by Calculated Risk on 4/27/2021 04:30:00 PM

Tuesday, April 27, 2021

April 27th COVID-19 Vaccinations, New Cases, Hospitalizations; Vaccinations have Slowed

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 232.4 million doses have been administered. 37.3% of the population over 18 is fully vaccinated, and 54.2% of the population over 18 has had at least one dose (139.9 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

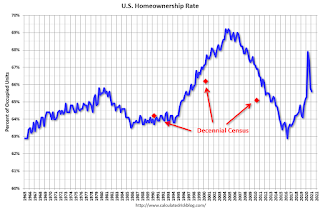

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Las Vegas Visitor Authority for March: No Convention Attendance, Visitor Traffic Down 40% Compared to 2019

by Calculated Risk on 4/27/2021 02:42:00 PM

From the Las Vegas Visitor Authority: March 2021 Las Vegas Visitor Statistics

March 2021 saw the highest visitation since Feb of last year as the destination welcomed more than 2.2M visitors, up nearly 45% MoM. With travel reduced last March due to the initial shutdown, year‐over‐year (YoY) comparisons show a 45.7% increase while a comparison to pre‐COVID 2019 monthly metrics shows visitation down roughly ‐40% from March 2019.

Hotel occupancy ramped up to 55.5%, up 13.5 pts MoM, as Weekend occupancy reached 77.7% (up 14.9 pts MoM) and Midweek occupancy reached 47.8% (up 15.7% MoM).

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 39.7% compared to the same month in 2019.

Convention traffic was non-existent again in March, and was down 100% compared to March 2019.

Note: A convention is scheduled for early June (HT MS): "Informa Markets, organizers of the World of Concrete, has received approval from the Nevada Department of Business and Industry to move forward with its 2021 in-person edition. The event is scheduled to be held June 8-10, 2021 at the Las Vegas Convention Center."

Real House Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/27/2021 11:14:00 AM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 12.0% year-over-year in February

It has been fifteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 31% above the previous bubble peak. However, in real terms, the National index (SA) is about 4% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 5% below the bubble peak.

The year-over-year growth in prices increased to 12.0% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be over $295,000 today adjusted for inflation (48%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is 4% above the bubble peak, and the Composite 20 index is back to mid-2005.

In real terms, house prices are at 2005 levels.

Note that inflation was negative for a few months last year, and that also boosted real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving mostly sideways, but picked up recently.

On a price-to-rent basis, the Case-Shiller National index is back to January 2005 levels, and the Composite 20 index is back to June 2004 levels.

In real terms, prices are back to 2005 levels, and the price-to-rent ratio is back to late 2004.

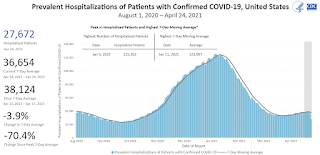

HVS: Q1 2021 Homeownership and Vacancy Rates

by Calculated Risk on 4/27/2021 10:36:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2021.

It is likely the results of this survey were significantly distorted by the pandemic.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

"National vacancy rates in the first quarter 2021 were 6.8 percent for rental housing and 0.9 percent for homeowner housing. The rental vacancy rate of 6.8 percent was not statistically different from the rate in the first quarter 2020 (6.6 percent) and 0.3 percentage points higher than the rate in the fourth quarter 2020 (6.5 percent). The homeowner vacancy rate of 0.9 percent was 0.2 percentage points lower than the rate in the first quarter 2020 (1.1 percent) and 0.1 percentage points lower than the rate in the fourth quarter 2020 (1.0 percent)

The homeownership rate of 65.6 percent was not statistically different from the rate in the first quarter 2020 (65.3 percent) and not statistically different from the rate in the fourth quarter 2020 (65.8 percent). "

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The Census Bureau will released data for 2020 soon.

The results in Q2 through Q4 of 2020 were distorted by the pandemic.

The HVS homeowner vacancy increased to 0.9% from 1.0% in Q4.

The HVS homeowner vacancy increased to 0.9% from 1.0% in Q4. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

Case-Shiller: National House Price Index increased 12.0% year-over-year in February

by Calculated Risk on 4/27/2021 09:11:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports 12.0% Annual Home Price Gain in February 2021

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 12.0% annual gain in February, up from 11.2% in the previous month. The 10-City Composite annual increase came in at 11.7%, up from 10.9% in the previous month. The 20-City Composite posted an 11.9% year-over-year gain, up from 11.1% in the previous month.

Phoenix, San Diego, and Seattle reported the highest year-over-year gains among the 20 cities in February. Phoenix led the way with a 17.4% year-over-year price increase, followed by San Diego with a 17.0% increase and Seattle with a 15.4% increase. Nineteen of the 20 cities reported higher price increases in the year ending February 2021 versus the year ending January 2021.

...

Before seasonal adjustment, the U.S. National Index posted an 1.1% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 1.1% and 1.2% respectively in February. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.1%, and the 10-City and 20-City Composites both posted increases of 1.1% and 1.2% respectively as well. In February, all 20 cities reported increases before and after seasonal adjustments.

“Strong home price gains continued in February 2021,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. The National Composite Index marked its ninth month of accelerating prices with a 12.0% gain from year-ago levels, up from 11.2% in January. This acceleration is also reflected in the 10- and 20-City Composites (up 11.7% and 11.9%, respectively). The market’s strength continues to be broadly-based: all 20 cities rose, and 19 cities gained more in the 12 months ended in February than they had gained in the 12 months ended in January.

“More than 30 years of S&P CoreLogic Case-Shiller data help us to put February’s results into historical context. The National Composite’s 12.0% gain is the highest recorded since February 2006, exactly 15 years ago, and lies comfortably in the top decile of historical performance. Housing’s strength is reflected across all 20 cities; February’s price gains in every city are above that city’s median level, and rank in the top quartile of all reports in 18 cities.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.1% in February (SA) from January.

The Composite 20 index is up 1.2% (SA) in February.

The National index is 31% above the bubble peak (SA), and up 1.1% (SA) in February. The National index is up 77% from the post-bubble low set in December 2011 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 11.7% compared to February 2020. The Composite 20 SA is up 11.9% year-over-year.

The National index SA is up 12.0% year-over-year.

Price increases were at expectations. I'll have more later.

Monday, April 26, 2021

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg, Q1 2021 Housing Vacancies and Homeownership

by Calculated Risk on 4/26/2021 09:00:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 11.6% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

• Also at 10:00 AM, the Q1 2021 Housing Vacancies and Homeownership from the Census Bureau.

April 26th COVID-19 Vaccinations, New Cases, Hospitalizations; 7-Day Average Cases Lowest Since March 21st

by Calculated Risk on 4/26/2021 05:01:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine,

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 230.8 million doses have been administered. 37.0% of the population over 18 is fully vaccinated, and 53.9% of the population over 18 has had at least one dose (139.2 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

MBA Survey: "Share of Mortgage Loans in Forbearance Slightly Decreases to 4.49%"

by Calculated Risk on 4/26/2021 04:00:00 PM

Note: This is as of April 18th.

From the MBA: Share of Mortgage Loans in Forbearance Slightly Decreases to 4.49%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 4.50% of servicers’ portfolio volume in the prior week to 4.49% as of April 18, 2021. According to MBA’s estimate, 2.25 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance remained the same relative to the prior week at 2.44%. Ginnie Mae loans in forbearance decreased 7 basis points to 6.09%, while the forbearance share for portfolio loans and private-label securities (PLS) increased by 8 basis points to 8.42%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers remained the same relative to the prior week at 4.72%, and the percentage of loans in forbearance for depository servicers declined 3 basis points to 4.64%.

“After two weeks of large declines, the share of loans in forbearance decreased for the eighth straight week, but by only 1 basis point. New forbearance requests increased, and the rate of exits declined,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “More than 40 percent of borrowers in forbearance extensions have now exceeded the 12-month mark.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week: from 0.05% to 0.06%."

New Home Prices

by Calculated Risk on 4/26/2021 12:57:00 PM

As part of the new home sales report released last week, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in March 2021 was $330,800. The average sales price was $397,800."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in March 2021 was $397,800, up 6% year-over-year. The median price was $330,800, up just 1% year-over-year. Builders are reporting same home prices are up sharply, so the mix has changed.

The second graph shows the percent of new homes sold by price.

Very few new homes sold were under $150K in March 2021 ("Less than 500 units" in March 2021, rounded down to zero). This is down from 30% in 2002. In general, the under $150K and under $200K brackets are going away.

Very few new homes sold were under $150K in March 2021 ("Less than 500 units" in March 2021, rounded down to zero). This is down from 30% in 2002. In general, the under $150K and under $200K brackets are going away. The $400K+ bracket increased significantly after the housing recovery started, but has been holding steady recently. A majority of new homes (about 68%) in the U.S., are in the $200K to $400K range.

Housing Inventory April 26th Update: A Slight Decrease week-over-week

by Calculated Risk on 4/26/2021 10:44:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.