by Calculated Risk on 3/25/2021 09:00:00 PM

Thursday, March 25, 2021

Friday: February Personal Income and Outlays

Friday:

• At 8:30 AM ET, Personal Income and Outlays, February. The consensus is for a 7.0% decrease in personal income, and for a 0.6% decrease in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 83.5.

• Also at 10:00 AM, State Employment and Unemployment (Monthly), February 2021

Freddie Mac: Mortgage Serious Delinquency Rate decreased in February

by Calculated Risk on 3/25/2021 04:40:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was 2.52%, down from 2.56% in January. Freddie's rate is up from 0.60% in February 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.14%, down from 0.16% in January, and up almost double from 0.08% in February 2020.

March 25 COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 3/25/2021 04:28:00 PM

According to the CDC, 133.5 million doses have been administered. 18.3% of the population over 18 is fully vaccinated, and 33.7% of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

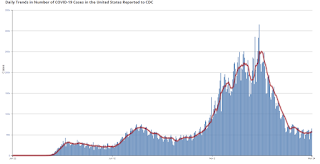

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

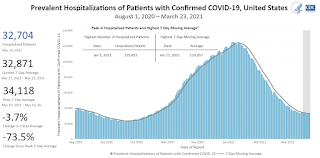

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Kansas City Fed: Tenth District Manufacturing Activity "Grew Solidly" in March

by Calculated Risk on 3/25/2021 02:10:00 PM

From the Kansas City Fed: Tenth District Manufacturing Activity Grew Solidly

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity grew solidly compared to a month ago and a year ago with positive expectations for future activity.These regional surveys have been strong in March.

“Regional factories continued to report solid growth in March,” said Wilkerson. “Materials prices remain extremely high for most firms. However, many manufacturers have been able to pass through at least a portion of the price increases on to customers.”

...

The month-over-month composite index was 26 in March, higher than 24 in February and 17 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The growth in district manufacturing activity was driven more by durable goods plants for primary metals, machinery, transportation equipment, furniture, and miscellaneous manufacturing. Month-over-month indexes for shipments, new orders, and order backlog expanded at a faster pace in March and supplier delivery time was very high as well. Growth in production and employment remained positive, but slightly slower than in recent months. Materials inventories were positive while finished goods inventories dipped further from a month ago. Year-over-year factory indexes rose in March, and business conditions are now comparable to levels at the start of the pandemic last year. The year-over-year composite index increased from 8 to 16, but new orders for exports and finished goods inventories continued to lag year-ago levels. The future composite index expanded slightly from 34 to 35 with an uptick in employment expectations.

emphasis added

Hotels: Occupancy Rate Highest in a Year; Down 15% Compared to Same Week in 2019

by Calculated Risk on 3/25/2021 12:57:00 PM

Note: Starting this week, the year-over-year comparisons are easy - since occupancy declined sharply at the onset of the pandemic - but occupancy is still down significantly from normal levels.

The occupancy rate is down 15.4% compared to the same week in 2019.

U.S. weekly hotel occupancy jumped almost seven points from the previous week to the highest level in the country since early March 2020, according to STR‘s latest data through March 20, 2021.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

March 14-20, 2021:

• Occupancy: 58.9%

• verage daily rate (ADR): US$108.07

• Revenue per available room (RevPAR): US$63.62

The 58.9% absolute occupancy was a 93.9% increase from the comparable, pandemic-affected week last year, but more importantly, represented almost 85% of occupancy regained from the 2019 benchmark. There was also more improvement in ADR, which reached 81% of the comparable 2019 level.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

AIA: "Architecture billings climb into positive territory after a year of monthly declines" in February

by Calculated Risk on 3/25/2021 10:50:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings climb into positive territory after a year of monthly declines

Continuing the positive momentum of a nearly three-point bump in January, the Architecture Billings Index (ABI) reached its first positive mark since February 2020, according to a new report today from The American Institute of Architects (AIA).

AIA’s ABI score for February was 53.3 compared to 44.9 in January (any score above 50 indicates an increase in billings). February also marked the first time the design contract score rose back into positive territory since the pandemic began with a score of 51.6 compared to 48.8 in January. The new project inquiries score for February reached a 22-month high water mark with a score of 61.2 compared to 56.8 in January.

“Hopefully, this is the start of a more sustained recovery. It is possible that scores will continue to bounce above and below 50 for the next few months, as recoveries often move in fits and starts,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Beyond the encouraging billing data, architecture employment added 700 new positions in January and has now regained 45 percent of the jobs that were lost since the beginning of the pandemic.”

...

• Regional averages: South (52.4); West (49.5); Midwest (49.3); Northeast (46.9)

• Sector index breakdown: mixed practice (52.5); commercial/industrial (50.5); multi-family residential (48.3); institutional (47.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 55.3 in February, up from 44.9 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index was been below 50 for eleven consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through most of 2021 (This usually leads CRE investment by 9 to 12 months).

The weakness over the last year was not surprising since certain segments of CRE are struggling, especially offices and retail.

Weekly Initial Unemployment Claims decreased to 684,000

by Calculated Risk on 3/25/2021 08:40:00 AM

The DOL reported:

In the week ending March 20, the advance figure for seasonally adjusted initial claims was 684,000, a decrease of 97,000 from the previous week's revised level. The previous week's level was revised up by 11,000 from 770,000 to 781,000. The 4-week moving average was 736,000, a decrease of 13,000 from the previous week's revised average. The previous week's average was revised up by 2,750 from 746,250 to 749,000.This does not include the 241,745 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 284,254 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 736,000.

The previous week was revised up.

Regular state continued claims decreased to 3,870,000 (SA) from 4,134,000 (SA) the previous week.

Note: There are an additional 7,735,491 receiving Pandemic Unemployment Assistance (PUA) that increased from 7,616,593 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,551,215 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 4,816,523.

Weekly claims were lower than the consensus forecast.

Q4 GDP Growth Revised up to 4.3% Annual Rate; PCE Growth Revised Down to 2.3%

by Calculated Risk on 3/25/2021 08:34:00 AM

From the BEA: Gross Domestic Product, (Third Estimate), GDP by Industry, and Corporate Profits, Fourth Quarter and Year 2020

Real gross domestic product (GDP) increased at an annual rate of 4.3 percent in the fourth quarter of 2020, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 33.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down to 2.3% from 2.4%. Residential investment was revised up from 35.8% to 36.6%. This was above the consensus forecast.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 4.1 percent. The upward revision primarily reflected an upward revision to private inventory investment that was partly offset by a downward revision to nonresidential fixed investment

emphasis added

Wednesday, March 24, 2021

Thursday: Q4 GDP, Unemployment Claims

by Calculated Risk on 3/24/2021 09:00:00 PM

On Thursday, from 11:30 AM - 12:30 PM (PST), UCI Professor Chris Schwarz talks on the economy and financial markets. This webinar is free for all and brought to you by UCI's Paul Merage School of Business and Center for Investment and Wealth Management as well as the Newport Beach Chamber of Commerce.

Chris' presentations are great. This is free. Register here

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 740 thousand from 770 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 4th quarter 2020 (Third estimate). The consensus is that real GDP increased 4.1% annualized in Q4, the same as the second estimate of 4.1%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

March Vehicle Sales Forecast: Bounce Back from Weather Impacted Sales in February

by Calculated Risk on 3/24/2021 05:23:00 PM

From WardsAuto: U.S. Light Vehicle Sales & Inventory Forecast, March 2021 (pay content)

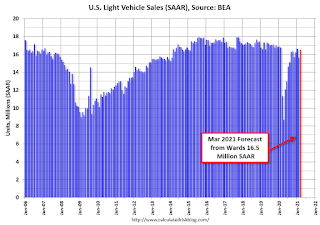

This graph shows actual sales from the BEA (Blue), and Wards forecast for March (Red).

The weather impacted sales in February, and sales are expected to bounce back in March to close to the January level.

The Wards forecast of 16.5 million SAAR, would be up about 5% from last month, and up 45% from a year ago (sales collapsed in March 2020).