by Calculated Risk on 4/03/2021 08:11:00 AM

Saturday, April 03, 2021

Schedule for Week of April 4, 2021

This will be a light week for economic data.

The key report this week is the Trade Deficit on Wednesday.

10:00 AM: the ISM Services Index for March.

During the Day: NY Fed, SCE Housing Survey: Data update

8:00 AM: Corelogic House Price index for February.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 6.917 million from 6.752 million in December.

The number of job openings (yellow) were down 3.3% year-over-year, and Quits were down 7.2% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $70.3 billion. The U.S. trade deficit was at $68.2 billion in January.

2:00 PM: FOMC Minutes, Minutes Meeting of March 16-17, 2021

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 700 thousand from 719 thousand last week.

12:00 PM: Discussion, Fed Chair Jerome Powell, The Global Economy, At the International Monetary Fund Debate on the Global Economy

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 0.5% increase in PPI, and a 0.2% increase in core PPI.

Friday, April 02, 2021

April 2nd COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/02/2021 03:44:00 PM

Note: I've been posting this data daily for over a year. I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 157.6 million doses have been administered. 22.4% of the population over 18 is fully vaccinated, and 39.2% of the population over 18 has had at least one dose (101.8 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

March Vehicles Sales increased to 17.75 Million SAAR

by Calculated Risk on 4/02/2021 01:19:00 PM

Wards released their estimate of light vehicle sales for March yesterday. Wards estimates sales of 17.75 million SAAR in March 2021 (Seasonally Adjusted Annual Rate), up 13.3% from the February sales rate, and up 56% from March 2020 (sales collapsed in March 2020).

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the Wards' estimate for March (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 17.75 million SAAR.

Note: dashed line is current estimated sales rate of 17.75 million SAAR.Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 4/02/2021 12:09:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of March 30th.

From Black Knight: Servicers Continue to Work Through Forbearance Plans as U.S. Enters Fifth Consecutive Week of Improvement

The country saw yet another week of forbearance improvement this week, with active plans falling by 33,000 (-1.3%). This marks the fifth consecutive week of improvement and the longest such stretch since September 2020.The number of loans in forbearance has slowly declined over the last few months.

Weekly declines were seen across investor classes, with GSE plans down 15,000, FHA/VA plans down 12,000, and plan volumes among portfolio/PLS mortgages falling by 6,000 for the week.

This week’s improvement has pushed the number of active plans down by 172,000 (-6.3%) from last month, the largest such M/M improvement since November 2020. As of March 30, there are now 2.54 million active forbearance plans, representing 4.8% of all active mortgages.

Click on graph for larger image.

As anticipated, these improvements were driven by the large volume of forbearance plan reviews taking place in recent weeks. Entering March, 1.2 million plans were scheduled for review for removal/extension during the month; as of March 30, some 300,000 such scheduled expirations remain, with another 655,000 on tap for April. These numbers suggest we could see continued improvement in coming weeks as servicers continue to review plans with scheduled expirations for removal or extension.

We’ll have another forbearance update published here on this blog next Friday, April 9.

emphasis added

Comments on March Employment Report

by Calculated Risk on 4/02/2021 09:46:00 AM

The headline jobs number in the March employment report was well above expectations, and employment for the previous two months was revised up.

Earlier: March Employment Report: 916 Thousand Jobs, 6.0% Unemployment Rate

In March, the year-over-year employment change was minus 6.720 million jobs. This will turn positive in April due to the sharp jobs losses in April 2020.

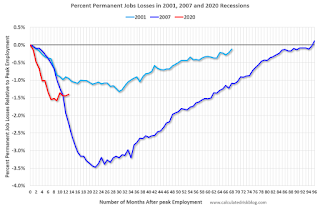

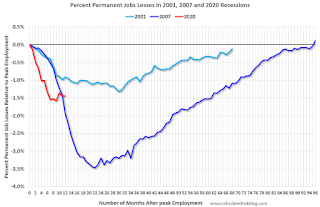

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the March report. (ht Joe Weisenthal at Bloomberg).

This data is only available back to 1994, so there is only data for three recessions.

In March, the number of permanent job losers decreased slightly to 3.432 million from 3.497 million in February.

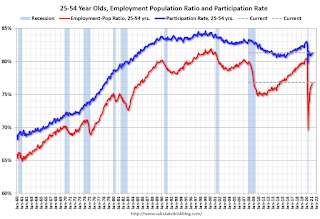

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate increased in March to 81.3% from 81.1% in February, and the 25 to 54 employment population ratio increased to 76.8% from 76.5% in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 5.8 million, changed little in March but is 1.4 million higher than in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in March to 5.826 million from 6.088 million in February.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 10.7% from 11.1% in February. This is down from the record high in April 22.9% for this measure since 1994.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.218 million workers who have been unemployed for more than 26 weeks and still want a job.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was well above expectations, and the previous two months were revised up 156,000 combined. The headline unemployment rate declined to 6.0%.

March Employment Report: 916 Thousand Jobs, 6.0% Unemployment Rate

by Calculated Risk on 4/02/2021 08:43:00 AM

From the BLS:

Total nonfarm payroll employment rose by 916,000 in March, and the unemployment rate edged down to 6.0 percent, the U.S. Bureau of Labor Statistics reported today. These improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic. Job growth was widespread in March, led by gains in leisure and hospitality, public and private education, and construction.

...

The change in total nonfarm payroll employment for January was revised up by 67,000, from +166,000 to +233,000, and the change for February was revised up by 89,000, from +379,000 to +468,000. With these revisions, employment in January and February combined was 156,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In March, the year-over-year change was negative 6.720 million jobs. Next month, the YoY change will be up significantly - since employment collapsed in April 2020.

Total payrolls increased by 916 thousand in March. Private payrolls increased by 780 thousand.

Payrolls for January and February were revised up 156 thousand, combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 61.5% in March, from 61.4% in February. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 61.5% in March, from 61.4% in February. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 57.8% from 57.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in March to 6.0% from 6.2% in February.

This was well above consensus expectations, and January and February were revised up by 156,000 combined.

Thursday, April 01, 2021

Friday: Employment Report

by Calculated Risk on 4/01/2021 09:00:00 PM

My March Employment Preview

Goldman March Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for March. The consensus is for 565,000 jobs added, and for the unemployment rate to decrease to 6.0%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and is currently about as bad as the worst of the "Great Recession".

April 1st COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/01/2021 06:00:00 PM

Note: I've been posting this data daily for over a year. I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 153.6 million doses have been administered. 21.7% of the population over 18 is fully vaccinated, and 38.4% of the population over 18 has had at least one dose (99.6 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Goldman March Payrolls Preview

by Calculated Risk on 4/01/2021 03:50:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 775k in March ... Big Data employment signals also indicate a pickup in job growth, and we expect a favorable swing in the weather to support construction employment following weakness in February. ... We estimate a three-tenth decline in the unemployment rate to 5.9%.CR Note: The consensus is for 565 thousand jobs added, and for the unemployment rate to decrease to 6.0%.

emphasis added

March Employment Preview

by Calculated Risk on 4/01/2021 12:46:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for 565 thousand jobs added, and for the unemployment rate to decrease to 6.0%.

Some analysts think this will be a very strong report with maybe 1 million jobs added. For example, from Merrill Lynch economists:

"We look for nonfarm payrolls to grow by a robust 1mn in March following a gain of 379k in February. Labor market indicators undoubtedly showed strong employment activity over the month. ... The unemployment rate should drop to 5.9% from 6.2% reflecting the strong job gains."

• First, currently there are still about 9.5 million fewer jobs than in February 2020 (before the pandemic).

• First, currently there are still about 9.5 million fewer jobs than in February 2020 (before the pandemic).This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and is currently about as bad as the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 517,000 private sector jobs, below the consensus estimate of 550 thousand jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be close to expectations.

• ISM Surveys: The ISM® manufacturing employment index increased in March to 59.6%, up from 54.4% last month. This would suggest essentially approximately 35,000 manufacturing jobs added in March. ADP showed 49,000 manufacturing jobs added.

The ISM® Services employment index will be released next week.

• Unemployment Claims: The weekly claims report showed a high number of initial unemployment claims during the reference week (include the 12th of the month), although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession! In general, weekly claims have been close to expectations.

• Weather: Weather is a wildcard every year during the winter. The SF Fed estimated that weather reduced employment by about 100 thousand in February. Usually we'd expect a bounce back in March, so this should provide a boost to the March report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. In February, the number of permanent job losers was mostly unchanged at 3.497 million from 3.503 million in January.

• Conclusion: Most of the indicators suggest a strong report in March. My guess is the report will be above the consensus.