by Calculated Risk on 4/01/2021 09:00:00 PM

Thursday, April 01, 2021

Friday: Employment Report

My March Employment Preview

Goldman March Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for March. The consensus is for 565,000 jobs added, and for the unemployment rate to decrease to 6.0%.

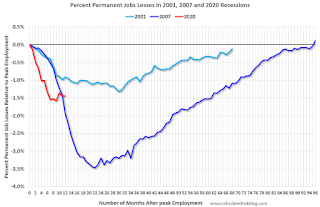

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and is currently about as bad as the worst of the "Great Recession".

April 1st COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/01/2021 06:00:00 PM

Note: I've been posting this data daily for over a year. I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 153.6 million doses have been administered. 21.7% of the population over 18 is fully vaccinated, and 38.4% of the population over 18 has had at least one dose (99.6 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Goldman March Payrolls Preview

by Calculated Risk on 4/01/2021 03:50:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 775k in March ... Big Data employment signals also indicate a pickup in job growth, and we expect a favorable swing in the weather to support construction employment following weakness in February. ... We estimate a three-tenth decline in the unemployment rate to 5.9%.CR Note: The consensus is for 565 thousand jobs added, and for the unemployment rate to decrease to 6.0%.

emphasis added

March Employment Preview

by Calculated Risk on 4/01/2021 12:46:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for 565 thousand jobs added, and for the unemployment rate to decrease to 6.0%.

Some analysts think this will be a very strong report with maybe 1 million jobs added. For example, from Merrill Lynch economists:

"We look for nonfarm payrolls to grow by a robust 1mn in March following a gain of 379k in February. Labor market indicators undoubtedly showed strong employment activity over the month. ... The unemployment rate should drop to 5.9% from 6.2% reflecting the strong job gains."

• First, currently there are still about 9.5 million fewer jobs than in February 2020 (before the pandemic).

• First, currently there are still about 9.5 million fewer jobs than in February 2020 (before the pandemic).This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and is currently about as bad as the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 517,000 private sector jobs, below the consensus estimate of 550 thousand jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be close to expectations.

• ISM Surveys: The ISM® manufacturing employment index increased in March to 59.6%, up from 54.4% last month. This would suggest essentially approximately 35,000 manufacturing jobs added in March. ADP showed 49,000 manufacturing jobs added.

The ISM® Services employment index will be released next week.

• Unemployment Claims: The weekly claims report showed a high number of initial unemployment claims during the reference week (include the 12th of the month), although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession! In general, weekly claims have been close to expectations.

• Weather: Weather is a wildcard every year during the winter. The SF Fed estimated that weather reduced employment by about 100 thousand in February. Usually we'd expect a bounce back in March, so this should provide a boost to the March report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. In February, the number of permanent job losers was mostly unchanged at 3.497 million from 3.503 million in January.

• Conclusion: Most of the indicators suggest a strong report in March. My guess is the report will be above the consensus.

Hotels: Occupancy Rate Down 17% Compared to Same Week in 2019

by Calculated Risk on 4/01/2021 11:40:00 AM

Note: Starting last week, the year-over-year comparisons are easy - since occupancy declined sharply at the onset of the pandemic - but occupancy is still down significantly from normal levels.

The occupancy rate is down 16.7% compared to the same week in 2019.

U.S. weekly hotel occupancy fell one point from the previous week, according to STR‘s latest data through March 27.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

March 21-27, 2021:

• Occupancy: 57.9%

• Average daily rate (ADR): US$108.31

• Revenue per available room (RevPAR): US$62.68

The 57.9% absolute occupancy was a 160.8% increase from the comparable, pandemic-affected week last year, but more importantly, represented more than 83% of occupancy regained from the 2019 benchmark. More than 21 million rooms were sold for the second week in a row, however, it was the first time in four weeks that the metric fell week over week, which is indicative of softening in the spring break demand that had boosted levels previously.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Construction Spending decreased 0.8% in February

by Calculated Risk on 4/01/2021 10:20:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during February 2021 was estimated at a seasonally adjusted annual rate of $1,516.9 billion, 0.8 percent below the revised January estimate of $1,529.0 billion.Both private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,165.7 billion, 0.5 percent below the revised January estimate of $1,171.6 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $351.2 billion, 1.7 percent below the revised January estimate of $357.4 billion.

Click on graph for larger image.

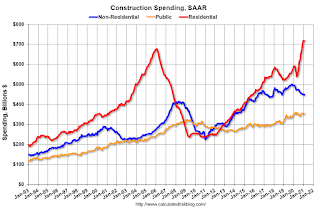

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 6% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 8% above the previous peak in March 2009, and 34% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 21.1%. Non-residential spending is down 9.7% year-over-year. Public spending is down slightly year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential will be under pressure. For example, lodging is down 24% YoY, multi-retail down 33% YoY, and office down 5% YoY.

ISM® Manufacturing index Increased to 64.7% in March

by Calculated Risk on 4/01/2021 10:17:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in March. The PMI® was at 64.7% in March, up from 60.8% in February. The employment index was at 59.6%, up from 54.4% last month, and the new orders index was at 68.0%, up from 63.2%.

From ISM: Manufacturing PMI® at 64.7%; March 2021 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in March, with the overall economy notching a 10th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was above expectations.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The March Manufacturing PMI® registered 64.7 percent, an increase of 3.9 percentage points from the February reading of 60.8 percent. This figure indicates expansion in the overall economy for the 10th month in a row after contraction in April. The New Orders Index registered 68 percent, up 3.2 percentage points from the February reading of 64.8 percent. The Production Index registered 68.1 percent, an increase of 4.9 percentage points compared to the February reading of 63.2 percent. The Backlog of Orders Index registered 67.5 percent, 3.5 percentage points above the February reading of 64 percent. The Employment Index registered 59.6 percent, 5.2 percentage points higher than the February reading of 54.4 percent. The Supplier Deliveries Index registered 76.6 percent, up 4.6 percentage points from the February figure of 72 percent. The Inventories Index registered 50.8 percent, 1.1 percentage points higher than the February reading of 49.7 percent. The Prices Index registered 85.6 percent, down 0.4 percentage point compared to the February reading of 86 percent. The New Export Orders Index registered 54.5 percent, a decrease of 2.7 percentage points compared to the February reading of 57.2 percent. The Imports Index registered 56.7 percent, a 0.6-percentage point increase from the February reading of 56.1 percent.”

emphasis added

This suggests manufacturing expanded at a faster pace in March than in February.

Weekly Initial Unemployment Claims increased to 719,000

by Calculated Risk on 4/01/2021 08:37:00 AM

The DOL reported:

In the week ending March 27, the advance figure for seasonally adjusted initial claims was 719,000, an increase of 61,000 from the previous week's revised level. The previous week's level was revised down by 26,000 from 684,000 to 658,000. The 4-week moving average was 719,000, a decrease of 10,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised down by 6,500 from 736,000 to 729,500.This does not include the 237,025 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 241,137 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 719,000.

The previous week was revised down.

Regular state continued claims decreased to 3,794,000 (SA) from 3,840,000 (SA) the previous week.

Note: There are an additional 7,349,663 receiving Pandemic Unemployment Assistance (PUA) that increased from 7,844,867 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,515,355 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 6,220,492.

Weekly claims were higher than the consensus forecast.

Wednesday, March 31, 2021

Thursday: Unemployment Claims, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 3/31/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 650 thousand from 684 thousand last week.

• At 10:00 AM, ISM Manufacturing Index for March. The consensus is for the ISM to be at 61.2, up from 60.8 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for a 0.9% decrease in construction spending.

• At All Day, Light vehicle sales for March. The consensus is for light vehicle sales to be 16.5 million SAAR in March, up from 15.7 million in February (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in February

by Calculated Risk on 3/31/2021 04:10:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 2.76% in February, from 2.80% in January. The serious delinquency rate is up from 0.65% in February 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble, and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.90% are seriously delinquent (up from 5.87% in January). For loans made in 2005 through 2008 (2% of portfolio), 10.01% are seriously delinquent (up from 9.98%), For recent loans, originated in 2009 through 2021 (96% of portfolio), 2.29% are seriously delinquent (down from 2.32%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.