by Calculated Risk on 5/04/2021 08:38:00 AM

Tuesday, May 04, 2021

Trade Deficit Increased to $74.4 Billion in March

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $74.4 billion in March, up $3.9 billion from $70.5 billion in February, revised.

March exports were $200.0 billion, $12.4 billion more than February exports. March imports were $274.5 billion, $16.4 billion more than February imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in March.

Exports are up 8.1% compared to March 2020; imports are up 18.1% compared to March 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports much more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $27.7 billion in March, from $11.8 billion in March 2020.

CoreLogic: House Prices up 11.3% Year-over-year in March

by Calculated Risk on 5/04/2021 08:00:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Millennials Propel Home Buying: Strong Demand and Short Supply Push US Home Prices Higher in March, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2021.

As consumer confidence rebounds and the job market picks back up, the 2021 spring homebuying season is on track to outpace trends seen in 2019 and 2018. Millennials lead the homebuying charge with older millennials seeking move-up purchases and younger millennials entering peak homebuying years. As we look towards the second half of the year, further erosion of affordability may dampen purchase demand as prospective buyers continue to compete for the severely limited supply of for-sale homes. A pick-up in construction and an increase in for-sale listings as more people get vaccinated may help moderate surging home price growth.

“Despite the severe slowdown last year, the 2021 spring homebuying season is trending strong — reflecting the many positive signs of economic recovery,” said Frank Martell, president and CEO of CoreLogic. “With prospective buyers continuing to be motivated by historically low mortgage rates, we anticipate sustained demand in the summer and early fall."

...

Nationally, home prices increased 11.3% in March 2021, compared with March 2020. On a month-over-month basis, home prices increased by 2% compared to February 2021.

“Lower-priced homes are in big demand and short supply, driving up prices faster compared to their more expensive counterparts,” said Dr. Frank Nothaft, chief economist at CoreLogic. “First-time buyers seeking a starter home priced 25% or more below the local-area median saw prices jump 15.1% during the past year, compared with the overall 11.3% gain in our national index."

emphasis added

Monday, May 03, 2021

Tuesday: Trade Deficit

by Calculated Risk on 5/03/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Logical Reaction to Data Sets Stage For Interesting Week

The week began with bond markets reacting to weaker economic data with a logical rally. That's the sort of quintessential connection that's been fairly elusive for most of the post-pandemic era. Last month's super strong jobs report (and subsequent bond losses) suggested that trend may be changing. ... [30 year fixed 3.10%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for March.

• At 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is the trade deficit to be $74.0 billion. The U.S. trade deficit was at $71.1 Billion in February.

May 3rd COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 5/03/2021 06:33:00 PM

Note: I'm looking forward to not posting this daily! I've been posting this data daily for over a year, and I'll stop once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

According to the CDC, 246.8 million doses have been administered. 40.6% of the population over 18 is fully vaccinated, and 56.3% of the population over 18 has had at least one dose (145.3 million people over 18 have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

MBA Survey: "Share of Mortgage Loans in Forbearance Slightly Decreases to 4.47%"

by Calculated Risk on 5/03/2021 04:00:00 PM

Note: This is as of April 25th.

From the MBA: Share of Mortgage Loans in Forbearance Slightly Decreases to 4.47%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 4.49% of servicers’ portfolio volume in the prior week to 4.47% as of April 25, 2021. According to MBA’s estimate, 2.23 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 points to 2.42%. Ginnie Mae loans in forbearance decreased 7 basis points to 6.02%, while the forbearance share for portfolio loans and private-label securities (PLS) increased by 13 basis points to 8.55%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 2 basis points to 4.70%, and the percentage of loans in forbearance for depository servicers also declined 2 basis points to 4.62%.

"The share of loans in forbearance decreased for the ninth straight week, dropping by 2 basis points. The rate of exits has slowed the past two weeks, with this week’s exit rate reaching the lowest since February,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The increase in the forbearance share for portfolio and PLS loans highlights both the ongoing buyouts of delinquent loans from Ginnie Mae pools as well as an increased forbearance share for other loans that are not federally backed.”

Added Fratantoni, “Job market and housing market data remain strong. We expect that further gains in hiring will help to support many homeowners as they exit forbearance in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.06% to 0.05%."

Fed Survey: Banks reported Eased Standards, Increased Demand for Residential Real Estate Loans

by Calculated Risk on 5/03/2021 02:13:00 PM

From the Federal Reserve: The April 2021 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, respondents to the April survey indicated that, on balance, they eased their standards on commercial and industrial (C&I) loans to firms of all sizes over the first quarter. Banks reported weaker demand, on net, for C&I loans to large and middle-market firms, and demand for C&I loans from small firms remained basically unchanged. Standards on commercial real estate (CRE) loans secured by nonfarm nonresidential properties remained basically unchanged, while banks tightened standards on construction and land development loans and eased standards on multifamily loans. Banks reported stronger demand for construction and land development and multifamily loans and reported weaker demand for nonfarm nonresidential loans.

For loans to households, banks eased standards across most categories of residential real estate (RRE) loans, on net, and reported stronger demand for most types of RRE loans over the first quarter. Banks also eased standards across all three consumer loan categories—credit card loans, auto loans, and other consumer loans. Meanwhile, demand for credit card and other consumer loans remained basically unchanged, and demand for auto loans moderately strengthened.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residnetial Real Estate lending is from the Senior Loan Officer Survey Charts.

This shows that banks have eased standards (tightened for subprime), and that there is increased demand for RRE loans.

Housing Inventory May 3rd Update: At Record Lows

by Calculated Risk on 5/03/2021 10:39:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Construction Spending increased 0.2% in March

by Calculated Risk on 5/03/2021 10:18:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during March 2021 was estimated at a seasonally adjusted annual rate of $1,513.1 billion, 0.2 percent above the revised February estimate of $1,509.9 billion. The March figure is 5.3 percent above the March 2020 estimate of $1,436.7 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,169.2 billion, 0.7 percent above the revised February estimate of $1,160.9 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $343.9 billion, 1.5 percent below the revised February estimate of $349.0 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 7% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 7% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 6% above the previous peak in March 2009, and 31% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 23.3%. Non-residential spending is down 9.1% year-over-year. Public spending is down 4.6% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential will be under pressure. For example, lodging is down 24% YoY, multi-retail down 31.5% YoY, and office down 4.2% YoY.

ISM® Manufacturing index Decreased to 60.7% in April

by Calculated Risk on 5/03/2021 10:04:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion in April. The PMI® was at 60.7% in April, down from 64.7% in March. The employment index was at 55.1%, down from 59.6% last month, and the new orders index was at 64.3%, down from 68.0%.

From ISM: April 2021 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in April, with the overall economy notching an 11th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was well below expectations.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The April Manufacturing PMI® registered 60.7 percent, a decrease of 4 percentage points from the March reading of 64.7 percent. This figure indicates expansion in the overall economy for the 11th month in a row after contraction in April 2020. The New Orders Index registered 64.3 percent, declining 3.7 percentage points from the March reading of 68 percent. The Production Index registered 62.5 percent, a decrease of 5.6 percentage points compared to the March reading of 68.1 percent. The Backlog of Orders Index registered 68.2 percent, 0.7 percentage point higher compared to the March reading of 67.5 percent. The Employment Index registered 55.1 percent, 4.5 percentage points lower than the March reading of 59.6 percent. The Supplier Deliveries Index registered 75 percent, down 1.6 percentage points from the March figure of 76.6 percent. The Inventories Index registered 46.5 percent, 4.3 percentage points lower than the March reading of 50.8 percent. The Prices Index registered 89.6 percent, up 4 percentage points compared to the March reading of 85.6 percent. The New Export Orders Index registered 54.9 percent, an increase of 0.4 percentage point compared to the March reading of 54.5 percent. The Imports Index registered 52.2 percent, a 4.5-percentage point decrease from the March reading of 56.7 percent.”

emphasis added

This suggests manufacturing expanded at a slower pace in April than in March.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 5/03/2021 08:30:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

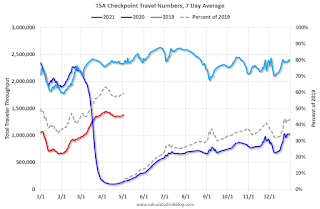

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of May 2nd.

The seven day average is down 40.6% from the same day in 2019 (59.4% of 2019). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - and TSA data has picked up in 2021, but mostly sideways over the last several weeks.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through May 1, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining was picking up again, but has moved up and down over the last couple of weeks. Florida and Texas are above 2019 levels.

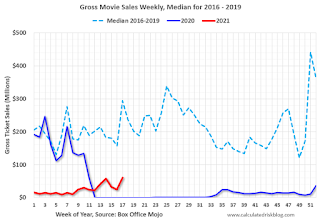

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $61 million last week, down about 79% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Occupancy is now above the horrible 2009 levels.

This data is through April 24th. Hotel occupancy is currently down 17% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of April 23rd, gasoline supplied was off about 3.4% (about 96.6% of the same week in 2019).

Gasoline supplied was up year-over-year, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through May 1st for the United States and several selected cities.

This data is through May 1st for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 68% of the January 2020 level. It is at 67% in Chicago, and 60% in Houston - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, April 30th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".