by Calculated Risk on 4/26/2021 08:30:00 AM

Monday, April 26, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of April 25th.

The seven day average is down 42.7% from the same day in 2019 (57.3% of 2019). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - and TSA data has picked up in 2021, but down slightly over the last few weeks.

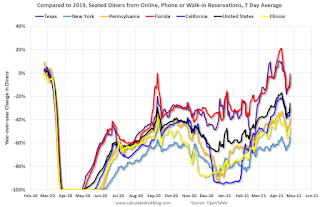

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through April 24, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was picking up again, but has moved up and down over the last couple of weeks.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $24 million last week, down about 83% from the median for the week.

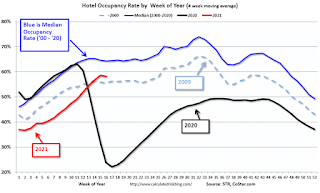

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Occupancy is now above the horrible 2009 levels.

This data is through April 17th. Hotel occupancy is currently down 13% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of April 16th, gasoline supplied was off about 3.2% (about 96.8% of the same week in 2019).

Gasoline supplied was up year-over-year, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through April 24th for the United States and several selected cities.

This data is through April 24th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 68% of the January 2020 level. It is at 63% in Chicago, and 61% in Houston - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, April 23rd.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, April 25, 2021

Sunday Night Futures

by Calculated Risk on 4/25/2021 06:21:00 PM

Weekend:

• Schedule for Week of April 25, 2021

• FOMC Preview

Monday:

• At 8:30 AM ET, Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $62.15 per barrel and Brent at $66.12 per barrel. A year ago, WTI was at $12, and Brent was at $15 - so WTI oil prices are UP sharply year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.87 per gallon. A year ago prices were at $1.74 per gallon, so gasoline prices are up $1.13 per gallon year-over-year.

April 25th COVID-19 Vaccinations, New Cases, Hospitalizations; 7-Day Average Cases Lowest Since March 23rd

by Calculated Risk on 4/25/2021 03:54:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 228.7 million doses have been administered. 36.5% of the population over 18 is fully vaccinated, and 53.6% of the population over 18 has had at least one dose (138.3 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

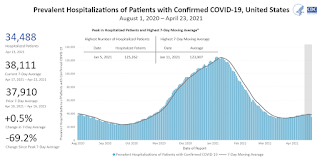

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

FOMC Preview

by Calculated Risk on 4/25/2021 09:39:00 AM

Expectations are there will be no change to rate policy when the FOMC meets on Tuesday and Wednesday this week.

Here are some comments from Goldman Sachs economists:

"[W]e expect the April FOMC statement to feature a more upbeat description of recent economic activity. But beyond that, next week’s meeting should be uneventful. ...We expect the FOMC to start hinting at tapering in the second half of this year and to begin tapering in early 2022. Our working assumption is that the pace of tapering will be $15bn per meeting, in which case it would take eight meetings or one year to complete."And from Merrill Lynch economists:

emphasis added

At the April FOMC meeting, we expect Chair Powell and the FOMC to give a more positive view of the economy but reiterate that risks remain from the virus and further progress is needed before a shift in policy.No projections will be released at this meeting. However, for review, here are the March FOMC projections.

Wall Street forecasts are for GDP to increase at a 6.5% annual rate in Q1 (to be released this coming Thursday). For the year, from Goldman Sachs projects: "We have raised our GDP forecast to reflect the latest fiscal policy news and now expect 8% growth in 2021 (Q4/Q4) and an unemployment rate of 4% at end-2021". And Merrill Lynch expects Q4 2021 over Q4 2020 real growth of 7.5%.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 5.8 to 6.6 | 3.0 to 3.8 | 2.0 to 2.5 | |

The unemployment rate was at 6.0% in March.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 4.2 to 4.7 | 3.6 to 4.0 | 3.2 to 3.8 | |

The decline in the unemployment rate depends on both job growth, and the participation rate. A strong labor market will probably encourage people to return to the labor force, and the improvements in the unemployment rate might be slower than some expect.

As of February 2021, PCE inflation was up 1.6% from February 2020.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 2.2 to 2.4 | 1.8 to 2.1 | 2.0 to 2.2 | |

PCE core inflation was up 1.4% in February year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 2.0 to 2.3 | 1.9 to 2.1 | 2.0 to 2.2 | |

My guess is core PCE inflation (year-over-year) will increase in 2021, but I think too much inflation will NOT be a concern in 2021. Since we saw negative MoM PCE and core PCE reading in March and April, we should ignore a jump in YoY inflation in March, April and May! There are also supply constraints that will push up prices in the near term, but should be temporary.

Saturday, April 24, 2021

April 24th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/24/2021 04:51:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 225.6 million doses have been administered. 35.9% of the population over 18 is fully vaccinated, and 53.1% of the population over 18 has had at least one dose (137.0 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Schedule for Week of April 25, 2021

by Calculated Risk on 4/24/2021 08:11:00 AM

The key report scheduled for this week is Q1 GDP.

Other key reports include February Case-Shiller house prices, and Personal Income and Outlays for March.

For manufacturing, the April Dallas and Richmond manufacturing surveys will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

9:00 AM: S&P/Case-Shiller House Price Index for February.

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 11.6% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

10:00 AM: the Q1 2021 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 525 thousand from 547 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2021 (Advance estimate). The consensus is that real GDP increased 6.5% annualized in Q1, up from 4.3% in Q4.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 6.0% increase in the index.

8:30 AM ET: Personal Income and Outlays, March 2021. The consensus is for a 20.1% increase in personal income, and for a 4.2% increase in personal spending. And for the Core PCE price index to increase 0.3%.

9:45 AM: Chicago Purchasing Managers Index for April.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 87.5.

Friday, April 23, 2021

April 23rd COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 4/23/2021 05:03:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 222.3 million doses have been administered. 35.2% of the population over 18 is fully vaccinated, and 52.6% of the population over 18 has had at least one dose (135.7 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

April Vehicle Sales Forecast: "Remain Strong"

by Calculated Risk on 4/23/2021 04:46:00 PM

From WardsAuto: April U.S. Light-Vehicle Sales Steadfastly Remain Strong (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for April (Red).

The Wards forecast of 17.9 million SAAR, would be up less than 1% from last month, and up 105% from a year ago (sales collapsed in March 2020).

Q1 GDP Forecasts: Around 7%

by Calculated Risk on 4/23/2021 11:56:00 AM

Q1 GDP will be released this coming Thursday. The consensus is for real GDP to increase 6.5%, quarter-over-quarter, on a Seasonally Adjusted Annual Rate (SAAR) basis.

From Merrill Lynch:

We expect the advance estimate of 1Q 2021 GDP to show an acceleration in growth to an eye-popping 6.5% qoq saar from 4.1% in 4Q 2020 [Apr 23 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +7.5% (qoq ar). [Apr 23 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 6.9% for 2021:Q1 and 4.6% for 2021:Q2. [Apr 23 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 8.3 percent on April 16 [Apr 16 estimate]

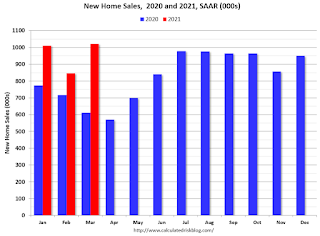

A few Comments on March New Home Sales

by Calculated Risk on 4/23/2021 10:40:00 AM

New home sales for March were reported at 1,021,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised up significantly.

This was well above consensus expectations for March and the highest sales rate since 2006.

Earlier: New Home Sales Increase to 1,021,000 Annual Rate in March; Highest Since 2006.

Click on graph for larger image.

Click on graph for larger image.This graph shows new home sales for 2020 and 2021 by month (Seasonally Adjusted Annual Rate).

The year-over-year comparisons are easy in the first half of 2021 - especially in March and April.

However, sales will likely be down year-over-year in August through October - since the selling season was delayed in 2020.

And on inventory: note that completed inventory (3rd graph in previous post) is at record lows, but inventory under construction is closer to normal.

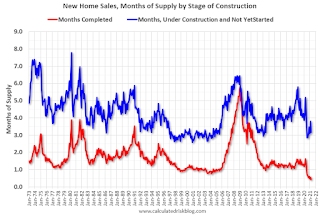

This graph shows the months of supply by stage of construction.

This graph shows the months of supply by stage of construction.The inventory of completed homes for sale was at 37 thousand in March tying the record low of 37 thousand in 2013 (when sales were much lower). That is about 0.4 months of completed supply (record low).