by Calculated Risk on 3/25/2021 08:40:00 AM

Thursday, March 25, 2021

Weekly Initial Unemployment Claims decreased to 684,000

The DOL reported:

In the week ending March 20, the advance figure for seasonally adjusted initial claims was 684,000, a decrease of 97,000 from the previous week's revised level. The previous week's level was revised up by 11,000 from 770,000 to 781,000. The 4-week moving average was 736,000, a decrease of 13,000 from the previous week's revised average. The previous week's average was revised up by 2,750 from 746,250 to 749,000.This does not include the 241,745 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 284,254 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 736,000.

The previous week was revised up.

Regular state continued claims decreased to 3,870,000 (SA) from 4,134,000 (SA) the previous week.

Note: There are an additional 7,735,491 receiving Pandemic Unemployment Assistance (PUA) that increased from 7,616,593 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,551,215 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 4,816,523.

Weekly claims were lower than the consensus forecast.

Q4 GDP Growth Revised up to 4.3% Annual Rate; PCE Growth Revised Down to 2.3%

by Calculated Risk on 3/25/2021 08:34:00 AM

From the BEA: Gross Domestic Product, (Third Estimate), GDP by Industry, and Corporate Profits, Fourth Quarter and Year 2020

Real gross domestic product (GDP) increased at an annual rate of 4.3 percent in the fourth quarter of 2020, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 33.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down to 2.3% from 2.4%. Residential investment was revised up from 35.8% to 36.6%. This was above the consensus forecast.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 4.1 percent. The upward revision primarily reflected an upward revision to private inventory investment that was partly offset by a downward revision to nonresidential fixed investment

emphasis added

Wednesday, March 24, 2021

Thursday: Q4 GDP, Unemployment Claims

by Calculated Risk on 3/24/2021 09:00:00 PM

On Thursday, from 11:30 AM - 12:30 PM (PST), UCI Professor Chris Schwarz talks on the economy and financial markets. This webinar is free for all and brought to you by UCI's Paul Merage School of Business and Center for Investment and Wealth Management as well as the Newport Beach Chamber of Commerce.

Chris' presentations are great. This is free. Register here

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 740 thousand from 770 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 4th quarter 2020 (Third estimate). The consensus is that real GDP increased 4.1% annualized in Q4, the same as the second estimate of 4.1%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

March Vehicle Sales Forecast: Bounce Back from Weather Impacted Sales in February

by Calculated Risk on 3/24/2021 05:23:00 PM

From WardsAuto: U.S. Light Vehicle Sales & Inventory Forecast, March 2021 (pay content)

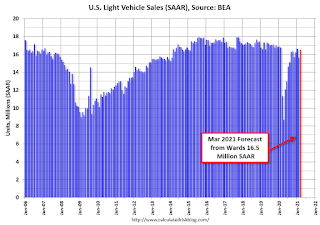

This graph shows actual sales from the BEA (Blue), and Wards forecast for March (Red).

The weather impacted sales in February, and sales are expected to bounce back in March to close to the January level.

The Wards forecast of 16.5 million SAAR, would be up about 5% from last month, and up 45% from a year ago (sales collapsed in March 2020).

March 24 COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 3/24/2021 04:12:00 PM

According to the CDC, 130.5 million doses have been administered. 17.9% of the population over 18 is fully vaccinated, and 33% of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Jim the Realtor: "Number of Offers"

by Calculated Risk on 3/24/2021 12:30:00 PM

Long term readers will remember me mentioning my friend "Jim the Realtor" in San Diego during the housing bubble and bust.

Jim wrote a post today about the number of offers for listings in San Diego: Number of Offers

CR Note: I'd call this a hot seller's market.[H]ere’s a review of properties that have gone pending this week ... They had EIGHTEEN OFFERS on this one, because it checks most of the boxes. Well-priced single-level with nice private yard that’s been tastefully renovated. The 17 other buyers will be battling it out for months on these!

DOT: Vehicle Miles Driven decreased 9.6% year-over-year in January

by Calculated Risk on 3/24/2021 09:42:00 AM

This will be something to watch as the economy recovers.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -11.3% (-28.4 billion vehicle miles) for January 2021 as compared with January 2020. Travel for the month is estimated to be 223.3 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for January 2021 is 247.1 billion miles, a -9.6% (-26.2 billion vehicle miles) decline from January 2020. It also represents 1.2% increase (2.8 billion vehicle miles) compared with December 2020.

Cumulative Travel for 2021 changed by -11.3% (-28.4 billion vehicle miles). The cumulative estimate for the year is 223.3 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Miles driven declined during the great recession, and the rolling 12 months stayed below the previous peak for a record 85 months.

Miles driven declined sharply in March, and really collapsed in April.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/24/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 19, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 13 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 26 percent higher than the same week one year ago.

“The 30-year fixed mortgage rate increased to 3.36 percent last week and has now risen 50 basis points since the beginning of the year, in turn shutting off refinance incentives for many borrowers. Refinance activity dropped to its slowest pace since September 2020, with declines in both conventional and government applications. Mortgage rates have moved higher in tandem with Treasury yields, as the outlook for the U.S. economy continues to improve amidst the faster vaccine rollout and states easing pandemic-related restrictions,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications were strong over the week, driven both by households seeking more living space and younger households looking to enter homeownership. The purchase index increased for the fourth consecutive week and was up 26 percent from last year’s pace. The average purchase loan balance increased again, both by quickening home-price growth and a rise in higher-balance conventional applications.”

Added Kan, “Inadequate housing inventory continues to put upward pressure on home prices. As both home-price growth and mortgage rates continue this upward trend, we may see affordability challenges become more severe if new and existing supply does not significantly pick up.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.36 percent from 3.28 percent, with points increasing to 0.42 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but falling as rates rise.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 26% year-over-year unadjusted.

According to the MBA, purchase activity is up 26% year-over-year unadjusted.Note: For the next 8 or 9 weeks, the MBA index will be up sharply year-over-year since purchase activity collapsed in late March 2020 in the early weeks of the pandemic.

Note: Red is a four-week average (blue is weekly).

Tuesday, March 23, 2021

Wednesday: Fed Chair Powell, Durable Goods

by Calculated Risk on 3/23/2021 09:11:00 PM

On Thursday, from 11:30 AM - 12:30 PM (PST), UCI Professor Chris Schwarz talks on the economy and financial markets. This webinar is free for all and brought to you by UCI's Paul Merage School of Business and Center for Investment and Wealth Management as well as the Newport Beach Chamber of Commerce.

Chris' presentations are great. This is free. Register here

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

• At 10:00 AM, Testimony, Fed Chair Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

• During the day, The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

March 23 COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 3/23/2021 05:13:00 PM

According to the CDC, 128.2 million doses have been administered. 17.6% of the population over 18 is fully vaccinated, and 32.4% of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.