in February (364,000) were 8.7% above sales last year in February (335,000).

Sales NSA in February (364,000) were 8.7% above sales last year in February (335,000).This was the highest sales for February (NSA) since 2006.

NAR: Existing-Home Sales Decreased to 6.22 million in February

by Calculated Risk on 3/22/2021 10:09:00 AM

From the NAR: Existing-Home Sales Descend 6.6% in February

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.6% from January to a seasonally-adjusted annual rate of 6.22 million in February. Sales in total climbed year-over-year, up 9.1% from a year ago (5.70 million in February 2020).Note: January was revised down from 6.69 million to 6.66 million SAAR.

Total housing inventory at the end of February amounted to 1.03 million units, equal to January’s inventory and down 29.5% from one year ago (1.46 million). Unsold inventory sits at a 2.0-month supply at the current sales pace, slightly up from January’s 1.9-month supply and down from the 3.1-month amount recorded in February 2020. NAR first began tracking the single-family home supply in 1982.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (6.22 million SAAR) were down 6.6% from last month, and were 9.1% above the February 2020 sales rate.

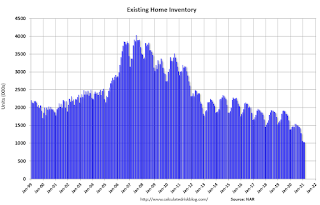

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was unchanged at 1.03 million in February from 1.03 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory was unchanged at 1.03 million in February from 1.03 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 29.5% year-over-year in February compared to February 2020.

Inventory was down 29.5% year-over-year in February compared to February 2020. Months of supply was increased to 2.0 months in February from 1.9 months in January (tied for all time low).

This was below the consensus forecast. I'll have more later.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 3/22/2021 08:17:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of March 21st.

The seven day average is down 44.6% from the same week in 2019 (55.4% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - and TSA data has moved up in 2021.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 20, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is picking up again - and is actually up compared to 2019 in Texas.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $17 million last week, down about 91% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Even when occupancy increases to 2009 levels, hotels will still be hurting.

This data is through March 13th. Hotel occupancy is currently down 1.4% year-over-year (down 25.8% compared to same week in 2019). Starting next week, occupancy will be up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy will still be down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of March 12th, gasoline supplied was off about 10.3% (about 89.7% of the same week in 2019).

Gasoline supplied will be up year-over-year soon, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through March 20th for the United States and several selected cities.

This data is through March 20th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 59% of the January 2020 level. It is at 52% in Chicago, and 60% in Houston (the Houston dip was a weather related decline) - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, March 19th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, March 21, 2021

Monday: Existing Home Sales

by Calculated Risk on 3/21/2021 08:19:00 PM

Weekend:

• Schedule for Week of March 21, 2021

• Housing: Active Inventory down around 50% YoY

• Lawler: Update on the Dismal Demographics of 2020; "Smallest Population increase since 1918"

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 9:00 AM, Discussion, Fed Chair Powell, How Can Central Banks Innovate in the Digital Age?, At the Bank for International Settlements Innovation Summit

• At 10:00 AM, Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.50 million SAAR, down from 6.69 million. Housing economist Tom Lawler expects the NAR to report sales of 6.29 million SAAR for February.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 5 and DOW futures are down 45 (fair value).

Oil prices were down over the last week with WTI futures at $60.87 per barrel and Brent at $63.98 per barrel. A year ago, WTI was at $19, and Brent was at $26 - so WTI oil prices are UP sharply year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.87 per gallon. A year ago prices were at $2.08 per gallon, so gasoline prices are up $0.79 per gallon year-over-year.

March 21 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/21/2021 04:22:00 PM

According to the CDC, 124.5 million doses have been administered. 17.1% of the population over 18 is fully vaccinated, and 31.5 of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

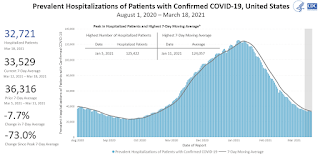

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Lawler: Update on the Dismal Demographics of 2020; "Smallest Population increase since 1918"

by Calculated Risk on 3/21/2021 08:11:00 AM

CR Note: Back in November, housing economist Tom Lawler wrote The Dismal Demographics of 2020.

Here is an update from Tom Lawler:

Updated provisional data released by the CDC indicates that the US “demographics” in 2020 was even more dismal that what I indicated in my November report of last year. Provisional data through this week show that there were over 3.36 million deaths in 2020.

Deaths: US deaths last year were up by 17.8% from 2019. Given reporting lags in some states the total death count for last year will be somewhat higher than that shown in the table below, these number will probably be pretty close to the total.

| US Deaths by Selected Age Groups | ||||

|---|---|---|---|---|

| 2019 | 2020 | Change | % Change | |

| TOTAL | 2,854,838 | 3,364,312 | 509,474 | 17.8% |

| <1 | 20,921 | 19,182 | -1,739 | -8.3% |

| 1 to 4 | 3,676 | 3,474 | -202 | -5.5% |

| 5 to 14 | 5,497 | 5,570 | 73 | 1.3% |

| 15 to 24 | 29,771 | 35,646 | 5,875 | 19.7% |

| 25 to 34 | 59,178 | 73,030 | 13,852 | 23.4% |

| 35 to 44 | 82,986 | 103,822 | 20,836 | 25.1% |

| 45 to 54 | 160,393 | 190,155 | 29,762 | 18.6% |

| 55 to 64 | 374,937 | 438,193 | 63,256 | 16.9% |

| 65 to 74 | 555,559 | 670,543 | 114,984 | 20.7% |

| 75 to 84 | 688,027 | 817,063 | 129,036 | 18.8% |

| 85+ | 873,746 | 1,007,461 | 133,715 | 15.3% |

| Not Stated | 147 | 173 | 26 | 17.7% |

| Source: CDC; "Not Stated" for 2020 assumed to grow by same amount as total | ||||

While Covid-19 deaths were obviously the major reason for the spike in deaths last year, deaths not directly attributable to Covid-19 also increased significantly last year, especially (in % terms) for the 15-44 year old age groups. This increase may reflect Covid-related deaths not identified as such, the effect of some people not seeking medical help because of the pandemic, and a sharp rise in deaths related to drug overdoses.

On the latter point, provisional CDC data (adjusted for estimated underreporting) show that there were an estimated 88,295 drug overdose deaths in the 12-month period ending August 2020, up 26.8% from drug overdose deaths in the 12-month period ending August 2019.

| US Deaths Not Directly Attributable to Covid-19 | ||||

|---|---|---|---|---|

| 2019 | 2020 | Change | % Change | |

| TOTAL | 2,854,691 | 2,985,526 | 130,835 | 4.6% |

| <1 | 20,921 | 19,139 | -1,782 | -8.5% |

| 1 to 4 | 3,676 | 3,450 | -226 | -6.1% |

| 5 to 14 | 5,497 | 5,503 | 6 | 0.1% |

| 15 to 24 | 29,771 | 35,058 | 5,287 | 17.8% |

| 25 to 34 | 59,178 | 70,495 | 11,317 | 19.1% |

| 35 to 44 | 82,986 | 97,187 | 14,201 | 17.1% |

| 45 to 54 | 160,393 | 172,197 | 11,804 | 7.4% |

| 55 to 64 | 374,937 | 393,395 | 18,458 | 4.9% |

| 65 to 74 | 555,559 | 589,712 | 34,153 | 6.1% |

| 75 to 84 | 688,027 | 712,663 | 24,636 | 3.6% |

| 85+ | 873,746 | 886,727 | 12,981 | 1.5% |

| Source: CDC; Excludes "Not Stated" | ||||

Births: Provisional CDC data through September 2020 suggest that the multi-year downtrend in US births accelerated last year. According to these data, there were an estimated 2.729 million US births from January to September of last year, down 3.1% from the comparable period of 2019. If full year births for 2020 are down by the same Percentage from 2019, then US births for 2020 will total just 3.632 million, the lowest number of births since 1981.

“Natural” Increase: Based on these death and birth data, the so-called “natural” increase in the US population (births minus deaths) totaled just 267,894 last year, the lowest such increase in what I believe is over a century.

| Population Change, ex-Migration | |||

|---|---|---|---|

| Year | Births | Deaths | Births - Deaths |

| 2020 (est) | 3,632,206 | 3,364,312 | 267,894 |

| 2019 | 3,745,450 | 2,854,838 | 890,612 |

| 2018 | 3,791,792 | 2,839,205 | 952,587 |

| 2017 | 3,855,500 | 2,813,503 | 1,041,997 |

| 2016 | 3,945,875 | 2,744,248 | 1,201,627 |

| 2015 | 3,978,497 | 2,712,630 | 1,265,867 |

| 2014 | 3,988,976 | 2,626,418 | 1,362,558 |

| 2013 | 3,932,181 | 2,596,993 | 1,335,188 |

| 2012 | 3,952,841 | 2,543,279 | 1,409,562 |

| 2011 | 3,953,590 | 2,515,458 | 1,438,132 |

| 2010 | 3,999,386 | 2,468,435 | 1,530,951 |

| 2009 | 4,130,665 | 2,437,163 | 1,693,502 |

| 2008 | 4,247,694 | 2,471,984 | 1,775,710 |

Net International Migration: While there is little doubt that combination of the pandemic and Trump administration policies resulted in a sharp decline in net international migration (immigration minus emigration), from what level to what level is not at all clear. There are not any good, timely data on either immigration or (especially) emigration, and historical data are not very reliable.

However, the State Department issues data on monthly immigrant visas issued, and in calendar year 2020 there were just 165,426 immigrant visas issued, down 64.2% from the previous year.

Click on graph for larger image.

Click on graph for larger image.It would not be too surprising if net international migration last year totaled only around 250,000. If that were the case, then the US population in 2020 increased by just 517,894 (or about 0.16%), the smallest increase since 1918, when war and a pandemic resulted in a small population decline.

Saturday, March 20, 2021

March 20 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/20/2021 04:16:00 PM

According to the CDC, 121.4 million doses have been administered. 16.7% of the population over 18 is fully vaccinated, and 30.7% of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Housing: Active Inventory down around 50% YoY

by Calculated Risk on 3/20/2021 01:24:00 PM

Yesterday I posted Some thoughts on Housing Inventory. I noted:

"It is likely the NAR [National Association of Realtors®] is overstating inventory since many MLSs include pending in the number of listings (as opposed to just active listings)."Housing economist Tom Lawler sent me the following graph.

This shows the YoY change in inventory for Realtor.com (with and without pending sales), and the YoY change in inventory from the NAR.

Click on graph for larger image.

Click on graph for larger image.This shows that the NAR report is similar to Realtor.com including pending sales.

Las Vegas Visitor Authority: No Convention Attendance, Visitor Traffic Down 64% YoY in January

by Calculated Risk on 3/20/2021 10:03:00 AM

From the Las Vegas Visitor Authority: January 2021 Las Vegas Visitor Statistics

Continued COVID impacts and the resulting absence of conventions and major tradeshows such as CES, World of Concrete, etc., translated to significant YoY declines in Jan visitation, occupancy and ADR. Las Vegas hosted roughly 1.3M visitors in Jan 2021, down -63.5% YoY.

Total occupancy for Jan improved MoM to 31.6% from 30.9% in Dec but was down from 85.9% in Jan 2020. While Weekend occupancy (48.3%) improved slightly MoM over Dec 2020, the temporarily dormant convention segment resulted in Midweek occupancy at 22.5%, down -61.3 pts YoY.

Average daily rates among open properties reached $90.71 (down -40.9% YoY) while RevPAR came in at approx. $28.66, down -78% vs. Jan 2020.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 63.5% year-over-year.

The casinos started to reopen on June 4th (it appears about 97% of rooms have now opened).

Convention traffic was non-existent again in January, and was down 100% compared to January 2020.

Schedule for Week of March 21, 2021

by Calculated Risk on 3/20/2021 08:11:00 AM

The key reports this week are the third estimate of Q4 GDP, February New and Existing Home Sales, and February Personal Income and Outlays.

For manufacturing, the March Richmond and Kansas City manufacturing surveys will be released.

Also Fed Chair Powell testifies on the Coronavirus Aid, Relief, and Economic Security Act.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

9:00 AM: Discussion, Fed Chair Powell, How Can Central Banks Innovate in the Digital Age?, At the Bank for International Settlements Innovation Summit

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.50 million SAAR, down from 6.69 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.50 million SAAR, down from 6.69 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 6.29 million SAAR for February.

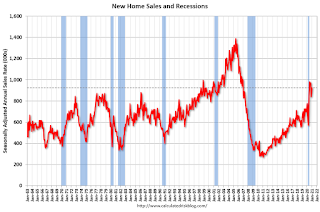

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 885 thousand SAAR, down from 923 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

12:00 PM: Testimony, Fed Chair Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Financial Services, U.S. House of Representatives

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

10:00 AM: Testimony, Fed Chair Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 740 thousand from 770 thousand last week.

8:30 AM: Gross Domestic Product, 4th quarter 2020 (Third estimate). The consensus is that real GDP increased 4.1% annualized in Q4, the same as the second estimate of 4.1%.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM ET: Personal Income and Outlays, February. The consensus is for a 7.0% decrease in personal income, and for a 0.6% decrease in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 83.5.

10:00 AM: State Employment and Unemployment (Monthly), February 2021