by Calculated Risk on 3/27/2021 08:11:00 AM

Saturday, March 27, 2021

Schedule for Week of March 28, 2021

The key report scheduled for this week is the March employment report on Friday.

Other key reports include January Case-Shiller house prices and March Auto Sales.

For manufacturing, the March Dallas Fed survey and the ISM Manufacturing survey will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

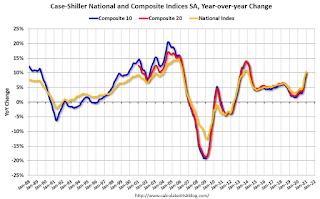

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 10.7% year-over-year increase in the Comp 20 index.

9:00 AM: FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 550,000 payroll jobs added in March, up from 117,000 added in February.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 60.3, up from 59.5 in February.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 2.6% decrease in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 650 thousand from 684 thousand last week.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.5 million SAAR in March, up from 15.7 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 16.5 million SAAR in March, up from 15.7 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 61.2, up from 60.8 in February.

10:00 AM: Construction Spending for February. The consensus is for a 0.9% decrease in construction spending.

8:30 AM: Employment Report for February. The consensus is for 565,000 jobs added, and for the unemployment rate to decrease to 6.0%.

8:30 AM: Employment Report for February. The consensus is for 565,000 jobs added, and for the unemployment rate to decrease to 6.0%.There were 379,000 jobs added in February, and the unemployment rate was at 6.2%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, and is still at the worst of the "Great Recession".

Friday, March 26, 2021

Real Personal Income less Transfer Payments

by Calculated Risk on 3/26/2021 10:23:00 PM

Government transfer payments decreased sharply in February compared to January, but were still $1 trillion (on SAAR basis) above the February 2020 level. Most of the increase in transfer payments - compared to the level prior to the crisis - is from unemployment insurance and "other" (includes direct payments).

This table shows the amount of unemployment insurance and "Other" transfer payments since February 2020 (pre-crisis level). The increase in "Other" was mostly due to other parts of the relief acts (including direct payments).

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Feb-20 | $506 | $28 |

| Mar-20 | $515 | $74 |

| Apr-20 | $3,379 | $493 |

| May-20 | $1,360 | $1,356 |

| Jun-20 | $758 | $1,405 |

| Jul-20 | $760 | $1,331 |

| Aug-20 | $692 | $636 |

| Sep-20 | $936 | $359 |

| Oct-20 | $732 | $304 |

| Nov-20 | $620 | $281 |

| Dec-20 | $654 | $304 |

| Jan-21 | $2,357 | $556 |

| Feb-21 | $781 | $537 |

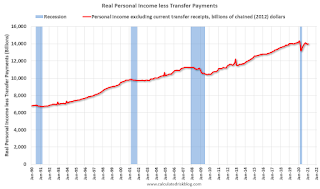

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

Click on graph for larger image.

Click on graph for larger image.This graph shows real personal income less transfer payments since 1990.

This measure of economic activity increased 0.2% in February, compared to January, and was down 2.5% compared to February 2020 (previous peak).

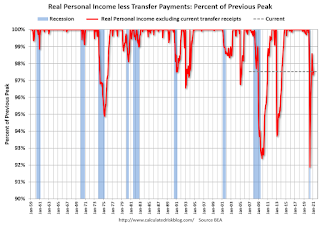

Another way to look at this data is as a percent of the previous peak.

Another way to look at this data is as a percent of the previous peak.Real personal income less transfer payments was off 8.1% in April. This was a larger decline than the worst of the great recession.

Currently personal income less transfer payments are still off 2.5% (dashed line).

March 26 COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 3/26/2021 04:02:00 PM

According to the CDC, 136.7 million doses have been administered. 18.8% of the population over 18 is fully vaccinated, and 34.6% of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

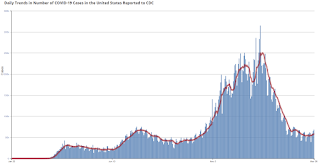

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

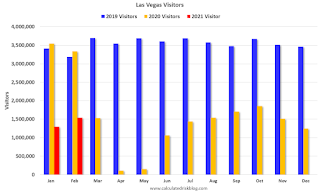

Las Vegas Visitor Authority: No Convention Attendance, Visitor Traffic Down 54% YoY in February

by Calculated Risk on 3/26/2021 01:35:00 PM

From the Las Vegas Visitor Authority: February 2021 Las Vegas Visitor Statistics

Although less than half of prior year levels, February's visitor tally of approx. 1.54M visitors reflected a welcome MoM increase of 18.9% over Jan 2021 as the vaccine rollout & continued protocols helped control the COVID spikes that emerged in Dec and Jan.

Total occupancy for Feb improved to 42.0%, 10.4 percentage points over Jan 2021, but was down from 86.8% in Feb 2020. Weekend occupancy (62.8%) and Midweek occupancy (32.1%) saw MoM gains over Jan of 14.5 pts and 9.6 pts, respectively.

Average daily rates reached $98 (up 8.1% MoM, down -25.8% YoY) while RevPAR came in at approx. $41.17, down -64.1% vs. Feb 2020.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 53.8% year-over-year.

Convention traffic was non-existent again in February, and was down 100% compared to February 2020.

Note: A convention is scheduled for early June (HT MS): "Informa Markets, organizers of the World of Concrete, has received approval from the Nevada Department of Business and Industry to move forward with its 2021 in-person edition. The event is scheduled to be held June 8-10, 2021 at the Las Vegas Convention Center."

Q1 GDP Forecasts

by Calculated Risk on 3/26/2021 11:21:00 AM

Note that the forecasts of the automated systems (based on released data) are declining, whereas the forecasts of economists have been increasing anticipating strong growth in economic activity in March due to the American Rescue Plan Act of 2021. From BofA yesterday:

"Total card spending, as measured by BAC aggregated card data, increased 45% 1-yr and 23% 2-yr for the 7-days ending Mar 20. The strong gain owes to the latest stimulus: total card spending for stimulus recipients is running 40% above the Feb avg."From Merrill Lynch:

1Q GDP tracking stands at 7.0% qoq saar. [Mar 26 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +7.5% (qoq ar). [Mar 26 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 6.1% for 2021:Q1 and 0.7% for 2021:Q2. [Mar 26 estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 4.7 percent on March 26, down from 5.4 percent on March 24. [Mar 26 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 3/26/2021 10:52:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of March 23rd.

From Black Knight: Another Week of Improvement in Forbearance Numbers

Active forbearance plans fell again this week, dropping by another 19,000 (-0.7%) from last Tuesday. In total, this puts the number of active plans down by 134,000 over the last month – a 5% reduction. This monthly decline represents the strongest rate of improvement since late November 2020 and is a direct result of servicers working through the 1.2 million plans that entered this month with scheduled March month-end expirations for extension and/or removal.The number of loans in forbearance has slowly declined over the last few months.

Of particular note when taking a look at this week’s numbers: even with such strong monthly improvement, there are still more than 460,000 active plans with March month-end expirations, which provides the potential for additional improvement in the coming weeks.

...

Click on graph for larger image.

Early extension activity suggests that mortgage servicers continue to approach forbearance plans in three-month increments, with the bulk of would-be March expirations being extended out through June. Plan extensions have accounted for 75% of all extension/removal activity in recent weeks, but removals are up simply as a result of the volume of expirations that were scheduled for this month.

Finally, the McDash Flash Payment Tracker shows that 90.7% of observed borrowers had made their payment through March 22, up from 89.8% at the same time in February suggesting that the recent improvement in outstanding mortgage delinquencies may resume in March after taking a step back last month. We’ll keep watching to see if this upward trend continues, and will post another weekly update on this blog next Friday, April 2.

emphasis added

BLS: February Unemployment rates down in 23 States

by Calculated Risk on 3/26/2021 10:28:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in February in 23 states and the District of Columbia, higher in 4 states, and stable in 23 states, the U.S. Bureau of Labor Statistics reported today. Forty-five states and the District had jobless rate increases from a year earlier and five states had little or no change. The national unemployment rate, 6.2 percent, was little changed over the month, but was 2.7 percentage points higher than in February 2020.Hawaii is being impacted by the lack of tourism.

Nonfarm payroll employment increased in 11 states, decreased in 3 states, and was essentially unchanged in 36 states and the District of Columbia in February 2021. Over the year, nonfarm payroll employment decreased in 48 states and the District and was essentially unchanged in 2 states.

...

Hawaii and New York had the highest unemployment rates in February, 9.2 percent and 8.9 percent, respectively, while South Dakota, 2.9 percent, and Utah, 3.0 percent, had the lowest rates.

Personal Income decreased 7.1% in February, Spending decreased 1.0%

by Calculated Risk on 3/26/2021 08:42:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income income decreased $1,516.6 billion (7.1 percent) in February according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $1,532.3 billion (8.0 percent) and personal consumption expenditures (PCE) decreased $149.0 billion (1.0 percent).The February PCE price index increased 1.6 percent year-over-year and the February PCE price index, excluding food and energy, increased 1.4 percent year-over-year.

Real DPI decreased 8.2 percent in February and Real PCE decreased 1.2 percent; goods decreased 3.3 percent and services decreased 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through February 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and the decrease in PCE was slightly below expectations.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 6.3% annual rate in Q1 2021. (using the mid-month method, PCE was increasing at 3.3%). However, these methods are understating growth in Q1, due to the American Rescue Plan Act of 2021. Both income and spending increased sharply in March, from BofA yesterday:

"Total card spending, as measured by BAC aggregated card data, increased 45% 1-yr and 23% 2-yr for the 7-days ending Mar 20.

The strong gain owes to the latest stimulus: total card spending for stimulus recipients is running 40% above the Feb avg."

Thursday, March 25, 2021

Friday: February Personal Income and Outlays

by Calculated Risk on 3/25/2021 09:00:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, February. The consensus is for a 7.0% decrease in personal income, and for a 0.6% decrease in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 83.5.

• Also at 10:00 AM, State Employment and Unemployment (Monthly), February 2021

Freddie Mac: Mortgage Serious Delinquency Rate decreased in February

by Calculated Risk on 3/25/2021 04:40:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was 2.52%, down from 2.56% in January. Freddie's rate is up from 0.60% in February 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.14%, down from 0.16% in January, and up almost double from 0.08% in February 2020.