by Calculated Risk on 5/12/2021 11:17:00 AM

Wednesday, May 12, 2021

Cleveland Fed: Key Measures Show Inflation Increased in April

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% April. The 16% trimmed-mean Consumer Price Index rose 0.4% in April. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for April here. Car and truck rental was up 505% annualized! Used cars and trucks were up 215% annualized.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 3.0%. Core PCE is for March and increased 1.8% year-over-year.

Note: We saw negative Month-to-month (MoM) core CPI and CPI readings in March, April and May 2020. We also saw negative MoM PCE and core PCE reading in March and April 2020. Although inflation picked up in April, the year-over-year change was impacted the base effect (decline last year).

South Carolina Real Estate in April: Sales Up 41% YoY, Inventory Down 56% YoY

by Calculated Risk on 5/12/2021 09:48:00 AM

Note: Remember sales were weak in April 2020 due to the pandemic, so the YoY comparison is easy. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the South Carolina Realtors for the entire state:

Closed sales in April 2021 were 9,900, up 41.4% from 7,000 in April 2020.

Active Listings in April 2021 were 12,019, down 55.5% from 27,024 in April 2020.

Inventory in April was down less than 1% from last month.

Months of Supply was 1.3 Months in April 2021, compared to 3.4 Months in April 2020.

BLS: CPI increased 0.8% in April, Core CPI increased 0.9%

by Calculated Risk on 5/12/2021 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in April on a seasonally adjusted basis after rising 0.6 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.2 percent before seasonal adjustment. This is the largest 12-month increase since a 4.9-percent increase for the period ending September 2008.CPI and core CPI were well above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.9 percent in April, its largest monthly increase since April 1982. Nearly all major component indexes increased in April. Along with the index for used cars and trucks, the indexes for shelter, airline fares, recreation, motor vehicle insurance, and household furnishings and operations were among the indexes with a large impact on the overall increase.

The all items index rose 4.2 percent for the 12 months ending April, a larger increase than the 2.6- percent increase for the period ending March. Similarly, the index for all items less food and energy rose 3.0 percent over the last 12 months, a larger increase than the 1.6-percent rise over the 12 month period ending in March. The energy index rose 25.1 percent over the last 12-months, and the food index increased 2.4 percent.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 5/12/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 7, 2021.

... The Refinance Index increased 3 percent from the previous week and was 12 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 13 percent higher than the same week one year ago.

“Mortgage rates fell last week to the lowest levels since February, tracking the dip in Treasury yields. The decline in rates helped the refinance index reach its highest level in eight weeks, driven by a 4 percent increase in conventional refinances. Additionally, refinance loan balances increased for the fourth straight week, an indication that higher-balance borrowers acted to take quick advantage of lower rates,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The first week of May was also strong for the purchase market. Applications were up 13 percent from a year ago, which was around the time the housing market awakened from the pandemic-induced stall in activity. Most markets this spring continue to see robust demand, but activity continues to be constrained by insufficient inventory levels, as well as homebuilder challenges related to the ongoing shortages and price increases for building materials.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.11 percent from 3.18 percent, with points decreasing to 0.32 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but below recent levels since mortgage rates have moved up from the record lows.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 13% year-over-year unadjusted.

According to the MBA, purchase activity is up 13% year-over-year unadjusted.Note: The unadjusted MBA purchase index will be up year-over-year for another week or so, since purchase activity collapsed in the early weeks of the pandemic - but then the comparisons will be more difficult.

Note: Red is a four-week average (blue is weekly).

Tuesday, May 11, 2021

Portland Real Estate in April: Sales Up 46% YoY, Inventory Down 53% YoY

by Calculated Risk on 5/11/2021 09:54:00 PM

Note: Remember sales were weak in April 2020 due to the pandemic. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For Portland, OR:

Closed sales in April 2021 were 2,946, up 46.2% from 2,015 in April 2020.

Active Listings in April 2021 were 2,222, down 53.3% from 4,757 in April 2020.

Inventory in April was up 14.4% from last month.

Months of Supply was 0.8 Months in April 2021, compared to 2.4 Months in April 2020.

Wednesday: CPI, Q1 Quarterly Report on Household Debt and Credit

by Calculated Risk on 5/11/2021 09:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.2% increase in CPI, and a 0.3% increase in core CPI.

• At 11:00 AM, NY Fed: Q1 Quarterly Report on Household Debt and Credit

May 11th COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 5/11/2021 03:58:00 PM

President Biden has set two vaccinations goals to achieve by July 4th:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) 160 million Americans fully vaccinated.

According to the CDC, on Vaccinations. Total administered: 263,132,561, as of yesterday: 261,599,381. Day: 1.53 million. (U.S. Capacity is around 4 million per day)

1) 58.5% of the population over 18 has had at least one dose.

2) 115.4 million Americans are fully vaccinated.

Note: I'll stop posting this daily once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

Note: The ups and downs during the Winter surge were related to reporting delays due to the Thanksgiving and Christmas holidays.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 31,210, up from 30,508 reported yesterday, and still above the post-summer surge low of 23,000.

New Hampshire Real Estate in April: Sales Up 13% YoY, Inventory Down 57% YoY

by Calculated Risk on 5/11/2021 01:18:00 PM

Note: Remember sales were weak in April 2020 due to the pandemic. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the New Hampshire Realtors for the entire state:

Inventory in April was up 17.5% from last month.

Boston Real Estate in April: Sales Up 35% YoY, Inventory Up 9% YoY

by Calculated Risk on 5/11/2021 12:26:00 PM

Note: Remember sales were weak in April 2020 due to the pandemic. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

For Boston (single family and condos):

Leading Index for Commercial Real Estate Increased in April

by Calculated Risk on 5/11/2021 11:56:00 AM

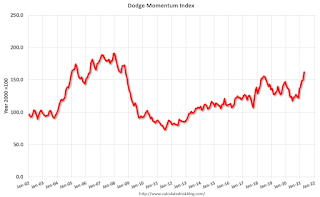

From Dodge Data Analytics: Dodge Momentum Index Increases In April

The Dodge Momentum Index posted an 8.6% gain in April, climbing to 162.4 (2000=100) from the revised reading of 149.5 in March. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. April’s gain marks the fifth consecutive monthly increase, and similar to February and March, was due to a large increase in institutional buildings entering the planning stage while commercial planning eased by less than one percent.

Since hitting its nine-year low in January, institutional planning has rebounded substantially, climbing 77% over the last three months. Healthcare and laboratory projects continue to dominate the sector, pushing institutional planning 50% higher on a year-over-year basis. Conversely, the commercial component has slipped in recent months as fewer warehouse projects have entered planning, though the sector is 21% higher than in April 2020. Overall, the Momentum Index is 31% higher than last April, which was the first full month of COVID-19 shutdowns.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 162.4 in April, up from 149.5 in March.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a decline in Commercial Real Estate construction through most of 2021, but maybe a pickup towards the end of the year.