by Calculated Risk on 4/23/2021 10:16:00 AM

Friday, April 23, 2021

New Home Sales Increase to 1,021,000 Annual Rate in March; Highest Since 2006

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 1.021 million.

The previous three months were revised up sharply.

Sales of new single-family houses in March 2021 were at a seasonally adjusted annual rate of 1,021,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 20.7 percent above the revised February rate of 846,000 and is 66.8 percent above the March 2020 estimate of 612,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This was the highest sales rate since 2006.

The second graph shows New Home Months of Supply.

The months of supply decreased in March to 3.6 months from 4.4 months in February.

The months of supply decreased in March to 3.6 months from 4.4 months in February. The all time record high was 12.1 months of supply in January 2009. The all time record low is 3.5 months, most recently in October 2020.

This is below the low end of the normal range (about 4 to 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of March was 307,000. This represents a supply of 3.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

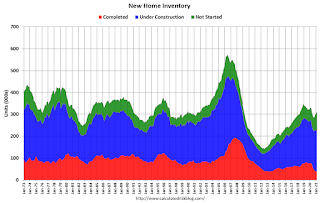

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is at a record low, and the combined total of completed and under construction is a little lower than normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2021 (red column), 97 thousand new homes were sold (NSA). Last year, 59 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was well above expectations, and sales in the three previous months were revised up sharply. I'll have more later today.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased Slightly

by Calculated Risk on 4/23/2021 08:24:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of April 20th.

From Black Knight: Another Week of Forbearance Improvement; 4.4% Of Homeowners Remain in Pandemic-Related Plans

Forbearance volumes improved this week, edging slightly lower since last week. This is typical of the mid-month lulls in improvement we’ve seen throughout the recovery.The number of loans in forbearance continues to decline.

Weekly reductions of GSE loans (-6,000) and FHA/VA loans (-5,000) were partially offset by an increase of 9,000 portfolio and privately securitized mortgages in forbearance.

Despite the week’s modest improvement, the number of outstanding plans is down by 298,000 (-11.4%) from the same time last month. As of April 20, there are 2.3 million (4.4% of) mortgage-holders in COVID-19-related forbearance plans, including 2.7% of GSE, 7.8% of FHA/VA and 4.8% of portfolio/PLS loans.

Click on graph for larger image.

Both inflow and outflow were muted this week, with fewer than 160,000 extensions/removals, the lowest such number in two months.

280,000 expirations remain on the books for April, an opportunity for additional improvement through the rest of this month and going into May. There are also 435,000 expirations due in May, and then a big jump to 890,000 due in June. This will mark the last big month for review activity before the first wave of plans reach their 18-month expirations.

Overall start activity continues to trend downward. It will be worth keeping an eye on the numbers going into May as servicers continue to work through their reviews. We’ll have another report published here next Friday, April 30.

emphasis added

Thursday, April 22, 2021

Friday: New Home Sales

by Calculated Risk on 4/22/2021 09:00:00 PM

Friday:

• At 10:00 AM: New Home Sales for March from the Census Bureau. The consensus is for 885 thousand SAAR, up from 775 thousand in February.

April 22nd COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/22/2021 04:02:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 218.9 million doses have been administered. 34.4% of the population over 18 is fully vaccinated, and 52.0% of the population over 18 has had at least one dose (134.3 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Hotels: Occupancy Rate Down 13% Compared to Same Week in 2019

by Calculated Risk on 4/22/2021 01:12:00 PM

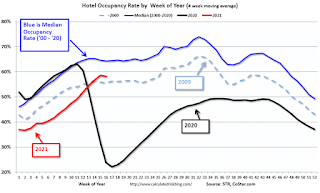

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

The occupancy rate is down 13% compared to the same week in 2019.

U.S. weekly hotel occupancy fell 2.6 percentage points from the previous week, according to STR‘s latest data through April 17.For more, see STR's U.S. Market Recovery Monitor

April 11-17, 2021:

• Occupancy: 57.3%

• Average daily rate (ADR): US$107.16

• Revenue per available room (RevPAR): US$61.37

Following the end of spring break, weekly demand fell back below the 22 million mark, and occupancy dipped to its lowest level since mid-March. The ADR level was also US$5 less after two straight weeks above US$112.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Comments on March Existing Home Sales

by Calculated Risk on 4/22/2021 11:36:00 AM

Earlier: NAR: Existing-Home Sales Decreased to 6.01 million in March

A few key points:

1) This was the highest sales rate for March since 2006, and the 4th highest sales rate for March on record (behind 2004, 2005, and 2006). Some of the increase over the last nine months was probably related to record low mortgage rates, a move away from multi-family rentals, strong second home buying (to escape the high-density cities), a strong stock market and favorable demographics.

2) Inventory is very low, and was down 28.2% year-over-year (YoY) in March. Also, as housing economist Tom Lawler has noted, the local MLS data shows even a larger decline in active inventory (the NAR appears to include some pending sales in inventory). Lawler noted:

"As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months."

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales by month for 2020 and 2021.

The year-over-year comparisons will be easy in Q2, and then difficult in the second half of the year.

The second graph shows existing home sales for each month, Not Seasonally Adjusted (NSA), since 2005.

Sales NSA in March (484,000) were 16.3% above sales last year in March (416,000).

Sales NSA in March (484,000) were 16.3% above sales last year in March (416,000).This was the highest sales for March (NSA) since 2006.

NAR: Existing-Home Sales Decreased to 6.01 million in March

by Calculated Risk on 4/22/2021 10:12:00 AM

From the NAR: Housing Market Reaches Record-High Home Price and Gains in March

Existing-home sales fell in March, marking two consecutive months of declines, according to the National Association of Realtors®. The month of March saw record-high home prices and gains. While each of the four major U.S. regions experienced month-over-month drops, all four areas welcomed year-over-year gains in home sales.Note: February was revised up from 6.22 million to 6.24 million SAAR.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 3.7% from February to a seasonally-adjusted annual rate of 6.01 million in March. Sales overall climbed year-over-year, up 12.3% from a year ago (5.35 million in March 2020).

...

Total housing inventory at the end of March amounted to 1.07 million units, up 3.9% from February's inventory and down 28.2% from one year ago (1.49 million). Unsold inventory sits at a 2.1-month supply at the current sales pace, marginally up from February's 2.0-month supply and down from the 3.3-month supply recorded in March 2020. Inventory numbers continue to represent near-historic lows; NAR first began tracking the single-family home supply in 1982.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (6.01 million SAAR) were down 3.7% from last month, and were 12.3% above the March 2020 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.07 million in March from 1.03 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.07 million in March from 1.03 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 28.2% year-over-year in March compared to March 2020.

Inventory was down 28.2% year-over-year in March compared to March 2020. Months of supply increased to 2.1 months in March from 2.0 months in February.

This was below the consensus forecast. I'll have more later.

Black Knight: National Mortgage Delinquency Rate Decreased Sharply in March

by Calculated Risk on 4/22/2021 08:41:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight’s First Look: National Mortgage Delinquency Rate Plunges Nearly a Full Percentage Point in March as Calendar and Economy Drive Improvement

• The national delinquency rate fell to 5.02% from 6.00% in February – a 16.4% decline – driven by a combination of economic and calendar-related tailwindsAccording to Black Knight's First Look report, the percent of loans delinquent decreased 16.4% in March compared to February, and increased 48% year-over-year.

• Over the past 20 years, delinquencies have fallen by nearly 10% on average in March due to tax return and other seasonal funds being used by homeowners to pay down past-due mortgage debt

• The decline was stronger than usual due to both January and February ending on Sunday – which tends to dampen performance and lead to following-month gains – as well as broader economic improvements

• Despite March’s strong performance, some 1.9 million mortgage-holders – including those in active forbearance – are at least 90 days past due on payments

• There are 1.5 million more such serious delinquencies than at the onset of the pandemic, nearly five times pre-pandemic levels

• Active foreclosures fell to yet another record low in March due to widespread moratoriums and forbearance utilization limiting both foreclosure inflow and outflow

• Prepayments rose by 17% in March to the highest level in more than 17 years driven by a seasonal rise in home sales alongside a rise in refinance activity locked in before rates began to rise in mid-February

emphasis added

The percent of loans in the foreclosure process decreased 3.6% in March and were down 27% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.02% in March, down from 6.00% in February.

The percent of loans in the foreclosure process decreased in March to 0.30%, from 0.32% in February.

The number of delinquent properties, but not in foreclosure, is up 880,000 properties year-over-year, and the number of properties in the foreclosure process is down 58,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2021 | Feb 2021 | Mar 2020 | Mar 2019 | |

| Delinquent | 5.02% | 6.00% | 3.39% | 3.65% |

| In Foreclosure | 0.30% | 0.32% | 0.42% | 0.51% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,672,000 | 3,186,000 | 1,792,000 | 1,903,000 |

| Number of properties in foreclosure pre-sale inventory: | 162,000 | 168,000 | 220,000 | 264,000 |

| Total Properties | 2,834,000 | 3,354,000 | 2,013,000 | 2,167,000 |

Weekly Initial Unemployment Claims decreased to 547,000

by Calculated Risk on 4/22/2021 08:37:00 AM

The DOL reported:

In the week ending April 17, the advance figure for seasonally adjusted initial claims was 547,000, a decrease of 39,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 10,000 from 576,000 to 586,000. The 4-week moving average was 651,000, a decrease of 27,750 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised down by 4,250 from 683,000 to 678,750.This does not include the 133,319 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 131,721 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 651,000.

The previous week was revised up.

Regular state continued claims decreased to 3,674,000 (SA) from 3,708,000 (SA) the previous week.

Note: There are an additional 7,309,604 receiving Pandemic Unemployment Assistance (PUA) that increased from 7,044,376 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,605,935 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 5,158,231.

Weekly claims were much lower than the consensus forecast.

Wednesday, April 21, 2021

Thursday: Unemployment Claims, Existing Home Sales

by Calculated Risk on 4/21/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a increase to 625 thousand from 576 thousand last week.

• Also at 8:30 AM, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 6.17 million SAAR, down from 6.22 million. Housing economist Tom Lawler expects the NAR to report sales of 6.02 million SAAR for March.

• At 11:00 AM, the Kansas City Fed manufacturing survey for April.