by Calculated Risk on 5/16/2021 11:50:00 PM

Sunday, May 16, 2021

Monday: NY Fed Mfg, Homebuilder Survey

Weekend:

• Schedule for Week of May 16, 2021

• The Long and Winding Road

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 23.9, down from 26.3.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 83 unchanged from 83 last month . Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 10, and DOW futures are down 100 (fair value).

Oil prices were mostly unchanged over the last week with WTI futures at $65.55 per barrel and Brent at $68.88 per barrel. A year ago, WTI was at $29, and Brent was at $31 - so WTI oil prices are UP sharply year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.04 per gallon. A year ago prices were at $1.86 per gallon, so gasoline prices are up $1.17 per gallon year-over-year.

May 16th COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/16/2021 03:56:00 PM

1) 59.8% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 123.3 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

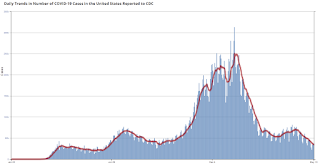

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 27,992, down from 29,024 reported yesterday, but still above the post-summer surge low of 23,000.

The Long and Winding Road

by Calculated Risk on 5/16/2021 11:34:00 AM

This is the 17th year I've been writing this blog.

However in 2009 I became more optimistic. For example, in February 2009, I wrote: Looking for the Sun (Note: that post shocked many readers since I had been very bearish).

A few years later, in early 2012, when many people were still bearish on housing, I called the bottom for housing: The Housing Bottom is Here

For the last 6+ years, there have been an endless parade of incorrect recession calls. The most reported was probably the multiple recession calls from ECRI in 2011 and 2012.And I updated that post several times, most recently in 2019

...

I disagreed with that call in 2011; I wasn't even on recession watch!

And on housing, over three years ago, in January 2018, I was quoted in a Bloomberg article:

Bill McBride, who runs the Calculated Risk blog and also called the crash, doesn’t think home prices are inflated this time around. Unlike in 2005, lenders are acting responsibly and the Wild West of real estate speculation hasn’t returned, he said. There is less to speculate on, too. Compared with the overbuilding that preceded the bust, today’s pace of construction isn’t fast enough, he said.

“Lending standards are still pretty good,” McBride said, and he doesn’t expect mortgage rates to “take off” in the short term.

No big deal, and definitely not a "gigantic" boom in house prices.And last month I wrote: Is there a New Housing Bubble?

The lack of wild speculation doesn't mean house prices can't decline, but it means that we won't see cascading declines in prices like what happened when the housing bubble burst.No one has a crystal ball, but one thing I've learned over the years is to watch housing inventory. And it is my sense that Existing Home Inventory Might Have Bottomed. If inventory has bottomed, then the question will be: How quickly will inventory increase? I don't have an answer yet, but if inventory increases slowly, house prices will continue to rise rapidly, and if inventory increases sharply, house price growth will slow.

...

From a historical perspective, house prices are high. But lending standards have been solid, and we haven't seen significant speculation - so I wouldn't call this a bubble.

Stay tuned!

Saturday, May 15, 2021

May 15th COVID-19 New Cases, Hospitalizations, Vaccinations

by Calculated Risk on 5/15/2021 04:57:00 PM

1) 59.4% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 121.8 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 29,024, down from 29,588, reported yesterday, but still above the post-summer surge low of 23,000.

Schedule for Week of May 16, 2021

by Calculated Risk on 5/15/2021 08:11:00 AM

The key reports this week are April Housing Starts and Existing Home Sales.

For manufacturing, the May NY and Philly Fed manufacturing surveys will be released.

8:30 AM: The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 23.9, down from 26.3.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 83 unchanged from 83 last month . Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM ET: Housing Starts for April.

8:30 AM ET: Housing Starts for April. This graph shows single and total housing starts since 1968.

The consensus is for 1.710 million SAAR, down from 1.739 million SAAR in March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of April 27-28, 2021

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 460 thousand from 473 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 43.2, down from 50.2.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 6.09 million SAAR, up from 6.01 million.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 6.09 million SAAR, up from 6.01 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for April 2021

Friday, May 14, 2021

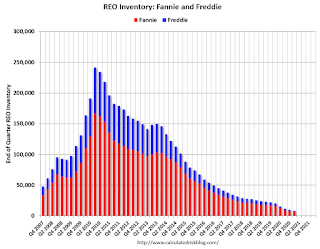

Fannie and Freddie: REO inventory declined in Q1, Down 58% Year-over-year

by Calculated Risk on 5/14/2021 05:19:00 PM

Fannie and Freddie earlier reported results two weeks ago for Q1 2021. Here is some information on Real Estate Owned (REOs).

For Freddie, this is down 98% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 6,918 at the end of Q1 2021 compared to 16,289 at the end of Q1 2020.

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q1 2021, and combined inventory is down 58% year-over-year.

This is well below a normal level of REOs for Fannie and Freddie.

May 14th COVID-19 New Cases, Hospitalizations; 7-Day Average Cases Lowest Since June 25, 2020

by Calculated Risk on 5/14/2021 04:28:00 PM

1) 59.1% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 120.3 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 29,588, down from 30,244 reported yesterday, but still above the post-summer surge low of 23,000.

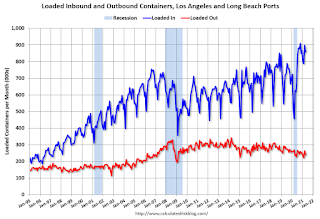

LA Area Port Traffic: Strong Imports in April

by Calculated Risk on 5/14/2021 01:33:00 PM

Note1: Import traffic was heavy in February and March - ships were backed up waiting to unload in LA. "some vessels are spending almost as much time at anchor as it takes to traverse the Pacific Ocean." They were still backed up in April!

Note2: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.4% in April compared to the rolling 12 months ending in March. Outbound traffic was up 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 37% YoY in April (collapsed last year due to pandemic), and exports were up 2.5% YoY.

Q2 GDP Forecasts: Around 10%

by Calculated Risk on 5/14/2021 12:03:00 PM

From Merrill Lynch:

We look for growth of 10.0% qoq saar in 2Q. [May 14 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +10.5% (qoq ar). [May 14 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 4.9% for 2021:Q2. [May 14 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2021 is 10.5 percent on May 14, down from 11.0 percent on May 7. [May 14 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 5/14/2021 10:50:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of May 11th.

From Black Knight: Forbearance Volumes Continue to Decline

We saw another week of good news in terms of forbearance volumes, which fell by 61,000 (-2.7%), continuing the strong trend of early-in-the-month improvements. Declines were seen across the board this week, with GSE forbearance volumes falling by 13K (-1.9%), FHA/VA plan volumes improving by 19K (-2.1%) and PLS/portfolio forbearances decreasing by 29K (-4.6%). Total plan starts are down 13% month-over-month, and continue to slowly decline.

Click on graph for larger image.

Some 250K plans are still listed with May 2021 expiration dates, which will provide a moderate opportunity for additional improvements over the next few weeks, and more acutely in early June. Another 860K plans are currently slated for review for extension/removal next month, the final quarterly review before early forbearance entrants begin to reach their 18-month plan expirations later this year. Thirty-eight percent of loans reviewed for extension/removal over the past month have been removed from forbearance, the highest such removal rate since mid-February

As of May 11, 2.16 million (4.1% of) homeowners remain in COVID-19 related forbearance plans, including 2.5% of GSE loans, 7.3% of FHA/VA loans, and 4.6% of portfolio/PLS loans.

emphasis added