by Calculated Risk on 4/15/2021 02:57:00 PM

Thursday, April 15, 2021

NMHC: "April Apartment Market Conditions Show Improvement"

The National Multifamily Housing Council (NMHC) released their April report: April Apartment Market Conditions Show Improvement

Apartment market conditions showed improvement in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for April 2021, as the industry begins to see signs of optimism. While the Sales Volume (77) and Equity Financing (68) indexes both came in above the breakeven level (50) for the third consecutive quarter, the index for Market Tightness (81) signaled tighter conditions for the first time since October 2019. The Debt Financing index (44) indicated weaker conditions.

“We are finally seeing improvement in most markets around the country,” noted NMHC Chief Economist Mark Obrinsky. “While gateway metros are still generally facing lower occupancy and rent levels compared to a year ago, conditions now appear to be on an upward trajectory. On the other hand, many Sun Belt markets continue to see substantial rent growth and strength in fundamentals.”

“Following what we saw as an inflection point last quarter, with a majority of respondents (53 percent) indicating market conditions were unchanged, two-thirds (67 percent) of respondents this quarter observed tighter conditions in their apartment markets. We move forward with cautious optimism, as vaccine rollout is well underway and there is hope that all residents will be able to return to work soon.””

...

The Market Tightness Index increased from 43 to 81, indicating tighter market conditions for the first time in six quarters. Two-thirds (67 percent) of respondents reported tighter market conditions than three months prior, compared to only 5 percent who reported looser conditions. Twenty-eight percent of respondents felt that conditions were no different from last quarter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Hotels: Occupancy Rate Down 15% Compared to Same Week in 2019

by Calculated Risk on 4/15/2021 11:59:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

The occupancy rate is down 15% compared to the same week in 2019.

The U.S. hotel industry posted its highest demand and occupancy levels since the beginning of the pandemic, according to STR‘s latest weekly data through April 10.For more, see STR's U.S. Market Recovery Monitor

April 4-10, 2021:

• Occupancy: 59.7%

• Average daily rate (ADR): US$112.22

• Revenue per available room (RevPAR): US$66.99

Reflecting the country’s almost 2-point improvement in occupancy from the previous week, more than 50% of properties posted a weekly occupancy above 60%.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAHB: Builder Confidence Increased to 83 in April

by Calculated Risk on 4/15/2021 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 83, up from 82 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Edges Up as Strong Demand Offsets Supply-Side Challenges

Strong buyer demand pushed builder confidence up in April even as builders continued to grapple with rising lumber prices and supply chain issues and consumers faced higher home prices due to a lack inventory. The latest NAHB/Wells Fargo Housing Market Index (HMI) released today shows that builder confidence in the market for newly built single-family homes rose one point to 83 in April.

“Despite strong buyer traffic, builders continue to face challenges to add much needed housing supply to the market,” said NAHB Chairman Chuck Fowke. “The supply chain for residential construction is tight, particularly regarding the cost and availability of lumber, appliances, and other building materials. Though builders are seeking to keep home prices affordable in a market in need of more inventory, policymakers must find ways to increase the supply of building materials as the economy runs hot in 2021.”

“While mortgage interest rates have trended higher since February and home prices continue to outstrip inflation, housing demand appears to be unwavering for now as buyer traffic reached its highest level since November,” said NAHB Chief Economist Robert Dietz. “NAHB’s forecast is for ongoing growth in single-family construction in 2021, albeit at a lower growth rate than realized in 2020.”

...

The HMI index gauging current sales conditions increased one point to 88 and the gauge charting traffic of prospective buyers posted a three-point gain to 75. The component measuring sales expectations in the next six months fell two points to 81.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose six points 86 and the South moved up one point to 83. The West held steady at 90 and the Midwest fell two points to 78.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast, and a very strong reading.

Housing and homebuilding have been one of the best performing sectors during the pandemic.

Industrial Production Increased 1.4 Percent in March

by Calculated Risk on 4/15/2021 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

In March, total industrial production increased 1.4 percent. The gain in March followed a drop of 2.6 percent in February, which largely resulted from widespread outages related to severe winter weather in the south central region of the country. For the first quarter as a whole, total industrial production rose 2.5 percent at an annual rate. In March, manufacturing production and mining output increased 2.7 percent and 5.7 percent, respectively. The output of utilities dropped 11.4 percent, as the demand for heating fell because of a swing in temperatures from an unseasonably cold February to an unseasonably warm March.

At 105.6 percent of its 2012 average, total industrial production in March was 1.0 percent higher than its year-earlier level, but it was 3.4 percent below its pre-pandemic (February 2020) level. Capacity utilization for the industrial sector increased 1.0 percentage point in March to 74.4 percent, a rate that is 5.2 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still below the level in February 2020.

Capacity utilization at 74.4% is 5.2% below the average from 1972 to 2020.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 105.6. This is 3.4% below the February 2020 level.

The change in industrial production was below consensus expectations.

Retail Sales Increased 9.8% in March

by Calculated Risk on 4/15/2021 08:45:00 AM

On a monthly basis, retail sales increased 9.8 percent from February to March (seasonally adjusted), and sales were up 27.7 percent from March 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $619.1 billion, an increase of 9.8 percent from the previous month, and 27.7 percent above March 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 9.7% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 27.4% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 27.4% on a YoY basis.Sales in March were slightly above expectations, and sales in January and February were revised up.

Weekly Initial Unemployment Claims decreased sharply to 576,000

by Calculated Risk on 4/15/2021 08:36:00 AM

The DOL reported:

In the week ending April 10, the advance figure for seasonally adjusted initial claims was 576,000, a decrease of 193,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 25,000 from 744,000 to 769,000. The 4-week moving average was 683,000, a decrease of 47,250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 6,500 from 723,750 to 730,250.This does not include the 131,975 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 152,419 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 683,000.

The previous week was revised up.

Regular state continued claims increased to 3,731,000 (SA) from 3,727,000 (SA) the previous week.

Note: There are an additional 7,053,575 receiving Pandemic Unemployment Assistance (PUA) that decreased from 7,554,290 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,160,267 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 5,634,967.

Weekly claims were much lower than the consensus forecast.

Wednesday, April 14, 2021

Thursday: Retail Sales, Unemployment Claims, NY and Philly Fed Mfg, Industrial Production, Homebuilder Survey

by Calculated Risk on 4/14/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 720 thousand from 744 thousand last week.

• Also at 8:30 AM, Retail sales for March is scheduled to be released. The consensus is for a 5.5% increase in retail sales. The consensus is probably low (given the stimulus checks).

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 18.2, up from 17.4.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 43.0, down from 51.8.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 3.0% increase in Industrial Production, and for Capacity Utilization to increase to 75.8%.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 83, up from 82. Any number above 50 indicates that more builders view sales conditions as good than poor.

Fed's Beige Book: "Economic activity accelerated to a moderate pace"

by Calculated Risk on 4/14/2021 04:13:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Dallas based on information collected on or before April 5, 2021."

National economic activity accelerated to a moderate pace from late February to early April. Consumer spending strengthened. Reports on tourism were more upbeat, bolstered by a pickup in demand for leisure activities and travel which contacts attributed to spring break, an easing of pandemic-related restrictions, increased vaccinations, and recent stimulus payments among other factors. Auto sales grew, even as new-vehicle inventories remained constrained by microchip shortages. The picture in nonfinancial services generally improved, partly supported by strengthening demand for transportation, professional and business, and leisure and hospitality services. Despite widespread supply chain disruptions, manufacturing activity expanded further with half the Districts citing robust growth. Bankers in most reporting Districts saw modest to moderate increases in overall loan volumes. Sustained high demand and tight supply of single-family homes further pushed up prices, and builders noted ongoing production challenges, including rising costs. Reports on commercial real estate and construction varied, with activity in the hotel, office, and retail segments generally remaining weak. Agricultural conditions were mostly stable over the reporting period. Activity in the energy sector was mixed; coal production fell, while oil and gas drilling was flat to up. Outlooks were more optimistic than in the previous report, boosted in part by an acceleration in COVID-19 vaccinations.

...

Employment growth picked up over the reporting period, with most Districts noting modest to moderate increases in headcounts. The pace of job growth varied by industry but was generally strongest in manufacturing, construction, and leisure and hospitality. Hiring remained a widespread challenge, particularly for low-wage or hourly workers, restraining job growth in some cases. Commercial and delivery drivers were specifically cited as in short supply, as were specialty and skilled tradespeople. Some firms noted absenteeism due to COVID-19 was down. Employment expectations were generally bullish. Wage growth accelerated slightly overall, with more significant wage pressures in industries like manufacturing and construction where finding and retaining workers was particularly difficult. Some contacts mentioned raising starting pay and offering signing bonuses to attract and retain employees.

emphasis added

April 14th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/14/2021 03:52:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 194.8 million doses have been administered. 29.6% of the population over 18 is fully vaccinated, and 47.6% of the population over 18 has had at least one dose (123.0 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

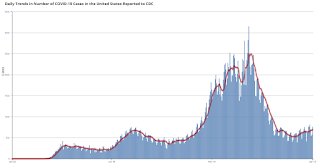

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

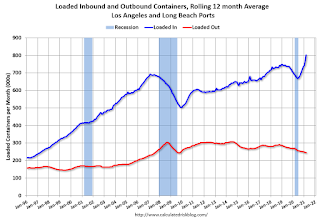

LA Area Port Traffic: Strong Imports in March

by Calculated Risk on 4/14/2021 02:18:00 PM

Note1: Import traffic was heavy in February and March - ships were backed up waiting to unload in LA. "some vessels are spending almost as much time at anchor as it takes to traverse the Pacific Ocean." They are still backed up in April!

Note2: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

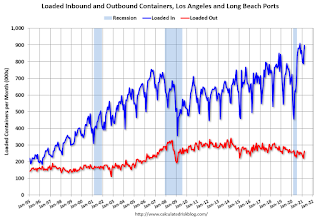

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 4.8% in March compared to the rolling 12 months ending in February. Outbound traffic was down 0.1% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 98% YoY in March (collapsed early last year due to pandemic), and exports were down 1.5% YoY.