by Calculated Risk on 4/27/2021 09:11:00 AM

Tuesday, April 27, 2021

Case-Shiller: National House Price Index increased 12.0% year-over-year in February

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports 12.0% Annual Home Price Gain in February 2021

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 12.0% annual gain in February, up from 11.2% in the previous month. The 10-City Composite annual increase came in at 11.7%, up from 10.9% in the previous month. The 20-City Composite posted an 11.9% year-over-year gain, up from 11.1% in the previous month.

Phoenix, San Diego, and Seattle reported the highest year-over-year gains among the 20 cities in February. Phoenix led the way with a 17.4% year-over-year price increase, followed by San Diego with a 17.0% increase and Seattle with a 15.4% increase. Nineteen of the 20 cities reported higher price increases in the year ending February 2021 versus the year ending January 2021.

...

Before seasonal adjustment, the U.S. National Index posted an 1.1% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 1.1% and 1.2% respectively in February. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.1%, and the 10-City and 20-City Composites both posted increases of 1.1% and 1.2% respectively as well. In February, all 20 cities reported increases before and after seasonal adjustments.

“Strong home price gains continued in February 2021,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. The National Composite Index marked its ninth month of accelerating prices with a 12.0% gain from year-ago levels, up from 11.2% in January. This acceleration is also reflected in the 10- and 20-City Composites (up 11.7% and 11.9%, respectively). The market’s strength continues to be broadly-based: all 20 cities rose, and 19 cities gained more in the 12 months ended in February than they had gained in the 12 months ended in January.

“More than 30 years of S&P CoreLogic Case-Shiller data help us to put February’s results into historical context. The National Composite’s 12.0% gain is the highest recorded since February 2006, exactly 15 years ago, and lies comfortably in the top decile of historical performance. Housing’s strength is reflected across all 20 cities; February’s price gains in every city are above that city’s median level, and rank in the top quartile of all reports in 18 cities.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.1% in February (SA) from January.

The Composite 20 index is up 1.2% (SA) in February.

The National index is 31% above the bubble peak (SA), and up 1.1% (SA) in February. The National index is up 77% from the post-bubble low set in December 2011 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 11.7% compared to February 2020. The Composite 20 SA is up 11.9% year-over-year.

The National index SA is up 12.0% year-over-year.

Price increases were at expectations. I'll have more later.

Monday, April 26, 2021

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg, Q1 2021 Housing Vacancies and Homeownership

by Calculated Risk on 4/26/2021 09:00:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 11.6% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

• Also at 10:00 AM, the Q1 2021 Housing Vacancies and Homeownership from the Census Bureau.

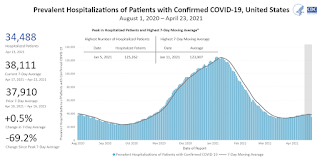

April 26th COVID-19 Vaccinations, New Cases, Hospitalizations; 7-Day Average Cases Lowest Since March 21st

by Calculated Risk on 4/26/2021 05:01:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 230.8 million doses have been administered. 37.0% of the population over 18 is fully vaccinated, and 53.9% of the population over 18 has had at least one dose (139.2 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

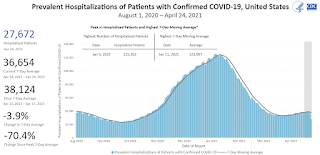

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

MBA Survey: "Share of Mortgage Loans in Forbearance Slightly Decreases to 4.49%"

by Calculated Risk on 4/26/2021 04:00:00 PM

Note: This is as of April 18th.

From the MBA: Share of Mortgage Loans in Forbearance Slightly Decreases to 4.49%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 4.50% of servicers’ portfolio volume in the prior week to 4.49% as of April 18, 2021. According to MBA’s estimate, 2.25 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance remained the same relative to the prior week at 2.44%. Ginnie Mae loans in forbearance decreased 7 basis points to 6.09%, while the forbearance share for portfolio loans and private-label securities (PLS) increased by 8 basis points to 8.42%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers remained the same relative to the prior week at 4.72%, and the percentage of loans in forbearance for depository servicers declined 3 basis points to 4.64%.

“After two weeks of large declines, the share of loans in forbearance decreased for the eighth straight week, but by only 1 basis point. New forbearance requests increased, and the rate of exits declined,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “More than 40 percent of borrowers in forbearance extensions have now exceeded the 12-month mark.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.05% to 0.06%."

New Home Prices

by Calculated Risk on 4/26/2021 12:57:00 PM

As part of the new home sales report released last week, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in March 2021 was $330,800. The average sales price was $397,800."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in March 2021 was $397,800, up 6% year-over-year. The median price was $330,800, up just 1% year-over-year. Builders are reporting same home prices are up sharply, so the mix has changed.

The second graph shows the percent of new homes sold by price.

Very few new homes sold were under $150K in March 2021 ("Less than 500 units" in March 2021, rounded down to zero). This is down from 30% in 2002. In general, the under $150K and under $200K brackets are going away.

Very few new homes sold were under $150K in March 2021 ("Less than 500 units" in March 2021, rounded down to zero). This is down from 30% in 2002. In general, the under $150K and under $200K brackets are going away. The $400K+ bracket increased significantly after the housing recovery started, but has been holding steady recently. A majority of new homes (about 68%) in the U.S., are in the $200K to $400K range.

Housing Inventory April 26th Update: A Slight Decrease week-over-week

by Calculated Risk on 4/26/2021 10:44:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 4/26/2021 08:30:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of April 25th.

The seven day average is down 42.7% from the same day in 2019 (57.3% of 2019). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - and TSA data has picked up in 2021, but down slightly over the last few weeks.

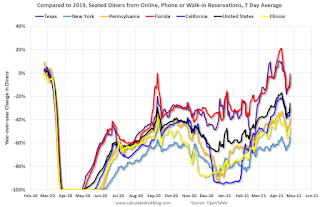

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through April 24, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was picking up again, but has moved up and down over the last couple of weeks.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $24 million last week, down about 83% from the median for the week.

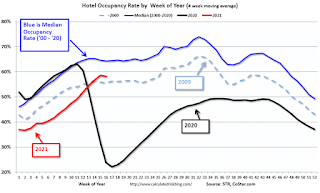

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Occupancy is now above the horrible 2009 levels.

This data is through April 17th. Hotel occupancy is currently down 13% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of April 16th, gasoline supplied was off about 3.2% (about 96.8% of the same week in 2019).

Gasoline supplied was up year-over-year, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through April 24th for the United States and several selected cities.

This data is through April 24th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 68% of the January 2020 level. It is at 63% in Chicago, and 61% in Houston - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, April 23rd.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, April 25, 2021

Sunday Night Futures

by Calculated Risk on 4/25/2021 06:21:00 PM

Weekend:

• Schedule for Week of April 25, 2021

• FOMC Preview

Monday:

• At 8:30 AM ET, Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $62.15 per barrel and Brent at $66.12 per barrel. A year ago, WTI was at $12, and Brent was at $15 - so WTI oil prices are UP sharply year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.87 per gallon. A year ago prices were at $1.74 per gallon, so gasoline prices are up $1.13 per gallon year-over-year.

April 25th COVID-19 Vaccinations, New Cases, Hospitalizations; 7-Day Average Cases Lowest Since March 23rd

by Calculated Risk on 4/25/2021 03:54:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 228.7 million doses have been administered. 36.5% of the population over 18 is fully vaccinated, and 53.6% of the population over 18 has had at least one dose (138.3 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

FOMC Preview

by Calculated Risk on 4/25/2021 09:39:00 AM

Expectations are there will be no change to rate policy when the FOMC meets on Tuesday and Wednesday this week.

Here are some comments from Goldman Sachs economists:

"[W]e expect the April FOMC statement to feature a more upbeat description of recent economic activity. But beyond that, next week’s meeting should be uneventful. ...We expect the FOMC to start hinting at tapering in the second half of this year and to begin tapering in early 2022. Our working assumption is that the pace of tapering will be $15bn per meeting, in which case it would take eight meetings or one year to complete."And from Merrill Lynch economists:

emphasis added

At the April FOMC meeting, we expect Chair Powell and the FOMC to give a more positive view of the economy but reiterate that risks remain from the virus and further progress is needed before a shift in policy.No projections will be released at this meeting. However, for review, here are the March FOMC projections.

Wall Street forecasts are for GDP to increase at a 6.5% annual rate in Q1 (to be released this coming Thursday). For the year, from Goldman Sachs projects: "We have raised our GDP forecast to reflect the latest fiscal policy news and now expect 8% growth in 2021 (Q4/Q4) and an unemployment rate of 4% at end-2021". And Merrill Lynch expects Q4 2021 over Q4 2020 real growth of 7.5%.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 5.8 to 6.6 | 3.0 to 3.8 | 2.0 to 2.5 | |

The unemployment rate was at 6.0% in March.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 4.2 to 4.7 | 3.6 to 4.0 | 3.2 to 3.8 | |

The decline in the unemployment rate depends on both job growth, and the participation rate. A strong labor market will probably encourage people to return to the labor force, and the improvements in the unemployment rate might be slower than some expect.

As of February 2021, PCE inflation was up 1.6% from February 2020.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 2.2 to 2.4 | 1.8 to 2.1 | 2.0 to 2.2 | |

PCE core inflation was up 1.4% in February year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2021 | 2022 | 2023 | |

| Mar 2021 | 2.0 to 2.3 | 1.9 to 2.1 | 2.0 to 2.2 | |

My guess is core PCE inflation (year-over-year) will increase in 2021, but I think too much inflation will NOT be a concern in 2021. Since we saw negative MoM PCE and core PCE reading in March and April, we should ignore a jump in YoY inflation in March, April and May! There are also supply constraints that will push up prices in the near term, but should be temporary.