by Calculated Risk on 4/13/2021 01:08:00 PM

Tuesday, April 13, 2021

Portland Real Estate in March: Sales Up 8% YoY, Inventory Down 54% YoY

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For Portland, OR:

Closed sales in March 2021 were 2,556, up 8.5% from 2,356 in March 2020.

Active Listings in March 2021 were 1,943, down 53.9% from 4,218 in March 2020.

Months of Supply was 0.8 Months in March 2021, compared to 1.8 Months in March 2020.

Cleveland Fed: Key Measures Show Small Uptick in Inflation in March

by Calculated Risk on 4/13/2021 11:11:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% March. The 16% trimmed-mean Consumer Price Index also rose 0.2% in March. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for March here. Motor fuel was up 185% annualized in March.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 1.6%. Core PCE is for February and increased 1.4% year-over-year.

Note: We saw negative Month-to-month (MoM) core CPI and CPI readings in March, April and May 2020. We also saw negative MoM PCE and core PCE reading in March and April 2020. Ignore a jump in YoY inflation in March, April and May!

Maryland Real Estate in March: Sales Up 11% YoY, Inventory Down 67% YoY

by Calculated Risk on 4/13/2021 10:05:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Maryland Realtors for the entire state:

Closed sales in March 2021 were 7,964, up 11.4% from 7,148 in March 2020.

Active Listings in March 2021 were 6,202, down 67.5% from 19,061 in March 2020.

Months of Supply was 0.8 Months in March 2021, compared to 2.5 Months in March 2020.

BLS: CPI increased 0.6% in March, Core CPI increased 0.3%

by Calculated Risk on 4/13/2021 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in March on a seasonally adjusted basis after rising 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. The March 1-month increase was the largest rise since a 0.6-percent increase in August 2012. Over the last 12 months, the all items index increased 2.6 percent before seasonal adjustment.CPI and core CPI were slightly above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The gasoline index continued to increase, rising 9.1 percent in March and accounting for nearly half of the seasonally adjusted increase in the all items index. The natural gas index also rose, contributing to a 5.0-percent increase in the energy index over the month. The food index rose 0.1 percent in March, with the food at home index and the food away from home index both also rising 0.1 percent. .

The index for all items less food and energy rose 0.3 percent in March. The shelter index increased in March as did the motor vehicle insurance index, the recreation index, and the household furnishings and operations index. Indexes which decreased over the month include apparel and education..

The all items index rose 2.6 percent for the 12 months ending March, a much larger increase than the 1.7-percent reported for the period ending in February. The index for all items less food and energy rose 1.6 percent over the last 12 months, after increasing 1.3 percent over the 12 month period ending in February. The food index rose 3.5 percent over the last 12 months, while the energy index increased 13.2 percent over that period.

emphasis added

Monday, April 12, 2021

Tuesday: CPI

by Calculated Risk on 4/12/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Bonds Look Past Weaker Treasury Auction

Today's relatively calm reaction to a fairly weak 10yr auction continues the recent tradition of bonds NOT freaking out every chance they get. ... [30 year fixed 3.28%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for 0.5% increase in CPI, and a 0.2% increase in core CPI.

April 12th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/12/2021 05:39:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 189.7 million doses have been administered. 28.6% of the population over 18 is fully vaccinated, and 46.5% of the population over 18 has had at least one dose (120.0 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

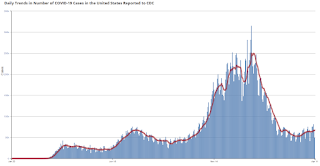

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

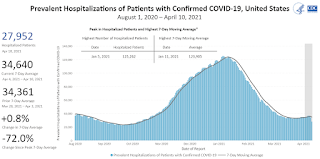

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 4.66%"

by Calculated Risk on 4/12/2021 04:00:00 PM

Note: This is as of April 4th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 4.66%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 24 basis points from 4.90% of servicers’ portfolio volume in the prior week to 4.66% as of April 4, 2021. According to MBA’s estimate, 2.3 million homeowners are in forbearance plans.

...

“The share of loans in forbearance decreased for the sixth straight week, dropping by 24 basis points – one of the largest decreases in the history of the series. The forbearance share also decreased significantly for all three investor categories, with the rate for Ginnie Mae loans down an impressive 45 basis points. Overall, forbearance exits increased to their fastest pace since early November,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Almost 32 percent of borrowers in forbearance extensions have now exceeded the 12-month mark. In terms of performance, more than 88% of homeowners who have exited into deferral plans, modifications, or repayment plans were current on their loans at the end of March, compared to 92% of all homeowners.”

Fratantoni added, “The accelerating economic recovery in March helped more homeowners recover and become current on their mortgages, in addition to helping other homeowners with more stable financial situations exit forbearance. Homeowners who are still facing hardships and need to extend their forbearance term should contact their servicers.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.04% to 0.05%."

Colorado Real Estate in March: Sales Up 13% YoY, Inventory Down 69% YoY

by Calculated Risk on 4/12/2021 01:12:00 PM

From the Colorado Association of REALTORS® for the entire state:

Closed sales for Single Family and Townhouse-Condo in March 2021 were 10,558, up 13.2% from 9,324 in March 2020.

Active Listings for Single Family and Townhouse-Condo in March 2021 were 6,732, down 69.0% from 21,729 in March 2020.

Months of Supply was 0.6 Months in March 2021, compared to 2.2 Months in March 2020.

Housing Inventory April 12th Update: At Record Lows

by Calculated Risk on 4/12/2021 10:45:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Minnesota Real Estate in March: Sales Up 3% YoY, Inventory Down 55% YoY

by Calculated Risk on 4/12/2021 10:11:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Minnesota Realtors®:

Total Residential Units Sold in March 2021 were 5,917, up 3.1% from 5,741 in March 2020.

Active Residential Listings in March 2021 were 7,738, down 54.8% from 17,124 in March 2020.

Months of Supply was 1.0 Months in March 2021, compared to 2.4 Months in March 2020.

This graph from the Minnesota Realtors® shows inventory in Minnesota since 2012. Inventory had been trending down, and then was flat over the last couple of years, and then declined significantly during the pandemic.